Can The S&P 500 Rebound & Close The Year On A High Note?

- This topic has 0 replies, 1 voice, and was last updated 3 months ago by .

-

Topic

-

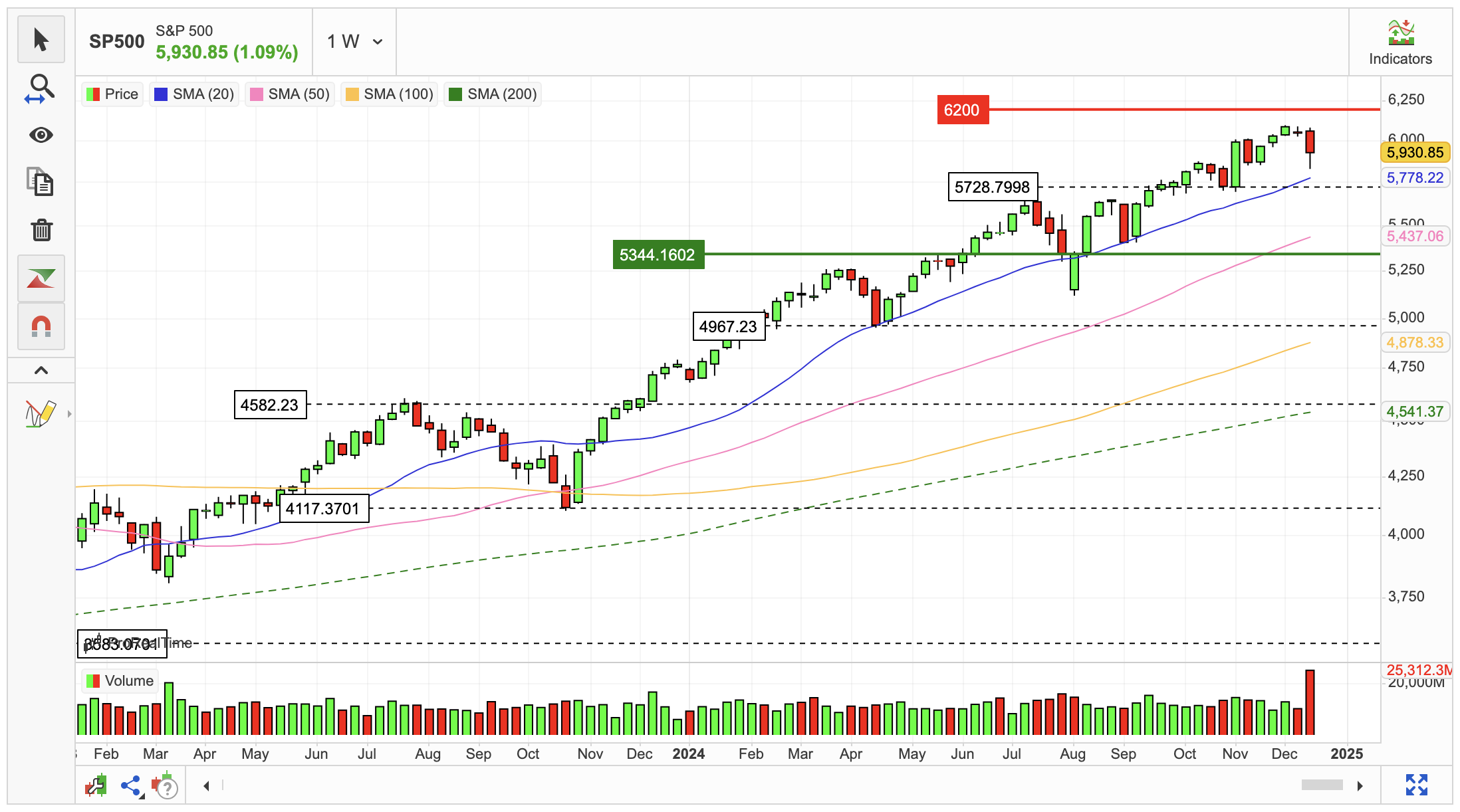

Investors are closely monitoring the S&P 500, hoping for a potential rebound from its recent slump and speculating whether the benchmark index can hit new highs before the year concludes.

The index, often considered a barometer for the broader US stock market, has faced headwinds in recent weeks due to mixed economic signals, Federal Reserve policy shifts, and sector-specific pressures.

Challenges Weighing On The S&P 500

A combination of factors has driven the S&P 500’s recent decline:

- Federal Reserve Policy Uncertainty: Although the Fed recently cut interest rates, Chair Jerome Powell’s remarks about the path forward have kept markets on edge. While lower rates typically support equity valuations, lingering inflation concerns and hints of a slower economic recovery have dampened enthusiasm.

- Sector Rotation: Technology stocks, which have been key drivers of the index in 2024, have shown signs of fatigue as investors rotate into more defensive sectors such as utilities and healthcare. This shift has placed downward pressure on the index.

- Geopolitical & Macroeconomic Pressures: Ongoing geopolitical tensions, coupled with weaker-than-expected data from key sectors like housing and manufacturing, have added uncertainty to the market, making it harder for the S&P 500 to regain its upward momentum.

Despite the challenges, there are reasons to believe the S&P 500 could stage a comeback and potentially reach new highs before year-end:

- Seasonal Trends: The “Santa C” aus rally” phenom” non—where markets tend to rise during the last five trading days of December and the first two of January—could provide a much-needed boost. Historically, this period has been marked by increased buying activity fuelled by investor optimism and portfolio rebalancing.

- Stronger Consumer Sentiment: The holiday shopping season has shown signs of resilience, with retail sales outperforming expectations in several categories. Strong consumer spending could bolster corporate earnings forecasts, particularly in the retail and e-commerce sectors.

- Improving Technical Indicators: Chart watchers have noted that the S&P 500 is approaching key support levels, which could serve as a springboard for a rally. If the index can hold above these levels and break through resistance points, it may regain positive momentum.

- ETF Flows & Liquidity: Exchange-traded funds (ETFs) tracking the S&P 500 have seen steady inflows, suggesting that institutional and retail investors still view the index as a reliable long-term investment. This influx of capital could help stabilise and lift the market.

The Road Ahead: Risks & Opportunities

While the S&P 500 has the potential to recover, it faces several hurdles. The market remains sensitive to upcoming economic data releases, including GDP growth, employment figures, and inflation metrics. Any signs of economic weakness could derail a year-end rally.

Moreover, corporate earnings for the fourth quarter, set to be released in early 2025, will weigh heavily on investor sentiment. Companies that demonstrate resilience in challenging conditions may lead the charge, while others may struggle to keep pace.

Investor Takeaway

The S&P 500’s bounce back and reaching new highs will depend on a delicate balance of positive economic indicators, investor sentiment, and technical market dynamics.

For investors, this period represents both a challenge and an opportunity. Those with a long-term perspective may find value in the current volatility, while short-term traders could capitalise on any late-year momentum.

As the clock ticks down in 2024, all eyes remain on the charts—and the S&P 500’s to close the year with a flourish.