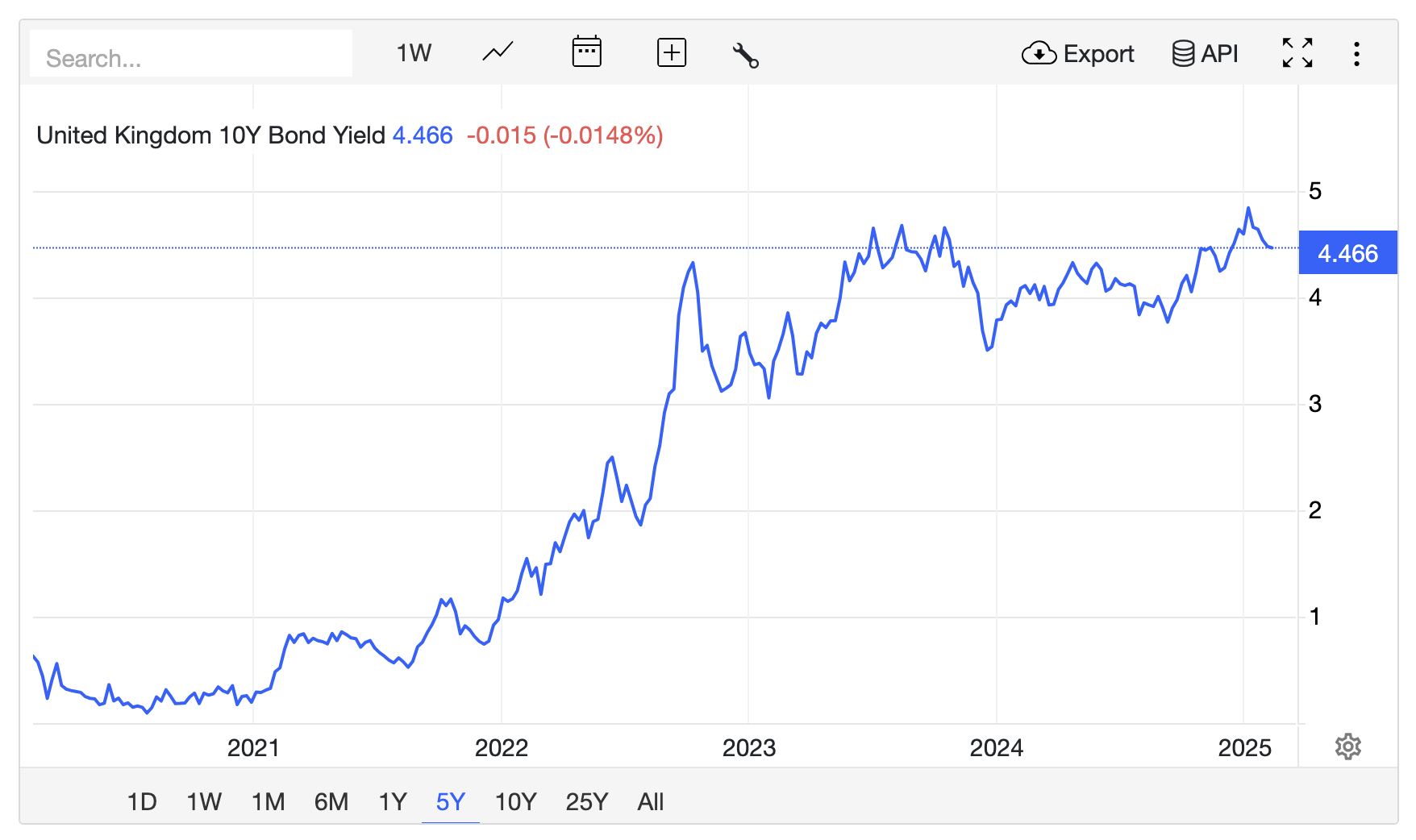

Britons Snap Up Bonds As Yields Hit Four-Year High

- This topic has 0 replies, 1 voice, and was last updated 2 months ago by .

-

Topic

-

Britons are buying government bonds (gilts) at the highest levels in four years, driven by a combination of attractive yields, tax advantages, and shifting market conditions.

January 2025 saw record trading volumes and values for gilts, according to Hargreaves Lansdown, as retail investors sought to capitalise on yields exceeding 4%—levels not seen since 2008.

This surge reflects a broader trend where higher bond yields are drawing money away from equities due to their lower risk and reliable returns.

The rise in gilt yields stems from several factors, including concerns over the UK government’s fiscal policies, persistent inflation, and global economic dynamics.

Sticky inflation and limited interest rate cuts by the Bank of England have kept borrowing costs elevated.

However, forecasts suggest potential rate cuts later in 2025 could lower yields, making current levels particularly attractive for investors looking to lock in returns.

For investors, this trend highlights a shift toward safer assets amid economic uncertainty.

Many see gilts as a dependable option for income generation and portfolio diversification during volatile times.

Chart: Trading Economics