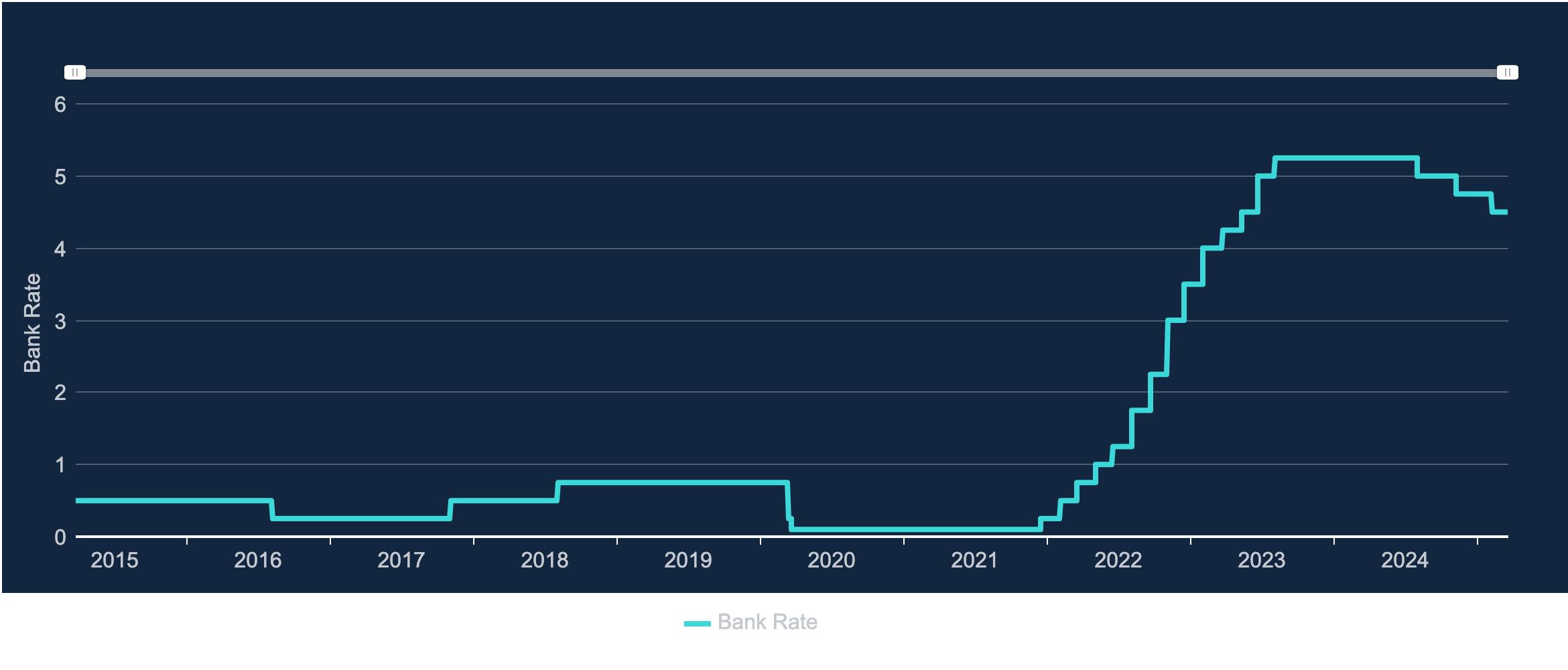

BoE Holds Steady At 4.5%: Inflation Focus Keeps Rate Cuts On Hold

- This topic has 0 replies, 1 voice, and was last updated 4 weeks ago by .

-

Topic

-

The Bank of England’s (BoE) decision to hold rates at 4.5% underscores its focus on taming inflation despite external pressures like US tariffs and global trade tensions.

With wage growth holding steady at 5.9%—well above the 2.5% inflation rate—the central bank is treading carefully to avoid stoking further price pressures.

While the BoE hinted at potential rate cuts later this year, the timing remains unclear, leaving traders to navigate a landscape of mixed signals.

The pound’s 0.3% dip post-announcement reflects the market’s cautious stance, as investors weigh the central bank’s gradual approach against economic uncertainties.

For short-term traders, this creates opportunities in GBP currency pairs and interest rate-sensitive assets, but volatility is likely to persist.

Keep an eye on inflation data and global trade developments for clues on the BoE’s next move.

Do you see the BoE cutting rates sooner rather than later, or will inflation keep them on hold? 🤔📊