BOE Holds Interest Rates At 4.75%

- This topic has 0 replies, 1 voice, and was last updated 10 months ago by .

-

Topic

-

On December 19, the Bank of England (BoE) announced it would maintain its benchmark interest rate at 4.75%. This decision comes as inflation continues to rise and economic growth remains fragile.

Inflation reached 2.6% in November, exceeding the BoE’s 2% target, while the UK economy has contracted for two consecutive months.

Despite speculation that the BoE might begin cutting rates soon, this cautious stance signals that rates may remain elevated longer to combat inflation and prevent economic overheating.

The BoE’s decision to hold rates steady had immediate and varied effects across financial markets:

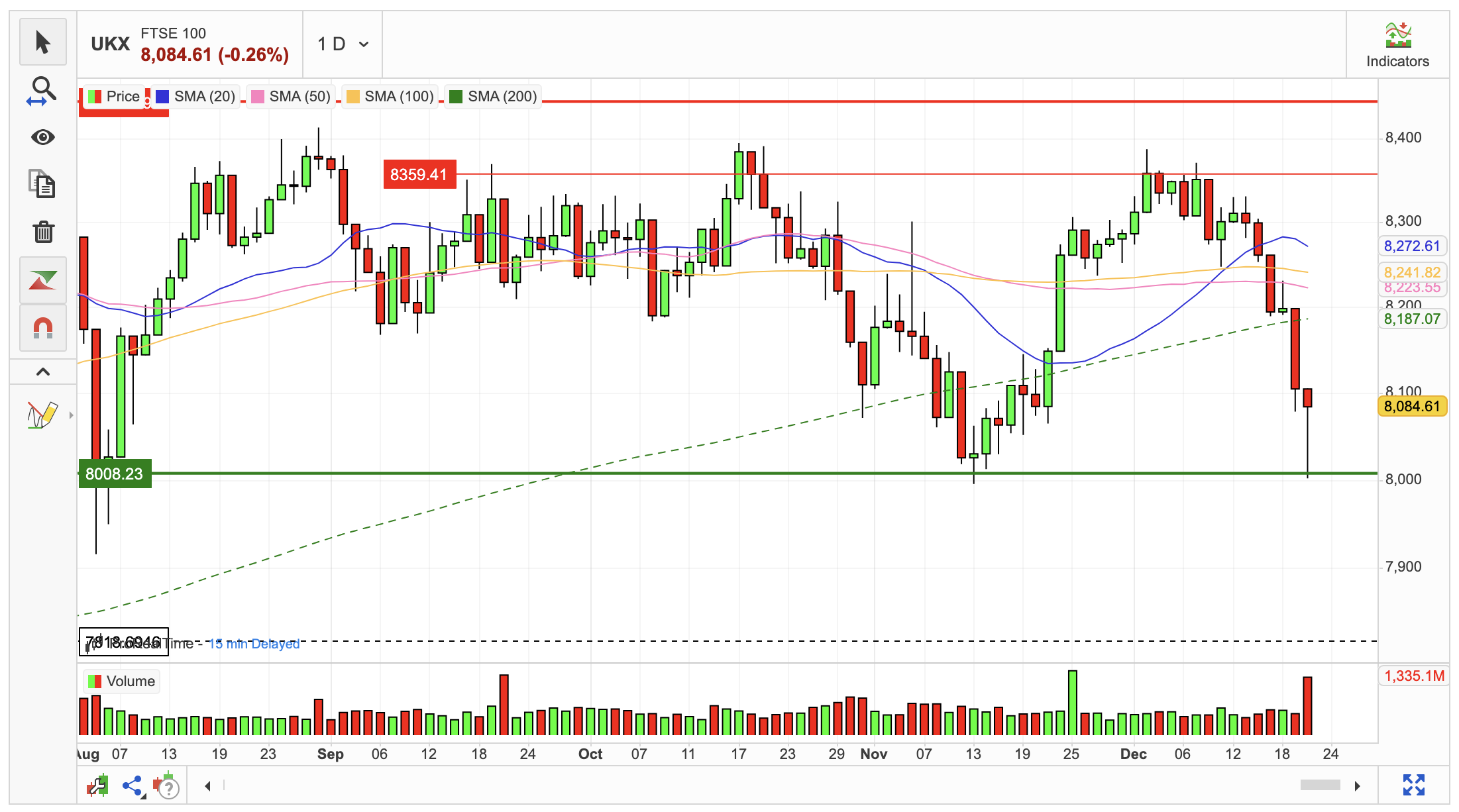

- Stock Markets: UK stock indexes, including the FTSE 100 and FTSE 250, dropped over 1% following the announcement. Sectors sensitive to interest rate policy, such as housebuilders and banks, were hit hardest as concerns over slower economic growth and sustained high borrowing costs weighed on investor sentiment.

- Bond Markets: UK government bonds (gilts) remained attractive to confident investors due to their relatively high yields. However, the elevated yields also limited potential price growth for gilts. The BoE’s decision reinforced expectations that borrowing costs could remain high, providing a mixed outlook for the bond market.

- Currency Markets: The British pound (GBP) stayed relatively stable against major currencies, reflecting limited room for significant appreciation. While the BoE’s decision supported the currency by curbing inflationary concerns, broader economic uncertainty and subdued growth prospects tempered upward momentum.

- Housing Market: Mortgage rates, which remained at around 5% for popular two-year fixed deals, continued to pressure the housing market. High borrowing costs and economic caution have slowed housing activity, with potential buyers and sellers adopting a wait-and-see approach.

- Alternative Investments: In the face of inflationary pressures and persistent uncertainty around interest rates, investors are increasingly exploring diversification beyond traditional bonds. Options such as real assets, commodities, and specific equities are being considered to hedge against inflation and market volatility.

The BoE’s decision underscores the delicate balance it faces in addressing inflation while supporting an economy that shows signs of strain.

Although inflation remains above target, the contraction in economic activity has raised concerns about the potential for a deeper downturn.

Market participants and analysts widely expect the BoE to continue to adopt a cautious approach, closely monitoring inflationary trends and economic indicators before making further moves.

Data: eToro