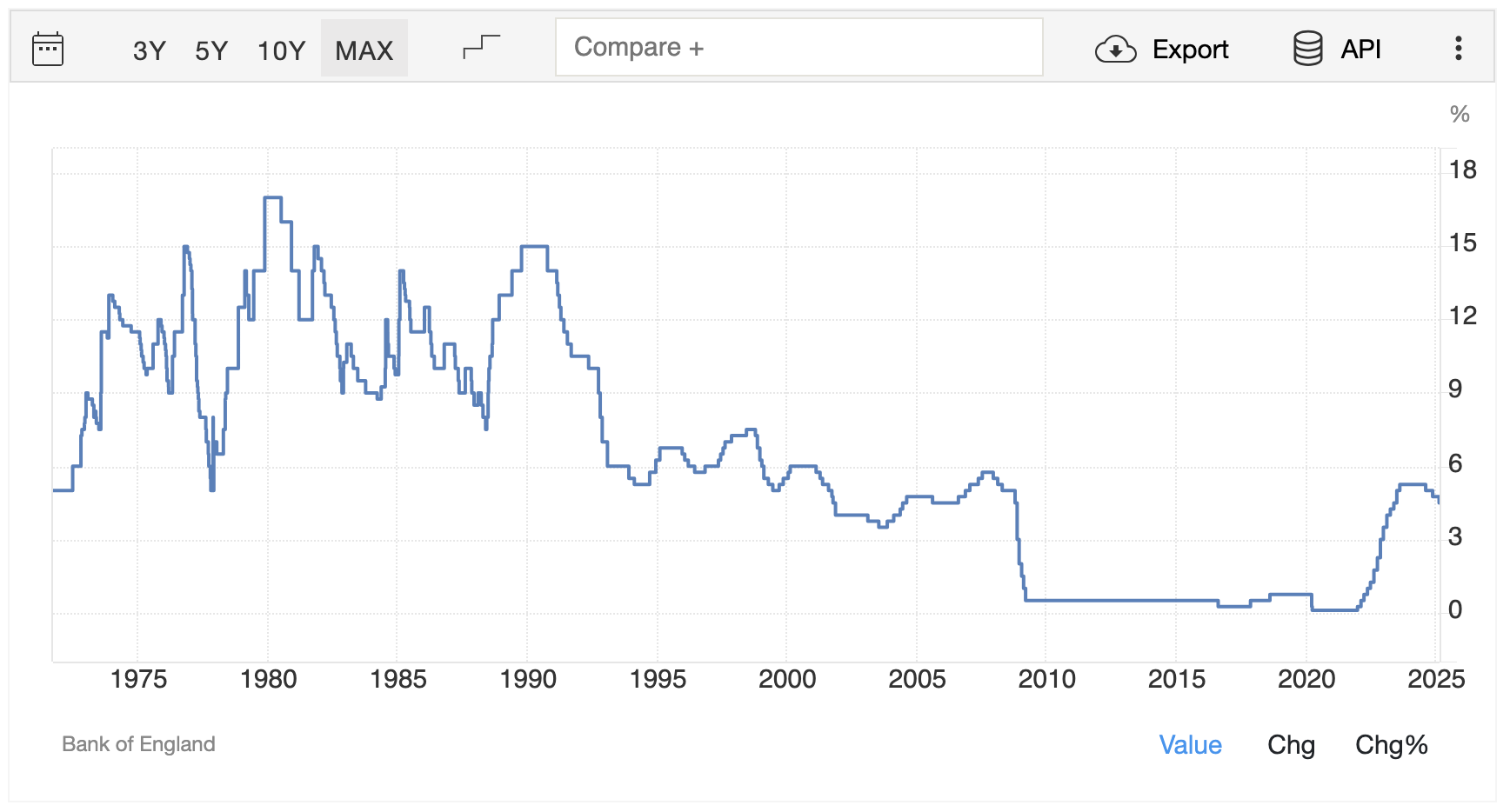

BoE Cuts Rates Amid Growth Fears, Traders Eye Sterling Volatility

- This topic has 0 replies, 1 voice, and was last updated 2 months ago by .

-

Topic

-

The Bank of England (BoE) has implemented its third consecutive interest rate reduction since August 2024, lowering the Bank Rate by 25 basis points to 4.5% in its February 2025 decision.

This move aligns with market expectations and reflects the central bank’s ongoing efforts to balance economic growth concerns with persistent inflationary pressures.

In a surprising display of unity, all nine members of the Monetary Policy Committee (MPC) supported the rate cut, defying predictions of an 8-1 vote split.

Notably, two members, including the traditionally hawkish Catherine Mann, advocated for a more aggressive 50 basis point reduction, signalling a potential shift in sentiment among some policymakers.

Despite this unanimous decision, the BoE maintains its cautious stance on monetary easing for the remainder of 2025.

The central bank continues to navigate the delicate balance between addressing mounting growth concerns and managing stubborn underlying services inflation.

The BoE’s downward revision of growth forecasts for the current year indicates that economic activity has underperformed compared to November 2024 projections.

This adjustment suggests a slight dovish tilt in the near-term risk balance between fostering growth and controlling inflation.

For traders, this announcement presents several potential opportunities:

Currency markets: The pound sterling may experience increased volatility in the short term. Traders could capitalise on potential weakening against major currencies like the US dollar or euro.

Bond markets: With interest rates declining, government bond yields may fall, potentially creating opportunities for bond traders to profit from price appreciation.

Equity markets: Lower interest rates could boost stock market performance, particularly for sectors sensitive to borrowing costs such as real estate and utilities.

Interest rate derivatives: Traders might consider adjusting their positions in interest rate swaps or futures based on expectations of future rate cuts.

Banking sector: Financial institutions may face pressure on their net interest margins, potentially impacting their stock prices and creating opportunities for both long and short positions.

However, traders should remain cautious and consider the BoE’s emphasis on gradual easing, as well as the ongoing economic uncertainties, when formulating their strategies.

Data: Trading Economics