AppLovin AI Stock Up 1,000% Year-To-Date

- This topic has 1 reply, 1 voice, and was last updated 1 month ago by .

-

Topic

-

AppLovin (NASDAQ: APP) shares surged by an impressive 35% following the release of its fourth-quarter 2024 financial results, which significantly exceeded analyst expectations.

The mobile technology company reported earnings per share of $1.73 on revenue of $1.37 billion, marking a 44% year-over-year increase.

This stellar performance has propelled AppLovin’s stock to new heights, with year-to-date gains now exceeding 1,000%, solidifying its position as one of the top-performing AI-related stocks of 2025.

The company’s success is largely attributed to its AI-driven advertising platform, which has experienced robust growth beyond its traditional gaming focus.

Advertising revenue surged by an impressive 73% year-over-year, reaching nearly $1 billion in Q4 alone.

This growth demonstrates AppLovin’s successful expansion into broader markets, including e-commerce, fintech, and insurance.

In a strategic move, AppLovin announced the divestment of its apps business for $900 million, allowing the company to focus entirely on its high-growth advertising technology segment.

This decision has been well-received by investors and analysts alike, who view it as a clear signal of AppLovin’s commitment to dominating the AI-powered advertising space.

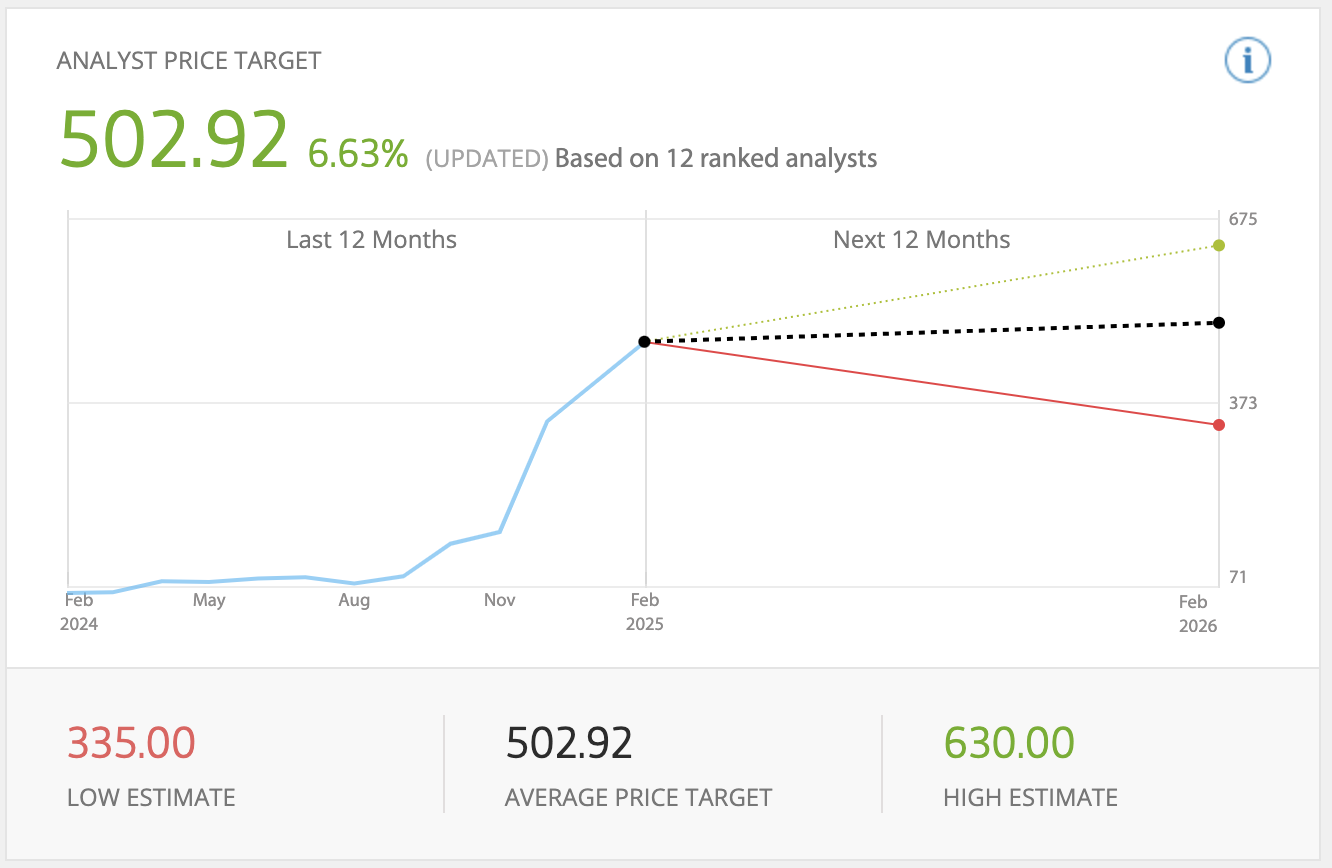

Wall Street analysts have responded enthusiastically to AppLovin’s performance, with several major firms significantly raising their price targets.

BTIG increased its target from $437 to $600, while BofA lifted its projection from $375 to $580.

These upward revisions reflect growing confidence in AppLovin’s AI-driven business model and its potential for continued expansion.

Looking ahead, AppLovin provided optimistic guidance for Q1 2025, projecting revenue between $1.355 billion and $1.385 billion, surpassing consensus estimates.

With its AI-powered advertising solutions gaining traction across various industries, AppLovin is well-positioned to capitalise on the growing demand for targeted, data-driven advertising.

As AppLovin continues to innovate and expand its AI capabilities, investors and industry observers are closely watching to see if the company can maintain its impressive momentum throughout 2025 and beyond.

Sources: eToro, TipRanks