AI Stocks Lift Wall Street As Nvidia Shines

- This topic has 0 replies, 1 voice, and was last updated 2 months ago by .

-

Topic

-

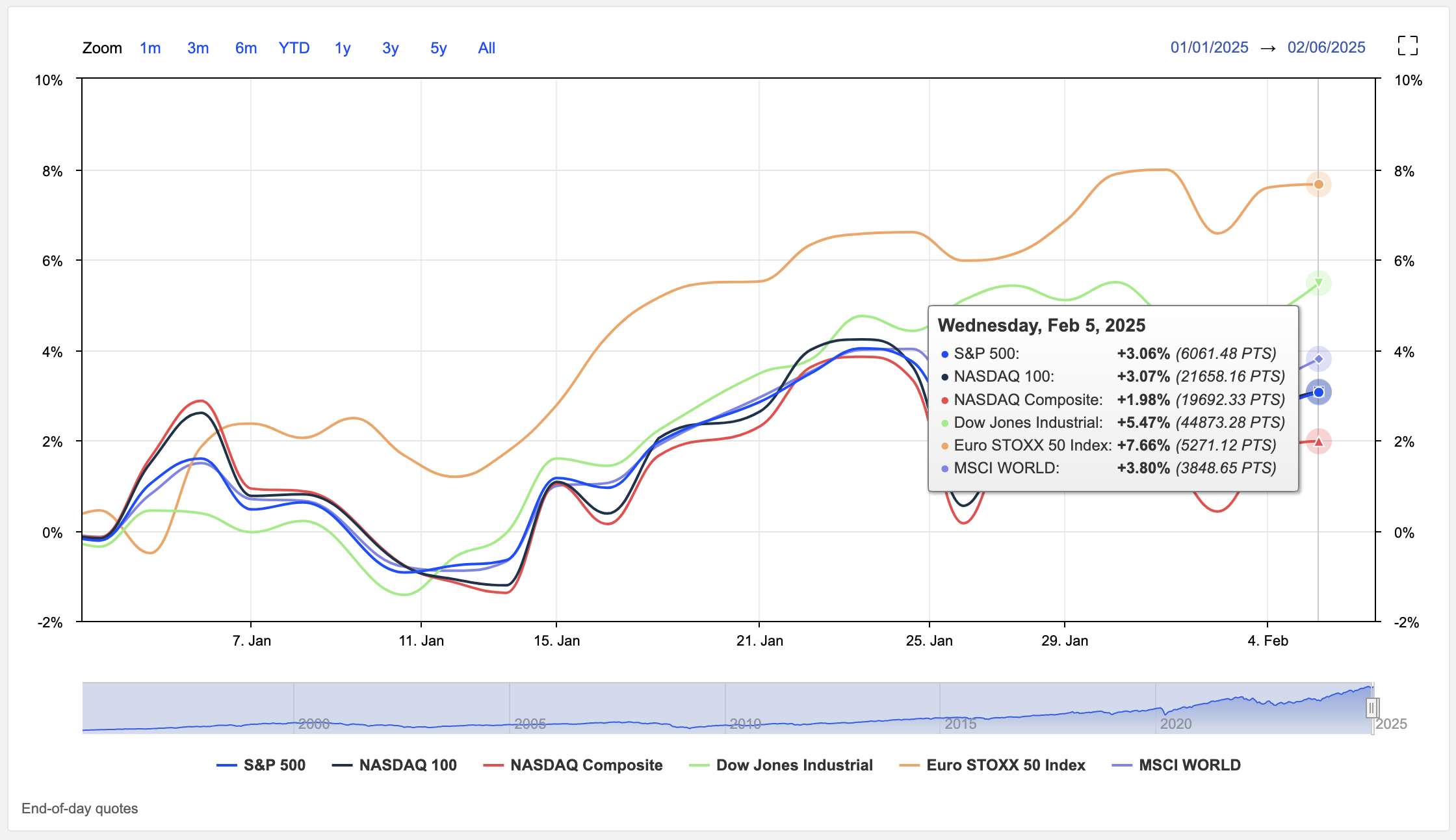

US equity markets concluded Wednesday’s trading session on a positive note, with major indices posting gains as investors processed a diverse array of corporate earnings reports and economic indicators.

The upward momentum was largely fuelled by a significant decline in long-term Treasury yields, which helped alleviate concerns about rising borrowing costs

The S&P 500 and Nasdaq 100 both advanced by around 0.40%, while the Dow Jones Industrial Average exhibited even stronger performance, surging by 317.24 points or 0.71% to close at 44,873.28.

This robust showing was primarily attributed to impressive gains from tech giant Nvidia and biotechnology firm Amgen.

Nvidia’s shares soared by 5.2%, catalysed by an announcement from Super Micro Computer regarding the full-scale production of its AI data centre utilising Nvidia’s cutting-edge Blackwell platform.

This news not only boosted Nvidia’s stock but also had a ripple effect across the tech sector, with Super Micro Computer’s shares skyrocketing by 8%.

Amgen further contributed to the market’s positive sentiment, with its stock price climbing 6.5% to $307.81, following the release of its fourth-quarter financial results.

The company’s earnings and revenue surpassed analysts’ expectations, underscoring the strength of its product portfolio and market position.

However, the day’s gains were tempered by disappointing performances from some tech heavyweights.

Alphabet, Google’s parent company, saw its shares plummet by 7% after reporting lower-than-anticipated cloud revenue.

Similarly, Uber experienced a 7.6% decline in its stock price due to disappointing forward guidance, despite strong earnings.

Adding to the market’s complexity was growing apprehension regarding increased regulatory scrutiny of major technology firms by Chinese authorities.

This development introduced an element of uncertainty to the broader market outlook, as investors grappled with potential implications for global tech giants operating in the world’s second-largest economy.

Despite these challenges, the overall market sentiment remained cautiously optimistic.

Investors continued to navigate the delicate balance between corporate performance, economic indicators, and geopolitical factors shaping the investment landscape.

The positive performance was further supported by encouraging economic data, with US private-sector hiring increasing by 183,000 jobs in January, surpassing analysts’ expectations of 150,000.

As the market looks ahead, attention remains focused on upcoming earnings reports from major companies and potential developments in US-China trade relations.

The postponement of tariffs on Canada and Mexico by President Trump has provided some relief, but the implementation of new tariffs on Chinese imports continues to be a source of concern for investors.

Source: Trading Economics, MarketScreener