AI Frenzy Fuels Fears Of Market Bubble

- This topic has 1 reply, 1 voice, and was last updated 2 months ago by .

-

Topic

-

The rapid ascent of US artificial intelligence (AI) stocks has sparked debates about a potential market bubble reminiscent of the late 1990s dot-com era.

While AI presents transformative opportunities, concerns arise over elevated valuations and the influence of prevailing economic conditions.

Parallels To The Dot-Com Bubble

The late 1990s witnessed a surge in technology stock valuations, driven by speculative investments in Internet-based companies.

Similarly, the current enthusiasm for AI has led to substantial investments in AI-related stocks.

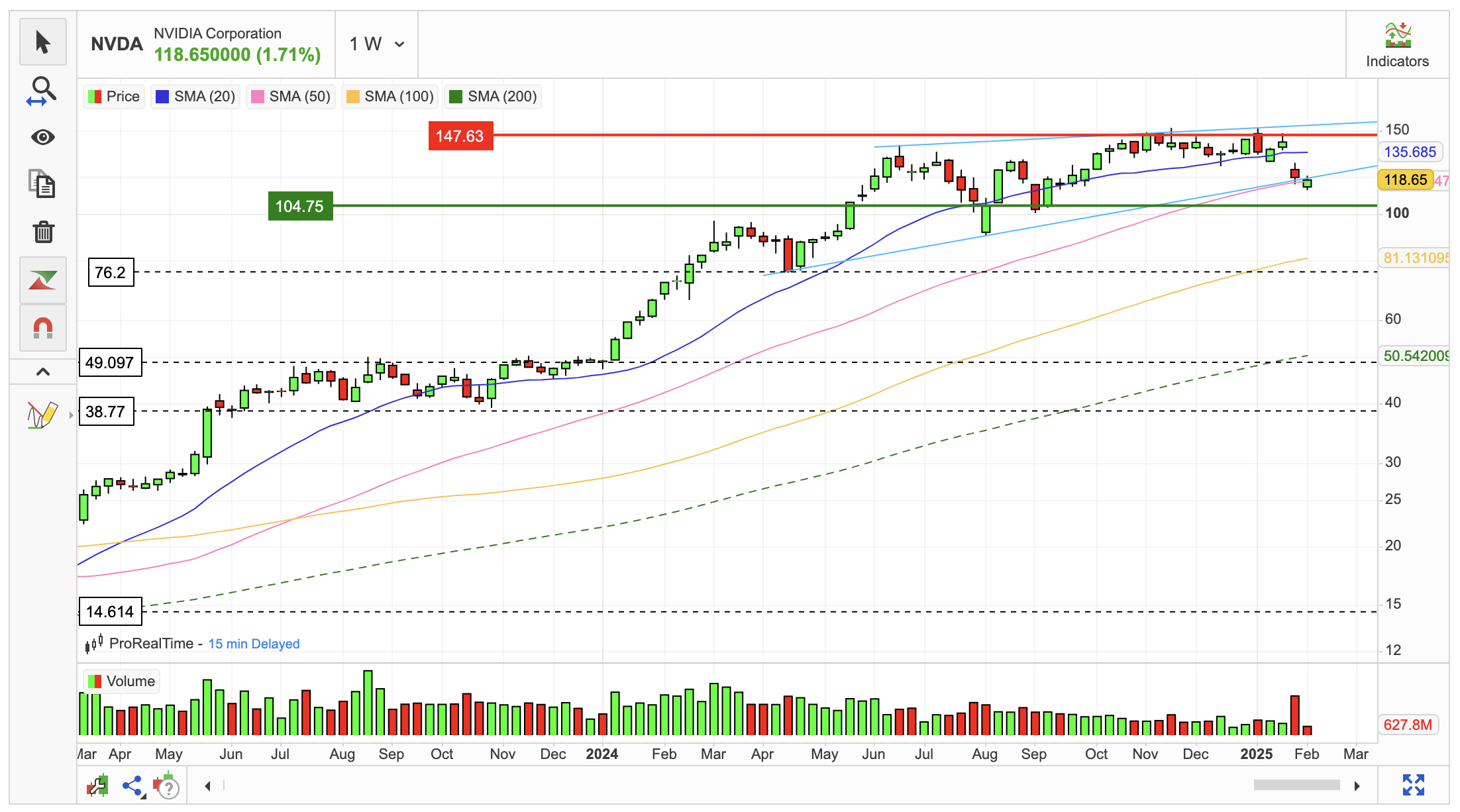

Notably, companies like Nvidia have seen significant appreciation in their stock prices, reflecting heightened investor interest. This pattern has led some analysts to caution about potential overvaluation.

Interest Rate Risks

Elevated stock valuations amid rising interest rates present a precarious scenario.

Higher interest rates can increase borrowing costs and reduce future cash flow valuations, potentially leading to downward pressure on high-growth stocks, including those in the AI sector.

Investors should be mindful of the interplay between interest rate fluctuations and stock valuations.

Diverse Perspectives

Opinions vary among financial experts regarding the existence of an AI-driven market bubble.

A March Bank of America survey indicated that 40% of fund managers believed AI stocks were in a bubble, while 45% disagreed, and 15% were uncertain.

This division underscores the complexity of assessing market dynamics in rapidly evolving sectors.

Conclusion

While AI continues to drive innovation and economic growth, the surge in AI stock valuations warrants cautious consideration.

Investors should remain vigilant, balancing optimism about AI’s potential with prudent analysis of market fundamentals and macroeconomic factors.

Sources: Investor’s Business Daily, Fool.com