Butterfly Spread Trading Strategy

The butterfly spread is an options trading strategy designed to profit from minimal price movement in the underlying asset.

This strategy is popular among traders looking to capitalize on low volatility environments.

It’s part of the spread trading family of trading strategies.

Key Takeaways – Butterfly Spread Trading Strategy

- Risk Management

- The butterfly spread limits both potential losses and gains.

- Offers a controlled risk-reward profile suitable for volatile markets.

- Cost-Effective

- This strategy is typically low-cost, as it involves buying and selling options at different strike prices, which minimizes upfront investment.

- Neutral Market Outlook

- Ideal for traders anticipating minimal price movement.

- Profits are maximized when the underlying asset’s price remains near the middle strike price at expiration.

Definition and Basic Structure

The butterfly spread involves three different strike prices and typically four option contracts.

It combines bull and bear spreads to create a position with limited risk and limited profit potential.

The structure can be applied using either call or put options.

Components of a Butterfly Spread

Long Butterfly Spread with Calls

- Buying One Call Option at the Lower Strike Price (A):

- This is the first leg of the butterfly spread.

- The trader buys one call option at a lower strike price (A), paying a premium.

- Selling Two Call Options at the Middle Strike Price (B):

- The trader sells two call options at a middle strike price (B), receiving premiums.

- This is the second leg and the core of the butterfly strategy.

- Buying One Call Option at the Higher Strike Price (C):

- Finally, the trader buys one call option at a higher strike price (C), paying another premium.

- This is the third leg of the butterfly spread.

Long Butterfly Spread with Puts

- Buying One Put Option at the Higher Strike Price (C):

- The first leg involves buying one put option at the higher strike price (C), paying a premium.

- Selling Two Put Options at the Middle Strike Price (B):

- The trader sells two put options at the middle strike price (B), receiving premiums, forming the second leg.

- Buying One Put Option at the Lower Strike Price (A):

- The final leg is buying one put option at the lower strike price (A), paying another premium.

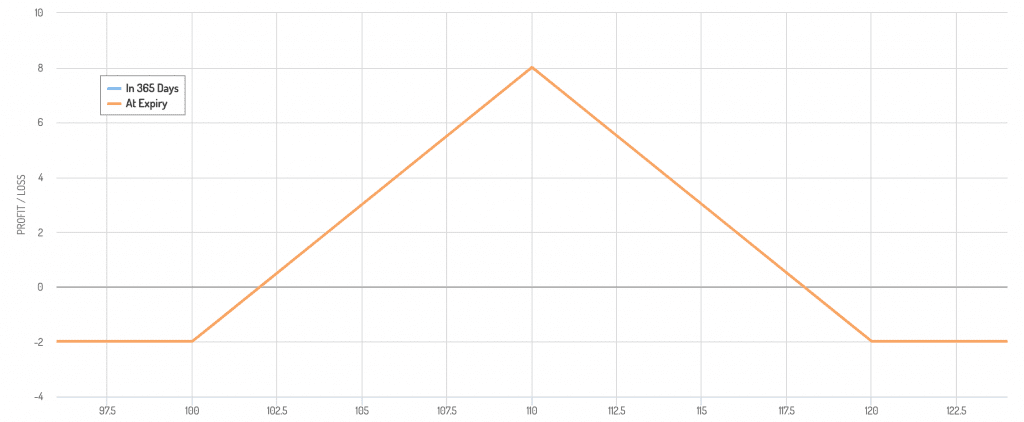

Butterfly Spread Payoff Diagram

Using calls and puts provides the same type of options payoff diagram:

Profit and Loss Potential

The maximum profit is achieved if the underlying asset’s price is exactly at the middle strike price (B) at expiration. The profit is calculated as:

- Maximum Profit = Strike Price of Middle Options (B) – Strike Price of Lower Option (A) – Net Premium Paid

The maximum loss occurs if the underlying asset’s price is outside the lower or higher strike prices (A or C) at expiration. The loss is limited to the net premium paid to enter the trade:

- Maximum Loss = Net Premium Paid

Breakeven Points

The breakeven points for a butterfly spread can be calculated as follows:

- Lower Breakeven Point:

- Lower Breakeven = Lower Strike Price (A) + Net Premium Paid

- Upper Breakeven Point:

- Upper Breakeven = Higher Strike Price (C) – Net Premium Paid

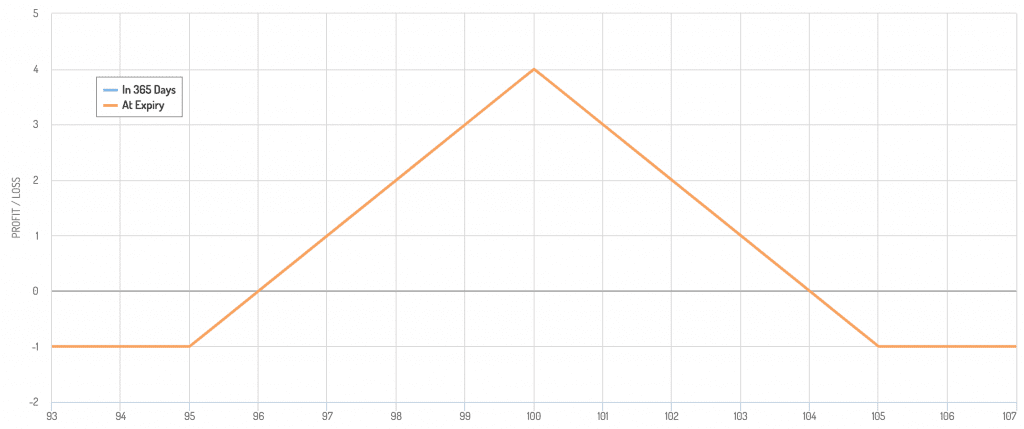

Example

Consider a stock trading at $100. A trader executes a butterfly spread with the following options:

- Buy one call at $95 (A) for $7

- Sell two calls at $100 (B) for $4 each

- Buy one call at $105 (C) for $2

The net premium paid is:

- Net Premium Paid = $7 – 2($4) + $2 = $1

The maximum profit is:

- Maximum Profit = $100 – $95 – $1 = $4

The breakeven points are:

- Lower breakeven: $95 + $1 = $96

- Upper breakeven: $105 – $1 = $104

Payoff Diagram

The payoff diagram can be found below:

Types of Butterfly Spreads

Butterfly spreads are versatile options strategies that can be tailored to different markets and expectations.

Here are the main types of butterfly spreads available to traders.

We’ll frame this by structure, market outlook, and profit and loss.

Long Butterfly Spread with Calls

- Structure – Buy one call at a lower strike price, sell two calls at a middle strike price, and buy one call at a higher strike price.

- Market Outlook – Neutral to slightly bullish. Traders expect the stock price to be close to the middle strike price at expiration.

- Profit and Loss – Limited profit if the stock price is at the middle strike price at expiration. Limited loss if the stock price is outside the wings (lower or higher strike prices).

Long Butterfly Spread with Puts

- Structure – Buy one put at a higher strike price, sell two puts at a middle strike price, then buy one put at a lower strike price.

- Market Outlook – Same as above.

- Profit and Loss – Same as above.

Iron Butterfly Spread

- Structure – Combination of a bull put spread and a bear call spread. Sell one at-the-money call and one at-the-money put, buy one out-of-the-money call, and buy one out-of-the-money put.

- Market Outlook – Neutral. Traders expect low volatility and the stock price to remain near the strike price of the sold options.

- Profit and Loss – Limited profit if the stock price is at the strike price of the sold options at expiration. Limited loss if the stock price moves significantly away from the strike price.

Broken-Wing Butterfly Spread

- Structure – Similar to the standard butterfly spread but with the wings (buy options) placed at unequal distances from the middle (sold options).

- Market Outlook – Neutral to slightly directional, depending on the skew of the wings.

- Profit and Loss – Limited profit with asymmetric risk. One side has a higher risk than the other, depending on the skew.

Calendar Butterfly Spread

- Structure – Combining calendar spreads (options with different expiration dates) into a butterfly structure.

- Market Outlook – Neutral with an expectation of low volatility in the near term but potential for higher volatility later.

- Profit and Loss – Limited profit if the stock price is near the strike price of the sold options at the first expiration. Losses depend on the movement of the underlying asset.

Advantages and Disadvantages

Advantages

- Potential for Quality Return – The potential return can be good if the underlying asset’s price is at the middle strike price at expiration.

- Limited Risk – Butterfly spreads have a clearly defined risk, making it easier for traders to manage potential losses.

- Low Cost – Compared to other strategies, butterfly spreads can be relatively inexpensive to set up because the premiums received from the sold options partially offset the cost of the bought options.

- Flexibility – Butterfly spreads can be adapted to various markets (neutral, slightly bullish, or slightly bearish) by adjusting the strike prices and the type of options used.

Disadvantages

- Commissions and Fees – Higher costs due to multiple transactions.

- Limited Profit Range – The maximum profit is only achieved if the underlying asset’s price is at the middle strike price at expiration. If the price moves significantly away from this point, the potential profit decreases.

- Complexity – Butterfly spreads can be complex to set up and manage, especially for novice traders. Understanding the nuances of different strike prices and expiration dates is important.

- Time Decay – Time decay (theta) works in favor of the strategy as expiration approaches, but it can also lead to losses if the underlying asset’s price does not move as expected.

Best Time to Implement Butterfly Spread Options Strategy

Low Volatility Expectations

Butterfly spreads are most effective in low volatility environments –where the underlying asset’s price is not expected to move significantly.

This allows the strategy to exploit the time decay of the options sold at the middle strike price.

Neutral Market Outlook

The strategy is ideal when the trader has a neutral outlook on the market and expects the underlying asset’s price to remain pretty close to the middle strike price of the spread.

Defined Event Horizons

Butterfly spreads can be advantageous around specific events, such as earnings reports or economic data releases, where the trader expects limited movement in the underlying asset’s price (i.e., for the company to meet expectations).

Range-Bound Market Conditions

In a range-bound market, where the underlying asset’s price is oscillating within a certain range, a butterfly spread can be used to take advantage of the predictable price pattern.

Expiration Proximity

Butterfly spreads can be set up when the options are nearing expiration, which allows the trader to take advantage of the accelerated time decay of the sold options.

This is most useful when the underlying asset’s price is close to the middle strike price.

Conclusion

The butterfly spread is an options strategy ideal for traders expecting low volatility.

By combining multiple options at different strike prices, traders can create a position with defined risk and reward characteristics.

Nonetheless, the complexity and limited profit potential need to be considered.