Best Brokers With Volatility Index (VIX) In 2026

Want to trade market volatility? Dig into the best brokers with the CBOE Volatility Index (VIX) and related instruments, based on the tests of our experts who’ve traded volatility indexes across multiple platforms.

Top 6 Brokers For Trading Volatility Index

We've exhaustively evaluated 140 brokers and these 6 jump out as the best brokers for trading volatility indices:

-

1

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

2

Optimus Futures

Optimus Futures -

3

IC Markets

IC Markets -

4

XM

XM -

5

AvaTrade

AvaTrade -

6

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Why Are These Brokers The Best For VIX Trading?

Here’s a rundown of why these brokers stand out for trading the VIX and volatility-based instruments:

- eToro USA is the best broker for trading the volatility index in 2026 - When we tested eToro USA, we accessed VIX futures CFDs and ETF options (like VXX) via the proprietary platform, with execution smooth and charts real-time. Spreads hovered near 2 points on VIX futures, and integrated sentiment tools helped refine entry timing. However, U.S. traders cannot use leverage on CFDs, limiting advanced strategies.

- Optimus Futures - Established in 2004, Optimus Futures specializes in low-cost, customizable futures trading. It provides access to a growing suite of around 70 futures markets spanning micro E-minis, energies, metals, grains, and cryptos. With commission tiers starting at $0.25 per side for micros and the option to choose your own clearing firm (e.g. Ironbeam, StoneX, Phillip Capital), the brokerage offers flexibility. Optimus Futures has also introduced excellent features like multi-bracket orders and journaling, giving active traders more control.

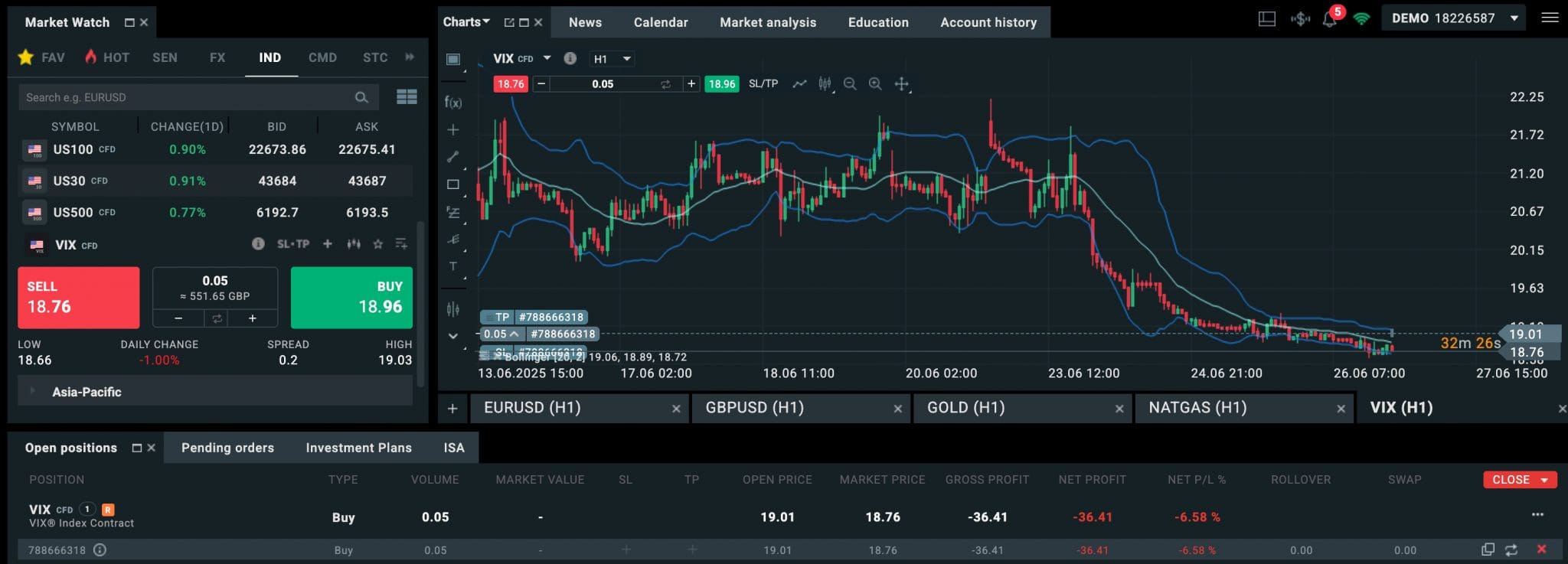

- IC Markets - IC Markets delivers raw pricing on volatility indices with impressive execution speed - crucial when trading sharp intraday VIX swings. Ideal for scalpers, the depth of liquidity minimizes requotes even in peak volatility. Its cTrader and MT5 platforms handle rapid-fire VIX trades smoothly, giving active traders a real edge during market turbulence.

- XM - Our trades on XM’s VIX Futures CFDs through MT5 executed with impressive speed and exceptionally low spreads - often around 0.07 index points. We experienced smooth order entry and zero slippage even during volatility surges. The MT5 platform also supports micro‑lot trading, ideal for precision control in high-stress market periods.

- AvaTrade - During our tests, AvaTrade’s risk tools stood out: the fee-based AvaProtect insurance lets you cap downside for a chosen time window on FX, gold and silver (AvaTradeGO/WebTrader), while standard SL/TP orders are available but not guaranteed during gaps. Execution stayed stable in fast markets.

- Pepperstone - When we tested Pepperstone, VIX trading on MT5 delivered rapid execution and low latency, even during CPI or Fed-driven spikes. Spreads averaged just under 2 points, and the Smart Trader Tools suite gave useful volatility gauges. It’s a solid choice for traders who want precision during high-impact news events.

Compare The Best VIX Brokers By Key Features

Find the right VIX broker for you based on our comparison of core features that matter to volatility traders:

| Broker | Minimum Deposit To Trade The VIX | Minimum Trade On The VIX | Fast Execution | Platforms | Regulator |

|---|---|---|---|---|---|

| eToro USA | $100 | $10 | ✔ | eToro Trading Platform & CopyTrader | SEC, FINRA |

| Optimus Futures | $500 | $50 | ✘ | Optimus Flow, Optimus Web, MT5, TradingView | NFA, CFTC |

| IC Markets | $200 | 0.01 Lots | ✔ | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | ASIC, CySEC, CMA, FSA |

| XM | $5 | 0.01 Lots | ✔ | MT4, MT5, TradingCentral | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| AvaTrade | $100 | 0.01 Lots | ✔ | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Pepperstone | $0 | 0.01 Lots | ✔ | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

How Safe Are The Best VIX Brokers?

Compare how well the top brokerages protect client funds when day trading volatility indices:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| eToro USA | ✘ | ✘ | ✔ | |

| Optimus Futures | ✘ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✔ | |

| XM | ✘ | ✔ | ✔ | |

| AvaTrade | ✘ | ✔ | ✔ | |

| Pepperstone | ✘ | ✔ | ✔ |

Compare Mobile Platforms For Trading VIX

If you’re trading on the go, see which of our top brokers offer strong mobile tools for volatility index trading:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| eToro USA | iOS & Android | ✘ | ||

| Optimus Futures | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| XM | iOS, Android & Windows | ✘ | ||

| AvaTrade | iOS & Android | ✘ | ||

| Pepperstone | iOS & Android | ✘ |

Are The Top VIX Brokers Good For Beginners?

See which of our leading providers offer demo accounts, support, and education for getting started VIX trading:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| eToro USA | ✔ | $100 | $10 | ||

| Optimus Futures | ✔ | $500 | $50 | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| XM | ✔ | $5 | 0.01 Lots | ||

| AvaTrade | ✔ | $100 | 0.01 Lots | ||

| Pepperstone | ✔ | $0 | 0.01 Lots |

Are The Top VIX Brokers Good For Advanced Traders?

Experienced traders will value our top platforms with low latency and tools to maximize VIX strategies:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

| Optimus Futures | TradingView Pine Script, API Features | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✔ | ✘ | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ |

| XM | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:1000 | ✔ | ✘ |

| AvaTrade | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✔ | 1:30 (Retail) 1:400 (Pro) | ✔ | ✘ |

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ |

Compare Detailed Ratings Of The Top VIX Brokers

See how the leading brokers for trading volatility stack up across our nine core scoring categories:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| eToro USA | |||||||||

| Optimus Futures | |||||||||

| IC Markets | |||||||||

| XM | |||||||||

| AvaTrade | |||||||||

| Pepperstone |

Compare Trading Fees

Costs can add up, so here’s how the best VIX trading platforms compare on spreads and other charges:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| eToro USA | ✔ | $10 | |

| Optimus Futures | ✘ | $0 | |

| IC Markets | ✘ | $0 | |

| XM | ✘ | $5 | |

| AvaTrade | ✔ | $50 | |

| Pepperstone | ✔ | $0 |

How Popular Are The Top VIX Brokers?

See which of the best brokers for VIX trading have the most client sign-ups:

| Broker | Popularity |

|---|---|

| XM | |

| eToro USA | |

| Pepperstone | |

| AvaTrade | |

| IC Markets |

Why Trade The VIX With eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

Cons

- Average fees may cut into the profit margins of day traders

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

Why Trade The VIX With Optimus Futures?

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Pros

- Optimus Futures has added event contracts from CME Group, allowing traders to express a daily market view with a simple yes-or-no position on major futures markets. Only offered by a handful of brokers, these fixed-risk products provide a straightforward way to speculate on a short-term basis.

- The brokerage provides the flexibility to choose your clearing firm, including Iron Beam, Phillip Capital, and StoneX, allowing for direct control over where your funds are held and the associated transaction costs - helpful for customizing the futures trading setup.

- Product and service upgrades, notably multi-bracket orders, an integrated trade journal, and a broader futures lineup, show Optimus Futures is making a clear effort to support active traders.

Cons

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

Why Trade The VIX With IC Markets?

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

Cons

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

Why Trade The VIX With XM?

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

Why Trade The VIX With AvaTrade?

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

Why Trade The VIX With Pepperstone?

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

Cons

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

How DayTrading.com Chose The Best Brokers For Trading The VIX

We followed a three-step process to find the top brokers for trading the VIX and related volatility products:

- VIX Access Verified – We manually logged into each platform in our database of 140 brokerages to confirm whether volatility indexes were available, such as CBOE Volatility Index (VIX) derivatives, VIX-linked ETFs/ETNs, or VIX CFDs. This ensured we only included brokers that genuinely support volatility trading.

- Product Testing – For each shortlisted broker, we personally tested the VIX trading experience. This involved checking the type and quality of the VIX product, trading conditions (spreads, execution, margin), platform tools and usability for volatility-focused strategies, and reliability during market hours.

- Broker Ranking by Overall Score – We then ranked these brokers based on overall ratings, using our in-house scoring system that pulls from 200+ data points across nine key categories. Only brokers that passed product-level volatility index testing and scored the highest overall scores made it into our final list.

What Is a Volatility Index?

A volatility index is a real-time gauge of expected market turbulence. For active traders, it’s essentially a barometer of fear, momentum, and uncertainty. This makes it a powerful tool for spotting short-term trading opportunities.

The most well-known volatility index is the VIX, often called the “fear index”. Created by the CBOE (Chicago Board Options Exchange), the VIX measures expected 30-day volatility in the S&P 500, based on options pricing.

When the VIX rises, it typically reflects increased nervousness in the market, often during sell-offs or major news events. When it drops, markets are seen as calmer or more complacent.

What Types of Volatility Indices Do Brokers Offer?

We’ve spent hours combing through volatility indexes on trading platforms, and not all providers offer the same volatility products.

While there are technically more volatility indexes, here’s a breakdown of the four types that are primarily available to retail traders from our research:

1. VIX (CBOE Volatility Index)

- The gold standard in volatility trading.

- Measures expected volatility in the S&P 500.

- Typically available via futures, options, ETFs and CFDs.

- Common on regulated brokers and trading platforms with US index exposure. eToro a stand-out option.

2. VSTOXX (EU Volatility Index)

- Europe’s equivalent of the VIX, based on the EURO STOXX 50 index.

- Useful for active traders focused on EU equity markets.

- Offered by select brokers with European derivatives access. XTB excelled in our analysis.

3. GVZ (Gold Volatility Index)

- Tracks expected volatility in the gold market, derived from gold option prices.

- Great for traders looking to hedge or speculate on gold price swings.

- Not commonly available at retail brokers, but there are exceptions. Interactive Brokers is the most trusted.

4. Volatility 75 Index (Synthetic VIX)

- A simulated volatility index offered by some brokers. Deriv pioneered this product.

- Not tied to real-world markets, but mimics high-volatility conditions 24/7.

- Popular with day traders for its constant movement and leveraged exposure.

- Comes in versions like Volatility 25/50/100, depending on desired intensity.

What Should I Look For When Choosing A Broker To Trade A Volatility Index?

Some brokers specialize in regulated market instruments (like VIX futures or VSTOXX CFDs), while others offer synthetic indices that trade 24/7 with tight spreads and algorithmic volatility.

Before you choose a platform, ask the same questions I did during testing:

- What type of volatility index can I trade, for example, real or synthetic?

- Is it available via CFDs, options, ETFs, futures, or another instrument?

- What are the trading hours, spreads, and margin requirements?

- Is the platform stable during high-volatility spikes?

What Is The Typical Spread Charged By Brokers On The VIX?

We analyzed VIX spreads from five leading brokers (Pepperstone, XTB, CMC Markets, IG, and XM) to come up with an average.

While the average spread came out at around 2.0, that’s that’s skewed by CMC Markets’ unusually wide spread of 8.0 during our latest tests.

A more realistic figure based on the median and trimmed average puts the typical VIX spread at around 0.6 to 0.7. This better reflects what day traders can expect on most top platforms during normal trading conditions.

What Leverage Do Brokers Offer On The VIX?

We investigated the maximum leverage available to trade the VIX at various brokers during our tests. For most regulated platforms, the maximum leverage is 1:5, meaning a 20% margin is required.

Some offshore brokers may offer higher leverage, but this may increase the risk of large losses. Unregulated brokers do not offer the same fund safeguards in our experience.

Bottom Line

We’ve watched the number of brokers offering a volatility index increase over the years, with many day traders drawn to these products where significant price fluctuations open up opportunities to generate profits.

However, our analysis shows the quality of providers can vary dramatically, from spreads and commission on volatility indices to the speed of execution and the quality of the trading software.

To find the right provider for your needs, turn to our rankings of the top VIX brokers.

FAQ

How Is The Volatility Index Calculated?

The VIX, or Volatility Index, is calculated by the CBOE using SPX options, specifically those with expiries between 23 and 37 days out. These include both monthly SPX options (expiring the third Friday of each month) and weekly SPX options (expiring every other Friday).

The VIX blends these options to create a 30-day forward-looking estimate of market volatility, not based on historical movement, but on real-time options pricing. It reflects how much traders are willing to pay for protection (or speculation) around the S&P 500.

For day and short-term traders, VIX spikes often signal market fear, higher intraday volatility, and wider price swings – making it a key sentiment indicator for short-term setups.

Why Is The Volatility Index Referred To As The “Fear Gauge”?

The VIX is often called the “fear gauge” because it rises when traders expect higher risk or turbulence, usually due to economic shocks, geopolitical events, or sudden sell-offs.

It doesn’t measure fear directly – it measures expected volatility, but since traders often buy SPX options as protection during uncertainty, rising VIX levels correlate closely with increased market anxiety.

For short-term traders, a rising VIX often means bigger moves, faster reversals, and higher risk-reward potential, but also more risk. It’s a warning light and an opportunity signal in one.

Article Sources

- VIX (CBOE Volatility Index)

- VSTOXX (EU Volatility Index)

- GVZ (Gold Volatility Index)

- VFTSE (FTSE 100 Volatility Index)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com