Brokers With Trailing Stop Loss Orders

Brokers with trailing stop loss orders enable traders to set a stop at a certain percentage or number of points below a security’s market price. As the name suggests, the stop loss then trails behind the asset when the price shifts in an advantageous direction. The free risk management tool is commonly used when trading volatile assets, such as commodities and exotic forex pairs.

This guide explains how to set up a trailing stop loss using examples. We also list and review the best brokers with trailing stop losses in 2025. Read on to find out whether the popular risk management tool is good or bad.

Brokers With Trailing Stop Loss

Here is a summary of why we recommend these brokers in April 2025:

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- Dukascopy - Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- xChief - xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

- InstaTrade - InstaTrade, based in the British Virgin Islands, is an online broker specializing in fixed income structured products and active trading through CFDs. Its zero-spread accounts, excellent research notably through InstaTrade TV, and access to the popular MT4 alongside its own web-accessible InstaTrade Gear, make it an attractive option for short-term traders at every level.

- Plexytrade - Established in 2024 and headquartered in Saint Lucia, Plexytrade is an ECN/STP broker. Geared towards active traders, it supports four account options, crypto deposits and withdrawals, plus very high leverage up to 1:2000 made possible by its unregulated status.

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | Active Trader Program With A 15% Reduction In Costs |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, Stocks, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- Beginners can get started easily with $0 minimum initial deposit

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- The broker's API facilitates access to 25 years of deep historical data and rates from 200+ currencies

Cons

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

Dukascopy

"If you’re an experienced trader, Dukascopy provides the tools you need: JForex for algorithmic strategies, competitive spreads from 0.1 pips, leverage up to 1:200, and the peace of mind of using a Swiss-regulated bank and broker."

Christian Harris, Reviewer

Dukascopy Quick Facts

| Bonus Offer | 10% Equity Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Regulator | FINMA, JFSA, FCMC |

| Platforms | JForex, MT4, MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:200 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, PLN, CZK, AED, SAR, HUF, MXN |

Pros

- Dukascopy is regulated by the Swiss Financial Market Supervisory Authority (FINMA) as both a broker and a bank, ensuring top-tier financial security and adherence to strict standards.

- Dukascopy features some of the best research we’ve seen, even a professional TV studio in Geneva covering financial news, market analysis, and daily insights from professionals.

- Dukascopy offers tight spreads starting from 0.1 pips, leverage up to 1:200 (depending on the jurisdiction), and volume-based commissions that reward high-frequency traders.

Cons

- While Dukascopy provides some educational resources and 24/7 support, the complexity of its platforms and tools required extensive testing and may overwhelm newer traders.

- Some account types, such as the MT4/MT5 accounts, require a higher minimum deposit of $1,000, which may not be ideal for traders with smaller budgets.

- While JForex is feature-rich, it has a steep learning curve, making it less suitable for beginner traders who might prefer simpler platforms.

xChief

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Bonus Offer | $100 No Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- The broker offers several account types to suit different traders, including a Cent account for beginners and pro-level hedging/netting accounts

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

- xChief offers STP/ECN execution with low spreads from 0.0 pips and low commission rates starting from $2.50 per side

Cons

- Fees and minimums are imposed on most withdrawal methods, including a €60 minimum for SWIFT bank transfers

- The broker trails competitors when it comes to research tools and educational resources

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

InstaTrade

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

- InstaTrade TV, consisting of video interviews and valuable market insights spanning equities, cryptos and more, helps identify opportunities and inform short-term trades.

- VPS hosting caters to algo trading strategies with a dedicated physical server providing rapid execution speeds as low as 9 milliseconds.

Cons

- InstaTrade sports one of the most cluttered websites and client cabinets in the industry, potentially overwhelming new traders, especially compared to XTB’s intuitive trading journey and resources.

- InstaTrade’s growing educational tools provide valuable information for aspiring traders, but still trail category leaders like eToro with no structured course based on experience level.

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

Plexytrade

"Plexytrade is a newcomer in the brokerage scene with attention-grabbing features like 1:2000 leverage, zero spreads on select instruments and fast execution speeds of less than 46 milliseconds. However, the absence of regulation is a significant concern, while the non-existent research and educational tools place it far behind industry frontrunners."

Christian Harris, Reviewer

Plexytrade Quick Facts

| Bonus Offer | 120% Cash Welcome Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Indices, Stocks, Commodities, Crypto |

| Platforms | MT4, MT5 |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- US residents are accepted as clients, distinguishing Plexytrade as one of the rare offshore brokers that cater to US-based traders.

- Plexytrade accommodates a range of trading methods and short-term strategies, including scalping, hedging, and automated trading.

- Plexytrade offers among the highest leverage we’ve seen, up to 1:2000, catering to advanced traders willing to forego regulatory protections.

Cons

- Plexytrade lacks regulation in major jurisdictions, significantly increasing the risks of opening an account and depositing funds.

- With around 100 instruments, Plexytrade restricts the flexibility of investors who prefer to trade across various assets, especially compared to Blackbull with its 26,000 securities.

- There are no social or copy trading features for inexperienced traders to replicate the trades of more experienced investors, trailing category leaders like eToro.

How Does A Trailing Stop Loss Work?

The definition and purpose of a trailing stop loss is to limit losses or lock in returns by pulling out of the market before the value of an asset moves too far in an unfavorable direction. The investor essentially defines a percentage by which the price of a security would need to fall to automatically close out the position. The stop loss will remain active until either the trader cancels the order or the position is liquidated.

- If a trader is going long, the trailing stop should be placed below the current price

- If a trader is going short, the trailing stop should be placed above the current quote

The trailing stop should not be confused with a standard stop loss which is similar but set at a fixed amount/price rather than a percentage/number of points that moves in tandem with the position. Some day traders manually move a standard stop loss to replicate the benefits of trailing stop loss alerts and notifications, but this is time-consuming and unnecessary.

The trailing stop is particularly useful when there is market growth in your favour but then pulls back, because your trailing stop will move with the positive price trend but it won’t head in the other direction.

Note, a trailing stop loss will close the trade at the next available price which means there is a chance of slippage. To avoid this, a trader can set a guaranteed stop loss.

Example

To help understand how brokers with trailing stop loss orders work, let’s look at an example…

A swing trader buys one ounce of gold at $1,750. But instead of using a classic stop loss to sell their holdings if the price falls below $1,487.50, the investor places a trailing stop loss order at 15% below the current price.

Now if the price of gold falls to $1,487.50, the broker would automatically exit the position. But if the value of gold climbs, the trailing stop-loss would follow suit, staying 15% below the market value.

This means if the price of gold climbs to $2,500, the trailing stop loss would increase to $2,125. If the value of gold did then subsequently fall to $2,125, the position would be closed and the trader would take home a profit of $375 ($2,125 – $1,750). Note, this doesn’t take into account any broker fees.

Setting Up Tips

Consider the tips below when setting up a trailing stop loss:

- Try not to set trailing stops at a threshold that will trigger unnecessarily. A sensible amount is beyond 1.5 times the lowest price drop in the asset’s current range.

- Trailing stops should reflect a market’s current volatility, so if there is little movement in the value of an asset then the trailing stop will likely be closer to the current price.

- When using trailing stops on stocks that are experiencing significant price swings, moving averages are helpful to overlay. This can help to prevent a trailing stop from triggering unnecessarily due to a low swing in price.

- Don’t be overly reliant on trailing stops. Keep an eye on momentum as it could be worth adjusting the trailing stop if the asset is reaching an all-time high, for example.

- Trailing stop losses can also be used in premarket and after hours trading sessions. Just check your futures broker, for example, supports extended hours.

Other Risk Management Tools Explained

Interactive brokers with trailing stop loss orders also tend to offer other useful risk management tools. One popular solution is a take profit order which sets the price to sell an asset to safeguard any profits which have been made on a trade. The trader can continue to benefit from the price moving in a favourable direction but if the market was to swing in a way that could jeopardise profits, then the trailing stop can be used for damage control.

Another popular form of risk management is hedging. This is essentially the practice of taking out opposing positions on similar assets to cover any losses on original trades. Used correctly, a hedge can be an effective way to minimize risk exposure.

One strategy that can also be used in collaboration with the tools and strategies above is the 1% rule. This is where you do not risk more than 1% of your total portfolio on any single trade. You could invest slightly more than that, however, the key is to be disciplined and not to risk a small amount of your overall capital or deposit. This will mean that several bad trades won’t erode all your trading funds.

Final Word On Brokers With Trailing Stop Loss

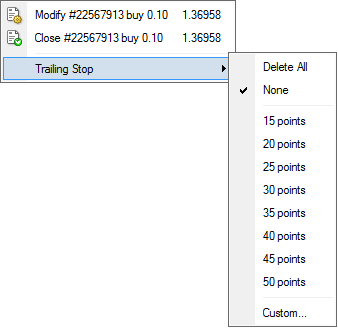

Brokers with trailing stop loss orders provide an effective risk prevention tool. Trailing stops are available on most popular trading platforms and algorithms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Some brands also offer trailing stop options on their own in-house trading terminals. Trailing stops are available at several popular brokers, including Webull, eTrade, Charles Schwab, and Questrade.

To prevent trailing stops from being triggered unnecessarily, research assets using moving averages and previous trends. This will help you choose thresholds which protect you from crashes, rather than cashing out during a dip that could be recovered from.

Use our list of top brokers with trailing stop loss orders to start trading today.

FAQ

What Is The Meaning Of A Trailing Stop Loss?

A trailing stop loss is a percentage-based threshold that can be set by the trader. If the value of an asset drops below this amount then it will be liquidated before its value can drop further. Importantly, the trailing stop will move in tandem with the original position if the market moves in the trader’s favour.

Is A Trailing Stop Loss A Good Idea?

Used correctly, brokers with trailing stop loss orders can help reduce risk exposure. Just make sure you have your trailing stop set beyond a level that could be triggered by ordinary market trends. This will help to avoid preemptive losses that could be easily recovered.

What Can I Do About Trailing Stop Losses Not Working?

If your trailing stop loss did not work, the best thing to do is to head to a demo account to refine your approach. You can also consider other risk management strategies.

Are Trailing Stop Losses A Suitable Form Of Risk Management For Beginners?

As long as you learn how to use them effectively, trailing stop losses can be a useful tool for all levels of traders. If you are new to trading, practice using brokers with trailing stop loss orders in a demo account first. You can then upgrade to a real-money account when you feel confident.

Which Is Better Stop Loss Or Trailing Stop Loss?

This will ultimately come down to trader preference. A standard stop loss is arguably easier to understand, but trailing stops provide greater flexibility – they will move with the market when it shifts in your favour but limit losses if it turns the other way.

How Long Does A Trailing Stop Loss Last?

Traders can decide how long they want a trailing stop loss to run on their platform. With that said, a trailing stop loss will usually run until the investor cancels the order or the position is liquidated.