Webull Review 2025

Pros

- The flagship charting platform offers comprehensive analysis tools including 60+ indicators, plus deep fundamental data

- The $0 minimum deposit and availability of fractional shares make broker highly accessible for beginners and those on a budget

- The Smart Advisor tool facilitates a more hands-off approach to investing, with low minimum investments and automatic rebalancing

Cons

- There’s only one platform on offer, with no additional third-party tools

- There’s a narrow range of payment methods available compared to competitors, with just ACH, ACATS and wire transfers available

- There are relatively high deposit and withdrawal fees for non-US residents, including a $45 charge for international wire withdrawals

Webull Review

Webull is a US-regulated broker that offers trading on stocks, options, ETFs, forex, and ADRs. Based on our tests, the broker offers excellent conditions for retail traders. Highlights for us are the commission-free trading, simple-to-use platform and no minimum deposit. Our experts also gave Webull a high trust score owing to its authorization from the SEC.

In this Webull review, we reveal the findings from our assessment. Our team evaluate, compare and rate the broker in key categories, including the investment offering, accounts, fees, platforms, research, education and customer support.

Quick Facts

| ? Available Account Currencies: | USD |

|---|---|

| ? Minimum deposit: | No Minimum Deposit |

| ?️ Max Leverage: | 1:4 |

| ? Spread: | No Spread |

| ⚖️ Regulator: | SEC, FINRA |

| ? Bonus: | Up to 12 free fractional shares when you deposit $100! |

| ?️ Trading Platform: | Web Platform, App |

| ???Free Demo Account: | ✔️ Yes |

| ? iOS App: | ✔️ Yes |

| ? Android App: | ✔️ Yes |

| ?Deposit money: | Wire Transfer, ACH Transfer |

Accounts

Webull offers two main accounts: an Individual Brokerage Account and an Individual Retirement Account (IRA).

With that said, we found that you can open three solutions: cash, margin, and an IRA. This provides a good degree of flexibility and supports different financial goals and trading horizons.

Our only minor complaint is that there is no joint account available.

Individual Brokerage Account

If you want to exclusively buy and sell securities, we recommend the Individual Brokerage Account. There are two versions of the account available:

Cash Account

Traders pay in full for whatever assets they purchase, since there is no margin available. Clients cannot short trade in the Cash account. However, the Cash account comes with a competitive 5.0% APY on uninvested cash, as well as other promotions.

The other benefit of the Cash Management scheme in our opinion is that there are no minimum amounts or fees.

A Required Maintenance (RM) call will occur if a cash account enters a negative balance.

Margin Account

Clients can utilize leverage to buy more securities. Thus, we think this account is more suited to experienced traders.

As per the Pattern Day Trader (PDT) rule enforced by FINRA, traders who deposit less than $2,000 will be limited to 3 day trades in 5 days and cannot use leverage or short sell. Those with between $2,000-$25,000 are also limited in their day trading activities but can access leverage up to 1:4 for intraday trades and 1:2 for overnight positions. You can also short-sell securities. Investors with over $25,000 can access the same leverage and short-selling but will have unlimited day trading.

Individual Retirement Account (IRA)

For longer-term investing, we would opt for the Individual Retirement Account (IRA). This allows you to invest in stocks, ETFs and options and comes with tax benefits, plus the option to move assets directly from your 401k.

There are 3 types of IRAs: Traditional, Roth and Rollover.

How To Open An Account With Webull

I found the registration process intuitive. I was able to register in a few quick steps:

- Enter your phone number and click ‘Send Code’ in the application form

- Enter the verification code sent to your phone and click ‘Next’

- Follow the instructions to provide the relevant details and complete the sign-up

| Webull | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Minimum Deposit | $0 | $0 | $100 |

| Minimum Trade | 0.00001 (Fractional Share) | $100 | 0.01 Lots |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Trading Fees

Webull stands out for its commission-free trading on stocks and ETFs, with a $0.55 fee on some options contracts. This is an attractive pricing model, especially for beginners looking for low-cost investing.

Generally, Webull makes revenue through margin interest on overnight leveraged positions, which starts at 9.49% annually for traders with a debit balance of $25,000 or less and decreases to 5.49% for clients with $3,000,000+.

These aren’t the cheapest rates we have seen, but they are lower than alternatives we have evaluated. E*Trade, for example, charges 14.20% on balances of less than $10,000 and 13.95% on balances between $10,000 to $24,999.99.

Our review also showed that there are fees on OTC securities, including a $0.0002 charge per share on low-priced shares up to a maximum of 5% of the value. Some illiquidity and F-stock charges may also apply, reaching up to $250.

There are zero commissions on cryptocurrencies like Bitcoin, but traders should be aware that a 100-basis point spread is applied to both sides of trades.

When we used Webull, we found that short-selling fees depend on the asset being traded and change daily. Investors using the Webull Smart Advisor tool should expect a 0.2% annualized fee with a $1 monthly minimum.

Non-Trading Fees

Webull compares well to alternatives when it comes to non-trading fees. There are no account management fees or inactivity charges.

However, small transaction and regulatory charges may apply from agencies such as the SEC. This is common practice at US-authorized brokers.

Additionally, whilst there are no opening or closing fees for IRAs, there is a $75 fee for transferring stocks from Webull, which is higher than other firms we have assessed.

Payment Methods

Webull is one of the few brokers we have tested with no minimum deposit. This makes the broker accessible to beginners and those with limited starting capital.

Looking at the negatives, deposit and withdrawal fees are on the high side for non-US clients without a US bank account. For example, you can expect a $12.50 charge for international wire transfer deposits and a $45 charge for international wire withdrawals. Domestic deposits and withdrawals only come with an $8 and $25 charge, respectively.

We also found that clients with a US account can deposit via ACH transfers, which are free but capped at $50,000 per day.

Another fee to be aware of is a $5 reversal charge for any deposits or withdrawals returned during the settlement period if there are insufficient funds in your account.

As for processing times, we find these to be reasonable. Wire transfer deposits are settled in your account the next business day after they are received. ACH transfers typically take 4 business days to settle.

Withdrawals can take up to 2 business days for ACH and domestic wire transfers, whilst international wire transfers can take up to 5 business days. Again, these compare well to most brokers we review.

How To Make A Deposit

Once you have linked your bank account in your client area, depositing at Webull is easy:

- Log in to your account and click ‘Transfer’

- Chose the method and enter the amount

- Confirm the deposit request

| Webull | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Payment Methods | ACH Transfer, Automated Customer Account Transfer Service, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

3.5 / 5Webull offers an impressive range of 2,000+ stocks, ETFs, options, and ADRs. You can also access a selection of cryptocurrencies and forex pairs.

This is a good breath of markets, especially in terms of equities. We also rate that fractional shares are available, allowing budget investors to buy a portion of high-value stocks.

On the downside, the 17 forex pairs and handful of cryptos mean Webull isn’t the best broker for serious currency traders.

You can trade:

- Stocks & ETFs – The broker-dealer offers more than 2,000 US stocks and ETFs, including major companies such as Tesla (TSLA) and indices like the S&P 500. Other popular assets include Gamestop, AMC and Zoom. Fractional shares and OTC stocks are also available.

- ADRs – Customers can also choose to invest in foreign company stocks. ADRs still pay dividends in US dollars so investors do not have to be concerned about exchange rates moving against them.

- Options – Webull provides options trading. Clients interested in this investment alternative must first be approved by filling in a questionnaire related to trading experience.

- Cryptocurrency – Users can trade crypto pairs through the broker’s Webull Pay app. Traders can buy 8 popular coins including Bitcoin, Bitcoin Cash, Ethereum, Dogecoin and Litecoin.

- Forex – Speculate on 17 currency pairs, including EUR/USD, GBP/JPY and USD/SGD.

| Webull | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Instruments | Stocks, ETFs, ADRs, OTCs, options, cryptos, forex, fractional shares | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Apps

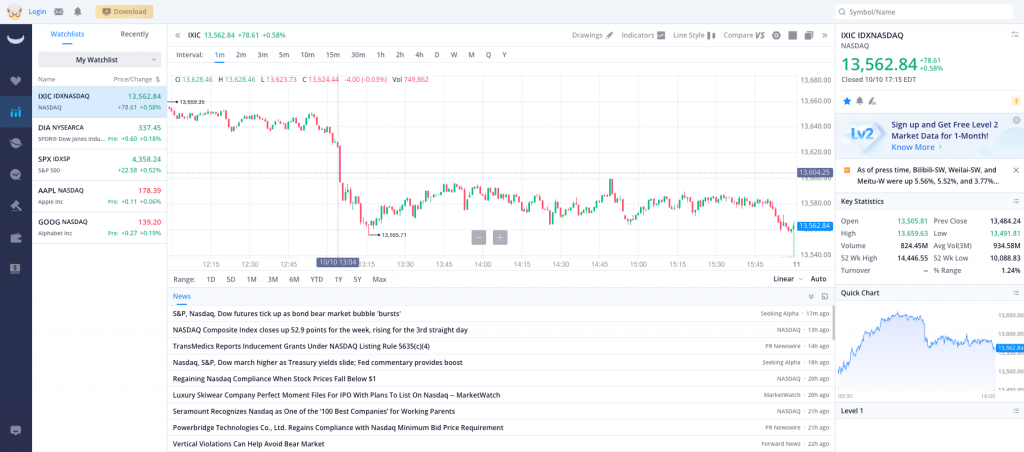

Webull offers a proprietary trading platform, available as a desktop download and web-based solution.

We find both interfaces feature-rich and easy to navigate, with a good range of technical indicators and charting styles. With that said, our tests have shown that the desktop platform boasts more advanced functionality.

Also, the lack of sophisticated third-party platforms like MetaTrader 4 (MT4) is a notable drawback, especially for serious traders looking for powerful charting software and algo trading.

Desktop Platform

Webull’s native desktop platform is available for download on Windows 7 PCs and above, along with Mac and Linux.

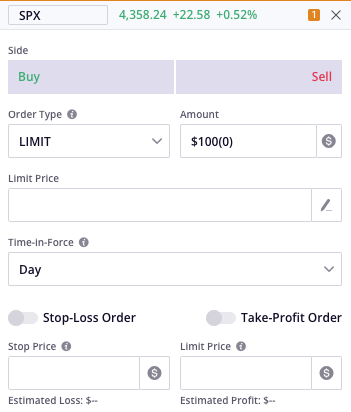

The powerful solution offers a fully customizable experience, with advanced charting and analysis tools and impressive order placement capabilities. You can execute simple orders such as limit, market and trailing stop, as well as group orders like bracket, OTO (one-triggers-the-other) and OTOCO (one-triggers-and-one-cancels-the-other).

We are also impressed with the real-time alerts, where you can set custom alerts based on price, news, technical signals or volume hikes. The optimized screeners are another excellent function. These are based on over 40 indicators which can be filtered to suit your preferences and inform trading decisions.

Other useful features our testing found include:

- 55+ indicators, including moving averages, market strength and more

- 60+ on-chart signals, including candlestick patterns

- Smart drawing tools with notation functionality

- Multiple time frames from one tick

- 8 line styles including Heikin Ashi

- On-chart asset comparisons

- Hotkeys and keyboard shortcuts

Web Platform

The Webull web platform can be accessed directly from the broker’s website and all major browsers. Similar to the desktop app, you can access the full range of charting styles, including Candlesticks and Heikin Ashi, plus a decent suite of technical indicators and drawing tools.

The interface is customizable, with adjustable widgets to suit your viewing preferences. We particularly rate the comprehensive market analysis tab, which contains detailed global market data including a top gainers and losers feed, plus best-performing industries.

Other useful features include:

- Market screener tool with filters and quote indicators

- 50 technical indicators and 14 drawing tools

- 15 time intervals, from 1 minute to 1 year

- Stock comparison tool

- 8 line styles

| Webull | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| MetaTrader 4 | No | No | Yes |

| MetaTrader 5 | No | No | Yes |

| cTrader | No | No | No |

| TradingView | No | Yes | Yes |

| Auto Trading | Capitalise.ai & TWS API | Expert Advisors (EAs) on MetaTrader | |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

How To Make A Trade

I find opening a trade on Webull’s platform a seamless process:

- Log in to the platform and head to ‘Watchlists’

- Select a stock from the list

- Navigate to the ‘Quotes’ tab

- Select ‘Trade’ and set your parameters

- Place the order

Mobile App

The Webull mobile app offers the broker’s full range of 11 advanced order types such as stop loss/take profit and OCO, plus the option to subscribe to Level 1 and Level 2 market data. You can also access 12 drawing tools, 50+ technical indicators, plus 63 on-chart technical signals.

We are impressed that the app also intuitively responds to voice prompts such as ‘buy’ and ‘sell’, allowing traders to place orders with voice commands. This is fairly unique and not a feature we have found at the majority of brokers we have evaluated.

For Apple Watch users, you can also synchronize your account to your device and check real-time quotes, positions, market news and watchlists without needing your phone on hand. Again, this helps Webull stand out from most competitors.

Regulation & Licenses

Webull is regulated by two of the most respected authorities in the US: the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These are good indicators for us that the brokerage is legitimate and trustworthy.

Our experts are also reassured to find that the broker-dealer is a member of the Securities Investor Protection Corporation (SIPC), which protects clients’ assets up to $500,000.

Note that cryptocurrency is offered to US clients only through a different entity, Bakkt LLC, and is therefore not protected by this scheme.

| Webull | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Regulator | SEC, FINRA, FCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Segregated Accounts | Yes | Yes | No |

| Negative Balance Protection | No | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Leverage

Traders can access leverage and utilize up to 1:4 (4x) day trading power and 1:2 overnight buying power using a margin account.

Importantly, our assessment found that you must have at least $2,000 to be approved for margin trading. Clients should also be aware of the risks associated with leveraged trading before opening an account. We recommend beginners approach leverage with caution.

| Webull | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Leverage | 1:4 | 1:50 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Execution

Order execution at Webull is reliable. For order sizes up to 99, you can expect speeds of up to 0.025 with 0.99 execution efficiency. Orders of over 10,000 shares will see faster speeds of around 0.007.

Our team are satisfied that the broker regularly evaluates its order routing and execution performance to ensure the best possible conditions.

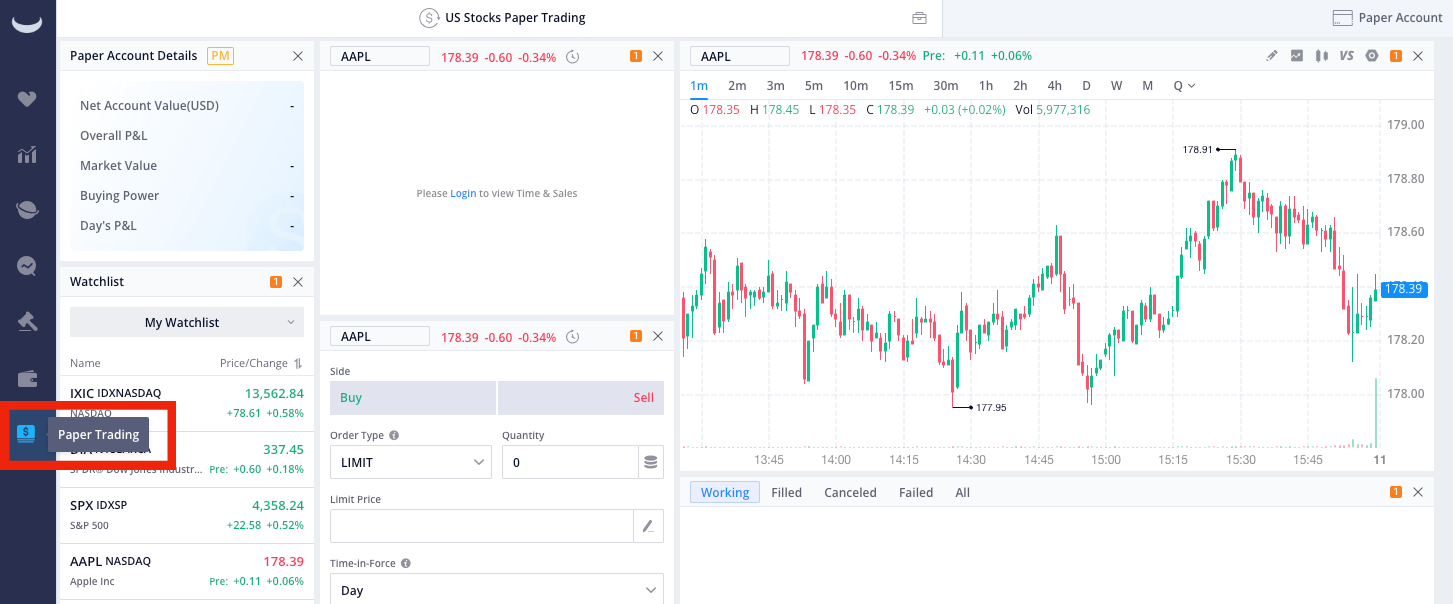

Demo Account

Webull provides an excellent paper trading environment for stocks and options. The demo account comes with unlimited virtual funding, making it a great tool for aspiring traders and new investors. When we used Webull, we also found the demo account useful for learning platform features.

To access the demo account, simply follow the steps above to sign up for a live account and then navigate to the ‘Paper Trading’ icon in the left-hand menu. We like that you can easily switch between live and demo mode so you can test strategies from one dashboard.

Bonuses & Promotions

Webull regularly offers welcome bonuses. For example, during testing, all new clients who deposit at least $100 could get 6-12 free stocks from NYSE and NASDAQ-listed companies.

UK traders can receive similar promotions, where they can earn 2 free fractional shares if they deposit any amount and complete one of the broker’s trading courses. You can then get 2 more fractional shares if you make your first trade within 30 days, with a value per share up to $2,000.

Another attractive offer is the $100 welcome bonus when you transfer an account with at least $2,000 in assets to Webull.

Still, we never recommend choosing a broker for their sign-up offers. More important are the broker’s trading conditions, industry standing and regulatory status.

Additional Tools

There were a couple of useful tools that elevated our experience while using Webull.

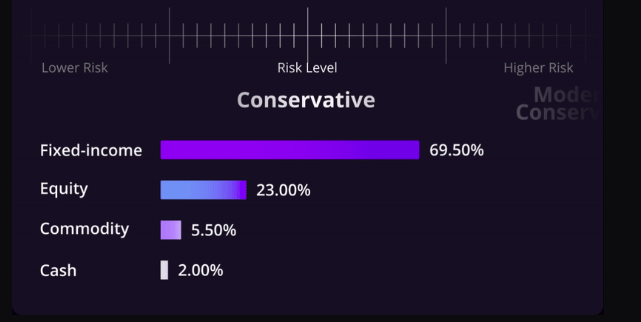

The Webull Smart Advisor is an automated investing service where professionals manage funds on your behalf. Clients have a good choice of risk profiles to suit their trading goals. The minimum investment is also low at $100. Still, it is worth noting that there is no guarantee you will make money.

We also rate the real-time OPRA data feed for options trading and the global indices feed from the Chicago Board Options Exchange (CBOE). Both provide useful insights that can support the decision-making process.

Research & Education

Based on our assessment, Webull offers an average suite of market research and analysis tools.

There is a good News Centre with market and stock updates, along with an IPO hub that details the latest information on recent filings, earnings, and dividends per share. These are all useful for aspiring investors, though seasoned traders can get more advanced tools and expert insights at alternative brokers.

The broker scores better when it comes to education. There are comprehensive video tutorials, articles and trading courses available for traders of varying experience levels. These cover popular topics like short selling and technical analysis and compare well to the likes of eToro US, in our opinion.

Customer Support

3.8 / 5Based on our tests, Webull scores well in terms of customer service. The broker provides 24/7 help, which is an improvement on the majority of firms that offer 24/5 support.

Webull also hosts an extensive help portal which covers a range of topics, from account management to platform support.

You can get in contact with the broker using these details:

- Live chat: function in the app

- Telephone number: +1 (888) 828-0618

- Email: customerservices@webull.us

Trading Restrictions

While using Webull, we found there is a limit on the number of intraday trades that you can execute within a set time. For example, margin accounts with less than $25,000 can execute 3x day trades in 5 business days.

Company Background

Webull Financial LLC is a US-based firm founded in 2017 with headquarters in New York City. The CEO is Anthony Denier while a Chinese company, Fumi Technology, is its parent corporation.

The company has a global presence and is available in the United States. The broker is also available to non-US citizens in several countries, including the UK.

This brokerage is regulated by the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Trading Hours

We are pleased to see that Webull offers extended premarket (4:00 am to 9:30 am ET) and after-hours (4:00 pm to 8:00 pm ET) trading, though only limit orders can be used at these times.

It is also good to see that there are no additional fees during extra market hours and the firm has a scanner for top gainers and losers in these periods.

Clients can trade cryptocurrencies 24/7.

Should You Trade With Webull?

Webull is a trusted broker-dealer based in the US offering stock and ETF trading alongside options and cryptos on an intuitive platform and mobile app.

With no minimum deposit, demo trading, fractional shares and strong educational materials, the brokerage is a good fit for new investors. Its commission-free trading offering on stocks and ETFs is particularly strong, while the intuitive app will appeal to mobile traders.

Considering the negatives, Webull isn’t the best pick for experienced traders based on our evaluation. Its platform lacks the advanced analysis tools available at alternatives. The investment offering is also missing popular products like mutual funds.

FAQ

What Is Webull?

Webull is a broker-dealer based in New York City that offers trading in stocks, ETFs, options, and cryptocurrency in the US and other selected countries. The SEC-regulated brokerage offers a beginner-friendly mobile app and commission-free trading on equities.

Is Webull Legit Or A Scam?

Webull is a legitimate broker. Although relatively new compared to established brands, Webull has gained a strong reputation. The firm is also regulated by the SEC and FINRA, two highly respected authorities. As a result, we are comfortable that the broker is not a scam.

Is Webull A Good Or Bad Broker?

Based on our tests, Webull is a good broker. Its mobile app is one of the best we have seen for beginners, while the no minimum deposit and smooth sign-up process make it easy to get started. The Smart Advisor and fractional shares are also useful tools not found at many alternatives.

Looking at the negatives, Webull isn’t the best broker we have evaluated when it comes to market research or additional tools. The investment offering also misses popular instruments like mutual funds. Margin rates also trail some alternatives.

Is Webull Good For Beginners?

Webull has a free demo account, zero minimum deposit and a wide range of educational materials, making it a good choice for new investors. The trading platform also stands out as one of the easiest to learn and navigate for beginners.

What Is Buying Power On Webull?

Buying power is the amount of cash held in the client account added to all available margin. These are the funds that the trader can access to buy securities.

Does Webull Have Level 2 Market Data?

Webull offers Level 2 market data on subscription. This offer is powered by NASDAQ TotalView and termed Level 2 Advance, for $1.99 per month.

Does Webull Offer A Good Mobile App?

Our experts enjoyed using the broker’s intuitive and user-friendly mobile app, which is available on iOS and Android devices. Traders can access Level 1 and Level 2 market data, plus smart voice-controlled trading commands.

Can You Buy XRP On Webull?

Currently, Ripple (XRP) is not offered by this broker. Instead, Webull offers eight of the most popular digital currencies on its Webull Pay app, including Bitcoin (BTC).

What Time Does Webull Close?

Normal trading hours for stocks cease at 4:00 pm, but extended market hours continue until 8:00 pm. Cryptocurrency trading does not close and runs 24/7.

Is Webull Better Than Robinhood?

Webull is better than Robinhood in our opinion. Our research uncovered unfair trading practices at Robinhood that harmed retail investors. In contrast, Webull has a good reputation and offers competitive trading conditions. If you are unsure which to use, opening a demo account is a good way to test both.

Can I Trade Hong Kong Stocks On Webull?

Yes, Webull offers a range of stocks listed on the Hong Kong Stock Exchange (HKEX), including Art Group Holdings, Tian Cheng Holdings and Maiyue Technology.

How To See Day Trades On Webull?

If you want to know how many trades per day on Webull you have left all you need to do is look in your order placing section located under each stock.

Top 3 Alternatives to Webull

Compare Webull with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Webull Comparison Table

| Webull | Interactive Brokers | FOREX.com | Dukascopy | |

|---|---|---|---|---|

| Rating | 4.4 | 4.3 | 4.5 | 3.6 |

| Markets | Stocks, ETFs, ADRs, OTCs, options, cryptos, forex, fractional shares | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $100 |

| Minimum Trade | 0.00001 (Fractional Share) | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | SEC, FINRA, FCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC | FINMA, JFSA, FCMC |

| Bonus | Up to 12 free fractional shares when you deposit $100 | – | Active Trader Program With A 15% Reduction In Costs | 10% Equity Bonus |

| Education | Yes | Yes | Yes | Yes |

| Platforms | Desktop App, Web Terminal | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | JForex, MT4, MT5 |

| Leverage | 1:4 | 1:50 | 1:50 | 1:200 |

| Payment Methods | 3 | 6 | 8 | 11 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Webull and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Webull | Interactive Brokers | FOREX.com | Dukascopy | |

|---|---|---|---|---|

| CFD | No | Yes | No | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | No | Yes |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | Yes | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

Webull vs Other Brokers

Compare Webull with any other broker by selecting the other broker below.

The most popular Webull comparisons:

- Kraken vs Webull

- Pocket Option vs Webull

- NinjaTrader vs Webull

- Saxo Bank vs Webull

- Webull vs Interactive Brokers

- Webull vs FOREX.com

- Webull vs Moomoo

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Webull yet, will you be the first to help fellow traders decide if they should trade with Webull or not?