Forex Trading in Zimbabwe

Forex trading has become an increasingly popular investment opportunity in Zimbabwe, driven by the country’s complex economic landscape and desire for alternative income sources.

Because of the volatile Zimbabwean dollar, persistent inflation and falling GDP growth, many Zimbabweans turn to foreign exchange to hedge against economic instability and earn returns in stronger currencies like USD.

However, Zimbabwe’s economy faces challenges, including hyperinflation, a volatile currency, and limited access to foreign currency. Tight currency controls make it hard for traders to move funds in and out of the country.

Ready to start forex trading in Zimbabwe? This guide for beginners will kickstart your journey.

Quick Introduction

- Forex traders in Zimbabwe must overcome hurdles, including unstable internet connections and a government that frequently changes policies related to foreign exchange. The US dollar remains the most popular currency for day-to-day transactions.

- Trading the local currency has also been complicated by the introduction of the ZiG (backed with gold and foreign exchange reserves), to replace the Zimbabwean dollar, which has suffered substantial depreciation over recent years.

- The Reserve Bank of Zimbabwe (RBZ) has imposed strict controls on the official exchange rate and foreign currency transactions, resulting in a challenging landscape for traders. Many residents use cryptocurrencies or international payment systems to bypass these restrictions.

Top 4 Forex Brokers in Zimbabwe

Based on our in-depth tests and analysis, these 4 platforms reign supreme for forex traders in Zimbabwe:

How Does Forex Trading Work?

Forex trading in Zimbabwe operates similarly to other global jurisdictions but with unique considerations.

It involves trading currency pairs, such as USD/ZAR (US Dollar/South African Rand) and EUR/USD (Euro/US Dollar). USD/ZAR is key due to Zimbabwe’s economic ties with South Africa and its reliance on USD for local transactions.

You buy one currency while selling another. You buy if you think the base currency (the first currency listed) will appreciate and sell if you expect it to depreciate.

The exchange rate determines how much of one currency you can buy with another. For instance, if the USD/ZWL rate is 350, you can exchange 1 USD for 350 ZWL.

The forex market in Zimbabwe is not fully regulated; traders generally rely on international brokers who may not be subject to Zimbabwean laws. Many residents engage in trading via forex apps provided by these firms.

The country’s Pula is pegged to a basket of currencies, with ZAR the reserve currency. It is not widely traded.

Due to Zimbabwe’s high inflation, many traders use forex as a hedge, investing in foreign currencies to protect their wealth from devaluation.Traders can speculate on short-term currency movements to profit from market fluctuations. Depending on the trader’s strategy and risk tolerance, this can involve day trading.

Is Forex Trading Legal in Zimbabwe?

Forex trading is legal in Zimbabwe but operates in a complex, restrictive regulatory environment.

The Reserve Bank of Zimbabwe (RBZ) is the primary regulator of financial activities in Zimbabwe. However, forex trading is not fully regulated; no specific regulatory framework governs the retail trading of currencies.

The Zimbabwean government also imposes strict controls on the movement of foreign currency. These controls manage the country’s foreign exchange reserves and stabilize the local Zimbabwean Dollar. They include restrictions on how much foreign currency individuals can access and move in and out of the country.

Is Forex Trading Taxed in Zimbabwe?

Profits earned from trading currencies online are considered taxable income in Zimbabwe.

As with other forms of income, forex trading profits should be declared in annual tax returns to the Zimbabwe Revenue Authority (ZIMRA).

The specific tax rate depends on overall income; Zimbabwe has a progressive income tax system in which tax rates increase with higher income levels, ranging from 0% to 40%.

If forex trading is an investment, it could be subject to a capital gains tax of 24.72%. However, most active forex traders in Zimbabwe fall under regular income tax unless they hold assets for extended periods.

Report all forex trading income accurately to avoid penalties. ZIMRA can impose fines or penalties for underreporting or failing to declare taxable income.Given the complexities, I recommend forex traders seek advice from tax professionals in Zimbabwe to ensure compliance.

When Is The Best Time To Trade Forex In Zimbabwe?

The best times to trade forex in Zimbabwe generally align with the active periods in the global forex market, where the highest volume and liquidity occur.

- London (10:00 AM – 6:00 PM CAT). London is the largest forex trading centre in the world. Its high liquidity and volatility make it ideal for trading major currency pairs like EUR/USD, GBP/USD, and USD/JPY. The last few hours of the London session overlap with the beginning of the New York session, boosting trading activity. This overlap is particularly important for those trading USD/ZAR, potentially a key pair for Zimbabwean traders due to its close links with South Africa.

- New York (3:00 PM – 11:00 PM CAT). This session is very active, especially during its overlap with the London session from 3:00 PM to 6:00 PM CAT. Since Zimbabwe’s economy is highly influenced by USD fluctuations, this session offers opportunities to trade on significant movements tied to US economic data releases, such as announcements from the Federal Reserve and employment data.

- Tokyo (2:00 AM – 10:00 AM CAT). This session is less volatile than London and New York, but suitable for traders who prefer a steadier market. This session can offer opportunities for trading pairs like USD/JPY or AUD/USD. Given Zimbabwe’s reliance on mining exports, which are typically priced in AUD, following AUD pairs during this session may be beneficial for traders looking to capitalize on the mining sector’s influence on currency values.

A USD/ZWL Trade

To show you how trading currencies works in practice, let’s look at a firsthand trade on the USD/ZWL.

Background

I’ve already highlighted the issues regarding the Zimbabwe currency. These challenges are amplified when you look to trade many African currencies on the FX markets.

The lack of liquidity, the wider spreads, holdover charges, and the potential for fills away from the quoted price are specific issues associated with all minor and exotic currency pairs.

Despite this, you can discover opportunities to trade such pairs if you apply your research and analysis carefully.

It’s also essential to stick to your trading plan and rules. For example, I never risk more than 0.5% of my account size on exotics and always trade with a stop-loss order, fixed or trailing.

Despite being a day trader, I often adopt a swing trading mindset when trading such currency pairs. In doing so, the fills and spreads aren’t as critical because I’m aiming for more pips, and I can also work with wider stop losses.

Analysis

For this trade, I divided my analysis into two parts. The fundamental analysis for trading the USD/ZWL pair involved researching articles about the state of the economy and the launch of the new currency. The overall sentiment convinced me that USD would remain strong vs ZWL.

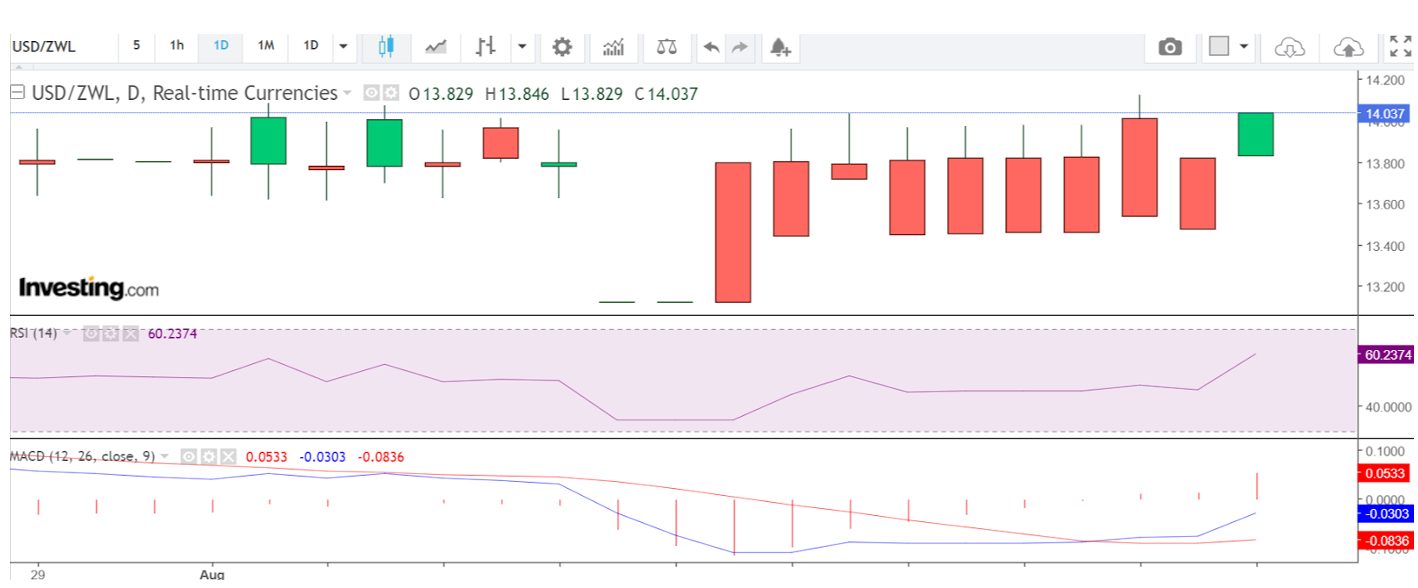

The chart below indicates that the pair experienced a sharp rise once the new currency was created. I see no reason to expect this situation to alter despite the pair trading in a tight range since.

When we analyze the second chart in terms of fundamentals, we can see that the fall in the inflation rate provided confidence in the new currency as USD/ZWL sold off.

However, I’m viewing this as a temporary measure. I’m convinced that USD will continue to grow in strength, especially because certain publications cite USD being used in 85% of day-to-day spending.

Turning to technical analysis, I’m using the daily chart. Although I advocate reading candlestick patterns to identify price action, I often apply trusted technical indicators to my chart to help support my trading decisions.

For this trade, I’ve used the RSI to indicate volatility, oversold, overbought conditions, and MACD, which can illustrate trade momentum and turns in sentiment.

The RSI is trading above 50 but some distance away from the overbought area of 70. However, remember that the oversold or overbought area can take time to appear on daily charts; moreover, an asset can remain in that band for some time.

The MACD moving averages crossed, and the histogram moved into positive territory, adding more confidence to my bullish sentiment.

The candlestick formation supported my beliefs; the solid, full green candle has certified the reversal to bullish conditions. The drop USD suffered due to the fall in inflation has faded, and in my opinion, the currency pair will revert to the mean and then continue its previous bullish trend.

Execution

My order ticket had a price of 13.900.

The stop loss order is close to the recent low of 13.480, the profit limit order is 14.500.

I envisage holding this forex trade for several days.

Bottom Line

Zimbabweans should generally trade currencies during the most active market sessions, particularly the London and New York sessions, where liquidity and volatility are highest.

Aligning your trading schedule with these peak periods can enhance your chances of making profitable trades, though you still risk losing your money. Monitoring Zimbabwe’s monetary and fiscal policies is also critical.

To get started, use DayTrading.com’s selection of the top forex trading platforms in Zimbabwe.

Recommended Reading

Article Sources

- Inflation Rate Zimbabwe - Trading Economics

- GDP Growth Rate Zimbabwe - Trading Economics

- ZiG - World Economic Forum

- Reserve Bank of Zimbabwe (RBZ)

- Zimbabwe Revenue Authority (ZIMRA)

- RSI - Investopedia

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com