CFD Trading In Zimbabwe

Trading in Zimbabwe has seen an increase in the adoption of contracts for difference (CFDs), reflecting a growing interest in this dynamic financial instrument.

CFDs present a powerful tool for speculating on the nation’s key exports, such as gold and nickel, to potentially profit from upward price trends and declines, offering flexibility not commonly found in conventional trading.

This beginner’s guide will provide a detailed exploration of CFD trading in Zimbabwe, highlighting the advantages and addressing the associated risks.

Quick Introduction

- A CFD is a financial tool that allows you to profit from the price fluctuations of various assets, such as African stocks, global indices, and precious metals, without actually owning them.

- Unlike conventional investing, CFD trading does not grant ownership of the underlying asset. You do not receive any ownership-related benefits, such as dividends when stock dealing.

- A key characteristic of CFDs is leverage, letting you manage more prominent positions than your investment. While leverage can boost profits, it also increases the risk of huge losses.

- CFDs are sophisticated products that come with considerable risks. Costs like spreads, overnight fees, and commissions can reduce the potential for profits.

- CFDs, being derivative instruments, may exhibit slight price discrepancies compared to the actual market value of the underlying asset.

- The Securities and Exchange Commission of Zimbabwe (SECZ) regulates securities like CFDs, and is an ‘orange tier’ body in DayTrading.com’s Regulation & Trust Rating.

Best CFD Brokers In Zimbabwe

We've run deep-dive tests into hundreds of CFD brokers and these 4 providers are best for traders in Zimbabwe:

How Does CFD Trading Work?

Imagine you’re interested in Clicks Group, the South African healthcare company listed on the Johannesburg Stock Exchange (JSE).

Rather than buying shares directly, you could trade a CFD to speculate on the stock’s price movements, potentially profiting from both rising and falling prices.

If you believe the value of Clicks Group’s stock will increase, you would open a ‘buy’ (or long) position on the CFD. On the other hand, if you expect the stock price to decline, you could open a ‘sell’ (or short) position.

Trading CFDs would enable you to take advantage of leverage, meaning you can control a larger position with a smaller investment. However, it’s important to remember that CFDs do not provide ownership of the underlying asset.

For example, suppose Clicks Group’s stock is priced at ZAR 30,000 per share, and you choose to trade 10 CFDs, each representing one share. The total value of the trade would be ZAR 300,000.

Thanks to leverage, you only need to deposit a fraction of the total trade value. If the leverage is 1:20, your required initial investment would be ZAR 15,000.

- If the price rises to ZAR 30,500, you make a profit. Each share earns ZAR 500 more, so your 10 CFDs earn a total profit of ZAR 5,000.

- If the price falls to ZAR 29,500, you will lose money. Each share will drop by ZAR 500, meaning your 10 CFDs will lose ZAR 5,000.

This example highlights how leverage can amplify profits and losses in CFD trading.

It emphasizes the need for careful risk management, as leverage introduces the possibility of substantial losses.

What Can I Trade In Zimbabwe?

CFDs allow you to trade across various local and international markets. However, the markets you can access will depend on the broker you select.

- Stock CFDs – Although not commonly provided by global brokers in our experience, you could trade stocks listed on the ZSE, such as African Distillers and First Capital Bank Ltd. Furthermore, you could trade stocks from global markets, including those in Asia, Europe and the US, which are typically more readily available.

- Index CFDs – The FTSE/JSE All Shares Index (JALSH), representing the largest companies on the JSE by market capitalization, is available for trading as a CFD. Likewise, you can trade major international indices like Germany’s DAX 40 and the US’s Dow Jones 30. These international indices generally provide higher liquidity and trading volumes, resulting in lower trading costs for short-term traders.

- Forex CFDs – Forex trading in Zimbabwe functions much like it does in other countries worldwide. You can buy and sell currency pairs such as USD/ZAR (US dollar/South African rand) and EUR/USD (euro/US dollar) through CFDs. The USD/ZAR pair is particularly significant due to Zimbabwe’s solid economic relationship with South Africa and the widespread use of the US dollar in domestic transactions. Still, not many CFD trading platforms offer it and expect wider spreads than with major USD pairs.

- Commodity CFDs – Commodity trading involves speculating on the price movements of key raw materials and essential goods. These include energy resources like oil and natural gas, precious metals like gold and silver, and agricultural commodities like corn and soybeans. Gold and nickel may be of particular interest to CFD traders in Zimbabwe, given their role as key exports for the country.

- Crypto CFDs – Cryptocurrency trading presents an intriguing opportunity in Zimbabwe. However, due to the limited presence of local crypto firms and the tough stance taken by the country’s central bank, you’ll most likely have to depend on international cryptocurrency brokers to trade CFDs on coins like Bitcoin and Ethereum, raising the risks.

Is CFD Trading Legal In Zimbabwe?

CFD trading is legal in Zimbabwe but subject to regulatory oversight.

While the Securities and Exchange Commission of Zimbabwe (SECZ) primarily regulates securities, including stocks, the trading of CFDs falls within the broader financial trading landscape, which may be influenced by multiple financial authorities, including the Reserve Bank of Zimbabwe (RBZ), regarding foreign exchange regulations.

You are encouraged to ensure compliance with local laws and regulatory guidelines when engaging in CFD trading.

Additionally, given the complexity of CFDs, it is advisable to operate through licensed and regulated brokers to avoid legal or financial risks.

Is CFD Trading Taxed In Zimbabwe?

CFD trading is subject to taxation in Zimbabwe. While no specific tax category exists exclusively for CFDs, the profits derived from trading CFDs are generally considered taxable income.

The tax rate applied to CFD trading profits in Zimbabwe varies based on your total income. Zimbabwe follows a progressive income tax system, where tax rates rise as income increases, ranging from 20% to 40%.

If your CFD trading is considered an investment because you hold positions for a prolonged period, it may be subject to a capital gains tax of up to 25%. However, you will likely be taxed under the regular income tax regime by actively trading CFDs as a day trader.

Ultimately, the tax you pay will depend on your situation and how the Zimbabwe Revenue Authority (ZIMRA) classifies the revenue.

An Example Trade

Let’s consider a hypothetical example to illustrate how CFD trading could operate in Zimbabwe.

Background

South Africa released its quarterly GDP growth figures, which surpassed market expectations.

The economy grew at 1.5%, higher than the forecasted 0.8%, signaling stronger-than-expected performance across industries such as mining and finance.

The positive sentiment led to an uptick in the JSE FTSE All Share Index, or JALSH, as investors showed renewed confidence in South African companies.

This would have been an ideal opportunity to potentially profit from the index’s upward momentum using a CFD.

Trade Entry & Exit

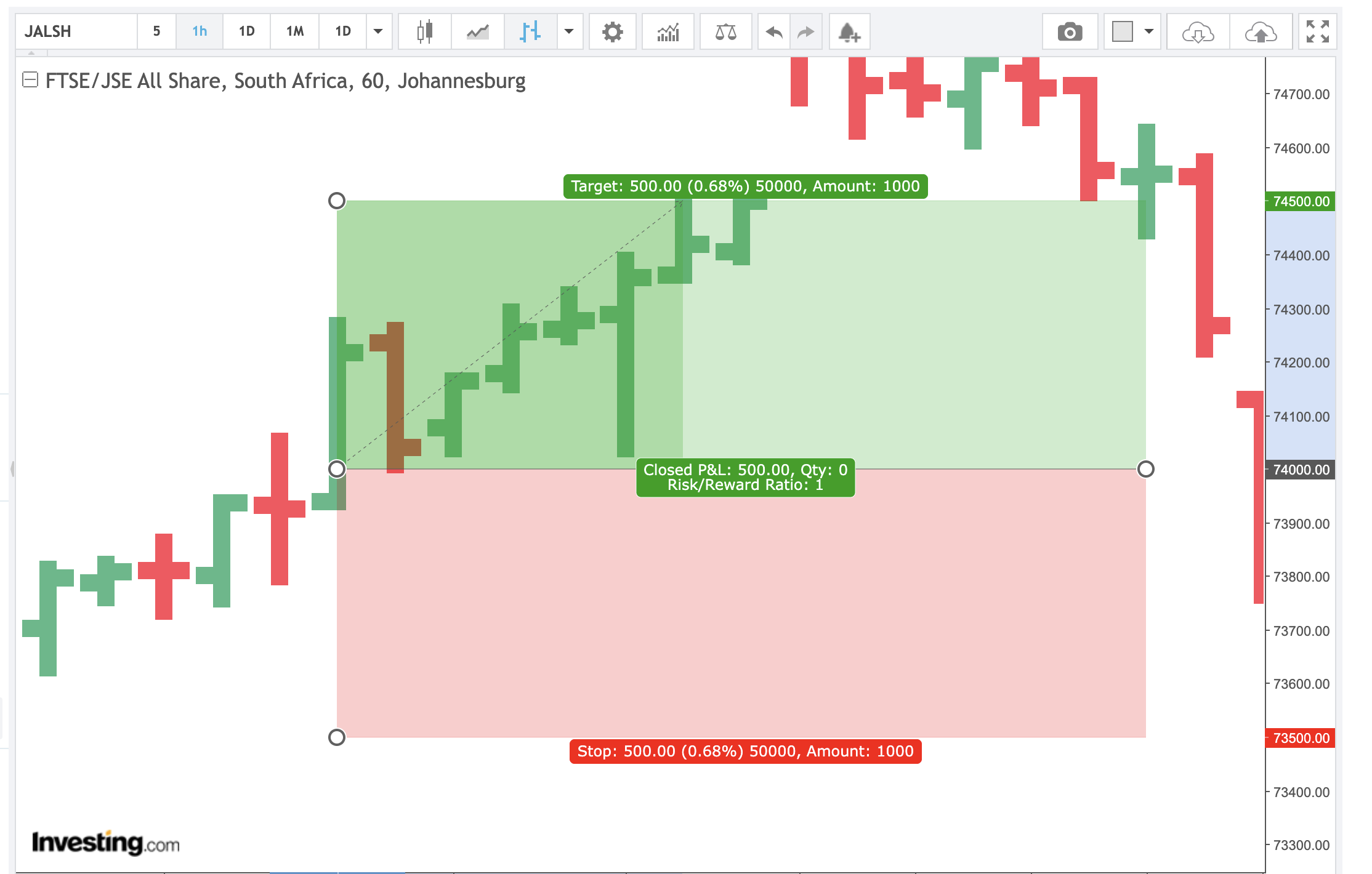

Let’s say I opened a CFD trade on the JALSH using my trading account denominated in ZAR (almost no CFD brokers offer an account based in Zimbabwe dollars (ZWD) from our research).

When I initiated my trade, the index was priced at ZAR 74,000, and I anticipated the price would rise further due to the positive market sentiment.

Since CFDs allow me to trade on leverage, my broker offered a 1:20 leverage ratio. I could control a position worth ZAR 74,000 with ZAR 3,700 as my margin.

I placed a ‘buy’ (long) trade for one CFD contract, speculating that the index would increase in value during the trading session.

By midday, the index had risen to ZAR 74,500, reflecting the optimism in the market. I monitored the price closely and decided to close my position to lock in my profit – the movement of ZAR 500 in the index value translated into a gain for my trade.

The profit calculation was straightforward.

My CFD contract reflected the index’s price movement. With the increase of ZAR 500, my profit on the trade amounted to ZAR 500.

Given the leverage, I used only a fraction of the position value as my initial investment. Still, the profit was calculated based on the full movement of the index, amplifying my return.

The trade was successful, with a profit of ZAR 500 on an initial margin of ZAR 3,700. This exemplifies one of the significant advantages of CFD trading: the ability to use leverage to maximize gains.

However, I carefully monitored the trade closely since the same leverage that amplified my profits could have magnified losses if the market had moved against me.

By closing my position promptly, I capitalized on the positive sentiment driven by the GDP news.This experience reinforced the importance of timing, research, and disciplined risk management when trading CFDs.

Bottom Line

Trading CFDs in Zimbabwe allows you to speculate on the price movements of various assets, including commodities, stocks, indices, and currencies, without owning the underlying asset.

This approach offers flexibility, enabling you to profit from rising and falling markets beyond Zimbabwe while leveraging your capital for more prominent positions.

However, CFDs carry significant risks, including potential amplified losses due to leverage and trading costs.

Zimbabwe also lacks the robust regulatory framework to govern CFDs that we see in more established jurisdictions.

You should trade CFDs with a regulated broker and adhere to local laws and financial guidelines.

To begin trading CFDs in Zimbabwe, explore our top CFD trading platforms and select the one that aligns with your specific needs.

Recommended Reading

Article Sources

- Securities and Exchange Commission of Zimbabwe (SECZ)

- Reserve Bank of Zimbabwe (RBZ)

- Zimbabwe Stock Exchange (ZSE)

- Zimbabwe Taxes on Personal Income - PWC

- Zimbabwe Revenue Authority (ZIMRA)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com