Best Forex Trading Platforms In Zambia 2025

The regulatory frameworks of the Bank of Zambia and the country’s Securities & Exchange Commission are still evolving, with many local investors turning to platforms regulated in other reputable jurisdictions to trade currencies online.

Discover the best forex brokers accepting traders in Zambia. Every platform has been tested by our experts and offers convenient funding for traders making deposits in Zambian Kwacha (ZMW).

6 Top Forex Trading Platforms In Zambia

Based on our evaluations, these 6 platforms excel for forex traders in Zambia:

This is why we think these brokers are the best in this category in 2025:

- XM - XM offers a strong selection of currency pairs with no re-quotes or hidden charges, while spreads have come down over the years, now starting from 0.8 pips on the EUR/USD in the commission-free account.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- IC Markets - IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

- FOREX.com - FOREX.com continues to uphold its stature as a premier FX broker, offering over 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $5 commission per $100k, it stands out. Moreover, its SMART Signals help to identify price behaviors across numerous major currency markets.

- Pepperstone - Pepperstone offers ultra-competitive forex spreads averaging 0.12 pips on EUR/USD in the Razor account, accompanied by a diverse portfolio comprising 100+ currency pairs - an extensive selection surpassing most competitors. Additionally, Pepperstone distinguishes itself by offering three currency indices (USDX, EURX, JPYX), not commonly found among alternative platforms. Pepperstone has now won our annual 'Best Forex Broker' award twice.

Best Forex Trading Platforms In Zambia 2025 Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | Regulator |

|---|---|---|---|---|---|

| XM | 55+ | 0.8 | / 5 | $5 | ASIC, CySEC, DFSA, IFSC |

| Vantage | 55+ | 0.0 | / 5 | $50 | FCA, ASIC, FSCA, VFSC |

| IC Markets | 75 | 0.02 | / 5 | $200 | ASIC, CySEC, FSA, CMA |

| AvaTrade | 50+ | 0.9 | / 5 | $100 | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| FOREX.com | 80+ | 1.2 | / 5 | $100 | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA |

| Pepperstone | 100+ | 0.1 | / 5 | $0 | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

|---|---|

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.8 |

| EURGBP Spread | 1.5 |

| Total Assets | 55+ |

| Leverage | 1:1000 |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- Although trusted and generally well-regulated, the XM global entity is registered with the weak IFSC regulator and UK clients are no longer accepted, reducing its market reach.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| Bonus Offer | 50% Welcome Deposit Bonus, earn redeemable rewards in the Vantage Rewards scheme |

|---|---|

| GBPUSD Spread | 0.5 |

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:500 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- Vantage caters to hands-off investors with beginner-friendly social trading via ZuluTrade & Myfxbook

- The low minimum deposit of $50 and zero funding fees make this broker a great choice for new traders

- The broker has recently made efforts to expand its suite of CFDs providing further trading opportunities

Cons

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- Unfortunately, cryptos are only available for Australian clients

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| GBPUSD Spread | 0.23 |

|---|---|

| EURUSD Spread | 0.02 |

| EURGBP Spread | 0.27 |

| Total Assets | 75 |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

Cons

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Bonus Offer | 20% Welcome Bonus up to $10,000 |

|---|---|

| GBPUSD Spread | 1.5 |

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade continues to enhance its suite of products, recently through AvaFutures, providing an alternative vehicle to speculate on over 35 markets with low day trading margins.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | 20% Welcome Bonus Up To $5000 |

|---|---|

| GBPUSD Spread | 1.3 |

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 80+ |

| Leverage | 1:400 |

| Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 100+ |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

How We Rate Forex Trading Platforms In Zambia

There are several key components we consider when rating forex brokers, notably:

Trust

Despite increasing interest in forex trading among Zambians, like many African countries, there are a limited number of local brokers regulated by the Bank of Zambia or the nation’s Securities & Exchange Commission.

However, if you choose to trade currencies with a global broker, it’s important to pick a platform that’s authorized by another trusted regulator, such as the FCA in the UK, ASIC in Australia or SEC in the US. This will help protect you from forex trading scams and safeguard your Zambian Kwacha.

We only recommend forex trading platforms to investors in Zambia that we trust after balancing the strength of their regulatory credentials with their years in the industry and the direct experiences of our researchers during the testing process.

- IG shines as the most trusted forex broker for Zambian traders. Not only does it hold 13 licenses but it boasts over 50 years in the industry, a listing on the London Stock Exchange, and our experts have traded real money on the platform with no withdrawal issues.

Forex Platforms

The top forex brokers in Zambia offer user-friendly platforms that allow you to analyze market trends and identify opportunities in African currencies and those further afield.

We’ve been testing forex brokers for many years and MetaTrader 4 and MetaTrader 5 remain the most widely supported options. However, we don’t love their outdated designs which we think pose a steep learning curve for newer traders.

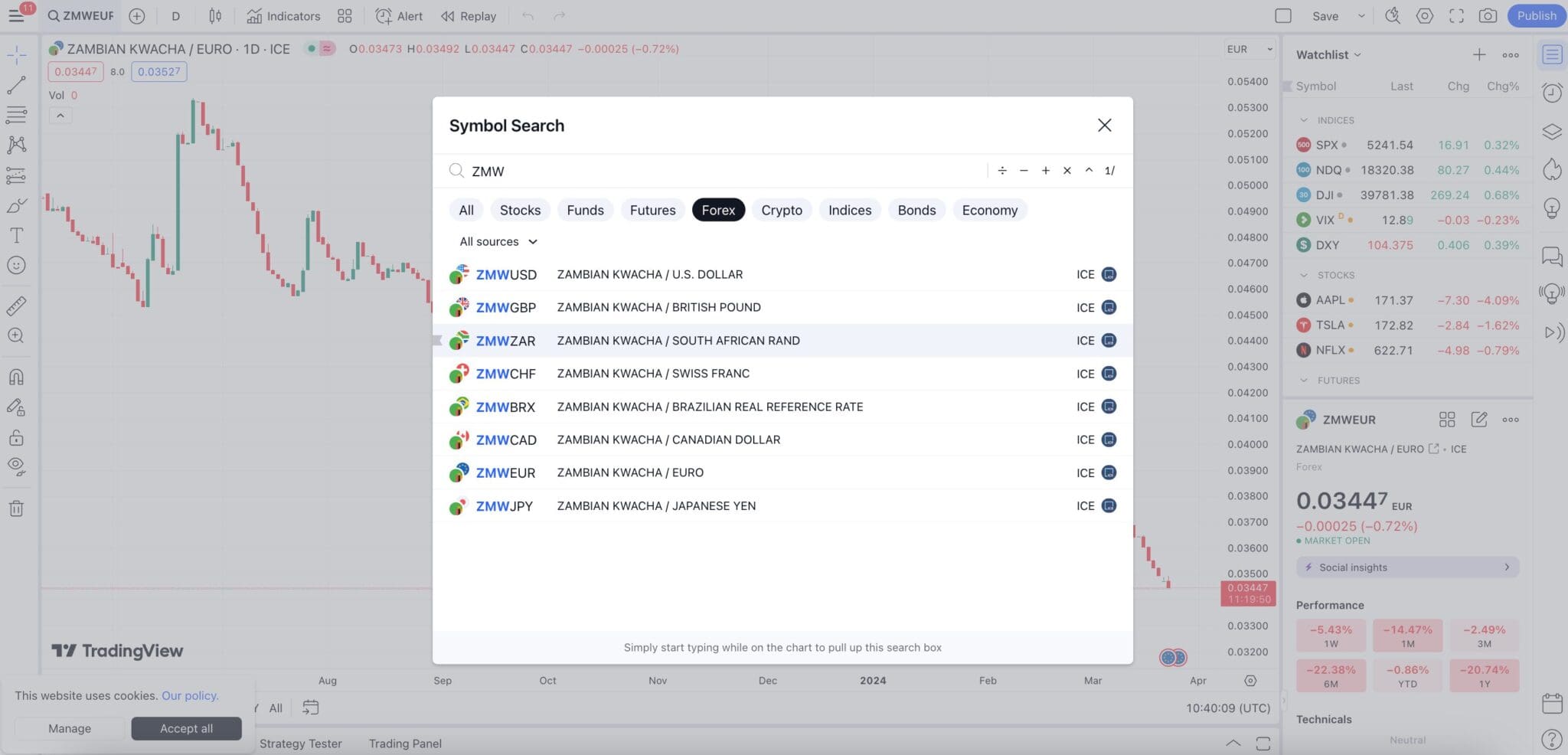

Instead, aspiring currency traders may prefer the bespoke platforms offered by several leading forex brokers. Alternatively, TradingView sports slick aesthetics with insights into eight currency pairs with the ZMW, including ZMW/USD, ZMW/EUR and ZMW/ZAR.

- Pepperstone offers a terrific selection of platforms helping it secure our ‘Best Forex Broker’ award twice, including MT4, MT5, cTrader, and TradingView. It also provides Smart Trader Tools with 28 indicator and expert advisor add-ons for MetaTrader.

Currency Pairs

We analyzed our 400-strong database of forex trading platforms and Zambian Kwachas (ZMW) are not commonly traded. However, regional currencies like South African Rands (ZAR) are widely available and most brokers carry a good selection of major, minor and exotic pairs.

Most of our top forex trading platforms offer at least 50 currency pairs, but some of the best options support over 80 forex assets, catering to a diverse range of short-term trading strategies.

- FOREX.com continues to offer among the widest selections of currency pairs for Zambian traders, with over 80 assets coupled with ultra-fast execution speeds of 20ms and tight spreads from 0.0 pips, catering to day traders.

Trading Fees

We score every broker on their trading fees, recording and analyzing spreads on popular currency pairs, including the EUR/USD. This allows us to identify the lowest-cost forex trading platforms for short-term traders.

We also factor in non-trading fees, such as conversion costs if depositing funds from Zambian Kwachas to an account based in another currency, such as US Dollar, which is highly likely as very few firms support ZMW accounts.

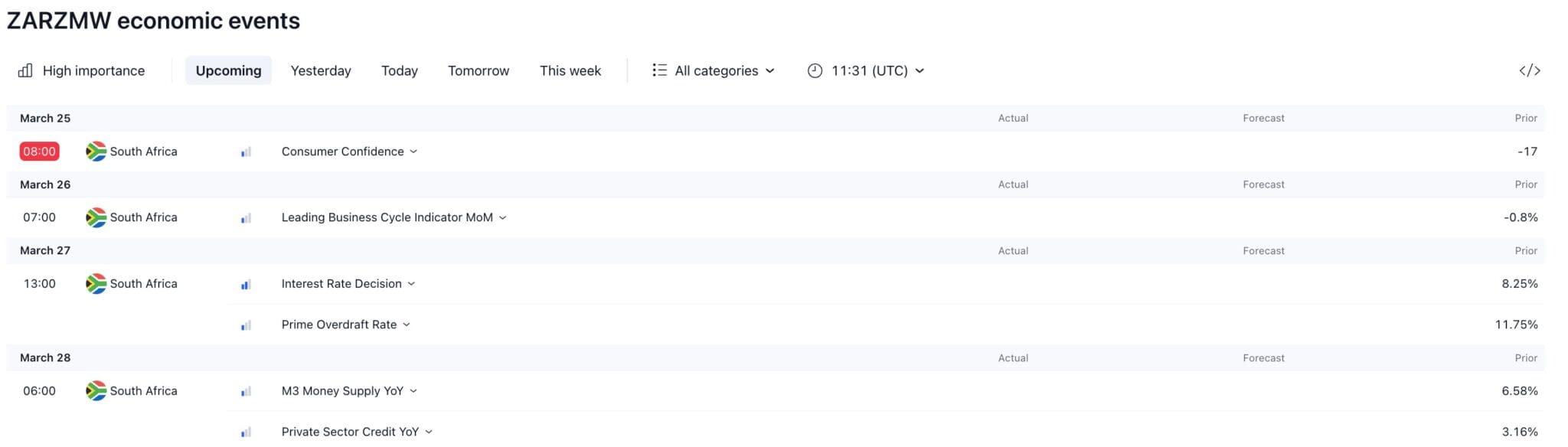

Finally, we balance pricing against the trading tools and insights provided. This is because it can be worth paying more for economic calendars that highlight upcoming interest rate decisions from Zambia’s central bank, for example, which can impact currency values.

- Year after year IC Markets stands out for its terrific forex pricing. We’ve experienced their zero-pip spreads on popular currency pairs first-hand, while their volume rebates for active traders and fast execution speeds also help forex traders secure the best prices.

Account Funding

We favor Zambian forex brokers with accessible minimum deposits, allowing traders of all levels to start speculating on currencies online.

Our extensive industry experience and comprehensive directory of forex brokers show most leading platforms accept Zambian traders with a minimum deposit of <250 USD, equivalent to around 6,500 KMW.

However, budget-conscious Zambians can even get started with no minimum at some forex trading platforms – among the highest rated being Pepperstone.

Methodology

To find the top forex brokers for Zambia, we identified all the platforms that accept Zambian traders and then ranked them by their overall rating, which factors in important areas, notably:

- Authorization from respected regulators, if not by Zambia’s Central Bank or Securities & Exchange Commission, then trusted bodies in other jurisdictions.

- A wide selection of currency pairs, including those of interest to Zambian traders like African currencies and majors with the US Dollar.

- Convenient deposits for Zambian traders, including affordable minimum deposits and secure payment methods.

- Intuitive forex platforms that we enjoy using with real-time data and tools to help discover short-term trading opportunities.

- Excellent pricing with low spreads and commissions with no hidden charges for forex trading.

FAQ

Is Forex Trading Legal In Zambia?

Forex trading is permitted in Zambia with residents able to speculate on currencies through online brokers.

You should also make sure you’re aware of tax obligations when trading currencies, in line with the Zambia Revenue Authority.

Who Regulates Forex Trading Platforms In Zambia?

The Bank of Zambia and the Securities & Exchange Commission oversee the financial markets, including forex trading participants.

However, the country’s regulatory framework remains underdeveloped compared to many other jurisdictions with a limited number of locally-registered brokerages to choose from. As a result, many Zambians trade currencies through forex brokers regulated elsewhere.

How Much Money Do I Need To Start Trading Forex In Zambia?

Our findings show most forex trading platforms in Zambia accept investors with an initial deposit of up to 250 USD, around 6,500 KMWs. The most affordable forex brokers go considerably lower, however, and Pepperstone even has no minimum.

Recommended Reading

Article Sources

- Bank of Zambia

- Zambia Securities & Exchange Commission

- Zambia Revenue Authority

- Zambia Digital Payment Method Usage - Statista

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com