Day Trading in Zambia

Zambia, a resource-rich nation in Southern Africa, has an economy heavily reliant on mining, particularly copper, contributing significantly to its GDP and export earnings, while also presenting short-term trading opportunities.

With a GDP of approximately $29 billion, the country is also seeing gradual growth in its financial sector, driven by efforts to diversify the economy, making it an attractive destination for active traders.

Are you ready to start day trading in Zambia? This guide will get you started.

Quick Introduction

- The Bank of Zambia (BoZ) and the Securities and Exchange Commission (SEC) are still developing Zambia’s regulatory landscape for online trading, requiring caution by investors.

- The Lusaka Securities Exchange (LuSE) serves as the primary platform for trading local equities, while forex trading is also popular, given the Zambian kwacha (ZMW) volatility.

- Zambia does not have a specific capital gains tax for day trading, so any profits generated are typically taxed as ordinary income at rates from 20% to 37%.

Top 4 Brokers in Zambia

Following our exhaustive tests, these 4 brokers emerged as the best for day traders in Zambia:

What Is Day Trading?

Day trading in Zambia involves the buying and selling of financial assets within a single trading day to capitalize on short-term price movements.

Zambian traders often focus on stocks listed on the LuSE – particularly shares of prominent local companies in the mining, banking, and agricultural sectors – such as Zambia Forestry and Forest Industries, and Zambia National Commercial Bank.

Additionally, the forex market is a popular choice due to the volatility of the local currency, the Zambian kwacha (ZMW). However, our analysis of hundreds of trading platforms shows the ZMW is not widely available for active trading.

As Zambia’s financial markets continue to develop, these assets offer opportunities for you to profit from the country’s economic dynamics. However, it’s essential to follow strict risk management as day trading is a high-risk approach to online trading.

Is Day Trading Legal In Zambia?

Day trading is legal in Zambia. The SEC and the BoZ regulate the activity and oversee the country’s financial markets.

You can legally engage in short-term trading on the LuSE and through licensed brokers offering access to local and international markets.

However, like in most jurisdictions, you must comply with Zambian regulatory requirements, including tax obligations and anti-money laundering (AML) regulations.

Using regulated brokers is vital to ensure the legality and security of trading activities, but like many African countries, there are a limited number of local regulated brokers in Zambia.

How Is Day Trading Taxed In Zambia?

In Zambia, the taxation of day trading activities generally falls under the framework of income tax rather than capital gains tax, as Zambia does not impose a separate capital gains tax on financial transactions.

Profits earned from day trading are often considered part of your taxable income and may be subject to Zambia’s income tax laws.

The income tax rate for individuals ranges from 20% to 37%, depending on the total income earned, payable to the Zambia Revenue Authority (ZRA). This applies if day trading is your primary source of income or a significant part of your earnings.

You must ensure you comply with all Zambian tax reporting requirements.I recommend consulting with a local tax professional to report and pay taxes on trading income accurately.

Getting Started

Starting day trading in Zambia is a straightforward process that involves three simple steps:

- Choose a broker. The SEC and the BoZ oversee Zambia’s financial industry, though regulatory oversight is less stringent than that of jurisdictions like the UK (FCA) or Australia (ASIC). This leads many Zambians to choose international brokers, often offering enhanced security features such as negative balance protection.

- Set up your account. You’ll typically need a National Registration Card (NRC) and a recent utility bill to verify your trading account. Once approved, you can fund your account via wire transfers, debit cards, or, if available, Zambia-based Zoona for mobile payments.

- Start day trading. You can invest in Zambian stocks listed on the LuSE or speculate on Zambian Kwacha (ZMW) exchange rates. Notable currency pairs include USD/ZMW, enabling trading against the US dollar. Commodities of interest may include copper, gold, plus softs like corn, soybeans and cotton, all of which Zambia produces.

A Trade In Action

Let’s consider a scenario with Zambia National Commercial Bank (Zanaco), the first bank in Zambia to register ZMW 1 billion in profit after tax.

Event Background

Zanaco’s earnings report exceeded expectations, with a net interest income of ZMW 3,457.85 million. The announced dividend hike further boosted investor sentiment.

As expected for such a positive report, higher than average pre-earnings trading volume indicated growing investor interest.

Trade Entry & Exit

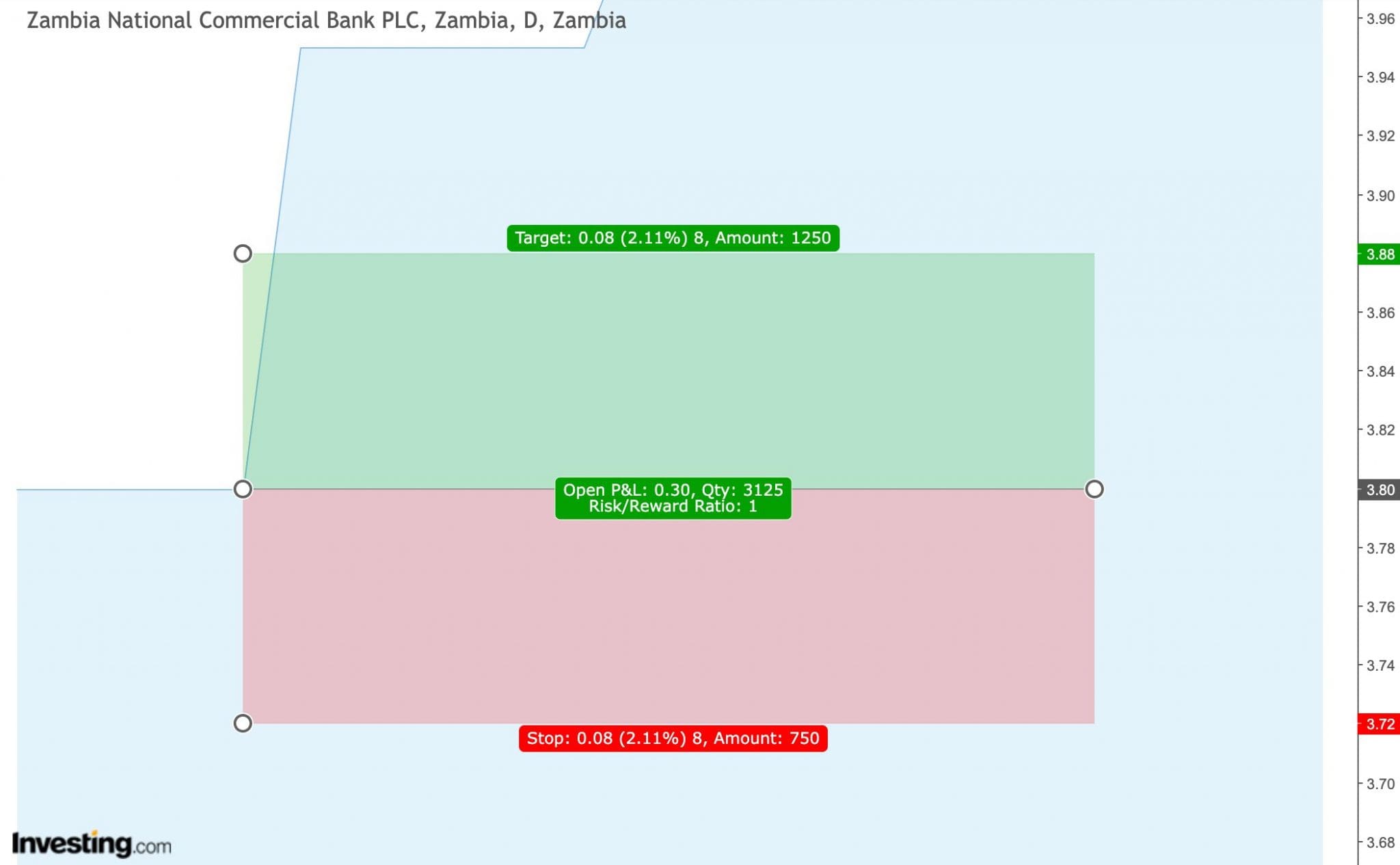

On the earnings release day, Zanaco opened slightly higher. Given the positive news and anticipated market reaction, I entered a long position at ZMW 3.80, with a stop-loss set at ZMW 3.72.

This trade offered a balanced 1:1 risk-reward ratio, with the potential profit matching the potential loss.

As predicted, the stock climbed to ZMW 3.84 by midday and finally hit my take-profit price of ZMW 3.88 by the end of the trading day.

The trade yielded a profit of 2.11%.

The successful outcome was attributed to accurate pre-trade analysis, timely entry and exit, and effective risk management through the stop-loss order.

Bottom Line

Day trading in Zambia is a legal and increasingly popular activity where you can profit from short-term price movements in local assets, particularly stocks listed on the LuSE and the forex market.

With the country’s financial markets still developing, you can focus on assets in key sectors like mining, banking, and agriculture, navigating a dynamic but evolving regulatory environment.

Regulated by the SEC and the BoZ, you must comply with income tax laws, as trading profits are typically taxed as ordinary income.

To get started, explore DayTrading.com’s recommended best day trading platforms.

Recommended Reading

Article Sources

- Bank of Zambia (BoZ)

- Lusaka Securities Exchange (LuSE)

- Securities and Exchange Commission (SEC)

- Zambia Revenue Authority (ZRA)

- Jamaica Individual Taxes on Personal Income - PWC

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com