CFD Trading in South Africa

Do you want to trade short-term price movements in markets like gold, one of South Africa’s key exports, without owning the asset? With contracts for difference (CFDs), trade rising and falling prices with a modest investment.

This beginner’s guide to CFD trading in South Africa explains the opportunities and risks, unpacks the regulatory and tax requirements on CFD traders, and walks through an example trade.

Quick Introduction

- A CFD is a derivative that lets you speculate on an asset’s price movement; you can trade CFDs on South African stocks, profiting from price changes without buying shares.

- CFDs are often traded using leverage, meaning you only need to deposit a fraction of the total value of your trade. This increases profits but also losses, so risk management is key.

- The Financial Sector Conduct Authority (FSCA), a ‘yellow tier’ body in DayTrading.com’s Regulation & Trust Rating, regulates CFD trading in South Africa.

- Trading CFDs incurs spreads (difference between buying and selling price), overnight financing (if you don’t day trade and hold positions overnight), and potentially commissions.

Best CFD Brokers in South Africa

We've tested hundreds of CFD brokers as of December 2025, and these are the 4 best for South African traders:

All CFD Brokers in South Africa

How Does CFD Trading Work?

A CFD is an agreement with a broker to exchange the difference between the opening and closing price of an asset, allowing you to profit from market movements without owning the asset.

Leverage is one of the most enticing elements of CFDs. Leverage lets you open larger positions while only committing a fraction of the total value or margin needed to, for example, buy the equivalent amount of shares listed on South African stock markets.

Let’s consider a scenario using the FTSE/JSE Africa All Shares Index, which comprises the top 99% of the market capitalization of all listed companies on the Johannesburg Stock Exchange.

If you’re convinced the FTSE/JSE will rise, you’d enter a CFD buy position. If each contract is valued at ZAR 86,000 (approximately the index price), and your brokerage requires a 5% margin, then to take a position on 10 contracts, you’d need a margin requirement of ZAR 43,000 (86,000 per contract x 10 contracts x 5%).

If the FTSE/JSE rises to 87,000, the price increase would yield ZAR 1,000 per contract. By closing your position, you could bag a total profit of ZAR 10,000 (10 contracts x ZAR 1,000), minus any fees your broker charges.

However, if the index falls to ZAR 85,000, you could lose ZAR 10,000, illustrating the risks involved with CFD trading; although you can control a significant size with leverage, gains and losses are magnified.

Understanding how margin and leverage work is fundamental.If you’re new to CFD trading, consider a demo account. It’s an excellent introduction to practice strategies and builds your confidence before you risk real money.

What Can I Trade?

CFD trading in South Africa delivers many trading opportunities across several financial markets, both in South Africa and internationally:

- Stock CFDs – You can trade individual South African stocks listed on the Johannesburg Stock Exchange as CFDs without the added expense of buying the shares.

- Index CFDs – The FTSE/JSE Africa All Shares Index is a market capitalization-weighted index. You could also consider CFDs on global indices like the Dow Jones or the NASDAQ, as the trading costs are very competitive.

- Forex CFDs – The South African Rand (ZAR) is actively traded in the foreign exchange market. Popular currency pairs include USD/ZAR and EUR/ZAR. These minor pairs provide liquidity and opportunities for short-term strategies like day trading.

- Commodity CFDs – Commodities important to South Africa’s economy like gold, platinum and palladium, can be traded as CFDs.

- Crypto CFDs – The fascination surrounding digital asset trading has reached South Africa. You can trade cryptocurrency CFDs like Bitcoin and Ethereum for access to the volatile world of crypto.

CFDs have gained significant popularity in South Africa where Single Stock Futures (SSFs) are also prominent. However, there are notable differences: SSFs expire while CFDs do not and SSFs represent 100 shares, whereas CFDs often represent 1 share.

Is CFD Trading Legal In South Africa?

CFD trading is legal in South Africa and regulated by the Financial Sector Conduct Authority (FSCA), the primary regulatory body overseeing and licensing financial services, including brokers offering CFD trading.

The FSCA ensures firms comply with local financial regulations, promotes market integrity, and protects retail traders from unfair practices.

Regulation ensures brokers meet specific standards, including capital adequacy, segregation of client funds, transparency, and fair trading operations.

South African residents can trade CFDs through local and international brokers that accept South African clients. International brokers must either be registered with the FSCA or comply with local regulations.

Is CFD Trading Taxed In South Africa?

Profits made from CFD trading are subject to taxation by the South African Revenue Service (SARS).

Suppose you are trading CFDs actively and frequently (i.e., your primary source of income or main activity is CFD trading). In that case, SARS may consider your profits as income, meaning profits get added to your overall taxable income and taxed at the standard income tax rates, ranging from 18% to 45%.

If CFD trading is a secondary activity, your profits might be classified as capital gains. South African residents must pay capital gains tax on net gains made during the tax year. For individuals, 40% of capital gains are included in taxable income and then taxed at their marginal tax rate.

CFD traders must report their profits and losses to SARS as part of their annual tax return. It’s essential to keep accurate records of all trades to help you calculate the taxable amount of your CFD profits.

If you’re trading stock CFDs, you may be entitled to dividends or charged for interest (financing costs). Any dividend adjustments you receive from stock CFDs are usually taxed as income in South Africa. Conversely, financing costs on leveraged positions may be considered deductible expenses.

If you’re a CFD trader and generate significant profits, you may be required to register for provisional tax. Provisional taxpayers make payments twice a year to SARS (in advance) based on their expected taxable income.

An Example Trade

To show you how CFD trading in Africa really works, I decided to trade Sasol Ltd (SOLJ) as a CFD.

Sasol Limited is a chemical and energy company listed on the Johannesburg Stock Exchange. It operates in South Africa and internationally.

Fundamental Analysis

I was drawn to this CFD share opportunity because my free screening software flagged it as oversold. The analyst sentiment I researched suggested it was a buy, with some suggesting a target price as high as 19,000. I entered my long CFD trade at 11,700, close to the 52 WK low of 11,036.

When analyzing a potential stock to trade as a CFD, I trust several vital metrics:

- P/E ratio, 52W range

- Net profit

- EPS (earnings per share)

- Profit margin

With a one-year change of -54.89%, my theory regarding the stock being oversold was validated.

Technical Analysis

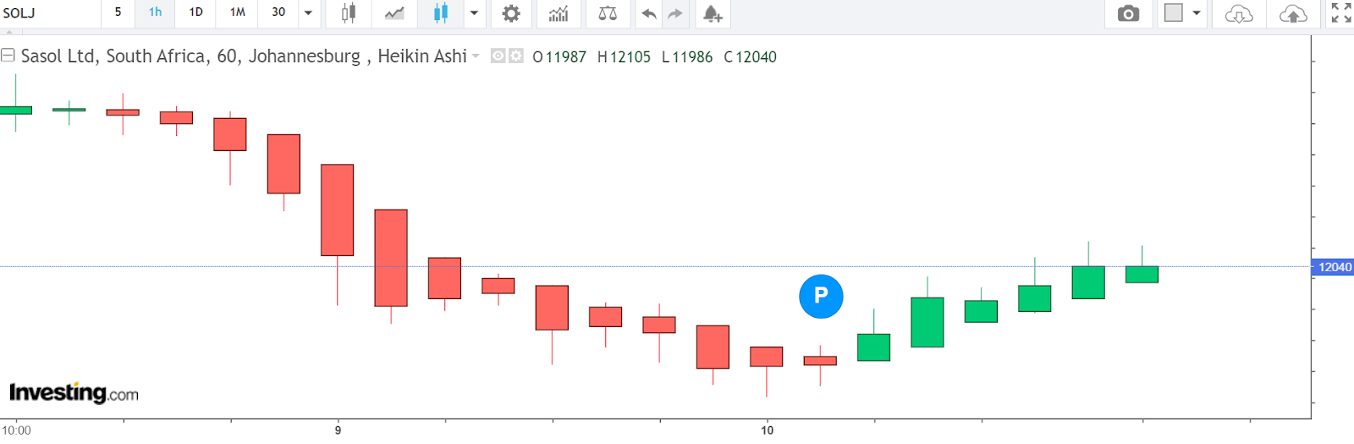

I believe in using as few indicators for technical analysis as possible on my charts. I also favor analysing candlestick formations for price action when looking for day trading opportunities.

I need to make rapid decisions when taking day trades, so it’s best to look at any chart (on any time frame) and make a snap “yes or no?” decision over a potential trade.

I’m looking for positive expectancy in trading strategies. If I’m right with trade direction approximately 60% of the time and can control my risk per trade at 1%, I should (in theory) be profitable over the medium to long term.

Using smoothed Heikin Ashi bars reduces candlestick formation analysis to its simplest elements.

1-Hour Timeframe

In the below 1-hour (HR) timeframe, I could see the bearish momentum exhausting. The last two bearish candlesticks/bars made higher lows, while the final bearish candlestick formed a Doji, indicating market indecision and a balance between buyers and sellers.

Volatility then increased as momentum shifted from bearish to bullish. A series of bullish candles with relatively full bodies and short wicks (shadows) followed, which suggested that the bullish momentum was sustained throughout the day’s trading sessions.

I used a CFD share market order to enter as the first bullish candle formed:

- My order was filled at 11,800

- My stop was placed near the recent low at 11,650

- My take profit limit order was set at 12,100

- My profit per contract worked out at ZAR 300

I used 1:5 leverage to take this trade on 30 contracts, which required a 20% margin, equalling ZAR 70,800. My profit was ZAR 9,000, before accounting for my broker fees.

Given the volatile nature of CFD trading, a solid risk management strategy is crucial.This can include setting stop-loss orders to automatically exit trades if they move against you and limiting the size of your positions relative to your overall portfolio.

Bottom Line

CFD trading in South Africa offers a flexible and accessible way to engage with global markets, from stocks and commodities to forex and indices. It is fully legal and regulated by the FSCA, ensuring protection for retail traders.

However, due to the inherent risks, especially with leveraged positions, beginner traders must educate themselves, manage risks carefully, and choose reputable, regulated brokers.

With proper understanding and strategy, CFD trading can be a valuable tool for diversifying investments and capitalizing on market opportunities in South Africa.

To get started, use DayTrading.com’s choice of the top platforms for day trading CFDs in South Africa.

Recommended Reading

Article Sources

- Financial Sector Conduct Authority (FSCA)

- The FTSE/JSE Africa All Shares Index

- Johannesburg Stock Exchange

- South African Revenue Service (SARS)

- Sasol Ltd (SOLJ)

- Analyst Sentiment - Market Beat

- Positive Epectancy

- Free Screening Software - Yahoo Finance

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com