Day Trading in South Africa

With its well-developed financial sector and robust regulatory framework, day trading in South Africa has proven popular. South Africa is home to the continent’s most advanced economy, boasting a GDP of approximately $370 billion, making it a pivotal player in regional and global markets.

Are you ready to start day trading in South Africa? This guide will get you going.

Quick Introduction

- The primary regulatory body in South Africa is the Financial Sector Conduct Authority (FSCA), the most active financial regulator on the continent and a ‘yellow tier’ agency in line with DayTrading.com’s Regulation & Trust Rating.

- The Johannesburg Stock Exchange (JSE) is the largest stock exchange in Africa and provides a platform for trading various instruments, including stocks, bonds, and derivatives, and is known for its robust market infrastructure.

- If your day trading activities are considered investing, profits are generally subject to capital gains tax (CGT) by the South African Revenue Service (SARS). However, if you are considered a professional trader, your profits are treated as ordinary income and taxed at personal income tax rates, ranging from 18% to 45%.

Top 4 Brokers in South Africa

We have reviewed 223 platforms and these have been identified as the top 4 for day traders in South Africa:

All Day Trading Platforms in South Africa

What Is Day Trading?

Day trading refers to buying and selling financial instruments, such as stocks, commodities, or indices within the same day. Forex trading in South Africa is also a huge market, providing exposure to the South African Rand.

To maximize returns, active traders often turn to CFD trading in South Africa, which permits the use of leverage, allowing investors to control larger positions with less capital. However, this strategy can also amplify losses.

While technology has made day trading in South Africa more accessible, it remains highly competitive requiring in-depth market knowledge, discipline, and strategic thinking.South African day traders must be well-prepared for rapid decision-making, deeply understand market dynamics, and adhere strictly to local regulations. This is crucial for success in day trading.

Equipped with this knowledge, South Africans can trade a wide range of local and global markets, including:

- Stocks: Equities can be easily influenced by news announcements and geopolitical factors, making them suitable for day trading strategies. Popular stocks on the JSE include Naspers, Prosus and BHP Billiton.

- Indices: South Africans may want to collectively speculate on the the largest stocks listed on the JSE through indices like the JSE All Share Index (J203) and JSE Top 40 Index (J200).

- Forex: Residents could use their local knowledge to take positions on currency pairs containing the South African Rand (ZAR), such as USD/ZAR, EUR/ZAR, AUD/ZAR and GBP/ZAR.

- Commodities: South Africa is among the world’s largest producers of precious metals like gold, platinum and palladium, as well as commodities like iron ore, potentially offering short-term trading opportunities.

- Cryptocurrencies: South African traders are allowed to deal in digital currencies like Bitcoin and Ethereum, though the FSCA has issued warnings about the risks of this asset class, which remains largely unregulated.

Is Day Trading Legal In South Africa?

Day trading is not only legal in South Africa but is also regulated to ensure fair and transparent practices. You must comply with rules laid down by the FSCA, which oversees financial market conduct and ensures investor protection.

You must also adhere to the Financial Intelligence Centre (FIC)‘s anti-money laundering (AML) and counter-terrorism financing (CTF) requirements. This includes verifying your identity when you open an online trading account.

Financial service providers involved in day trading must be licensed and registered with the FSCA and meet ongoing compliance standards.

The regulatory framework ensures that day trading activities are conducted in a structured and transparent environment, with oversight mechanisms to prevent market manipulation and protect investors.

How Is Day Trading Taxed In South Africa?

Trading gains are subject to taxation by the South African Revenue Service (SARS), with the treatment depending on whether your activity is classified as investing or as a profession.

If your short-term trading is considered investing, gains are generally subject to capital gains tax (CGT). For individuals, only 40% of the capital gain is included in taxable income, and the tax rate applied is based on your marginal income tax rate.

Conversely, the profits are treated as ordinary income if you are deemed a professional trader. These profits are taxed at personal income tax rates, ranging from 18% to 45%.

Additionally, if your trading involves dividends, these are further subject to Dividend Withholding Tax (DWT). The DWT rate is set at 20%. Generally, it is the responsibility of the company distributing the dividend to deduct and remit the DWT.

I recommend maintaining thorough records of all day trading transactions and seeking advice from a local tax professional to ensure compliance with South African tax regulations and accurately determine your tax liabilities.

Getting Started

Starting day trading in South Africa can be broken down into three simple steps:

- Choose a top South African day trading broker. Evaluate key areas to find the right provider for your needs, for example, do you want to trade South African stocks or currency pairs with the ZAR? Also look for a low-cost provider with fast execution speeds, timely support, low margin requirements if you plan to use leverage, and a strong charting package, which all contribute to an excellent short-term trading environment.

- Set up your account. To open a South African trading account, you’ll need to complete an online application and provide your personal and financial information. Identity verification is mandatory, so be prepared to submit copies of documents like South Africa’s Smart ID Card and proof of address. After reviewing and agreeing to the broker’s terms and conditions, you’ll be ready to start day trading.

- Deposit funds. Once your trading account is approved, you can fund it using your preferred payment method, often debit card, bank wire transfer, and sometimes local solutions like South Africa’s Ozow and SnapScan. Also consider using a ZAR trading account to minimize conversion fees.

A Day Trade In Action

Let’s consider a scenario in which I day trade Naspers, a South African multinational Internet, technology, and multimedia holding company with interests in online retail, publishing, and venture capital investment.

Event Background

I had closely monitored the company’s performance, and a positive earnings report was released that morning.

The report exceeded analysts’ expectations. Its full-year earnings increased more than twofold, driven by stronger e-commerce performance.

The company’s share price had shown a steady upward trend in pre-market trading, and I noticed that the trading volume was higher than usual, indicating strong investor interest.

Trade Entry & Exit

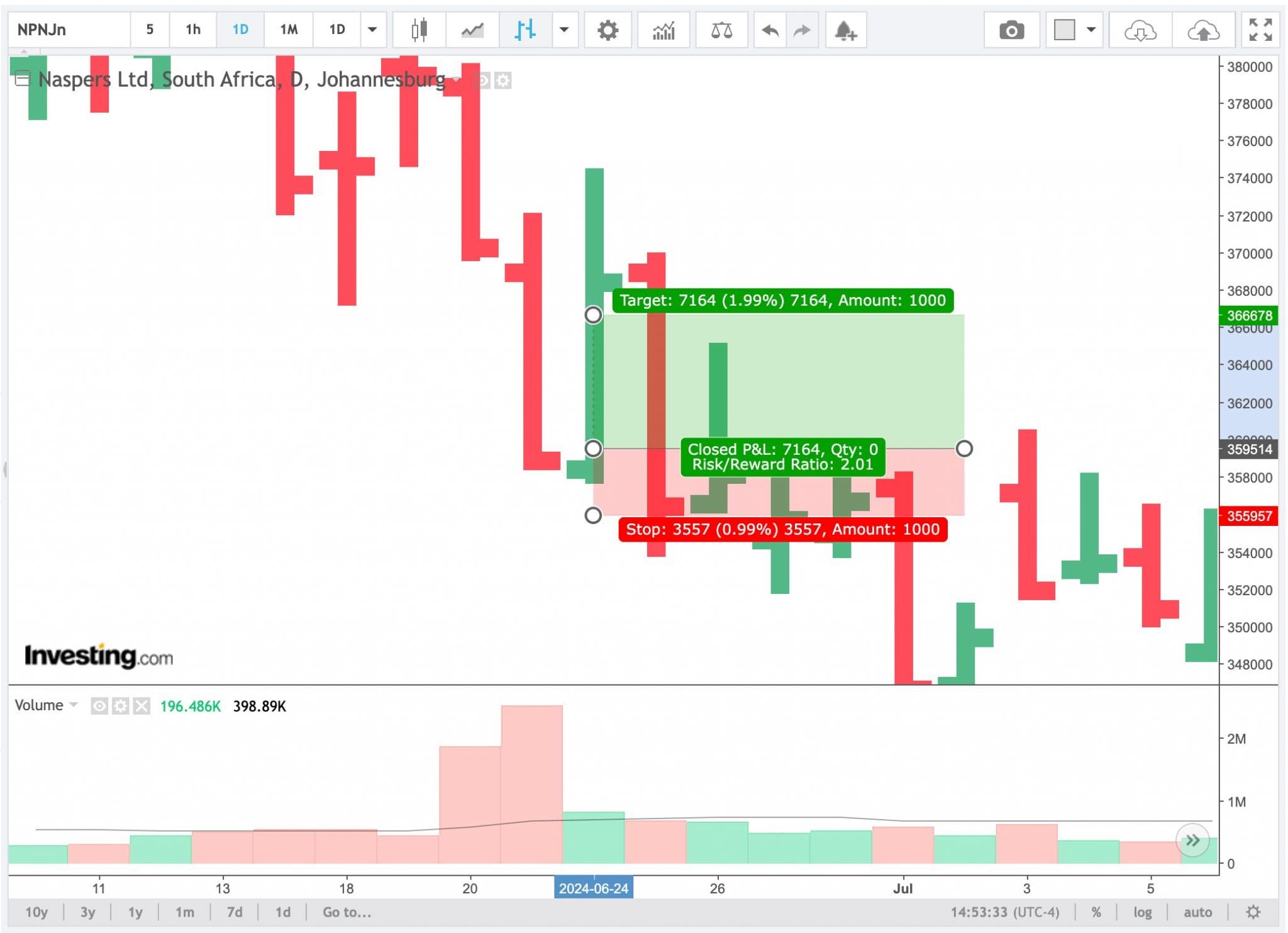

With all the data pointing to a short-term bullish trend, I decided it was the right moment to enter the trade. Based on the market price, I placed a long (buy) order for shares at ZAR 359,514.

My strategy was to capitalize on the immediate price spike following the earnings report while setting a tight stop-loss order at ZAR 355,957 to manage potential risks. I also placed a take profit order at ZAR 366,678 to lock in profits if the stock reached my target before the end of the trading day.

I closely monitored the stock, monitoring price movements and market conditions throughout the day.

The stock price continued to rise in response to the positive news, reflecting heightened investor enthusiasm. By mid-afternoon, Naspers’ share price had reached my target and secured my profits.

The total gain amounted to 1.99% ROI, a satisfactory return given the short holding period. Post-trade analysis showed that the price eventually experienced a pullback over the next few days, validating my decision to exit when I did.

Overall, Naspers’ positive earnings report proved to be a lucrative opportunity for day trading. The combination of strong financial performance and favorable technical indicators allowed me to capitalize on short-term market movements effectively.

Bottom Line

Day traders in South Africa have access to advanced trading technologies and platforms supported by a growing ecosystem of fintech innovations.

The dynamic interplay between market opportunities and regulatory frameworks defines the day trading landscape in South Africa, offering both potential rewards and challenges for investors.

To get started, use DayTrading.com’s selection of the best brokers for day trading in South Africa.

Recommended Reading

Article Sources

- Financial Sector Conduct Authority (FSCA)

- Johannesburg Stock Exchange (JSE)

- South African Revenue Service (SARS)

- South Africa GDP - International Monetary Fund

- South Africa Taxes on Personal Income - PWC

- Dividend Withholding Tax (DWT)

- Financial Intelligence Centre (FIC)

- Crypto Health Warning - FSCA

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com