XTB Secures Regulatory Approvals In UAE And Indonesia

XTB has achieved a key milestone, securing regulatory approvals in Indonesia and the United Arab Emirates (UAE), as first reported by Finance Magnates.

Key Takeaways

- XTB gained a PALN license from Bappebti, a ‘yellow tier’ body in our Regulation & Trust Rating, allowing it to offer stocks and ETFs. XTB also acquired Eagle Capital Futures in 2024, positioning Indonesia as its “Gateway to Asia”.

- XTB gained a Category 5 license from the UAE Securities and Commodities Authority, a ‘yellow tier’ body in our Regulation & Trust Rating, enabling expanded trading services beyond Dubai’s economic zone.

A Strategic Leap

XTB’s latest licenses highlight its ambition to penetrate high-potential markets in Asia and the Middle East.

CEO, Omar Arnaout, emphasized the groundwork undertaken to prepare for Indonesia’s launch, citing its large population as a major growth driver.

Meanwhile, the UAE approval cements the company’s regional presence, complementing its Dubai operations.

These developments signal XTB’s commitment to delivering comprehensive trading solutions across global markets.

About XTB

XTB is an online broker regulated by other trusted authorities such as the FCA in the UK, CySEC in Cyprus, and KNF in Poland.

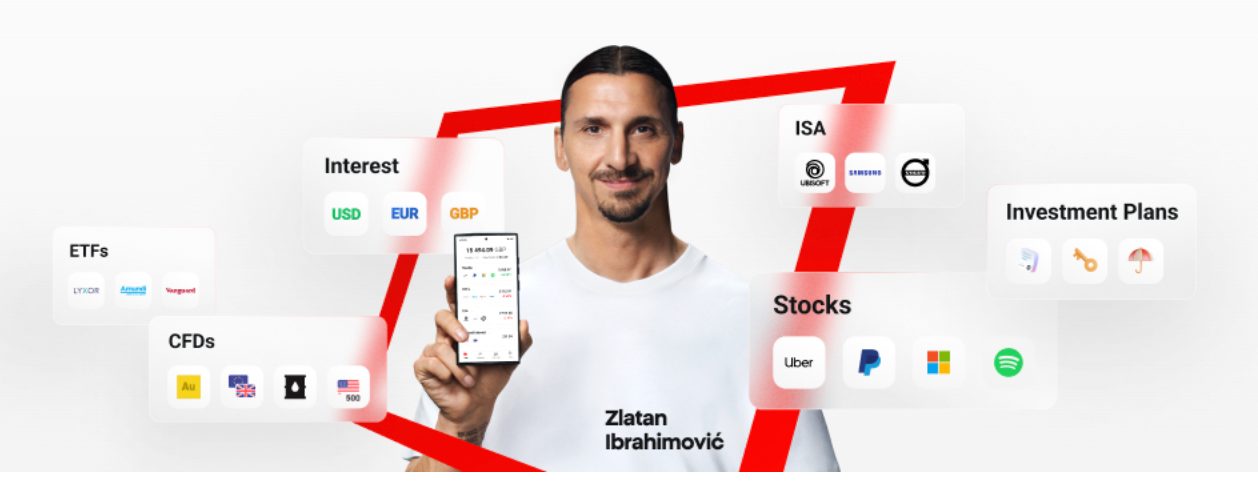

XTB supports a wide range of instruments, including CFDs, shares, forex, and cryptocurrencies, with Investment Plans also added in 2024.

Their proprietary xStation platform excels for its user-friendly features and educational resources, suitable for traders at all levels.

New traders can get started with no minimum deposit.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com