XTB Introduces Zero-Fee ISA And 4.75% Cash Yield For UK Investors

XTB has added a stocks and shares Individual Savings Account (ISA) for UK traders with 3,000 stocks and 700 ETFs, alongside 4.75% interest on unused cash.

As reported by Finance Magnates, while CFDs remain the broker’s key revenue driver, the latest products, alongside multi-currency cards and automated ETF portfolios, signal the company’s commitment to expanding its product range.

Key Takeaways

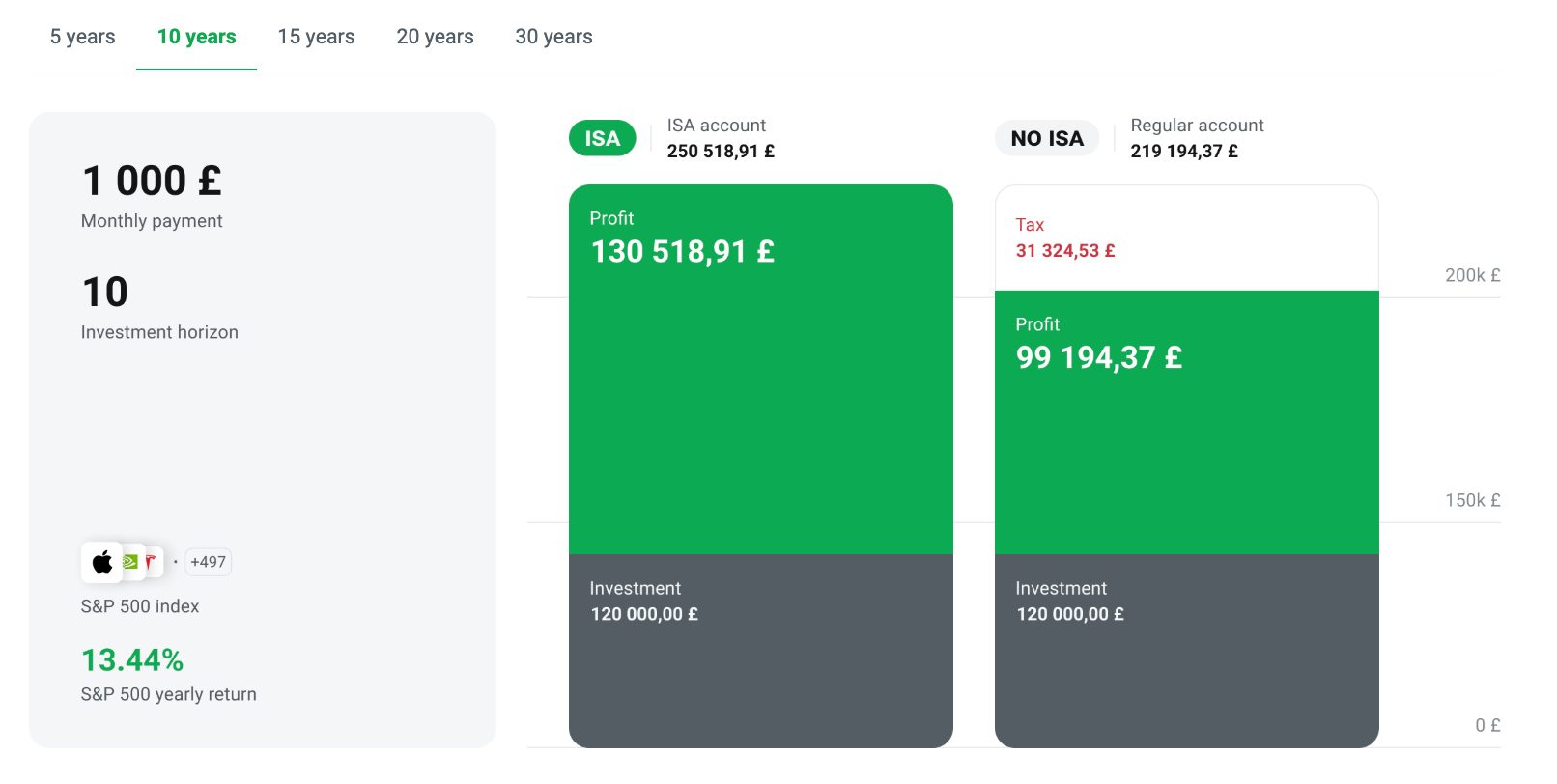

- XTB’s ISA offers commission-free trading for most users, with charges applying only to monthly trading volumes above €100,000.

- Uninvested cash earns daily interest up to 4.75%, credited monthly, outperforming several other brokers that pay interest.

- Customers retain full control to move in and out of the market without penalty, ensuring their cash is always working.

- The ISA is part of XTB’s broader push to democratize trading and expand its suite of passive and active financial products.

XTB joins other brokers that have introduced ISAs for tax-efficient investments, including CMC Markets. However, it stands out by offering a higher rate of interest, with CMC paying out just 2%.

XTB’s UK Managing Director, Joshua Raymond, commented on the news: “We believe that offering customers a zero-cost route into the market, coupled with one of the best rates of interest, is a best-of-both-worlds solution. It gives customers the confidence to go in and out of the market as they choose.”

About XTB

XTB is a leading online broker offering over 6,400 trading instruments, including CFDs on shares, indices, ETFs, raw materials, forex, crypto, real shares, real ETFs, and more recently, investment plans.

XTB’s xStation platform sports an intuitive interface, customizable news feeds, sentiment heatmaps, and trader calculators, simplifying the trading experience.

Regulated by top-tier authorities like the FCA, CySEC, and KNF, XTB provides a transparent and reliable trading environment for users globally.

New traders can get started with no minimum deposit.