XTB Introduces Investment Plans – Your Path to Passive Returns

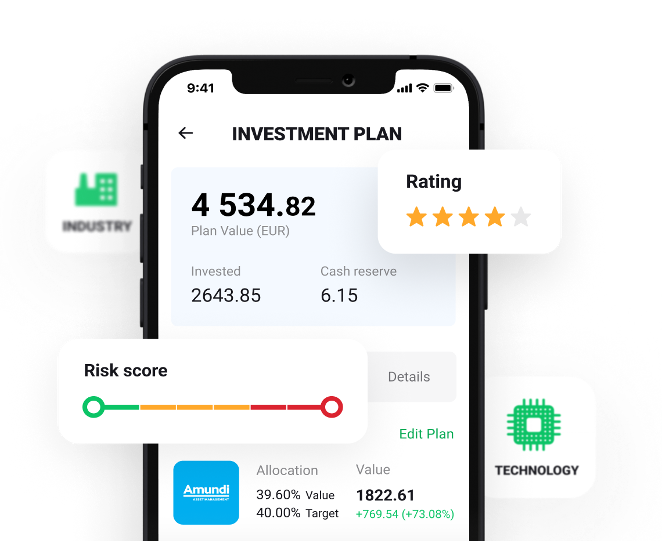

XTB Investment Plans streamline passive investing by replacing the often complex and manual ETF portfolio management process with a simple method for selecting, investing, and overseeing ETF portfolios.

Key Takeaways

- XTB’s Investment Plans automate the savings process for retirement, home buying, or future planning.

- Select preferred ETFs, assign percentages for each investment, and manage your plan through the intuitive app.

- Set up recurring payments for seamless and automated investing in a few clicks.

How Does It Work?

Manual ETF portfolio management typically entails multiple steps, including searching for and choosing ETFs, determining investment amounts, evaluating the weight of each ETF in the portfolio, and manually calculating the necessary ETF quantities to achieve the desired portfolio weight, followed by individual purchases for each.

XTB’s Investment Plans simplify the process:

- Choose from 350+ ETFs that match your risk tolerance and market or sector preferences

- Allocate the desired percentage to each ETF in your portfolio

- Add funds to your plan with the intended investment amount

- Confirm your selection

There is also the option to buy fractional ETFs, lowering the capital requirements for budget traders.

Key Features

XTB has also refined its Investment Plan offering in recent months, introducing several features that elevate the experience:

- Browse and choose ETFs with user-friendly filters

- Enjoy an enhanced interface for a seamless user experience

- Quickly assess the risk of an ETF with the informative Risk Score

- Simplify portfolio management with the user-friendly Performance tab

- Hassle-free auto-investing through scheduled recurring payments

About XTB

With over two decades of experience, XTB is a top-tier forex and CFD broker, authorized by prominent regulators such as FCA and KNF.

Traders can speculate on thousands of markets on the broker’s xStation platform and app, including stocks with zero commission, forex, commodities and indices.

New traders can open an XTB account and explore the app with no minimum deposit.

Your capital is at risk. The value of your investments may go up or down.