xCube Review 2025

Pros

- Authorized by the Securities & Commodities Authority

- You can open an account in 4 easy steps

- Direct access to IPOs

Cons

- Relatively new brand

- No free demo account

- Available to investors in the UAE only

xCube Review

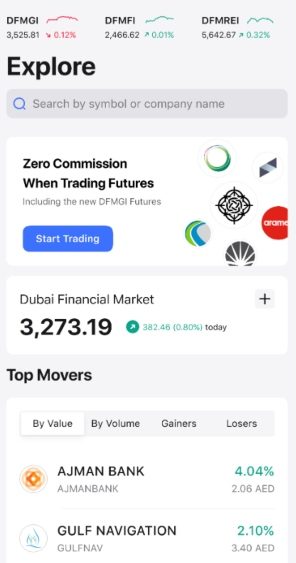

xCube is an app-based investing platform built for traders in the United Arab Emirates. Users can invest in leading Dubai Financial Market (DFM) stocks and futures and subscribe to upcoming IPOs to purchase equities as soon as they are released. In this review, we assess the accounts available, the firm’s safety and regulation status, and the fees you can expect to pay.

Quick Take

- Fees are low with no commission on futures and registration for IPOs

- The xCube platform lacks the advanced analysis and research tools found on the best apps

- Leading alternatives, such as Moomoo, offer access to the iShares MSCI UAE ETF, which follows the performance of an index comprised of UAE stocks, providing portfolio diversification while spreading risk

Markets & Assets

The broker caters to both short-term traders and long-term investors, allowing clients to purchase stocks with capital or on margin.

On the downside, the selection of assets is narrow compared to leading brokers that facilitate access to the UAE as well as other popular financial hubs, such as the US, Europe and Asia.

Stocks

xCube provides clients with access to all 178 stocks listed on the Dubai Financial Market. However, stock trading through xCube is limited to long positions only – instead, investors must trade futures to take short positions.

We appreciated that you can view upcoming IPOs via the trading platform and pre-allocate capital to automatically invest once an equity is released to the market. This is a notable bonus over some alternatives.

Futures

In addition to stocks, xCube also offers futures on a range of Dubai-centric products. Traders can go long or short on several assets such as Oman oil futures, whole-index futures and selected single-stock futures.

Importantly, when we used xCube we found that futures have to be traded in a margin account, where investors can access leverage. Each individual product has its own maximum leverage amount up to 1:2 (50% margin), though some equities are not available for margin trading.

Account Types

There are two accounts available to xCube investors – the cash account and the margin account.

An xCube cash account allows clients to purchase DFM equities using deposited cash and low commissions. We were pleased to see there is no minimum deposit requirement to open a cash account, which will appeal to beginners.

Upgrading to a margin account allows investors to trade futures as well as equities, also unlocking the ability to trade with leverage. There is also no minimum deposit or additional fees to open a margin account – xCube only charges for the margin that clients actively use to trade.

How To Open An xCube Account

I found the registration process fast and intuitive, with Dubai residents able to use their Emirates ID or passport to verify their identity, though you will also need a proof of address document to hand.

To open an account:

- Download the xCube app on either an iOS or Android mobile device

- You will be guided through the registration process within the app, being prompted to supply verification documents and personal details at various stages

- You will be asked to make an initial deposit, though there is no requirement that you do so until you wish to make a trade

Fees

While using xCube, our team found trading fees to be one of the broker’s strongest areas, with competitive charges for stock purchases and futures trading.

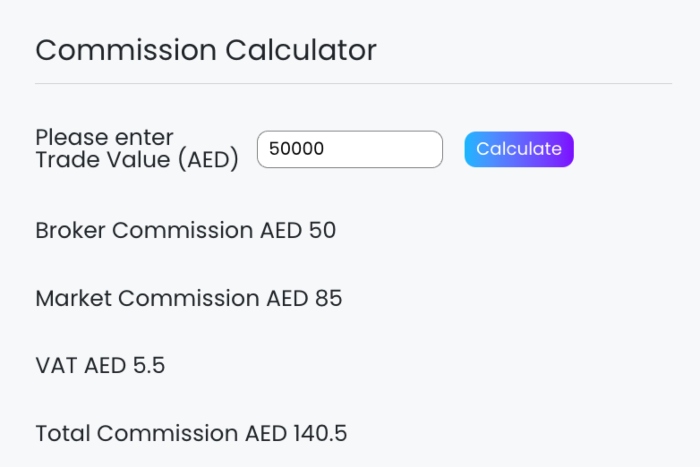

When investing in equities, the broker also offers a handy calculator on its website to calculate charges. The fee structure entails a broker commission of 0.1% of the total trade value, a variable value market commission (10 AED/ $3 minimum) and a small VAT charge.

To put these charges into perspective, if an investor purchased 1000 AED/ $280 of stock, there would be a 13.1 AED/ $3.50 commission charge.

For futures trading, the broker omits the commission entirely while offering highly competitive margin rates.

Payment Methods

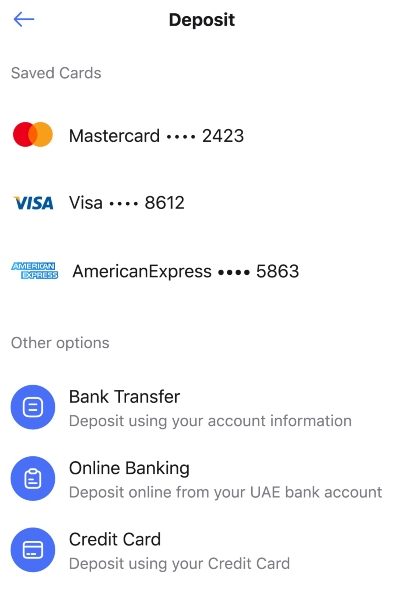

xCube supports a good range of payment options, with credit cards from Visa, MasterCard and Amex all accepted.

Investors can also make online banking transfers from select UAE banks as well as manual bank transfers. We found that this really reduced the time between opening an account and starting to invest.

Another plus is that the broker does not levy any fees for deposits and withdrawals, though some payment methods such as bank transfers may incur separate charges.

xCube App

On the negative side, there is only one trading platform supported by xCube, which is its proprietary trading app.

I thought the application had several helpful trading tools, such as customisable watchlists, clear price charts and integrated daily financial news. I also liked being able to easily trade on-the-go, with a quick login and deposit process.

However, more experienced investors may prefer a more capable, computer-based platform – especially when day or swing trading using leverage.

For those that would benefit from additional tools or features, such as level two data, multi-asset charting and trading indicators, I would recommend a broker that supports third-party trading platforms such as MetaTrader 5.

Security & Regulation

Due to its royal ownership, we judge xCube to be unlikely to be fraudulent. The broker is also regulated by the UAE Securities and Commodities Authority and the DFM. These are both good indications that the firm is legitimate.

Our experts also found that the app itself can be secured by a biometric login or passcode, though full login details are required to access an xCube account on a new device.

On the downside, xCube is less upfront about where client funds are held. Another drawback for us is the lack of information about any fund protection or insurance measures in place.

Company Background

xCube LLC was launched in early 2022 by Dubai royal family member and current deputy ruler Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum.

The platform aims to provide easy access to Dubai’s financial markets for investors, as well as to function as a market maker and enhance overall DFM liquidity.

xCube is regulated by the UAE Securities & Commodities Authority and is available as a mobile app for Android and Apple devices.

The broker is only open to investors from the UAE, with an Emirates ID or local passport required for account creation.

Trading Hours

xCube follows the Dubai Financial Market trading hours, though investors can access their accounts, view assets and make payments at any time.

The DFM market hours run on Gulf Standard Time (GMT+4) and have a pre-market session from 9:30 am until 10 am, a main session from 10 am until 2:45 pm and then a market close session from 2:45 pm until 3 pm.

xCube Verdict

For UAE-based beginner investors looking to speculate on DFM products, xCube is an attractive option. The brand offers competitive commissions, solid security and a handy mobile app.

However, for those that want more advanced trading opportunities, brokers with more sophisticated platforms and non-UAE assets are a better choice.

FAQs

Is xCube A Good Investing App?

xCube offers a no-frills investing app for traders that want to speculate on the Dubai Financial Market with low fees. However, the platform lacks the sophisticated analysis features of other apps and market access is limited to the UAE.

Is xCube Trustworthy?

xCube is authorized by the UAE Securities and Commodities Authority and the DFM, which is a good sign that the company is legitimate. However, the firm’s track record is limited and alternative brokers have a longer history of providing online investing in a secure trading environment.

Is xCube A Market Maker?

xCube operates as a market maker and aims to boost DFM liquidity by making it easier to invest in equities and futures.

Where Is xCube Based?

xCube LLC is based in Dubai and run by Dubai royal and minister of finance, Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum.

Does xCube Offer High Leverage?

xCube clients can open a margin account and use leverage of up to 1:2 on selected assets. These are modest levels, although they align with other brokers in the region.

Top 3 Alternatives to xCube

Compare xCube with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular and top-tier online brokerage. It is also quick and easy to open a new account.

xCube Comparison Table

| xCube | Interactive Brokers | Dukascopy | Firstrade | |

|---|---|---|---|---|

| Rating | 2 | 4.3 | 3.6 | 4 |

| Markets | Stocks, Futures, IPOs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | No | Yes | Yes | No |

| Minimum Deposit | $0 | $0 | $100 | $0 |

| Minimum Trade | $0 | $100 | 0.01 Lots | $1 |

| Regulators | UAE Securities and Commodities Authority, DFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | SEC, FINRA |

| Bonus | – | – | 10% Equity Bonus | Deposit Bonus Up To $4000 |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | TradingCentral |

| Leverage | – | 1:50 | 1:200 | – |

| Payment Methods | 5 | 6 | 11 | 4 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Firstrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by xCube and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| xCube | Interactive Brokers | Dukascopy | Firstrade | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

xCube vs Other Brokers

Compare xCube with any other broker by selecting the other broker below.

The most popular xCube comparisons:

Customer Reviews

4 / 5This average customer rating is based on 1 xCube customer reviews submitted by our visitors.

If you have traded with xCube we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of xCube

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

So far so good. Need advanced tools & computer interface for better market analysis. Gold ETF for basic user may attract more new investors.