xChief Review 2025

Pros

- xChief delivers a high-quality day trading environment via the MT4 and MT5 platforms, with market-leading charts, indicators and tools

- The broker offers several account types to suit different traders, including a Cent account for beginners and pro-level hedging/netting accounts

- The broker offers a turnover rebate scheme geared towards active investors, as well as trading credits and several other occasional bonuses

Cons

- xChief is an offshore broker with weak regulatory oversight from the VFSC, so traders will receive limited safeguards

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

- Fees and minimums are imposed on most withdrawal methods, including a €60 minimum for SWIFT bank transfers

xChief Review

XChief (Formerly ForexChief) is a multi-asset online broker offering 100+ instruments on the MetaTrader 4 and MetaTrader 5 platforms. Access STP direct to market execution with no interference. Our xChief broker review will cover account types, leverage, sign up and login requirements, regulation, and more.

xChief Headlines

The brokerage was established in 2014 as ForexChief, now operating from headquarters in Dubai. xChief Ltd is licensed by the Australian Securities and Investments Commission (ASIC) under registration number 001312104, and by the Mwali International Services Authority under registration number HY00923433, as an international brokerage and clearing house.

The broker uses STP/NDD technology with direct-to-market execution from global servers. A primary focus of the company is the technical stability of the trading servers and software to create a secure investing environment for all customers.

xChief had further office presence including within Indonesia and Nigeria. Eight account types and five base currencies also make the trading firm accessible to global investors.

Trading Platform

xChief clients can access MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both are industry-recognised platforms available for free download to PC and Mac desktop devices or compatible online via all major web browsers.

When we used xChief, our experts found that MT4 is the best fit for beginners and forex traders. The previous ForexChief platforms received the same evaluation.

In contrast, MT5 offers several extra features and tools that will benefit experienced traders, including 2 additional order types and 12 more charting timeframes. MT5 is also faster and built for trading non-forex assets.

MetaTrader 4

- 9 timeframes

- Live news streams

- Customizable charts

- 4 pending order types

- Analysis of quote dynamics

- MQL4 programming language

- Access to expert advisors (EAs)

- 50+ built-in technical indicators

- Ability to overlay analytical objects

- User-friendly, multilingual interface

- Social trading with signal service

MetaTrader 5

- 21 timeframes

- One-click trading

- Copy trading support

- Built-in virtual hosting

- 4 order execution modes

- Built-in economic calendar

- 80+ built-in technical indicators

- Set stop loss and take profit levels

- Enhanced order management capabilities

- Customizable charts, view up to 100 simultaneously

MetaTrader is available in 10+ languages.

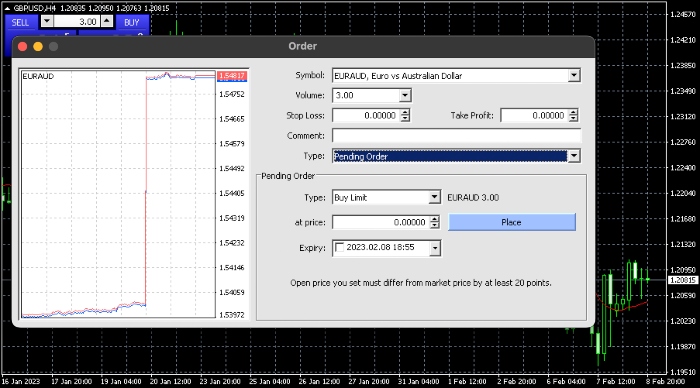

How To Place A Trade

- Use the Market Watch window in the left to choose an asset, such as the EUR/AUD

- Click on ‘New Order’ in the menu at the top

- Enter the volume in lots

- Input any stop loss or take profit levels

- Choose the order type – instant or pending order

- Fill in the remaining parameters

- Click on ‘Place’ or ‘Buy’ or ‘Sell’

Assets & Markets

3.7 / 5xChief offers trading opportunities in over 100 assets which is comparable to many alternatives. With that said, the top brokers offer a wider range of instruments and more options within asset classes.

- Metals: speculate on silver and gold prices

- Commodities: Crude oil and natural gas energies

- Forex: 40+ major, minor and exotic currency pairs

- Indices: trade global indices including FTSE 100, DAX 40, Nasdaq and S&P 500

- Cryptocurrencies: 5 popular digital currency/USD pairs including Bitcoin, Ethereum and Litecoin

- Stocks: trade shares in some of the world’s top companies including Amazon, Apple, Microsoft and eBay

Note, access to assets varies by account type.

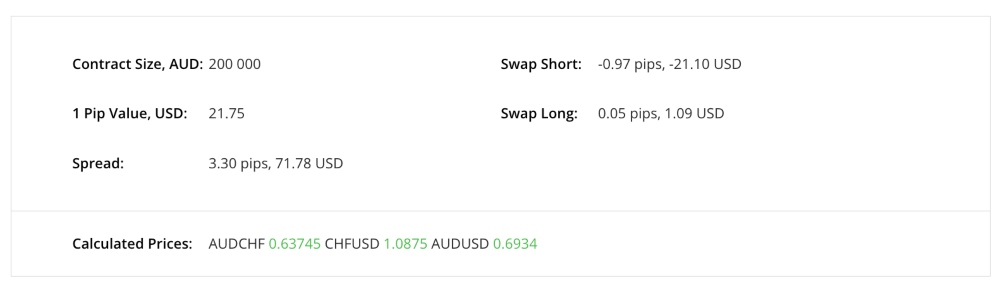

xChief Fees

All account types offer floating spreads, with Direct accounts from 0 pips and Classic+ accounts from 0.3 pips, respectively. While using ForexChief, we were provided with spreads of 0.9 pips on major forex pairs, such as the EUR/USD, which is competitive.

Commissions also apply to the majority of account types. Stocks and cryptos, for example, typically come with a 0.1% charge. A full breakdown can be found in the account types section below.

Leverage

xChief leverage varies by account type, with rates up to 1:1,000. The broker is not regulated by a European Union authority so it does not comply with the ESMA leverage capping.

Our xChief review found leverage rates and margin requirements vary between trading instruments and account currencies, with position volume a key metric. These are:

- CFD Commodities: position volume of $0-$50,000, 1:50 maximum leverage, 2% floating margin. Position volume of more than $100,000, 1:10 maximum leverage, 10% floating margin

- Major Forex Pairs: position volume $0-$500,000, 1:1000 maximum leverage and 0.1% floating margin. Position volume of more than $10,000,000, 1:25 maximum leverage and 4% floating margin

- Minor Forex Pairs: position volume $0-$200,000, 1:1000 maximum leverage and 0.1% floating margin. Position volume of more than $7,000,000, 1:25 maximum leverage and 4% floating margin

Mobile Apps

MetaTrader 4 and MetaTrader 5 are both available as mobile applications. The apps are free to download and are compatible with iOS and Android (APK) devices.

Access the full trading features of the desktop platform, including analytical tools and customizable charts and graphs, while on the go from a portable device.

Payment Methods

Deposits

xChief does not charge a fee for deposit payments, except for some electronic solutions. Third-party bank charges or exchange fees may apply.

Minimum deposit requirements are $10 or equivalent currency under all account types. This is a good news for beginners who can get started with a limited bankroll. Base currencies vary between accounts but include USD, EUR, CHF, GBP and JPY.

Funding methods vary by local jurisdiction and include:

- Bank Wire Transfer: 1-2 business day processing

- Debit/Credit Cards & UnionPay: instant processing

- Electronic Payments: Skrill, Neteller, WebMoney (0.8% fee) and Perfect Money (1.99% fee)

- Cryptocurrency: 8 digital currency coins including BTC and ETH. Processing after 3 confirmations completed

- Local Transfer Solutions: includes Malaysia online banking and Mexico local solutions, instant transfer time

How To Make A Deposit

- Sign into the client portal

- Click on ‘Deposit and Withdrawal’ from the menu on the side

- Select ‘Deposit Funds’

- Pick a payment method from the list of options

- Choose the currency and deposit value

- Select your trading account from the menu

- Press ‘Continue’ and confirm the payment by selecting ‘Submit’

Withdrawals

Withdrawals must be made back to the original payment method. Fees and processing times vary between methods:

- Cryptocurrency: 1 day processing time, no charge

- Bank Wire Transfer: 2 business day processing, no fee

- Local Transfer Solutions: 2-7 business day processing, no charges

- Credit/Debit Cards: 2-7 day processing time, minimum 2% commission, and $5 fee

- Electronic Payments: Skrill (1 day processing, 1% charge), Neteller (1 business day transfer, 1.9% commission and $1 fee), WebMoney (0.8% commission), Perfect Money (0.5% commission)

Note, personal detail verification is required for credit/debit cards and bank transfer methods.

Demo Account Review

xChief offers a demo account available on the MT4 and MT5 platforms. These accounts are a good way to practise trading, navigate platform features and test strategies risk-free. Specific details including virtual funds and length of availability are not specified.

A simple online registration form is required to open a paper trading account.

Deals & Promotions

xChief offers various bonus and incentive programmes. This include welcome deposit ($500) and no deposit bonus ($100) deals, depending on the trader’s location. Importantly though, the bonus is normally available for trading purposes only and may not be withdrawn until after certain conditions have been met. Check terms and conditions before opting in.

Trading credits are also available with XChief. These are termless and interest-free credits to be used as equity for forex trades. Clients may receive trading credit for each deposit made to a live account, for up to 70% of the initial funding.

In addition, the broker is known to run deals with free access to VPS services, souvenirs, brand merchandise, plus account and trading support. Head to the ‘Promotions and Bonuses’ tab when you sign up to see what is available.

Regulation & Licensing

xChief Ltd is licensed by the Australian Securities and Investments Commission (ASIC) under registration number 001312104, and by the Mwali International Services Authority under registration number HY00923433, as an international brokerage and clearing house.

Traders should not that this regulation with ASIC is comparable to protection offered by bodies like the FCA, and is very robust.

The broker also complies with client fund segregation and protection against technical faults.

Additional Features

It was pleasing to see some analytical tools available on xChief’s website. The brokerage hosts a library of trading content, including investment articles with the latest tips, forex trading strategies, guides on how to use technical indicators and a full schedule of trading sessions by stock exchange.

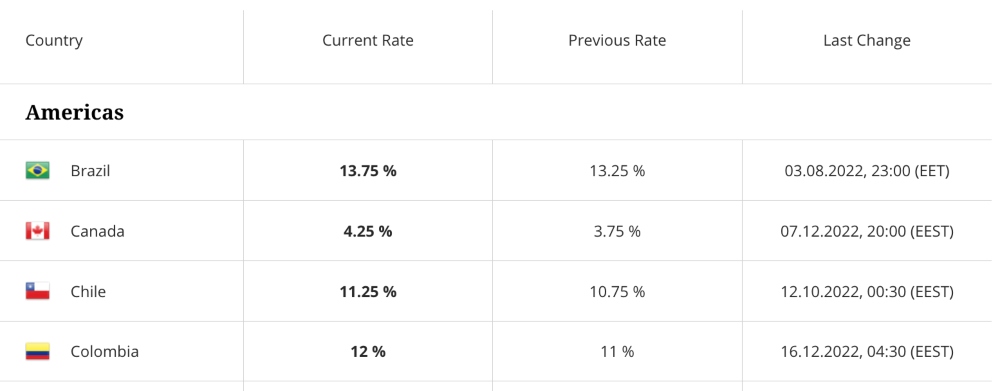

The analytics posts include live currency charts, economic calculators and the latest interest rate charges by country. All analytics tools can be accessed without needing to open a trading account. On the downside, some of the content is out of date and needs updating.

One useful tool for aspiring investors is copy trading, which is available through signals integrated on the MetaTrader platform. Successful traders can also sell their signals to generate additional income.

In addition, the broker publishes details of changes to interest rates across key regions. This is available for free on the ForexChief website.

Account Types

xChief broker offers various trading account types including; Direct, Classic and Cent. Minimum deposit requirements across all accounts are $10 or equivalent currency.

Base currencies vary between accounts but include USD, EUR, CHF, GBP and JPY.

MetaTrader 4

All MT4 accounts access market execution orders, hedging and scalping, 30% stop out call, 0.01 lots minimum order size, maximum leverage of 1:1,000 and access to expert advisors (EAs).

MT4 Direct FX and MT4 Classic+

- 150+ available contracts

- Swap-free account available

- Floating spreads from 0 pips

- Maximum order size of 100 lots

- MT4 Classic+ Commissions: CFD indices free, stocks CFDs 0.1%, crypto CFDs 0.10%

- Direct FX Commissions: CFD indices $15 per Mio, stocks CFDs 0.1%, crypto CFDs 0.10%

Cent MT4 Direct FX

- 40+ available contracts

- Floating spreads from 0 pips

- Maximum order size of 100 lots

- Commissions: FX spot and metals CFDs, $15 per Mio

Cent MT4 Classic+

- 40+ available contracts

- Floating spreads from 0.3 pips

- Maximum order size of 100 lots

- Commissions: FX spot and metals CFD, free

PAMM versions of the DirectFX and Classic+ accounts are also available on xChief. These match the conditions of their standard counterparts, except base currencies are limited to USD and EUR and there are no trading credits, turnover rebates, welcome bonuses or swap-free solutions.

MetaTrader 5

All accounts access market execution orders, hedging or netting, 30% stop out call, 0.01 lots minimum order size, maximum leverage of 1:400 and maximum order size of 100 lots.

MT5 Direct FX

- 60+ available contracts

- Floating spread from 0 pips

- Swap-free account available

- Commissions- $15 per 1 mio

MT5 Classic+

- No commissions

- 60+ available contracts

- Swap-free account available

- Floating spread from 0.3 pips

Cent MT5 Direct FX

- 42 available contracts

- Commissions: $15 per 1 mio

- Floating spreads from 0 pips

Cent MT5 Classic+

- 42 available contracts

- Commissions: $15 per 1 mio

- Floating spreads from 0.3 pips

How To Open An xChief Account

It is quick to open a real account. Customers must complete a simple online registration form. You may be required to provide identification verification documents such as proof of residency under the know-your-customer (KYC) compliance.

It was good to see that xChief also offers an Islamic, swap-free trading account.

Trading Hours

The brokerage follows standard office hours and 24-hour trading hours Monday-Friday, though these timings may vary by instrument.

Customer Support

3.5 / 5xChief offers on-hand, multilingual customer support available 24/7:

- Live chat: icon in the bottom right-hand corner of each webpage

- Telephone:+65 3159 3652 (Singapore) or +234 903 079 5364 (Nigeria)

- Email: info@forexchief.com

Working times vary for the international helpdesk. Telephone customer support is provided in English, Arabic, Spanish, French, Italian, Portuguese, Hindi, Russian and Chinese.

There is also a comprehensive FAQ section on the broker’s website.

Safety & Security

Personal area and portal access are password protected. Unusually, bonus payments can be gained before personal identification documents are submitted.

Secure login protection is supported for the MT4 and MT5 platforms with high-tech encryptions and industry-standard data privacy.

However, be cautious of several user reviews reporting ForexChief scam concerns.

XChief Verdict

xChief provides competitive trading opportunities for customers of different abilities and experience levels on the established MT4 and MT5 platforms. The trading conditions and pricing structure is competitive, with tight spreads and low commissions.

Moreover, the range of markets accessible is decent, PAMM accounts are supported and high leverage rates are available. However, the conditions for the financial incentives xChief offers are very high. The rebranding from ForexChief has resulted in further regulatory progress, with the firm now operating under the ASIC regulatory regime.

FAQs

Is ForexChief (xChief) Legit Or A Scam?

xChief (formerly ForexChief) is a regulated brokerage firm with oversight from ASIC in Australia.

Does xChief Offer A Demo Account?

Yes, xChief offers a demo account that can be used on the MT4 and MT5 platforms. Prospective investors can sign up for a paper trading account on the official website in a few minutes.

What Trading Platforms Does xChief Offer?

xChief offers two trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both terminals have advanced trading tools and features, including access to EAs, dozens of technical indicators and customizable dashboards. MT4 and MT5 apps are also available on mobile devices.

What Is The xChief Minimum Deposit?

Minimum deposit requirements across all live trading accounts with xChief are $10 or equivalent. Base currencies vary between accounts but include USD, EUR, CHF, GBP and JPY. This makes the broker accessible for beginners.

Is xChief Trustworthy?

xChief Ltd is licensed by the Australian Securities and Investments Commission (ASIC) under registration number 001312104, and by the Mwali International Services Authority under registration number HY00923433, as an international brokerage and clearing house. This provides more reassurance for customers.

Top 3 Alternatives to xChief

Compare xChief with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

xChief Comparison Table

| xChief | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| Rating | 3.9 | 4.3 | 3.6 | 4 |

| Markets | CFDs, Forex, Metals, Commodities, Stocks, Indices | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $0 | $100 | $1 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | ASIC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | SVGFSA |

| Bonus | $100 No Deposit Bonus | – | 10% Equity Bonus | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:1000 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 12 | 6 | 11 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by xChief and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| xChief | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

xChief vs Other Brokers

Compare xChief with any other broker by selecting the other broker below.

Customer Reviews

4.6 / 5This average customer rating is based on 11 xChief customer reviews submitted by our visitors.

If you have traded with xChief we would really like to know about your experience - please submit your own review. Thank you.

Available in United States

Available in United States

The trading conditions are fair, with competitive spreads and a good variety of instruments. Execution speed is decent, though there could be some improvements in slippage during high volatility. Overall, it’s a solid choice for everyday trading.

I’ve been trading on the xPRIME account for over six months, and the conditions are excellent. Withdrawals are processed quickly, and the customer support team is very responsive. Overall, it’s been a smooth experience.

VIP bonus is great, but it would be awesome if they added PayPal also it would be good if they added more features like copy trading and more tools

xChief is a decent broker. They offer both MT4 and MT5 platforms, which is convenient. There are some minor drawbacks, but overall, the company is satisfactory. Withdrawals are processed smoothly, which is the most important aspect for me.

xChief offers a reliable service with good order execution and a stable trading platform. I’ve had a positive experience with them and appreciate the dependable performance. The terminal works consistently well, and I haven’t encountered any significant issues. Overall, I’m pleased with xChief and haven’t found any major downsides.

The company has its strengths and weaknesses, but it remains more attractive compared to its competitors. I have successfully withdrawn money numerous times without encountering any problems. This reliability in financial transactions makes it a preferable choice for me.

The company is not perfect, but it looks decent against the competition. Money is withdrawn. There are no problems with the terminal. I would like better trading conditions, but I can’t say that they are worse than the competition.

Overall not a bad company. Not without flaws, but it looks competitive against the background of other companies. Great choice of trading accounts, good support, fast withdrawal. The company has many pluses.

They also offer a choice of both mt4 and mt5.

Two years have passed and I still have no issues with them.

xChief has low spreads.

They have excellent trading conditions and superb customer care

Using their services for over a year, I find the broker to be a decent choice. While perfection might elude them, they certainly stand out favorably among their competitors. The personal account is well-organized, and the trading terminal demonstrates stable performance. A trustworthy broker that gets the job done effectively.