CFD Trading In Uzbekistan

Contracts for difference (CFDs) are derivatives that traders use to speculate on a variety of different securities.

In Uzbekistan, dealing in CFDs – along with a broad spectrum of other securities – is rising strongly thanks to a series of economic and financial market reforms in recent years.

In this beginner’s guide, you will find key information about CFD trading in Uzbekistan. You’ll discover how these sophisticated financial instruments work, the different types of assets that they can be used to trade, and the regulatory protections that traders in Uzbekistan receive.

Quick Introduction

- CFDs can be used to trade forex, bonds, cryptocurrencies, commodities and shares, such as those listed on the local Toshkent Republican Stock Exchange.

- Like elsewhere, Uzbekistan’s CFD traders typically use leverage (borrowed funds). This is a high-risk, high-return strategy that can inflate profits as well as losses.

- Trading is regulated by the Central Bank of the Republic of Uzbekistan, although traders only enjoy limited protection (as indicated by the body’s ‘orange tier’ classification under DayTrading.com’s Regulation & Trust Rating).

- Both residents and non-residents in Uzbekistan generally pay a flat rate of income tax at 12% on their trading profits, which likely extends to CFDs.

Best CFD Brokers In Uzbekistan

Through extensive testing, we've pinpointed these 4 CFD trading platforms as the best for traders in Uzbekistan:

How Does CFD Trading Work?

Traders can use CFDs to speculate on a large selection of financial markets.

They allow individuals to speculate without having to own the underlying asset, whether that be a company’s equity, a forex pairing, a commodity or a cryptocurrency.

The advantage here is that trading can be simpler and less expensive, thanks also to the high levels of market liquidity that CFDs generally enjoy.

However, a key drawback is that these derivatives leave investors exposed to counterparty risk. This is because they are traded over the counter instead of on a regulated exchange.

CFD trading is also considered risky it tends to involve the use of leverage, the technical term for money that is borrowed from a broker.

Lent funds allow a trader to make more money when the market moves in the ‘right’ direction. But it can also result in whopping losses when asset prices move unexpectedly.

As a result, it’s a good idea for new traders to use limited amounts of leverage, or none at all.

Here’s how it works…

Let’s say I wish to profit from movements of the Uzbekistan Composite Index (UCI), a key indicator of the performance of Uzbekistan’s stock market.

If I believe the UCI will appreciate, I could purchase a CFD that’s linked to the index. If the broker I use requires margin of 20%, and each derivative contract changes hands at 650, I’ll need to deposit 3,900 Uzbekistani som (UZS) to buy 30 contracts (650 per contract x 30 contracts x 20%).

Now let’s say the benchmark index rises to 660, at which point I close my contract. With a profit of UZS 10 for each contract, I’ll have earned 300 in total from this trade (10 x 30 contracts).

Conversely, if the UCI had slipped to 640, I’d have booked a loss of 10 per contract, and as a result a total loss of 300.

What Can I Trade With CFDs?

The different financial markets CFD traders can speculate on varies from broker to broker. They can include:

- Stock CFDs: Domestic equities may be able to be bought and sold on the Toshkent Republican Stock Exchange. Some of the largest and most popular shares include metal product manufacturer O’zmetkombinat, glassmaker Kvarts, and financial services provider O’zsanoatqurilishbank. However, they aren’t widely offered on trading platforms in our experience, especially compared to US and European stocks.

- Index CFDs: Derivatives may be available for local indices like the UCI. However, you’re more likely to find major global indices like the S&P 500 in the US, the FTSE 100 in the UK and the DAX 40 in Germany.

- Forex CFDs: CFDs may be able to exchange the Uzbekistani som against a spectrum of international currencies. Pairings could include the USD/USZ (involving the US dollar), EUR/USZ (featuring the euro), and RUB/USZ (which pits the som against the Russian ruble). However, major forex pairs like EUR/USD and USD/JPY are more widely available and generally offer the superior liquidity and trading costs short-term traders seek.

- Commodity CFDs: Uzbekistan is a major producer of many important commodities including natural gas, gold, uranium and cotton. Traders can deal in CFDs linked to these natural resources, alongside a swathe of others.

- Cryptocurrency CFDs: Derivatives based on virtual currencies like Bitcoin and Ethereum are taking off, helped by the growth of the digital economy.

CFDs that involve local shares and indices – along with those backed by the domestic currency – tend to experience low trading volumes. They are also not typically offered by CFD brokers based on our research.So dealing these financial instruments can be less smooth and usually incurs higher trading costs than trading US, European, and other global markets.

Is CFD Trading Legal In Uzbekistan?

Yes. Dealing in CFDs is supervised by the Central Bank of the Republic of Uzbekistan, though specific regulations governing these derivatives have not yet been developed.

The bank is responsible for maintaining financial stability and integrity in the country, along with ensuring that markets function efficiently and transparently. As a consequence, financial brokerages should acquire a licence to do business.

The central bank’s stated aims include to “ensure the protection of the rights and legitimate interests of consumers of credit institutions, increase the availability of financial services and the level of financial literacy of the population and business entities.”

However, the Central Bank of the Republic of Uzbekistan does not publish a list of authorized firms on its website.

For this reason – and because the body is only classified as an ‘orange tier’ regulator under DayTrading.com’s Regulation & Trust Rating – investors should consider using a broker that’s licensed by a ‘green tier’ body under our ranking system.

Is CFD Trading Taxed In Uzbekistan?

Active CFD traders may need to personal income tax (PIT) to the State Tax Committee of the Republic of Uzbekistan. This is charged at a flat rate of 12% for both residents and non-residents.

The country’s tax year runs from 1 January to 31 December, and completed tax returns must be submitted by 1 April of the following year.

A CFD Trade In Action

Armed with this information, you’re ready to begin trading CFDs. But how might a trade with one of these derivative products go down?

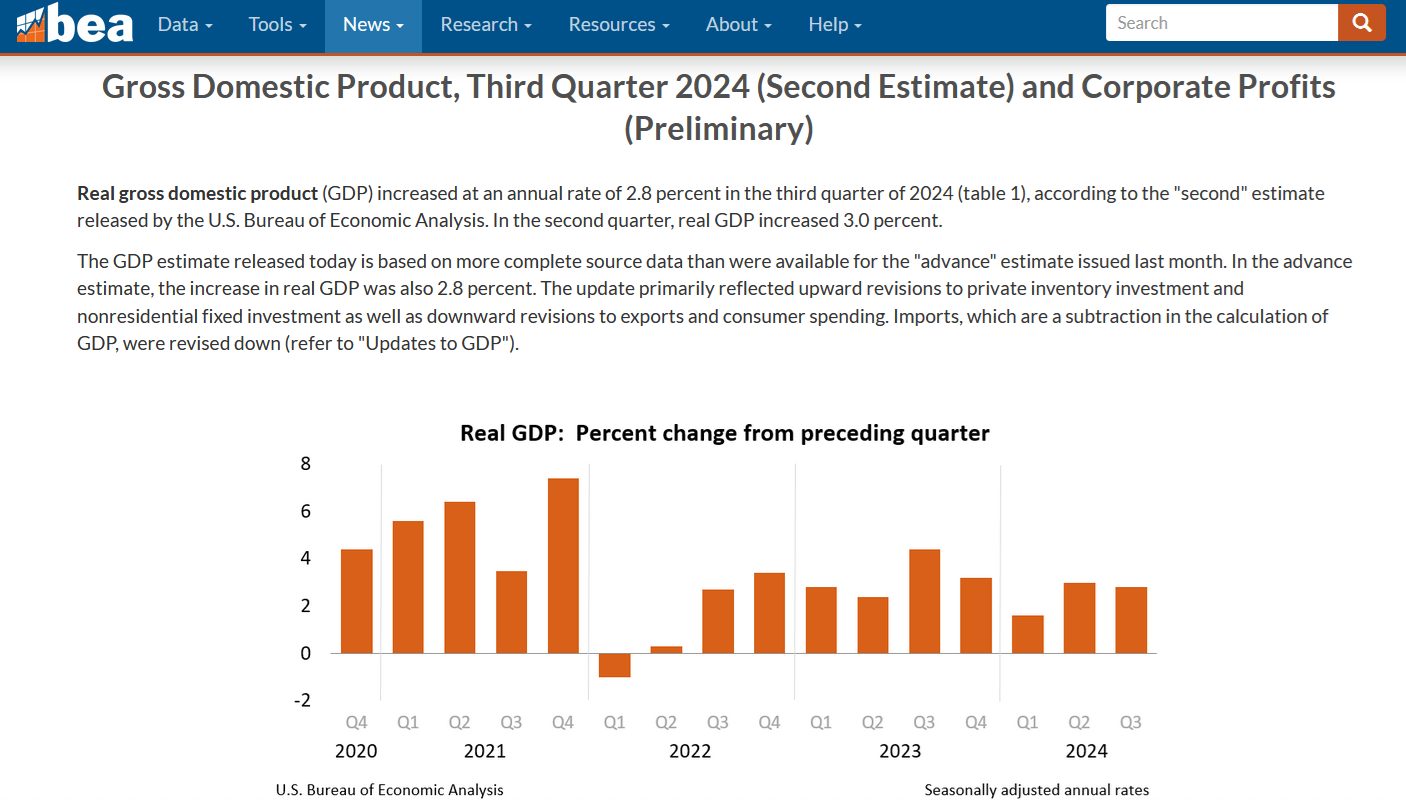

In this hypothetical example, I’ll be buying an oil-linked contract before the US Bureau of Economic Analysis (BEA) announces the latest GDP data.

The Background

Oil prices are higher cyclical, meaning they experience substantial fluctuations according to broader economic conditions that dictate supply and demand levels.

Prices are quoted using two benchmarks: Brent crude and West Texas Intermediate (WTI). The former, which will be the basis of my trade, represents oil that’s drilled in the North Sea, while the latter corresponds with oil produced in the US.

My expectation is that advanced growth numbers from the BEA released will show GDP growth of 3.2% in the last quarter. That’s ahead of the 3% increase that’s currently baked into the oil price.

My estimate, if correct, could have significant implications for energy prices, given the US’ status as the world’s largest energy consumer.

My conclusion is based on key economic data like job numbers, inflation readings and consumer spending. But I don’t just rely on fundamental analysis like this to inform my trade.

As a short-term trader, I also conduct detailed technical analysis, a discipline that involves studying past price and volume data.

Locating patterns, indicators and trend lines on the charts helps me to better identify possible opening and closing positions for my trades.

The Trade

With my plan drawn up, open my trading platform at 05:20 Uzbekistan Time Zone (UZT). This is 10 minutes before the BEA is due to release its GDP numbers, and corresponds to 5:20 Eastern Time (ET) in the US.

At this time, the Brent CFD I wish to trade is sitting at $72.65 per barrel. I buy 20 contracts using margin of 20%, which leads me to depositing $290.60 in my trading account ($72.65 per contract x 20 contracts x 20%).

Next, I execute my trade using two risk management devices:

- I place a take profit order at $72.93 per barrel.

- I input a stop loss instruction at $72.41 per barrel.

The fast-paced nature of day trading makes these devices an important part of any trading strategy. They work by closing my position when the CFD rises either to my take profit or stop loss order, whichever comes first. And so they enable traders like me to successfully book profits or limit losses.

Within a few moments of punching in my trades, the BEA releases its GDP numbers. For me it’s good news, showing GDP growth of 3.1% in the last quarter.

This is below my 3.2% bet, but still above the 3% that the market had priced in. And so Brent crude prices move higher, triggering my take profit instruction at $72.93 at 05:42 UZT.

With my trade closed, I sit back and calculate my profit, which stands at $5.60 ($72.93 – $72.65 x 20 contracts).

Bottom Line

CFDs are growing rapidly as an asset class in Uzbekistan.

However, as with other regions, dealing these complex financial products is a high-risk endeavor, especially for those choosing to use leverage. For this reason, putting in place strict risk management measures is essential.

If you’re ready to get started, check out our list of the best CFD trading platforms that are available today.

Recommended Reading

Article Sources

- Toshkent Republican Stock Exchange

- Uzbekistan Composite Index (UCI) - Toshkent Republican Stock Exchange

- Central Bank of the Republic of Uzbekistan

- State Tax Committee of the Republic of Uzbekistan

- International Tax Uzbekistan Highlights 2022 - Deloitte

- Uzbekistan - Individual – Taxes on Personal Income - PwC

- Current Local Time in Tashkent, Uzbekistan – timeanddate.com

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com