Best Day Trading Platforms And Brokers In Uzbekistan

To day trade financial markets, such as Asian stocks or commodities important to Uzebkistan’s economy like natural gas and cotton, you’ll need an online broker.

The Central Bank of the Republic of Uzbekistan supervises the country’s financial services providers, but many Uzbeks opt for trusted international brokers for access to global markets with competitive trading conditions.

Delve into DayTrading.com’s pick of the best day trading brokers in Uzbekistan. Some of our recommendations offer specific products that will appeal to Uzbek traders, such as Asian securities and Islamic accounts.

Top 6 Platforms For Day Trading In Uzbekistan

Following our exhaustive tests, these 6 brokers stand out as the best for short-term traders in Uzbekistan:

Here is a summary of why we recommend these brokers in April 2025:

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- XM - XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC and CySEC and offers a comprehensive MetaTrader experience.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- Deriv - Established in 1999, Deriv is an innovative broker now serving over 2.5 million global clients. The firm offers CFDs, multipliers and more recently accumulators, alongside its proprietary derived products which can't be found elsewhere, providing flexible short-term trading opportunities.

Best Day Trading Platforms And Brokers In Uzbekistan Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage | Regulator |

|---|---|---|---|---|---|

| AvaTrade | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| IC Markets | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ASIC, CySEC, FSA, CMA |

| XM | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:1000 | ASIC, CySEC, DFSA, IFSC |

| Exness | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| RoboForex | $10 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | R StocksTrader, MT4, MT5, TradingView | 1:2000 | IFSC |

| Deriv | $5 | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView | 1:1000 | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Bonus Offer | 20% Welcome Bonus up to $10,000 |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- AvaTrade continues to enhance its suite of products, recently through AvaFutures, providing an alternative vehicle to speculate on over 35 markets with low day trading margins.

Cons

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, FSA, CMA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

Cons

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | ASIC, CySEC, DFSA, IFSC |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of <2 minutes and now a growing Telegram channel.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with the weak IFSC regulator and UK clients are no longer accepted, reducing its market reach.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, DKK, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

Cons

- Retail trading services are unavailable in certain jurisdictions, such as the US and the UK, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Bonus Offer | $30 No Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

Cons

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

Deriv

"Deriv is ideal for active traders seeking alternative and unique ways to speculate on global financial markets, from multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours."

Christian Harris, Reviewer

Deriv Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs |

| Regulator | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

| Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP |

Pros

- Account funding is a breeze with a very low minimum deposit of $5 and a huge selection of payment options, plus Tether was added to the cashier in 2023.

- Deriv revamped its app in 2025, now sporting a slicker interface alongside improved position management and streamlined contract details for smarter mobile trading, earning it DayTrading.com's 'Best Trading App' award.

- Deriv stands out with its innovative products, from multipliers and derived indices to its addition of accumulator options, providing exclusive short-term trading opportunities.

Cons

- Leverage up to 1:1000 will appeal to traders with a large risk appetite but frustratingly there is no ability to flex the leverage in the account area.

- Apart from the MFSA in the EU, Deriv lacks top-tier regulatory credentials, reducing the level of safeguards like access to investor compensation.

- While the Academy launched in 2021 is a step in the right direction, there is limited education on advanced trading topics for seasoned traders and no live webinars to upskill new traders.

Methodology

To create our list of the top day trading platforms in Uzbekistan, we took our database of 223 brokers and focused on those that accept Uzbek traders.

Then we sorted them by their overall rating, using the results from our direct tests and hard data.

- We selected brokers that accept day traders from Uzbekistan.

- We recommended brokers we trust after assessing their regulatory credentials.

- We prioritized brokers with a good range of financial markets.

- We focused on brokers with competitive day trading fees.

- We favored brokers with reliable charting platforms.

- We investigated each broker’s leverage and margin requirements.

- We examined each broker’s order execution speeds and quality.

- We checked for Islamic accounts (Uzbekistan is a Muslim-majority country).

How To Choose A Day Trading Broker In Uzbekistan

Drawing on our years of testing the industry’s top brokers, we’ve narrowed it down to these key things you should consider when choosing a provider for day trading:

Trust

It’s essential to choose a trustworthy broker to help protect you from trading scams – a significant and persistent risk in the industry.

The Central Bank of the Republic of Uzbekistan supervises the financial markets in the country, but it doesn’t regulate many online brokers.

Some Uzbeks therefore choose international firms licensed by other trusted regulators, such as ‘green tier’ bodies in DayTrading.com’s Regulation & Trust Rating. There are no laws preventing this but it’s important to still adhere to Uzbek’s rules on trading and taxes.

There are also other indications of a trustworthy trading platform:

- A healthy track record with no reports of unfair practices or major lawsuits.

- Positive user reviews from active traders and industry experts.

- A public listing on a stock exchange demonstrating transparency.

- eToro secured a podium finish in our pick of the ‘Safest Brokers‘ with a 4.8/5 trust score and oversight from a long row of trusted regulators, including the FCA in the UK and ASIC in Australia. It’s also shot to fame with over 30 million users thanks to its market-leading social investing network.

Market Access

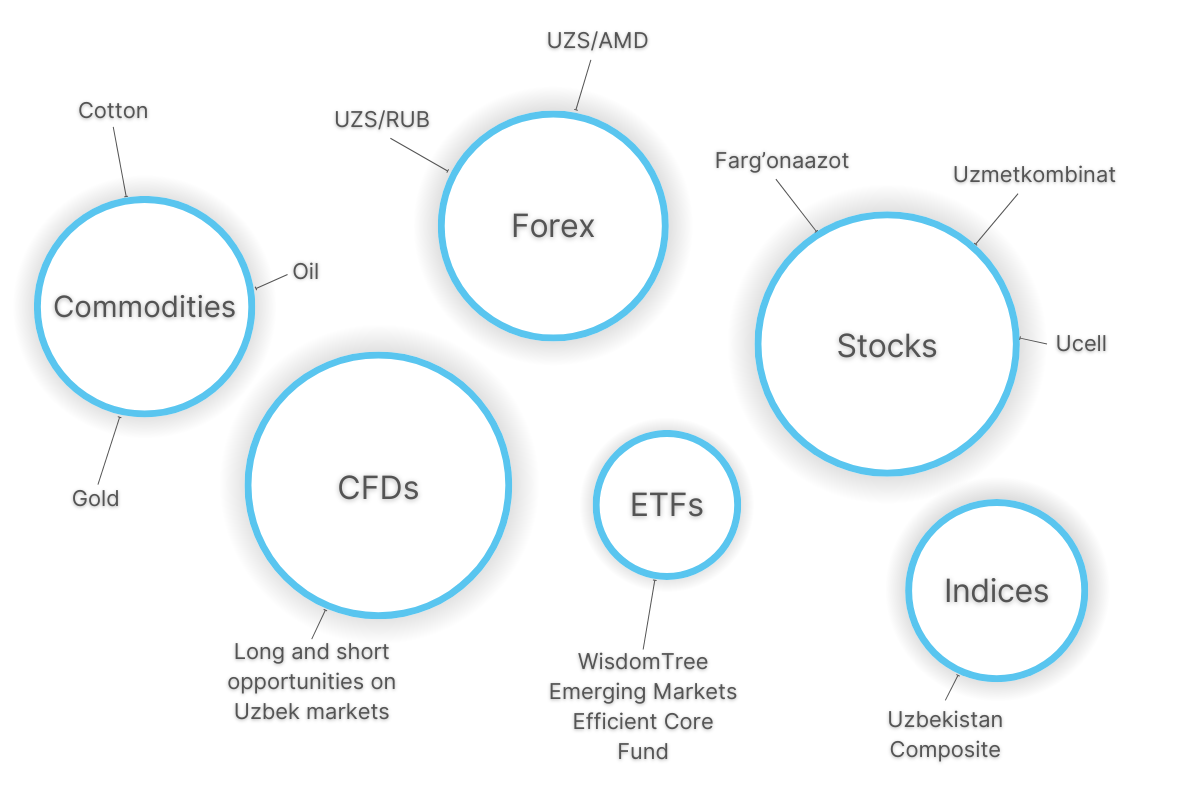

Pick a broker with access to the financial markets you want to take short-term positions in.

Traders in Uzbekistan may be looking for currency pairs involving the som (UZS), such as UZS/USD, or stocks listed on the Republican Stock Exchange, such as Uzmetkombinat. However, these are rarely supported from our investigations.

Still, you can explore other relevant markets, including chief export commodities like natural gas and cotton (Uzbekistan is the second largest exporter of cotton), major currency pairs like EUR/USD, and stocks on Asian indices, such as Japan’s Nikkei 225.

- Pepperstone offers over 1,300 day trading assets spanning diverse markets, including Middle Eastern ETFs, exotic currency pairs, hard and soft commodities, and stocks from multiple global exchanges. It has also scooped our ‘Best Overall Broker’ and ‘Best Trading App’ awards in recent years.

Day Trading Fees

Find a broker with low fees for active traders that still delivers a high-quality trading environment.

Spreads and commissions will make up the bulk of your trading fees, while FX conversion charges if you deposit, trade and withdraw in Uzbekistan som may accumulate behind the scenes.

Fees are typically higher on volatile and illiquid markets like Middle-Eastern securities or exotic currency pairs compared to highly liquid markets like EUR/USD, where spreads can hit as low as 0.0 pips during peak hours.

Also consider any account maintenance costs like inactivity fees, or additional charges for Islamic accounts given Uzbekistan remains a majority-Muslim country.

- XM‘s Zero accounts offer ultra-low spreads from 0.0 pips on major currency pairs and low commissions of $3.50 per lot, making it great for day traders. Alternatively, you can trade with zero commissions in the Standard account with spreads from 0.8 pips, making it attractive to beginners.

Charting Platforms

Find a reliable charting environment to analyze the markets, develop fast-paced strategies and execute trades.

Most brokers we’ve evaluated offer at least one of the MetaQuotes solutions, MetaTrader 4 or MetaTrader 5, while an increasing number also provide more contemporary software like TradingView.

Alternatively, some firms like eToro have their own proprietary terminals which are brilliant for newer traders who require a simpler interface with integrated tutorials and access to peers to discuss trading ideas.

- Exness offers several excellent platforms to suit various trading requirements, including MT4, MT5, and a proprietary web platform. There are also high-quality research tools to aid trading strategies, notably Trading Central which is fantastic for analyzing price action in prominent markets like gold.

Leverage Trading

Many day traders turn to leverage to increase their buying power and results (profit and loss), however it’s vital to understand the cash outlay, or margin, required by the broker to open and maintain positions.

There are no widely publicized restrictions on leverage trading for retail investors in Uzbekistan and our research shows that you can access leverage in excess of 1:500. Here, a 1 million som outlay would give you 500 million to trade with.

Importantly, we don’t recommend beginners trade with high leverage. Employing risk management tools like careful position sizing and stop loss orders are also essential to minimize potential losses.

- Deriv offers leverage up to 1:1000 with clear margin requirements. Leverage levels are also flexible to suit various experience levels and there’s the option to trade with multipliers which don’t let you lose more than your initial deposit.

Execution Quality

Pick a broker with fast and reliable order execution, which is vital for active traders.

This is especially important when trading volatile markets like Uzbek stocks because quick execution ensures that your trades are processed at the desired price, reducing slippage and maximizing profitability.

During our tests, we investigate execution speed metrics where available, and ideally, firms will deliver speeds of under 100 milliseconds.

- IC Markets is an especially fast broker for day trading, with average execution speeds of 35 milliseconds. The company’s trade servers are located in New York and London, allowing the broker to maintain reliable connectivity to global liquidity providers.

Account Funding

Sign up with a broker that makes it convenient to deposit, trade and withdraw.

We rarely encounter brokers that require more than 250 USD to open an account. Some brokerages even have no minimum deposit requirement, making them ideal for beginner traders and those with limited capital.

It’s also worth checking whether any local payment methods are available which can provide a more localized trading experience. Research from Paymentwall shows that credit cards are still the primary method of online payment in Uzbekistan.

- RoboForex is accessible for all day traders with its 10 USD starting deposit across most account types. Plenty of convenient payment methods are also available, including cards, bank wire and e-wallets.

FAQ

Who Regulates Day Trading Platforms In Uzbekistan?

The Central Bank of the Republic of Uzbekistan oversees the country’s financial markets, but they don’t regulate many online brokers.

As a result, many residents opt for trusted, international trading platforms. This is allowed but you must follow tax rules and the latest trading regulations in Uzbekistan.

Which Is The Best Broker For Day Traders In Uzbekistan?

This depends on your individual requirements, but for an excellent starting point, head to DayTrading.com’s list of the top day trading platforms in Uzbekistan.

For example, Pepperstone stands out for its diverse selection of global markets, including emerging markets ETFs and many of Uzbekistan’s primary export commodities, while XM offers competitive pricing for active traders.

Recommended Reading

Article Sources

- Republican Stock Exchange (UZSE)

- The Central Bank of the Republic of Uzbekistan

- Uzbekistan Exports - Trading Economics

- Payment Methods in Uzbekistan - PaymentWall

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com