Day Trading in Uzbekistan

Since the mid-2010s, Uzbekistan has undertaken a wide programme of structural reforms to boost economic growth, liberalise its currency and capital markets, and attract foreign investment. This has supercharged day trading activity in recent years.

This guide will explain the key things you need to know to begin day trading in Uzbekistan. It will discuss the Central Asian country’s regulatory landscape and tax regime, and walk through an example short-term trade.

Quick Introduction

- Economic reforms make Uzbekistan an increasingly attractive venue for day trading, where investors can now deal in a wide variety of financial assets, with stock traders able to buy and sell shares on the Toshkent (Tashkent) Republican Stock Exchange.

- The markets are regulated by the Central Bank of the Republic of Uzbekistan, an ‘orange tier’ regulator according to DayTrading.com’s Regulation & Trust Rating, which despite positive strides, is yet to earn the reputation of regulators in other jurisdictions.

- Short-term traders are typically required to pay income tax at 12% to the State Tax Committee of the Republic of Uzbekistan on any profits they make.

Top 4 Brokers in Uzbekistan

Our in-depth testing and analysis points to these 4 platforms as top-notch for traders from Uzbekistan:

Day Trading Platforms in Uzbekistan

What Is Day Trading?

Uzbekistan is one of Central Asia’s most populous nations, and home to one of the region’s fastest-growing economies.

Since 2016, President Shavkat Mirziyoyev has implemented a raft of structural reforms to bolster growth and make it a more business-and-investor-friendly environment.

The variety of financial instruments that day traders can deal in has improved because of these changes. Popular asset classes today include stocks, corporate and government bonds, forex, cryptocurrencies and derivatives (like futures contracts).

Share trading takes place on the Toshkent Republican Stock Exchange (referred to as TSE or RSE), which is based in the country’s capital.Individuals can trade in a wide range of companies such as financial services provider Hamkorbank, automobile retailer UzAuto Motors, and telecoms giant Uzbektelecom.

Is Day Trading Legal In Uzbekistan?

Yes. Online financial market trading is overseen by the Central Bank of the Republic of Uzbekistan, an organization that – in its own words – “regulates the banking sector and exercises the powers of licensing, regulation and prudential supervision.”

While the country’s economic landscape is undergoing rapid transformation, the nascent nature of financial market trading in Uzbekistan means the regulatory landscape is still developing. Therefore, investors need to take great care.

Unfortunately, the central bank doesn’t publish a list of forex trading platforms that are approved to do business in the country.

Investors can sidestep this problem, however, by using a brokerage that’s licensed to trade foreign exchange in other territories that have tight regulatory requirements (such as the FCA in the UK, the SEC in the US, or any European Union (EU) member state).

How Is Day Trading Taxed In Uzbekistan?

The profits that a professional trader makes are often subject to income tax and must be declared to the State Tax Committee of the Republic of Uzbekistan.

The organization’s duties include the “implementation of the state tax policy,” and to ensure the “effective enforcement of tax laws” and “the full collection of taxes and other obligatory payments to the state budget.”

Personal income tax is levied at a flat rate of 12%. The country’s tax year runs from 1 January to 31 December, and tax returns must be completed and returned by 1 April the following year.

Getting Started

To begin day trading, investors need to complete three steps:

- Find a broker. This part of the process requires the most time and effort. It’s important that you take care to identify a properly reputable, licensed broker, whether they be approved in Uzbekistan or another region with tight financial regulations. Important things to consider include the user-friendliness of the trading platform; the range of financial instruments on offer; trading fees and other costs; the amounts of leverage (or borrowed funds) they allow clients to use if interested in CFD trading in Uzbekistan; and the availability and quality of educational materials.

- Open an account. The next step, by comparison, should be much briefer. You will need to provide some personal details, alongside proof of identification and address. An active trader might also be asked a series of other investing-related questions, such as information on their trading experience and investing objectives.

- Deposit money. The last stage is to put some Uzbekistani Som in your account with which to trade. Popular methods of payment include wire transfers or debit cards. Some brokerages may also permit the use of an online payment providers like PayPal or even Uzbekistan-based Payme (though this is not widely supported based on our evaluations).

A Day Trade In Action

With all these tasks ticked off, you’ll be ready to get started day trading. But what might a short-term trade in Uzbekistan look like?

Consider this scenario, in which I plan to turn a profit trading shares on the Toshkent stock market.

The Plan

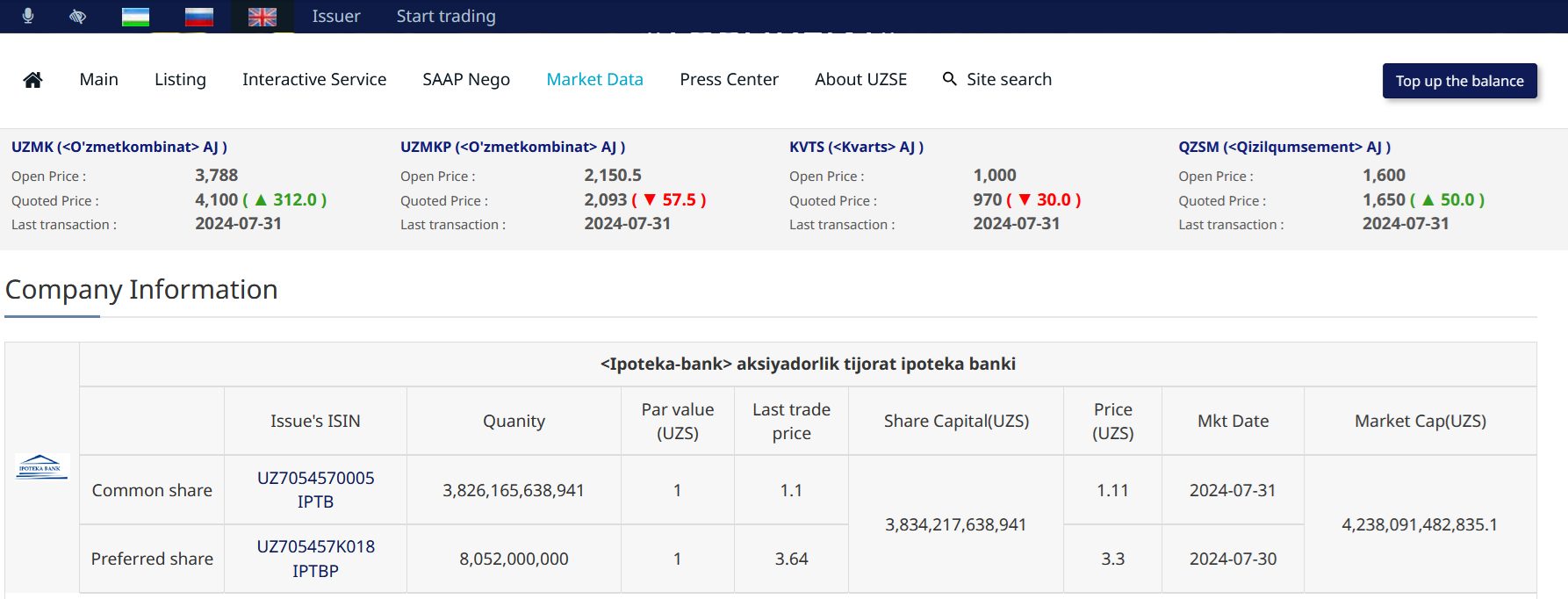

My plan involves buying shares in Ipoteka Bank, one of Uzbekistan’s largest financial institutions. More specifically, I intend to take out a long position in the company before the country’s central bank makes its next interest rate announcement.

After doing some research, I conclude that policymakers will keep interest rates on hold at 13.5%. This differs from the broader market, which has priced in a 25-basis-point cut to 13.25%.

If I’m right, the Ipoteka Bank share price – along with those of other financial services providers in Uzbekistan – may rise in value. Higher interest rates are favourable for bank profits: they raise the difference between the interest that borrowers are charged and what is paid out to savers.

Before placing my trade, I also look at the charts to better understand where Ipoteka Bank’s shares might go, as well as the size of any price movements. Technical analysis uses past price and volume data to create useful indicators and trends, and reveal chart patterns.

The Trade

With these steps completed, I open my trading platform and prepare to execute the trade.

The central bank tends to release interest rate news between 12:00 and 13:00 Uzbekistan Time Zone (UZT). So I sit down at 11:45 and punch in my orders.

I find that Ipoteka Bank shares are trading at 1.11 Uzbeki Som. So I place a ‘take profit’ order at 1.19, and a ‘stop loss’ instruction at 1.06.

This strategy helps me to effectively manage risk. If the bank moves to 1.19, my trade is automatically closed and I book a profit before prices possibly reverse again. In addition, if the share falls to 1.06 I exit my position, which in turn can help me to limit losses.

After keying in my trades, I sit back and wait for the central bank’s interest rate release. Just after 12:30, the bank announces that it decided to hold rates at 13.5%, as I’d hoped. Within an hour, the Ipoteka Bank share price has hit 1.19, closing my position out, and giving me a profit of 0.08 Uzbek Som for each share I bought.

Bottom Line

Ongoing reforms in Uzbekistan mean that day trading in the country is becoming increasingly popular. Yet investors need to be careful when choosing which brokerage to do business with: regulatory frameworks and investor protections are less comprehensive than those in regions with mature financial markets.

To get started, see DayTrading.com’s selection of the best day trading brokers in Uzbekistan.

Recommended Reading

Article Sources

- Navigating Uzbekistan’s Economic Transformation - KPMG

- The World Bank in Uzbekistan - World Bank

- The EBRD In Uzbekistan – European Bank for Reconstruction and Development (EBRD)

- Toshkent Republican Stock Exchange (TSE)

- Central Bank of the Republic of Uzbekistan

- State Tax Committee of the Republic of Uzbekistan

- Uzbekistan - Individual – Taxes on Personal Income - PwC

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com