USGFX Review 2025

Pros

- MT4 integration

- Demo account

- Copy trading

Cons

- Weak regulatory oversight

USGFX Review

USGFX is a long-standing trading broker. Through the MT4 and MT5 platforms, clients can trade CFDs on forex, commodities and indices. But how does USG compare to alternatives? This USGFX review will cover key information, such as account types, leverage, fees, demo accounts, withdrawals, and anything else potential traders should know.

Key Takeaways

- USGFX offers MetaTrader 4, MetaTrader 5, plus copy trading

- A range of payment methods including cryptos are accepted

- Fees are high unless you qualify for a VIP or ECN account

- The £500 minimum deposit for UK traders is high vs competitors

- The broker is no longer regulated by the FCA and the UK

Company Details

‘United Strategic Group’, or USG, is a global brokerage group operating USFGX. Launched in 2007, it is an award-winning broker that facilitates leveraged trading on forex, commodities and indices.

Until recently, the broker’s head office was based in Australia but following a dispute with the ASIC, the headquarters has since relocated to London, UK. The group’s current CEO is Soe Hein Min.

Depending on where you reside, you will either use the UK-based site or the USGFX-global brand. The broker accepts traders from the majority of countries, including Singapore and Iran. Traders in the US and Japan cannot register for a live account.

Trading Platforms

USGFX provides both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These are industry-leading terminals and will meet the needs of most beginners and seasoned traders.

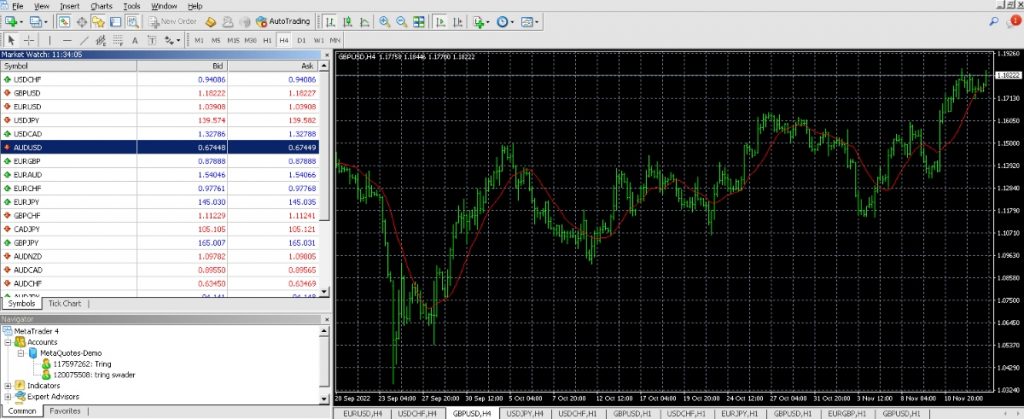

MetaTrader 4

MetaTrader 4 is a reliable and customizable platform.

Clients have access to over 30 technical indicators, in addition to more than 2,000 analytical objects available for download via the MetaTrader marketplace. Moreover, the platform supports one-click trade executions, as well as algorithmic trading bots that can automate the investing process.

On the downside, MT4 is only available on Windows. If you have an iOS device such as an Apple Mac computer, you will need to use your mobile phone or run an emulator.

MetaTrader 5

MetaTrader 5 is the faster and more powerful platform from MetaQuotes, launched five years after MT4.

With a total of 21 time frames starting at one minute, it is easy to customize the platform to suit your trading style. It also comes with 80 in-built analytical objects including popular indicators such as pivot points, exponential moving averages and MACD.

One of the key benefits of using MT5 is access to the MQL5 programming language that clients can use to design and implement their own expert advisors. This way, customers can create trading robots suited to their strategy.

Similar to MT4, USGFX clients must use a Windows computer or mobile device to trade through the MT5 platform.

How To Place A Trade

- Download and log in to the MetaTrader terminal

- Select your desired asset from the Market Watch widget on the left-hand side of the screen

- This will bring up the price history chart

- Click on ‘New Order’

- Select the order type from ‘Market Execution’ or ‘Pending Order’. Market execution opens the position immediately while pending order waits for certain conditions to be met

- Enter the trade details, including position size (in lots), any comments, plus any stop loss and take profit

- Click ‘Buy’ or ‘Sell’

Autochartist

USGFX has also partnered with Autochartist for advanced charts and technical reports. Clients can monitor multiple markets simultaneously and receive signals in real-time. The plug-in for MT4 and MT5 is a useful tool for traders looking to conduct advanced technical analysis.

Markets & Instruments

USGFX offers a narrow range of assets vs competitors.

Account holders can trade CFDs on margin spanning 60+ assets made up of major, minor and exotic currency pairs such as AUD/USD, EUR/CAD and GBP/CHF. The broker also offers trading on global indices such as the Nasdaq, plus commodities like gold and silver.

On the downside, there are no stocks or cryptocurrency.

USGFX Fees

USGFX does not charge commission fees on trades, but rather the broker makes its money through spreads. The spread is the difference between the current best bid price and best ask price for a given asset, however, the smallest that a spread can be relates to your account type. It is through these different minimums that USGFX in effect imposes its fees.

Unfortunately, when we used USGFX, we found that spreads are only competitive with the VIP and ECN accounts, which start at 1.3 pips and 1.5 pips, respectively. The Mini and Standard accounts offer floating spreads from 2.8 pips and 2.2 pips, respectively. This is higher than many competitors and means the firm isn’t a good pick for traders looking to keep costs down.

Additionally, the broker charges a swap rate, which is a cost imposed on leveraged positions that are held overnight. USGFX charges for swaps two days after your position is closed and so the longer you hold the position, the more you have to pay in one go.

Leverage

The maximum leverage available depends on the USG branch you are using. Those that trade with the UK site are limited to a maximum of 1:30, in line with regulations from the FCA. For major forex positions, the maximum leverage is 1:30, for minor/exotic forex, major indices and gold, the cap is 1:20, and for commodities and non-gold metals, the limit is 1:10.

If you are trading through the global entity, you can open contracts with leverage of up to 1:500. When you register for a live account, you can choose the maximum leverage from 1:100, 1:200, 1:400 and 1:500.

Account Types

The USGFX accounts available depend on the region you are based, but there are profiles to suit different budgets and trading styles.

Global Branch

Mini Account

- Minimum deposit of $100

- Floating spreads from 2.8 pips

- Individual account only

- Leverage up to 1:500

Standard Account

- Minimum deposit of $10,000

- Floating spreads from 2.2 pips

- Individual, joint and corporate accounts

- Leverage up to 1:500

VIP Account

- Minimum deposit of $50,000

- Floating spreads from 1.3 pips

- Individual, joint and corporate accounts

- Leverage up to 1:500

Pro-ECN Account

- Minimum deposit of $50,000

- Floating spreads from 1.5 pips

- Individual, joint and corporate accounts

- Leverage up to 1:100

UK Accounts

Retail Accounts

- Minimum deposit of £500

- Floating spreads from 1.3 pips

- Negative balance protection

- Your money is kept separate from the company’s funds

- Margin close out at 50%

- Leverage up to 1:30

Professional

- No minimum deposit

- Floating spreads from 0.8 pips

- Margin close out at 20%

- Leverage up to 1:400

How To Open A USGFX Account

- Follow the ‘Visit’ button at the top or bottom of this www.usgfx.com forex trading review

- There are four pages of information you need to provide. These are personal details such as name and address, password, identity document numbers and financial information such as tax identification number

- Send proof of identity documents to be reviewed and verified. Standard accounts require only a single government-issued ID and proof of address. Joint and corporate accounts require additional information

- Deposit funds and begin trading

Demo Account

Traders can also register for a free demo account, using either MT4 or MT5. A paper trading account is a good way to practice trading and get used to how the platforms work or test out new strategies.

To open a demo account, you need to submit a request via the website and the customer service team will respond, informing you if the application has been accepted. If you are successful, you will have £100,000 of simulated funds you can trade for 30 days.

USGFX Payment Methods

Our experts found that USG offers a decent selection of traditional payment options, plus e-wallets and cryptos. However, the minimum deposit for UK traders is steep and there are withdrawal fees to take into account, which is a drawback vs alternatives.

Deposits

For UK-based traders, the minimum deposit is high at £500 whereas, through the global site the starting requirement is a more reasonable $100.

For all clients, there is no deposit fee for any method except crypto. Available payment solutions and expected processing times:

- Credit or debit card from Visa or Mastercard: Less than two hours

- Bank wire transfer: Between one and three working days

- ecoPayz/Skrill/Neteller: Instant

Clients of the USGFX global entity also have access to the following methods:

- Online banking for clients based in Asia (including Malaysia and Thailand): Instant

- Cryptos such as Bitcoin and Tether: Up to 30 minutes with a 0.5% fee

- Perfect Money: Within one working day

- FasaPay: Instant

How To Make A Deposit To USGFX

- Sign in using your login details

- Click on the ‘Deposit’ button

- Select your desired deposit method and your respective account details

- Specify the amount you wish to deposit, noting the minimum deposit requirements

- Confirm the request. You may need to complete a verification step via your payment method to release the funds

- Once the USG team has confirmed the validity of the deposit, it will be credited to your live trading account

Withdrawals

Similar to deposits, the methods available for withdrawing funds from USGFX depend on the site you register with. With all methods, the expected wait time for withdrawals to be processed is between three and five business days.

Available methods and their fees for UK traders:

- Bank wire transfer: USGFX does not charge, however, it will not cover any fees that your bank may impose

- Credit or debit card from Visa or Mastercard: €0.8

- ecoPayz: 2% fee

- Skrill/Neteller: 1% fee

Available methods and their fees for global traders:

- FasaPay, credit or debit card, Perfect Money, Skrill and Neteller: €0.8

- Online banking for select countries: Free

- Crypto: 0.0004 BTC fee

- Wire transfer: $40

Regulation

Although USGFX held a license with the Financial Conduct Authority (FCA), this expired in December 2022 and was not renewed. Therefore, the firm is no longer regulated in the UK and clients may not be afforded the protections that come with FCA licensing, for example, negative balance protection.

USGFX is now only regulated by the Financial Services Authority of St. Vincent & the Grenadines. It holds a license under the name of United Strategic Group LLC with reference number 648LLC2020. Importantly, this is not a well-regarded regulator.

USGFX Promotions

The global USGFX site runs various promotions, allowing registered clients to receive bonuses and prizes. Unfortunately, these are only available for global traders, not UK investors.

Promotions include the New Year Weekly Bonus where clients can receive up to $1 per lot traded as long as the minimum volume thresholds are reached. If you deposit between $10,000 and $20,000, the bonus per lot is $0.5. If you deposit more than $20,000, the bonus per lot is $1.

Another popular deal is the Spring Bonus where clients receive a cash reward for making a deposit. The lowest offer was a 5% bonus for deposits of at least $500. This percentage reward increases up to 25% for deposits of $20,000 or more.

Customer Support

If you need support from the USG customer service team, including for withdrawal problems, you can seek help through:

- Live chat – logo bottom-right of website

- Telephone – +44 207 846 3712 for the UK branch, +61 2918 90223 for the global site

- Email – info@usgfx.co.uk for UK, clientsupport@usgfx.global for international traders

- Social media – accounts on Twitter, Facebook and LinkedIn where you can also keep up to date with any USGFX news and announcements

- FAQs – official website

Mobile App

There is no dedicated app for USGFX, but clients can download the MT4 and MT5 apps on their mobile devices. Download links for the applications on Google Play and the Apple App Store can be found on the broker’s website.

While using USGFX, our experts were impressed with the mobile trading functionality. The MetaTrader apps offer straightforward zoom and scroll functionality, one-click trading, integrated news, plus multiple charts and graphs.

Additional Tools

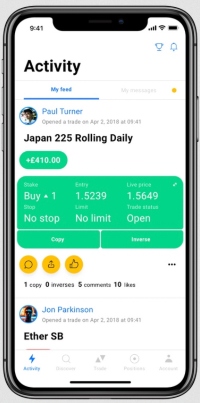

Copy Trading

USGFX has linked with Pelican Trading, a regulated company that facilitates copy trading. Customers can view, follow and replicate the trades made by other investors.

The platform makes it easy to see a breakdown of each trade that is made by your chosen investor and with one click you can either copy the trade exactly or open its inverse.

TradersClub Coaching Program

USGFX runs an education center with the aim of boosting clients’ knowledge of online trading. Through this free service, customers can potentially improve their trading success by reading guides and breakdowns of key topics. For example, how to read charts and how to conduct both fundamental and technical analyses.

Regardless of your experience level, this program can prove useful as there are always new tips and tricks you can pick up.

USGFX Verdict

USGFX is a well-made international broker that is suitable for clients that want to open leveraged CFDs on forex, commodities and indices. With both MT4 and MT5 to choose from, clients can customize their trading experience to suit their desired style and day trading strategy.

On the downside, spreads are wide, minimum deposits in the UK are high, and the breadth of tradable assets is narrow vs many competitors. The loss of the FCA regulatory license is also a concern. As a result, our experts recommend considering the alternative brokers listed below.

FAQs

Is USGFX Legit?

USGFX is a real broker that has held licenses with both the ASIC and the FCA. However, the company has since lost its operating licenses from both regulators. With this in mind, consider alternative brokers for a more secure trading environment.

Is USGFX Good For Day Trading?

USGFX is only worth considering for day trading if you qualify for the Pro or ECN accounts. These will give you the tightest spreads and fast trade executions, however, the $50,000 minimum deposit for the ECN account will put this out of reach for most retail traders.

The broker’s other accounts come with relatively high fees which will erode the profits of traders making a large volume of intraday trades.

Is USGFX A Good Or Bad Broker?

USGFX offers the MT4 and MT5 platforms, copy trading, and generous leverage for global traders. However, the high trading fees, narrow range of assets, plus limited regulatory oversight means USG is not a top-rated broker.

Does USGFX Offer Demo Trading?

Yes, clients can request a free demo account with £100,000 of simulated funds. This is an effective way to practice trading on USGFX risk-free, which is important if you want to test out any new strategies before implementing them with real capital.

Is USGFX Trustworthy?

At the time of writing, the brokerage is regulated by the Financial Services Authority of St Vincent and Grenadines. In the past, it has held licenses with the FCA of the UK and the ASIC of Australia, but both of those have since expired and not been renewed. It is also worth noting that the FSA of St Vincent and Grenadines is not a highly trusted regulator.

Does USGFX Offer Mobile Trading?

To trade through your USG account on mobile, you must download either the MetaTrader 4 or MetaTrader 5 app. These are available on iOS and Android devices and you can find links to the download page on the respective app store or on the broker’s official website.

Top 3 Alternatives to USGFX

Compare USGFX with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

USGFX Comparison Table

| USGFX | Interactive Brokers | World Forex | xChief | |

|---|---|---|---|---|

| Rating | 2 | 4.3 | 4 | 3.9 |

| Markets | CFDs, Forex, Commodities, Indices | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $1 | $10 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA | ASIC |

| Bonus | – | – | 100% Deposit Bonus | $100 No Deposit Bonus |

| Education | No | Yes | No | No |

| Platforms | MT4, MT5, AutoChartist | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 | MT4, MT5 |

| Leverage | 1:30 (EU), 1:500 (Global) | 1:50 | 1:1000 | 1:1000 |

| Payment Methods | 11 | 6 | 10 | 12 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

World Forex Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by USGFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| USGFX | Interactive Brokers | World Forex | xChief | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | No | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | No | No |

| Bonds | No | Yes | No | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | No |

USGFX vs Other Brokers

Compare USGFX with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of USGFX yet, will you be the first to help fellow traders decide if they should trade with USGFX or not?