Best Forex Trading Platforms In The US 2025

The US Dollar is traded three times more than the Euro, New York is gaining on London as the largest foreign exchange hub, and the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA) hold forex brokers to the highest standards. These factors are attracting US forex traders at all levels to the market and increasing the demand for online trading platforms.

Explore our selection of the best forex trading platforms in the US following comprehensive testing and analysis. Every broker recommended specifically caters to forex traders in the US:

- They offer trading on currency pairs containing the US Dollar

- They provide a USD-based forex account for convenient deposits

- They have offices and support staff based in the United States

- They are regulated by the CFTC/NFA

Top 5 Forex Trading Platforms In The US

Many of the 223 brokers we've evaluated as of 2025 offer an excellent forex trading environment, but these 5 stand out as the best for traders in the USA:

Here is a summary of why we recommend these brokers in April 2025:

- NinjaTrader - NinjaTraders supports the trading of popular currencies including the EUR/USD. The software also offers advanced features to streamline the trading experience, including complex order types like market if touched (MIT) and one cancels other (OCO).

- Interactive Brokers - IBKR presents an extensive range of over 100 major, minor, and exotic forex pairs, surpassing the offerings of nearly all leading alternatives, though not CMC Markets. Forex trading occurs over multiple platforms and boasts institutional-grade spreads starting from 0.1 pips and 20 complex order types, including brackets, scale, and one-cancels-all (OCA) orders.

- Plus500 US - Plus500 US offers futures trading on a small selection of 13 currencies, including popular pairs like the EUR/USD and GBP/USD. Day trading margins are competitive, starting from $40, while the educational resources do an excellent job of breaking down the basics of forex futures for new traders.

- FOREX.com - FOREX.com continues to uphold its stature as a premier FX broker, offering over 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $5 commission per $100k, it stands out. Moreover, its SMART Signals help to identify price behaviors across numerous major currency markets.

- OANDA US - OANDA offers a diverse selection of 68 currency pairs, more than many alternatives. The broker’s in-house platform offers superb day trading capabilities via powerful TradingView charts, including 65+ technical indicators and 11 customizable chart types.

Best Forex Trading Platforms In The US 2025 Comparison

| Broker | US Regulated | USD Account | Currency Pairs | EUR/USD Spread | Forex App Rating | Minimum Deposit |

|---|---|---|---|---|---|---|

| NinjaTrader | ✔ | ✔ | 50+ | 1.3 | / 5 | $0 |

| Interactive Brokers | ✔ | ✔ | 100+ | 0.08-0.20 bps x trade value | / 5 | $0 |

| Plus500 US | ✔ | ✔ | 13 | 0.75 | / 5 | $100 |

| FOREX.com | ✔ | ✔ | 80+ | 1.2 | / 5 | $100 |

| OANDA US | ✔ | ✔ | 65+ | 1.6 | / 5 | $0 |

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| GBPUSD Spread | 1.6 |

|---|---|

| EURUSD Spread | 1.3 |

| EURGBP Spread | 1.6 |

| Total Assets | 50+ |

| Leverage | 1:50 |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Account Currencies | USD |

Pros

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- You can get thousands of add-ons and applications from developers in 150+ countries

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

Cons

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| GBPUSD Spread | 0.08-0.20 bps x trade value |

|---|---|

| EURUSD Spread | 0.08-0.20 bps x trade value |

| EURGBP Spread | 0.08-0.20 bps x trade value |

| Total Assets | 100+ |

| Leverage | 1:50 |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

Cons

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

Plus500 US

"Plus500 US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500 US Quick Facts

| Bonus Offer | Welcome Deposit Bonus up to $200 |

|---|---|

| EURUSD Spread | 0.75 |

| Total Assets | 13 |

| Platforms | WebTrader, App |

| Account Currencies | USD |

Pros

- Plus500 US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

Cons

- Although support response times were fast during tests, there is no telephone assistance

- Plus500 US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

- Despite competitive pricing, Plus500 US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | Active Trader Program With A 15% Reduction In Costs |

|---|---|

| GBPUSD Spread | 1.3 |

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 80+ |

| Leverage | 1:50 |

| Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- Alongside a choice of leading platforms, FOREX.com offers a superb suite of supplementary tools including Trading Central research, SMART Signals pattern scanner, trading signals, and strategy builders.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| GBPUSD Spread | 3.4 |

|---|---|

| EURUSD Spread | 1.6 |

| EURGBP Spread | 1.7 |

| Total Assets | 65+ |

| Leverage | 1:50 |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- The broker offers a transparent pricing structure with no hidden charges

- Day traders can enjoy fast and reliable order execution

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

Forex trading is risky. Most retail investors lose money. Only risk what you can afford to lose.

How We Chose The Best Forex Trading Platforms In The US

To find the best forex trading platforms in the US, we identified all those offering currency-related trading products and accepting investors from the US, then we ranked them by their total rating.

Our forex broker ratings are based on extensive hands-on testing, drawing on over 100 data points and the firsthand observations of our industry experts, focusing on key areas, notably:

Trust

We’ve recommended forex brokers we trust after weighing their:

- Regulatory credentials: We confirmed they are regulated by the US CFTC/NFA.

- Years of experience: We checked they have been offering forex trading for at least 15 years.

- Our experts opinion: We ensured they scored at least 4.5/5 in our Regulation & Trust rating.

Of these, the best sign that a forex broker can be trusted is authorization from the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA), ‘green-tier’ regulators in line with our Regulation & Trust rating, protecting forex traders in the US through:

- Forex brokers must segregate client funds, providing protection against insolvency. When Refco became insolvent in 2005, the CFTC successfully secured $7 billion in customer funds.

- Forex brokers must display risk warnings. FOREX.com uses the following: “Forex trading involves significant risk of loss and is not suitable for all investors. Full Disclosures and Risk Warning.”

- Forex brokers must not provide leverage trading beyond 1:50, limiting losses. Hugo’s Way offers very high leverage up to 1:500 because it’s not regulated in the US so should be avoided.

- Forex brokers must publish reports to show fair execution and pricing. This report from Interactive Brokers clearly details their use of various clearing houses and depositories.

- IG earns our vote as the most trusted US forex broker. It’s regulated by 13 bodies including the CFTC, and has over 50 years in the industry, plus our experts have used the IG platform for real-money forex trading and highly praise the secure and dependable trading environment.

Currency Pairs

We’ve recommended forex brokers that offer trading on a wide range of currency pairs, catering to various day trading strategies.

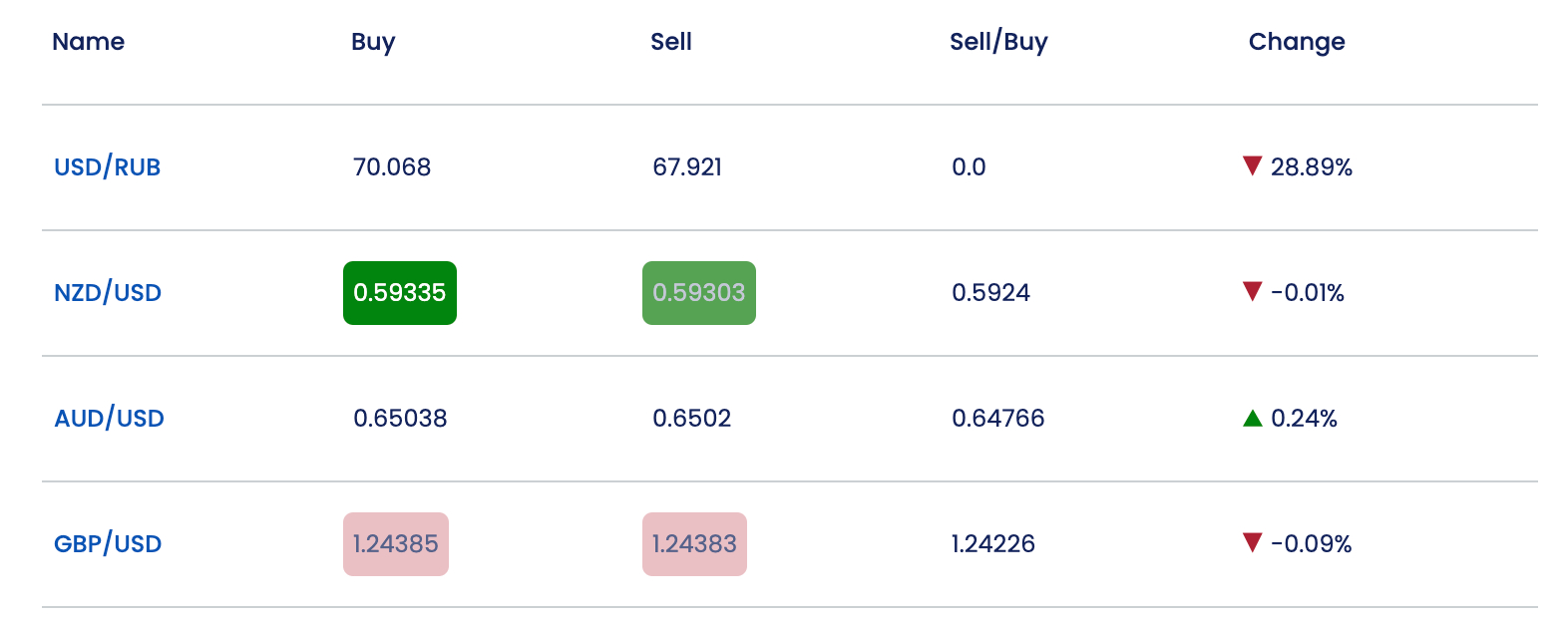

Every one of our top-rated forex brokers in the United States offers trading on currency pairs containing the US Dollar, including majors: EUR/USD, USD/JPY, GBP/USD and USD/CHF.

These are the most widely traded currency pairs, comprising up to 75% of global forex trading volumes, and typically exhibiting the lowest fees, making them appealing to active traders looking to keep costs down when operating in slim margins.

- FOREX.com offers a terrific selection of over 80 currency pairs with 22 containing the US Dollar. It’s also one of the few forex brokers to offer a dedicated news and analysis section on the Dollar with almost daily expert insights and short-term outlooks delivered in written, video and chart form, alongside actionable trading ideas – fantastic resources for beginners.

Pricing

We’ve recommended forex brokers with competitive pricing after evaluating spreads on popular currency pairs; EUR/USD, GBP/USD and EUR/GBP, and balancing these with any additional fees, such as inactivity penalties, and critically, the overall quality of the forex trading environment.

This is because we’ve learned that it can be worth paying more depending on your needs. For example, superior education if you’re a beginner, the fastest execution if you’re a short-term trader, and automated trading tools if you’re an algo trader.

Importantly, newcomers may prefer a commission-free account to keep pricing simple, while advanced forex traders may prefer a low-spread and commission account, which can reduce costs when executing frequent trades.

Let’s say I’m an active trader of the USD/GBP pair and opt for an account that offers low spreads and a commission. Here’s why this could work for me: Each time I execute a forex trade, I pay a small fixed commission, but I could benefit from significantly tighter spreads.For example, while a commission-free account might offer a spread of 1.2 pips, my account might only have a 0.3 pip spread but include a $7 commission. Over many forex trades, the savings from the lower spreads can outweigh the commissions.

- IG is one of the lowest-cost US forex brokers, with spreads averaging 1.2 on the EUR/USD, 1.8 on GBP/USD and 1.8 on EUR/GBP, plus up to 15% rebates for the most active traders and competitive margins from 2% on the EUR/USD. Its ProRealTime platform is also one of the most comprehensive platforms we’ve seen with first-rate analysis tools and around 100 indicators.

Tools

We’ve recommended forex brokers with user-friendly and feature-rich platforms following direct testing of their desktop, web and/or mobile solutions.

The forex industry has been dominated by MetaTrader 4 (MT4) for years, but we’re observing a shift towards more user-friendly platforms like TradingView that come stacked with helpful features, notably forex heatmaps, market forecasts, trading ideas and dozens of indicators.

This isn’t surprising – I’ve spent countless hours testing the MetaTrader 4 forex platform over the years and am always struck by its bland design, especially the web solution that is unintuitive and fiddly, resulting in a subpar user experience.

With 50% of retail forex investors now using mobiles to trade, according to Gitnux, US brokers are also investing in forex trading apps, which increasingly offer a comprehensive mobile trading experience, complete with mobile-optimized charting, in-built research and analytics, plus in-app support to resolve urgent trading queries.

- OANDA’s forex trading tools are superb. MT4 is available for the purists, while its OANDA’s Trade solution offers one of the cleanest workspaces I’ve experienced, complete with graphs from MultiCharts, market analysis, plus live and historical exchange rates.

FAQ

Which Is The Best Forex Trading Platform In The US?

Use our rankings of the best forex trading platforms in the USA to find the right broker for you as everyone’s needs are different.

We also recommend making use of forex demo accounts, offered by all of our recommended brokers, to get familiar with platform features and test strategies before risking funds.

Who Regulates Forex Brokers And Trading Platforms In The US?

The Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) regulate forex brokers in the US.

We recommend choosing a forex trading platform registered with these financial bodies. We also recommend reading the CFTC’s advice on how to protect yourself against forex trading scams.

What Is The Minimum Amount Of Money I Need To Trade Currencies In the US?

Our analysis of the largest US forex brokers shows you’ll normally need up to $250 to open a trading account, with debit card, wire transfer and ACH transfer the most supported payment methods.

However, brokerages such as IG and OANDA are increasingly catering to budget forex traders in the US with no minimum investment.

Recommended Reading

Article Sources

- Forex Market Daily Trading Volumes - Statista

- London Is Still World’s Biggest FX-Trading Hub But Grip Slipping - Bloomberg

- Commodity Futures Trading Commission (CFTC)

- National Futures Association (NFA)

- Foreign Exchange Volumes - Bank of International Settlements

- Refco Bankruptcy - CFTC Chairman Reuben Jeffery

- FOREX.com US Disclosures & Risk Warning

- Interactive Brokers NFA Disclosure Statement

- Forex Industry Statistics - Gitnux

- Forex Fraud Advice - CFTC

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com