Forex Trading in the US

The US is a key player in the global foreign exchange market, with a 19% slice of worldwide trading volumes (second only to the UK). The US dollar also remains the world’s dominant vehicle currency.

This huge financial system attracts FX traders, but you must navigate regulations from the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA), which aim to ensure investor protection.

Are you looking to get into forex trading in the US? This starter’s guide unpacks the essentials.

Quick Introduction

- The US dollar (USD) is on one side of 88% of all forex trades in terms of trading volumes, followed by EUR, JPY, and GBP, according to the Bank of International Settlements (BIS).

- Due to the US’s dominant position, focusing on pairs with the USD like EUR/USD, USD/JPY and GBP/USD can present trading opportunities and valuable insights into the US economy.

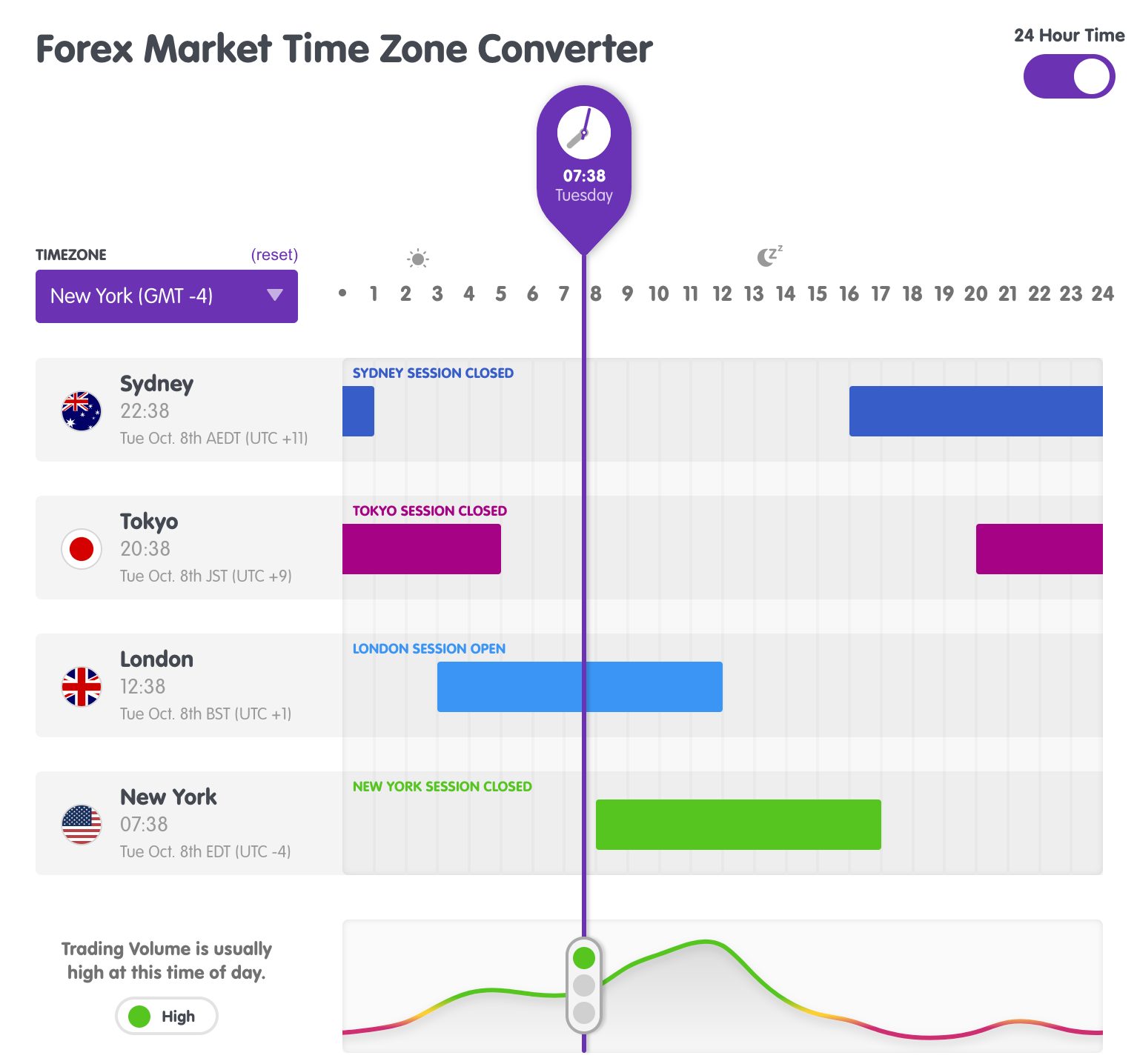

- The best time for US investors to trade currencies, especially USD pairs, is during the New York-London overlap (08:00 to 12:00 EST) when market volatility and liquidity are greatest.

- Forex trading in the US is tightly regulated by the CFTC and NFA, ‘green tier’ bodies in DayTrading.com’s Regulation & Trust Rating, ensuring robust investor safeguards.

Best Forex Brokers in the US

After reviewing 226 trading platforms we have found these to be the 4 best US forex brokers:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

4

FOREX.com

FOREX.com

How Does Forex Trading Work?

Forex trading involves buying and selling currency pairs to profit from exchange rate fluctuations, with the bid as the highest price a buyer will pay, the ask as the lowest a seller will accept, and the difference being the spread.

You might buy, or go long, on the EUR/USD pair if you expect the euro to appreciate against the US dollar. Conversely, you would sell, or go short, if you expect the euro to depreciate against the US dollar.

To start trading currencies online in the US, you’ll need to:

- Open an account with a forex broker: We recommend choosing a CFTC-regulated forex provider.

- Deposit funds: Opt for a USD account (offered by almost every brokerage) to minimize conversion fees.

- Execute trades: Use your broker’s desktop, web, or increasingly mobile forex app, to execute trades.

While getting started may be straightforward, trading currencies remains a high-risk activity. The forex market is volatile and you could lose any money you invest.Risk management is essential and I suggest beginners start with a demo account.

What Currency Pairs Can I Trade?

You can potentially trade hundreds of currency pairs, however the most heavily traded currency pairs in the US and worldwide, known as the ‘majors’, all include the USD. They represent the next largest and most liquid currencies, paired with the USD.

Given these characteristics, they tend to have tight spreads and high liquidity, reducing slippage and providing optimal conditions for fast-paced trading strategies.

Top of the list is the EUR/USD, which is the most traded currency pair globally, accounting for more than 20% of all forex transactions according to the BIS. This is a firm favorite with forex traders in the US.

Here’s a list of the major forex pairs:

- EUR/USD – Euro / US Dollar

- USD/JPY – US Dollar / Japanese Yen

- GBP/USD – British Pound / US Dollar

- USD/CHF – US Dollar / Swiss Franc

- AUD/USD – Australian Dollar / US Dollar

- USD/CAD – US Dollar / Canadian Dollar

- NZD/USD – New Zealand Dollar / US Dollar

Is Forex Trading Legal In The US?

Forex trading is legal in the US, but it is heavily regulated.

You are allowed to participate in the foreign exchange market, but you must do so through registered brokers and comply with regulations set by the CFTC and the NFA.

The legal framework governing forex trading in the US is rooted in the Commodity Exchange Act (CEA), a piece of legislation enacted in 1974. The CEA has undergone numerous amendments to broaden the regulatory scope of forex trading by introducing new rules and enhancing the authority of regulatory agencies.

These strict regulations include limits on leverage (ranging from 1:10 to 1:50), mandatory reporting requirements, and safeguards to protect retail traders from fraud or malpractice.

Only licensed brokers can legally offer forex trading services, making the US market more secure and restrictive than most countries.

Is Forex Trading Taxed In The US?

Forex trading is taxed in the US, and the Internal Revenue Service (IRS) offers two different tax treatments depending on your contract type:

- Forex options and futures contracts fall under Section 1256, where you benefit from a 60/40 tax split. This means 60% of gains are taxed as long-term capital gains at a lower rate (0% to 20%), while 40% are taxed as short-term gains at ordinary income tax rates (10% to 37%).

- For retail traders engaging in spot forex trades, Section 988 applies, treating gains or losses as ordinary income or loss, taxed at the standard income tax rate. This can be useful if you have losses, as they can be deducted against other income.

You can choose which tax treatment to use but must decide at the start of the tax year. Accurate record-keeping is crucial for proper IRS reporting.

When Is The Best Time To Trade Forex?

The best time to trade forex in the US is typically when market activity is at its highest, ensuring greater liquidity and tighter spreads.

This occurs during the overlap between the New York and London trading sessions, which run from 08:00 to 12:00 Eastern Time (ET).

Both major financial centers are active during this period, leading to increased trading volume and more opportunities to capitalize on market movements.

Another good time for US traders is during the New York session, which runs from 08:00 to 17:00 ET, as it captures most of the significant market movements related to US economic data releases.

However, it would help to avoid low-volatility periods like the late New York session or around holidays when markets tend to be less active.

A Trade In Action

To illustrate the practical application of forex trading in the US, I’ll share a step-by-step account of a short-term (intraday) trade I executed on the EUR/USD currency pair:

Event Background

The US government released strong Non-Farm Payroll (NFP) data, showing much higher job growth than expected. The announcement came in with 254,000 jobs added, significantly exceeding forecasts of around 140,000.

This signaled a robust labor market, fueling speculation that the Federal Reserve might keep interest rates higher for longer to control inflation.

As a result, the US dollar strengthened rapidly across the board, especially against the euro, since the eurozone’s economic data had been weaker in comparison, and there were no immediate signs of tightening from the European Central Bank (ECB).

Trade Entry & Exit

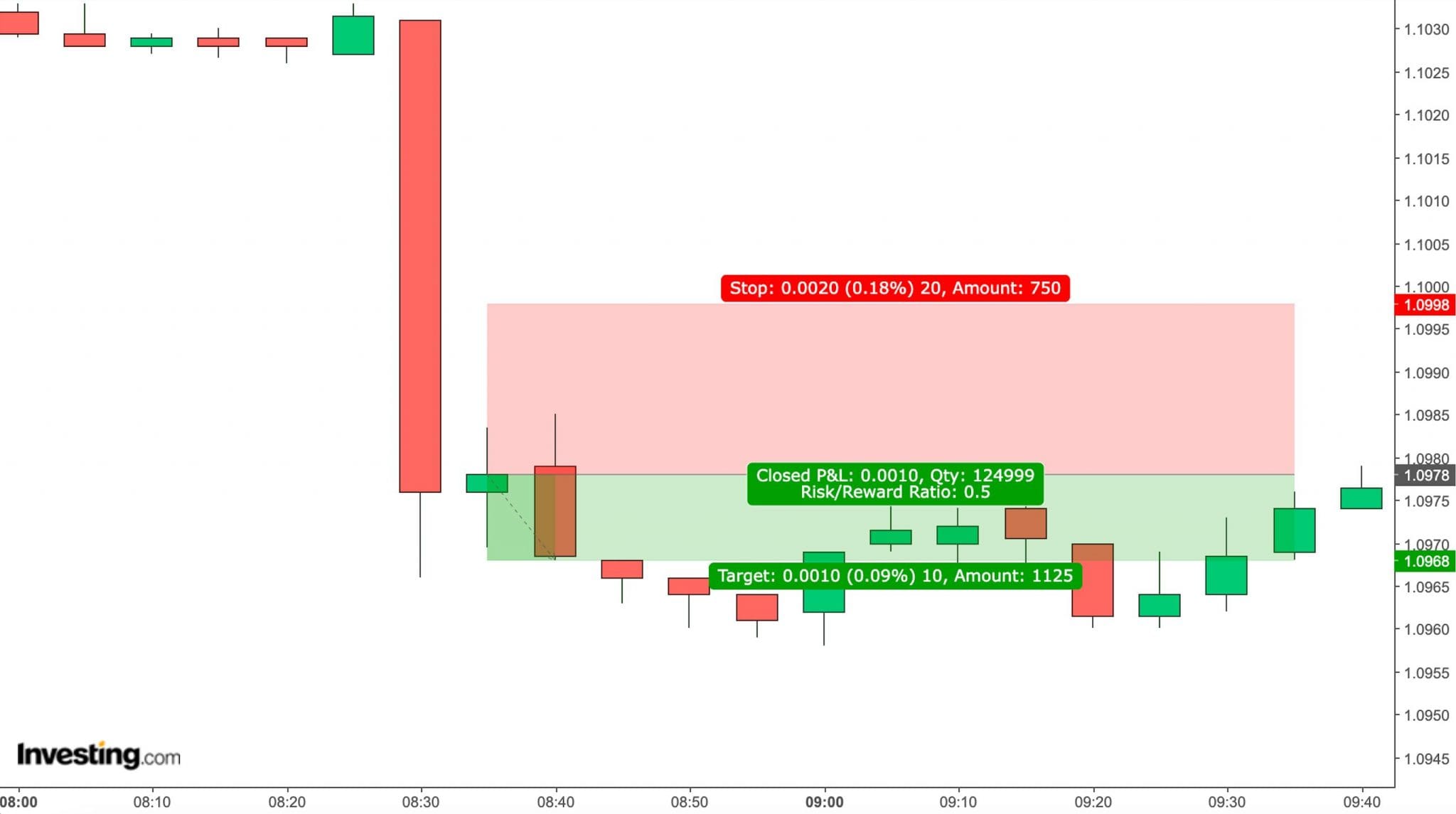

On the morning of the announcement, I watched the EUR/USD pair closely. When the NFP numbers were released at 08:30 ET, I saw a sharp drop in the euro against the dollar.

The EUR/USD was trading around 1.10299 right before the announcement, but within 5 minutes, it plunged over 50 pips to 1.09766 as traders reacted to the positive US data.

I decided to enter the trade when I saw the pair bounce slightly to 1.09777. Given the strength of the US data and expectations for continued dollar strength, I anticipated that the market still had room to push lower.

I placed a short (sell) position at 1.09780 with a stop-loss set at 1.09980 (20 pips) to protect against any unexpected reversal. My target for the trade was 1.09680 (10 pips), where I believed I could make a quick trade to capitalize on the price momentum.

The EUR/USD continued to decline as more traders digested the NFP data and speculated on future Fed rate hikes. The pair hit my target within 15 minutes and automatically exited the trade.

The NFP data release provided a perfect opportunity to capitalize on strengthening the US dollar.By acting quickly on the sharp movement in the EUR/USD pair, I was able to enter a short trade at the right moment.

Bottom Line

Forex trading in the US is a key part of the global foreign exchange market, offering trading opportunities within the world’s largest economy.

It is legal but highly regulated, with oversight from the CFTC and NFA to ensure transparency and protect investors.

While the market offers high liquidity, especially during overlapping sessions with major financial centers, it is also subject to US taxation rules, making record-keeping essential for compliance with the IRS.

Start trading foreign currencies by opening an account with one of DayTrading.com’s top US forex brokers.

Recommended Reading

Article Sources

- OTC Foreign Exchange Turnover - BIS

- Commodity Futures Trading Commission (CFTC)

- National Futures Association (NFA)

- Commodity Exchange Act (CEA)

- Internal Revenue Service (IRS)

- Section 1256 - Wikipedia

- Section 988 - Wikipedia

- US Taxes on Capital Gains - PWC

- US Taxes on Personal Income - PWC

- Forex Market Hours - BabyPips

- Federal Reserve

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com