Upstox Review 2025

Pros

- 2-in-1 joint demat and trading accounts available with pre-included stock Smartlists

- Transparent, flat pricing at INR 20 per order on stocks and no monthly maintenance charges

- Fast and free funding methods via local bank transfer, Google Pay, cheque and more

Cons

- Charges for non-resident Indians (NRI)

- Not as beginner-friendly as competitors

- Digital gold has been discontinued

Upstox Review

Upstox, formerly known as RKSV Securities, is an online private discount broker from India offering commodities, equities, futures, mutual funds, IPOs, currencies and options. Our 2025 review looks at the broker’s trading platforms, brokerage pricing rates, leverage rates and account types so you can decide whether to sign up and start trading with Upstox today.

Upstox Headlines

Upstox was founded and established in 2011 by owners Raghu Kumar, Ravi Kumar and Shrinivas Viswanath. It was formerly known as RKSV Securities India Pvt. Ltd. The brokerage is backed by a group of investors, which include Kalaari Capital, Ratan Tata and GVK Davix. Additionally, the broker is registered with the National Securities Depository Limited (NSDL), Securities and Exchange Board of India (SEBI) and Central Depositories Services India (CDSL).

Upstox offices are currently headquartered in Mumbai, India but the broker has partner offices all over the country, including in Kerala and Gujarat. The broker claims to have over 4 million users as of 2021. The broker is most suited to Indian residents but opens up its services to non-resident Indians (NRI) under specific account opening processes.

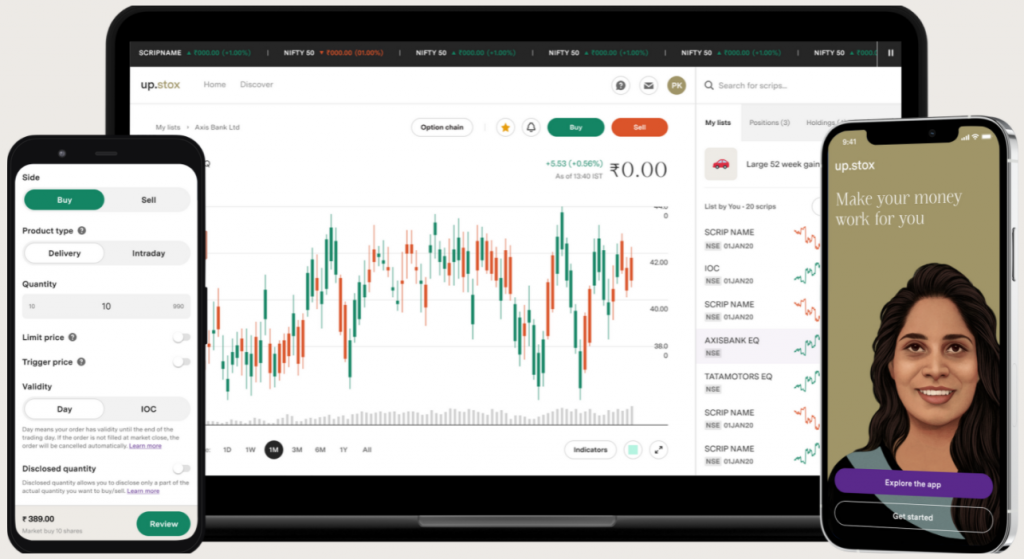

Trading Platform

Upstox Pro Web

Upstox Pro is the broker’s proprietary web, HTML-based trading platform. Users do not need to download the platform and can easily login access this on a Windows PC or Mac through a browser. The terminal’s main features include:

- Powerful charting tools to spot market trends

- Instant multiple order types i.e. GTT order

- Simple and intuitive dashboard

- 100+ customisable indicators

- Latest market news feed

- Various widgets

- Watchlists

Additional Platforms

Upstox offers a range of external software packages to enhance its users’ trading experience. Packages include NEST trading software and Dartstock

The NEST platform provides a tool for placing orders to buy and sell securities. NEST is free for clients and well suited to frequent traders, though it does require download and installation. Key features include:

- Semi-auto trading

- Plugins for multiple charts

- Run real-time data by exporting it into excel

- Check SPAN margin available for NFO expiry contracts

Dartstock is a platform from iDarts that combines traditional features with F&O-focused tools, a range of order types and charting and graph functions and a suite of scanning tools, covering asset, trend and opportunity finders.

Note that all partner platforms, including NEST and Dartstock, have been temporarily disabled from April 2021.

Upstox also provides an API for developers and algo traders, supporting Node JS and Python. Additionally, The broker’s back office system allows you to view your profit and loss (P&L) reports and historical yearly statements.

Assets

Upstox offers a wide range of asset classes and investing options that can be traded from one platform: Upstox Pro. These include:

- Stocks on the BSE, NSE and MCX exchange, as well as major global stocks

- 2000+ mutual fund schemes

- Futures & Options (F&O)

- Equities

- IPOs

In 2020, Upstox expanded its global investments to include 60 exchanges across 25 countries, such as US stocks on the NYSE.

As of 24th August 2021, Upstox has discontinued the buying of digital gold, as per exchange guidelines, and the selling of e-gold from 5th September 2021.

Fees

As a discount broker, Upstox offers low trading fees across its asset classes. The pricing model features include the following charges:

- Zero commission in mutual funds

- Zero brokerage plan on mutual funds and IPOs

- Flat INR 20 fee or 0.1% (whichever is lower) on Equity Delivery orders

- Flat INR 20 fee or 0.05% (whichever is lower) on Equity Intraday, Futures and Options, Currency and Commodity. The flat INR 20 fees remain, regardless of the size of your order.

Upstox has a comprehensive charge list of brokerage rates on its website, with no hidden charges. This includes SEBI charges, Demat transaction charges, joining fees, holding charges and stamp charges. Additionally, members can calculate the full cost of trade with their brokerage calculator.

Leverage

Under SEBI guidelines updates, Upstox offers up to 1:5 leverage on intraday and cover orders (CO) in equities. Additionally, the broker is permitted up to 1:1.33 margins on intraday and CO orders in futures and stock futures, indices and stock options (selling), NSE currency futures, and MCX futures. However, margins are not applicable to options buying.

If you have any doubts about margin requirements, Upstox’s intraday margin and leverage calculator breaks down the total amount required to construct your portfolio.

Mobile Apps

Upstox offers a proprietary mobile version of its Upstox Pro platform called Pro Mobile. The mobile app is available on both iOS and Android, so you can trade on the go. Members can still access the same features on the desktop app, such as charts, multiple order types, price alerts. However, mobile app users benefit from instant notifications.

Payment Methods

Upstox offers the following methods for funding accounts, with varying processing times and fees:

- Smart Fund Transfer: Instant (Free. Deposit up to INR 5,000,000 in one transaction with an unlimited number of transactions).

- NetBanking: 1 – 10 minutes (INR 7 every transfer)

- UPI Transfer: 1 – 10 minutes (Free)

- Google Pay: 1 – 10 minutes (Free)

- Cheque: 3 – 5 working days (Free)

- IMPS/RTGS: 30 minutes (Free)

- NEFT: 3 – 4 hours (Free)

Withdrawing funds can be done directly from the Upstox Pro app. Withdrawals are automatically returned to your primary registered bank account. Withdrawals are usually processed within two working days from the time of request. You can withdraw up to the amount available on your account and there are no withdrawal charges.

Upstox has partnered with 23 banks, which allows you to transfer funds via ATOM instantly. Banks include the Bank of India, YES Bank, HDFC Bank, IDBI Bank and ICICI Bank.

Demo Account

Upstox does not formally offer a simulated demo account. However, users can access the broker’s trading platforms without funding your account by simply opening an account. You will have access to live market data and get an insight into the Upstox Pro platform but you can’t access virtual funds or place any simulated orders.

Regulation & Licensing

Under RKSV Securities, Upstox is licensed with SEBI under registration number INZ000185137. It is also registered with the CDSL (IN-DP-CDSL- 00283831) and NSDL (IN-DP-NSDL-11497282). In addition, it is also a member of the BSE, NSE and MCX exchanges.

Education

Upstox has a dedicated YouTube series with free, easy-to-understand videos called ‘Learn With Upstox’. These are suited to new traders looking to begin their investment journey or for more seasoned traders looking to enhance their current investment strategy.

Account Types

Demat Account

Upstox’s Demat account allows you to hold your shares in an electronic format. Indian traders cannot invest without a Demat account to store their positions. These accounts also let you monitor all your stocks and funds in one place, also providing access to the mutual funds platform page.

Demat accounts must be paired with a trading account to actually link to the exchanges and place the orders. Upstox Demat accounts can be opened individually, providing storage but no trading services (you would open a trading account with a different broker).

Demat accounts with Upstox incur a yearly “annual maintenance charge” (AMC) of INR 150 and an account opening charge of INR 249.

Trading Account

The trading account acts like the cash you use to purchase on the market. This account allows you to place orders on Upstox Pro, trade across multiple asset segments and easily transfer funds from your bank to your trading account. This account has a zero AMC fee and you can enjoy free equity delivery trading with no hidden charges.

Upstox offers a 2-in-1 joint account, which combines the Demat and trading accounts, providing a holistic trading solution.

When opening an account, you will need to submit documents that prove your identity and go through a KYC account verification process.

Trading Hours

Trading times on Upstox adhere to the following market hours:

- NSE Cash, BSE Cash and NSE F&O: 09:15 to 15:30 IST

- NSE Currency Derivatives: 09:00 to 17:00 IST

- MCX: 10:00 to 23:30 IST from April to October, 10:00 to 23:55 IST from November to March. On Saturdays, the market timings are between 10:00 and 14:00 IST.

Customer Support

If you encounter login issues on Upstox Pro or have any queries, contact the Upstox customer care team:

For New Accounts:

- Helpline Numbers: 022 4179 2991, 022 6904 2291, 022 7130 9991 (everyday from 09:00 to 23:00 IST)

- Email: new.account@upstox.com

For Existing Users:

- Helpline Numbers: 022 4179 2999, 022 6904 2299, 022 7130 9999 (Mon – Fri 08:00 to 23:00 IST or Sat – Sun 09:00 to 23:00)

- Email: support@upstox.com

- Headquarters Address: RKSV/Upstox, 30th Floor, Sunshine Tower, Senapati Bapat Marg, Dadar (W), Mumbai, Maharashtra 400013

Safety & Security

As a member of the CDSL, Upstox members can access a TPIN number as an alternative to the Power of Attorney (PoA) for Demat accounts. This is a 4-digit telephone Personal Identification Number that verifies the authenticity of a client for a more secure service.

Additionally, Upstox has a two-factor authentication (2FA) process for logging in to your account, which requires your year of birth, user ID and password and year of birth. However, the broker was hacked in April 2021 after a data breach, where the broker has since updated its security systems.

Upstox Verdict

Upstox is a discount broker with a wide-ranging product offering for Indian traders of all experience levels. The broker boasts low trading fees and a powerful web trading platform called Upstox Pro. With an established history of 10 years in business, its user base in India has grown to the millions. However, Upstox is limited to Indian clients (residents or NRIs), so international traders may need to look elsewhere to earn money trading.

FAQs

Is Upstox A Good Discount Broker?

Upstox has one of the best discount offerings in the market when compared to other low-fee brokers like Angel Broking and Zerodha. You can find a zero-fee brokerage plan on mutual funds and IPOs, as well as a maximum INR 20 flat fee no matter how large the order size is.

Is Upstox A DP?

Yes. Upstox is a depository participant (DP) of CDSL and NSDL. These are two designated depositories in India. Therefore, when opening a Demat account with Upstox, you’re essentially opening that Demat account with CDSL or NSDL through the broker.

Does Upstox Offer A Demat Account?

Yes. Upstox offers a Demat account on both web and mobile platforms. This Demat account can be coupled with a trading account for a 2-in-1 or both a trading and bank savings account for a 3-in-1.

What Is A TPIN in Upstox?

A TPIN is a 4-digit unique personal code, which you can manage on Keystone. A TPIN verifies transactions as an added security layer and makes security processes on the phone much faster.

Does Upstox Offer A 3-In-1 Account? What are the charges and benefits?

Yes. Upstox offers a 3-in-1 account for existing customers, which includes a Demat, trading and savings account bundled in one. Therefore, you can trade seamlessly without worrying about transferring funds. This account also allows you to trade in all of the broker’s asset segments. This is made possible with their partnership with Indusind bank. There are no charges when opening a 3 in 1 account on Upstox.

Top 3 Alternatives to Upstox

Compare Upstox with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- NinjaTrader – NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand’s award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

Upstox Comparison Table

| Upstox | Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|---|

| Rating | 2.9 | 4.3 | 4.5 | 4.5 |

| Markets | Stocks, Futures, Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | INR 0 | $0 | $100 | $0 |

| Minimum Trade | INR 500 | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | SEBI | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC | NFA, CFTC |

| Bonus | – | – | Active Trader Program With A 15% Reduction In Costs | – |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | NinjaTrader Desktop, Web & Mobile, eSignal |

| Leverage | – | 1:50 | 1:50 | 1:50 |

| Payment Methods | 2 | 6 | 8 | 4 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

NinjaTrader Review |

Compare Trading Instruments

Compare the markets and instruments offered by Upstox and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Upstox | Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|---|

| CFD | No | Yes | No | No |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | No |

| Copper | No | No | No | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | No | No |

| Bonds | No | Yes | No | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | No |

Upstox vs Other Brokers

Compare Upstox with any other broker by selecting the other broker below.

The most popular Upstox comparisons:

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Upstox yet, will you be the first to help fellow traders decide if they should trade with Upstox or not?