Ultima Markets Review 2025

Awards

- Best Broker in Asia 2024, International Business Magazine Awards

- Best Multi-Asset Trading Platform Asia 2024, International Business Magazine Awards

- Best Forex Trading Platform Asia Pacific 2024, World Business Outlook Awards

- Best CFD Broker Asia 2024, World Business Outlook Awards

- Fastest Growing CFD Broker Asia 2024, World Business Outlook Awards

- Most Popular Broker 2024, BrokersView

- Best CFD Broker-APAC 2024, Traders Fair Hong Kong

Pros

- Flexible trading accounts with spread-only pricing or low commission solutions

- Easy-to-use copy trading app available on Apple and Android

- Regulated by the Cyprus Securities & Exchange Commission

Cons

- $20,000 minimum deposit for the best trading conditions

- Narrow range of trading instruments with no cryptos

- Weak regulatory oversight through the offshore branch

Ultima Markets Review

In this review of Ultima Markets, our team assesses the pros and cons of signing up. We evaluate the broker’s accounts and fees, platforms and tools, regulatory status, customer support and market research. Our experts share their key findings for each area we tested Ultima Markets in.

Assets & Markets

2.5 / 5Ultima Markets offers a slim product portfolio with 250+ CFDs spanning popular asset classes, such as forex, stocks and commodities. The main offering of forex is limited to just 30+ currency pairs, which lags behind many top brokers.

You can trade the following assets:

- Forex – 80+ pairs including majors like the EUR/USD

- Shares – Popular US stocks including Meta, Google and Apple

- Indices – Major indices including S&P 500, GER 40 and ASX 200

- Commodities – Leading metals and energies including Crude Oil, Gold and Silver

Ultimately, if you want to build a diverse portfolio, alternatives like eToro are a better option, with 3000+ instruments.

Account Types

Ultima Markets offers three live accounts; Standard, ECN, and Pro ECN.

We appreciate the flexibility this provides, with the Standard account best for beginners looking for spread-only pricing, the ECN account serving investors looking for the tightest spreads, and the Pro ECN account designed for high-volume traders.

Importantly, there are no differences in platform access, trading instruments, and the maximum leverage between each account.

The range of base currencies will also appeal to global traders; USD, AUD, GBP, EUR, CAD, JPY, SGD, and HKD.

We have highlighted the key differences between the accounts below.

Comparison of Trading Accounts

| Standard | ECN | Pro ECN | |

|---|---|---|---|

| Minimum Deposit | $50 | $500 | $20,000 |

| Spreads | From 1 pip | From 0 pips | From 0 pips |

| Commission | $0 | $5 | $3 |

How To Open A Live Account

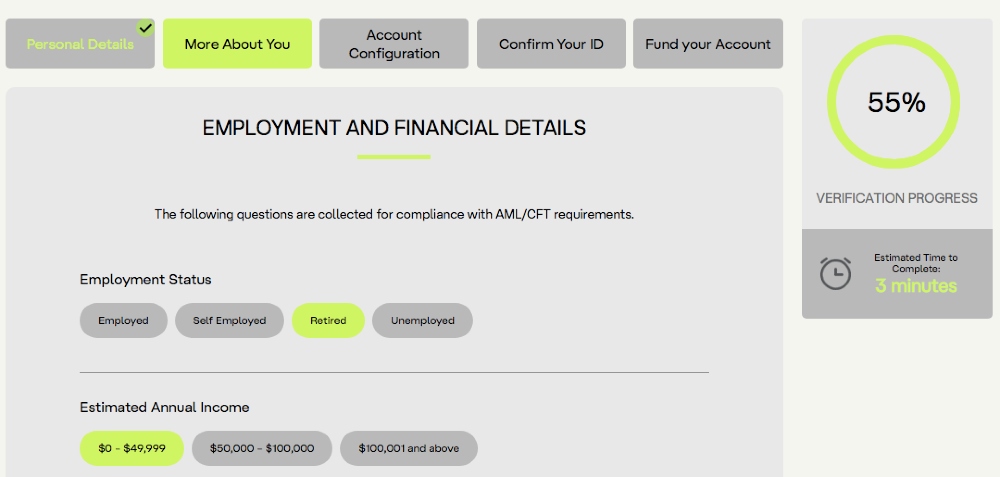

I found Ultima Markets’ application process fairly lengthy, with numerous stages involved and detailed information on my employment history and financial situation. Nevertheless, I was able to complete the sign-up process in less than twenty minutes by following these steps:

- Choose ‘Open Live Account’ at Ultima Markets

- Enter your personal details in the fields (name, country of residency, phone number, email, and account type)

- Add the missing details on the initial ‘Personal Details’ page and click ‘Next’

- Input your current residential address and confirm whether you are a US citizen, then click ‘Next’

- Provide your employment information and financial status

- Configure your account requirements by choosing a trading platform, account type, and base currency

- Review and confirm adherence to the T&Cs by clicking the tick box

- Upload an identity and proof of residency document

- Fund your account and start trading

Payment Methods

Ultima Markets offers a modest selection of deposit methods, with support for bank cards, wire transfers and cryptos like Bitcoin and Tether. Unfortunately, there are limited e-wallets like PayPal, which typically facilitate low-cost, secure and near-instant deposits.

On a lighter note, there are no fees charged by the broker, though third-party banking charges may apply for wire transfers which is fairly standard.

Payment times are in line with most competitors:

- Credit/debit card – one to two hours processing

- International bank wire transfer – two to five working days processing

- Crypto – one to two hours processing

- E-wallets – one hour processing

How To Make A Deposit

I find funding my live trading account straightforward, taking just a few minutes to complete:

- Log in to the Ultima Markets client portal

- Click ‘Funds’ from the menu and then ‘Deposit Funds’

- Choose a payment method and follow the on-screen instructions

Note that you must complete account verification before you can deposit funds.

Trading Fees

Ultima Markets offers average trading fees. The Standard account uses variable spreads which start from 1 pip on popular assets like major forex pairs. This is reasonable but higher than competitors like XTB.

ECN account holders benefit from tighter spreads from 0 pips but the $5 commission is higher than many alternatives, which generally charge around $3.50.

The best pricing is offered on the Pro ECN account, with very low commissions of $3, though with a $20,000 minimum deposit, this will be out of reach for many retail traders.

Non-Trading Fees

Ultima Markets scores better when it comes to non-trading fees. There are no deposit or withdrawal fees, nor inactivity penalties to deter casual investors.

The key charge to be aware of is industry-standard swap fees that apply to positions held overnight.

Platforms & Apps

Ultima Markets offers the reliable MetaTrader 4 (MT4), available as a web trader, desktop download, or mobile app. This is one of the best platforms in our opinion, catering to a range of trading styles, investing horizons and automated strategies.

Highlights for me are the excellent charting and analysis tools. There are 30+ integrated indicators, 9 timeframes, 4 pending orders, and support for Expert Advisors (EAs).

I find it particularly strong for forex trading, with excellent levels of customization and thousands of additional indicators and tools available from the MetaTrader marketplace.

How To Open A Trade

I find opening new positions on MT4 straightforward. Simply follow these steps:

- Right-click on the instrument from the ‘Market Watch’ and choose ‘New Order’

- Input the trade parameters including trade volume, order type, and any stop losses

- Add a comment if desired

- Click ‘Buy’ or ‘Sell’ to confirm the trade

Ultima Markets also offers its own app, available on iOS and Android devices. I find the application intuitive, with dynamic charting and risk management tools so you can trade on the go. I can manage my account, analyze price movements, and view key updates in the integrated calendar.

Regulation & License

Ultima Markets is regulated by three financial bodies, and although not all are top-tier, we are reassured by oversight from the Cyprus Securities and Exchange Commission (CySEC), license number 426/23.

With this, EU traders benefit from robust safety measures, including segregated client funds, negative balance protection, and access to the Investor Compensation Fund (ICF).

Non-EU traders will sign up with the broker’s global entities, which are regulated by the Financial Services Commission (FSC) of Mauritius and the St Vincent and the Grenadines Financial Services Authority (SVGFSA). Unfortunately, we don’t consider these trustworthy regulators, and traders may not receive sufficient account and legal safeguards.

Leverage

Ultima Markets offers leverage up to 1:30 in the EU, in line with local regulations. This means a $100 outlay will give you $3,000 in buying power.

The broker’s offshore branch offers much higher leverage up to 1:2000, which is among the highest we have seen. Yet while this may be attractive to traders with a large risk appetite, we recommend caution and risk management tools.

The margin call level is 80% and a stop-out will occur at 50%.

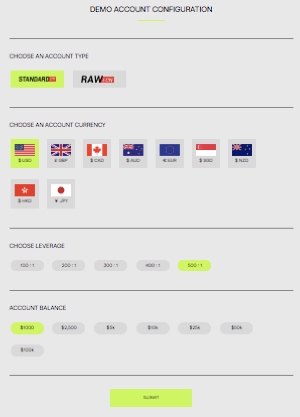

Demo Account

We were pleased to find that Ultima Markets offers a free demo account. Customers can trade with a virtual account balance of up to $100,000 and high leverage up to 1:500.

The downside is that the practice profile is only available for 90 days – we prefer brokers that offer unlimited paper trading so you can refine strategies alongside your live account.

How To Open A Demo Account

It only took me a couple of minutes to sign up for a demo trading account:

- Click the ‘Open Account’ icon on the broker’s homepage

- Choose ‘Open Demo Account’

- Enter your personal details in the fields below and click ‘Next’

- Add your demo account parameters on the following page (trading platform, account type, base currency, leverage, and virtual account balance), then click ‘Open Demo Account’

- Login credentials will displayed on the following screen and sent to your email address

Tools

Ultima Markets is a no-frills broker and we feel the lack of additional tools and features is a downside that will disappoint traders looking for useful extras.

Traders at Ultima Markets are limited to basic tools such as an economic calendar and trading calculators including margin, profit, and swap rates. There are also some market news and insights published on the broker’s website, plus free VPS hosting.

Looking at the positives, the firm’s proprietary social trading app is a notable advantage. The mobile application is available for free download and provides access to a pool of like-minded traders to share strategy ideas.

We were also able to copy experienced traders’ positions in real time. Our team found it straightforward to view the performance statistics of registered signal providers, with the risk parameter replication being a favorite feature of ours. Minimum investment amounts vary by provider, though the signals we found required an average of $50-$100.

Education

0.8 / 5Ultima Markets does not score well when it comes to educational content. The broker offers very little in terms of tutorials or learning materials for beginners, and we see this as a significant disadvantage compared to the likes of eToro.

Bonus Offers

We found that access to bonuses varies by country of residence. Traders registered under the CySEC entity will not be able to access any promotional offers, such as a no deposit bonus. This is due to regulatory restrictions.

Incentives for global traders are provided, however. When we signed up for an Ultima Markets account, we were offered a 20% and 50% deposit bonus. The higher-tier welcome reward is offered to traders depositing $500 or more, with the 20% scheme for deposits thereafter over $5,000. After reviewing the terms and conditions, we noted that total credits are capped at $10,000 and only profits generated using the bonus can be withdrawn.

The broker also runs trading competitions with cash prizes for the 10 top investors that can prove their skills. These competitions are usually free to enter for account holders.

Unfortunately, there are no rebate schemes or discounts based on trading volumes which may deter serious traders.

Execution

We see Ultima Markets’ ECN execution model as a strong point, with the broker connecting to dozens of top-tier liquidity providers via the OneZero bridge.

The brand uses the NY4 data center to secure low latency and ultra-fast order execution, averaging under 20ms – we consider anything less than 100ms fast.

Trading Restrictions

We did not uncover any trading restrictions while using Ultima Markets. This means scalping, hedging and automated trading are all supported.

Customer Service

We are reassured to see that Ultima Markets offers 24/5 customer support, covering standard trading hours for most markets.

You can contact the broker via email, live chat, or Telegram. Though there is no telephone contact, the online chat function served us well during testing and we received responses to our queries within three minutes.

To get in contact with Ultima Markets:

- Live Chat – Icon found bottom right of the broker’s website

- Email – contact@ultimamarkets.com or info@ultimamarkets.com

- Telegram – @ultimamarkets

Company Details

Ultima Markets was founded in 2016 and has its registered head office in Mauritius.

Today, the company provides services to users in 170+ countries and has entities regulated by the FSC Mauritius, SVGFSA, and CySEC.

The brand offers retail investors access to 250+ CFDs on the MetaTrader 4 platform.

Trading Hours

Ultima Markets trading hours vary by instrument. Forex, for instance, can be traded 24/5 while stocks follow their respective market opening times.

When we used Ultima Markets, we found that daily updates of server changes and market updates including public holidays are routinely published in their announcements.

Should You Trade With Ultima Markets?

Ultima Markets offers a basic trading environment for online investors. The $50 minimum deposit is accessible, the MetaTrader 4 platform is reliable, and you can speculate on popular global markets. There is also a social trading app for hands-off investors.

Considering the negatives, Ultima Markets trails other brokers in many areas. Trading fees aren’t the lowest, there are limited deposit and withdrawal options, and there is little in terms of market research, education or advanced trading tools.

Overall, we recommend considering alternatives.

FAQ

Is Ultima Markets Legit Or A Scam?

Ultima Markets has a branch that is regulated by CySEC, which is a reassuring sign of legitimacy. However, the offshore global entity operates with limited regulatory oversight and there are some negative user reviews. As a result, we recommend caution.

Can I Trust Ultima Markets?

Ultima Markets does not have the highest trust score. Our team uncovered complaints about withdrawal issues, while its regulatory credentials are weak if you trade with the offshore branch.

Can You Make Money Trading With Ultima Markets?

It is possible to make a profit when trading forex with Ultima Markets. You will however need to have suitable financial market knowledge and apply risk management strategies, especially if trading with leverage.

Is Ultima Markets A Regulated Broker?

Ultima Markets Cyprus Limited (Ltd) is regulated by the Cyprus Securities and Exchange Commission (CySEC). This is a respected financial watchdog.

On the downside, the global subsidiary is regulated by the Financial Services Commission of Mauritius and the St Vincent and the Grenadines Financial Services Authority, which are less reputable.

Does Ultima Markets Offer Low Trading Fees?

Ultima Markets offers average trading fees. The most competitive pricing can be found on the Pro ECN account, with spreads from 0 pips and a $3 commission. However, the $20,000 minimum deposit will put this out of reach for many beginners.

Alternatively, the Standard account offers spreads from 1 pip and zero commissions, which is reasonable although not the cheapest we have seen.

Does Ultima Markets Have An App?

Yes, Ultima Markets offers a proprietary mobile app, available for download to iOS and Android devices. You can use the app to monitor financial markets, make changes to your account, and open/close positions in real-time.

Alternatively, MT4 can be used as a mobile application and there is a bespoke copy trading solution.

How Long Do Withdrawals Take At Ultima Markets?

Fund withdrawals from a live trading account vary by method, but are in line with most competitors. International wire transfers typically incur the longest wait times of up to five working days.

Top 3 Alternatives to Ultima Markets

Compare Ultima Markets with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Ultima Markets Comparison Table

| Ultima Markets | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| Rating | 3.7 | 4.3 | 3.6 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $100 | $1 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | CySEC, FSC, SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | SVGFSA |

| Bonus | 50% Deposit Bonus up to $10,000 | – | 10% Equity Bonus | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | UM Social, UM App, MT4 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:30 (EU), 1:2000 (ROW) | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 6 | 6 | 11 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Ultima Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Ultima Markets | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Ultima Markets vs Other Brokers

Compare Ultima Markets with any other broker by selecting the other broker below.

The most popular Ultima Markets comparisons:

Customer Reviews

5 / 5This average customer rating is based on 2 Ultima Markets customer reviews submitted by our visitors.

If you have traded with Ultima Markets we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Ultima Markets

Article Sources

- Ultima Markets Website

- Ultima Markets Cyprus Ltd - CySEC License

- Ultima Markets Ltd - FSC Mauritius License

- Ultima Markets Ltd - SVGFSA License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

The ultimate trading experience!

Even though they’re new, Ultima has been the best broker for me. I’ve never faced any problems with them. They’re a multi-regulated and highly reliable broker. Additionally, their website UI is user-friendly, and the trading app is absolutely fantastic!

I used them for a couple of years, never had any problems, and Interactive Brokers, heralded by many as a promising investment gateway, caught my attention with its plethora of tools and features. Hence is a thumbs up from me ! Very recommended.