CFD Trading In Uganda

Want to use contracts for difference (CFDs) to profit from rising and falling markets in Uganda and globally?

In this beginner’s guide, we’ll break down everything you need to know about CFD trading in Uganda: how it works, the local regulatory environment, the opportunities, the risks, and a detailed example trade.

Quick Introduction

- Whether you’re eyeing gold prices, major tech stocks, or forex pairs like USD/UGX, CFDs provide a way to trade on price movements without owning the assets themselves.

- With CFDs, you can trade both long (buy) and short (sell) positions, making it possible to benefit from both upward and downward market trends.

- CFDs offer leverage, meaning you can open larger positions with a smaller deposit of Ugandan shillings (UGX). This can amplify returns but also losses.

- Uganda’s Capital Markets Authority (CMA) regulate other aspects of financial markets, but CFDs are not explicitly covered under their powers, creating a gap in protection for traders.

Best CFD Brokers In Uganda

These 4 CFD providers stand out as the best for traders in Uganda based on our hands-on tests:

How Does CFD Trading Work?

CFDs allow Ugandan traders to engage with global markets without incurring the extra cost and administration necessary to own the assets.

You trade the price difference and utilize the leverage provided by your CFD broker to make informed predictions about whether the price of an asset will go up or down.

For traders with less starting capital, leverage provides an opportunity to participate in larger markets. You can control and open bigger positions but only commit a fraction of the total value (or margin) required to buy an equivalent number of popular shares like Bank of Baroda Uganda listed on, for example, the Uganda Securities Exchange.

Let’s use an example of trading a Ugandan stock market index, the Ugandan All Share Index (ALSI), to demonstrate the opportunities and risks of trading with leverage.

If you think the ALSI will rise, you may consider buying a CFD position. If each CFD contract is valued at Ugandan shillings (UGX) 1,187, and your brokerage requires a 30% margin, then to take a position on 1,000 CFD contracts, you’d need a margin of UGX 356,100 (1187 x 1000 x 30% = UGX 356,100).

If the ALSI rises to 1,200, the price increase will yield UGX 13 per contract. By closing your position, you would bank a total profit of UGX 13,000 (1,000 contracts x UGX x 13), excluding broker fees. But, if the index falls to 1,174, you will lose UGX 13,000.

This ALSI index CFD trading example highlights the inherent risks of CFD trading; although you can control increased size using leverage, both the gains and losses are amplified.

Knowing how margin and leverage work is vital to your potential success. If you are new to CFD trading, why not open a demo trading account?Most reputable brokers provide demos free of charge. They’re an excellent introduction to CFD trading. You can practice trading strategies, experiment with technical indicators and build confidence before risking your Ugandan shillings in the CFD markets.

What Can I Trade?

Uganda provides many trading opportunities for CFDs in various financial markets:

- Stock CFDs – You can trade some of the most active and high-value Ugandan stocks listed on Uganda’s Securities Exchange, such as British American Tobacco Uganda (BATU) and Airtel Uganda. You could also consider trading other stocks from US, European and global markets which are more widely available and traded in higher volumes.

- Index CFDs – The Ugandan All Share Index can be traded as a CFD. This stock market index tracks the performance of all the companies listed on Uganda’s Securities Exchange. Many CFD traders will prefer to trade global market indices to capitalize on a stock exchange’s overall performance rather than invest in individual shares. Therefore, you may also consider trading the leading global index CFDs like the Dow Jones and NASDAQ. Due to liquidity, the trading costs, like fees, spreads and commissions are generally competitive.

- Forex CFDs – The Ugandan shilling (UGX) is a currency traded in the foreign exchange market. An actively traded UGX currency pair is the USD/UGX, which is popular due to the international trade in Uganda’s primary agricultural commodities, which account for about 80% of the country’s total exports. USD/UGX is liquid because agri products are often sold in USD, and it offers opportunities for short-term currency traders interested in trading UGX. However, it’s essential to know that the spreads trading exotic and minor pairs are higher than those for major USD and EUR pairs.

- Commodity CFDs – Vital global commodities, such as precious metals like gold and silver and crude oil, can be traded as CFDs in Uganda. This lets traders speculate on price movements often linked to the domestic economy and macroeconomic events.

- Crypto CFDs – The allure of trading digital assets has attracted the attention of Uganda’s traders. You can trade cryptocurrency CFDs like Bitcoin and Ethereum for access to the volatile world of crypto.

Is CFD Trading Legal In Uganda?

Yes, CFD trading is legal in Uganda, but it falls into a somewhat grey area due to the lack of a specific local regulatory framework.

Ugandans can access international platforms offering CFDs, but the absence of local regulation means traders must take extra precautions to ensure their activities are safe and legitimate.

Institutions like the Bank of Uganda (BoU) and the Capital Markets Authority (CMA) oversee various elements of financial markets, however CFDs are not explicitly regulated under their powers.

Ugandans should prioritize brokers regulated by credible authorities like the FCA in the UK and ASIC in Australia. Regulatory oversight ensures that providers follow strict guidelines for transparency, security, and fair trading practices.

In case of disputes, Ugandan traders might face challenges seeking redress since most brokers operate outside Uganda. This underscores the importance of choosing a well-regulated platform.

CFD trading is legally accessible in Uganda, offering opportunities to trade globally. However, the lack of local regulation makes it crucial for traders to approach this activity cautiously.By choosing a regulated CFD trading platform, understanding the risks, and trading responsibly, Ugandan traders can securely explore the benefits of CFDs.

Is CFD Trading Taxed In Uganda?

CFD trading profits are taxable in Uganda, and the Uganda Revenue Authority (URA) oversees taxation matters.

Although there isn’t specific guidance on CFD trading, general tax regulations likely apply, particularly under Uganda’s Income Tax Act and other relevant tax laws.

The URA requires individuals and businesses to declare all income, including trading profits. Depending on the trader’s circumstances, CFD trading earnings would typically be classified as personal or business income.

Uganda has a progressive income tax structure for individuals:

- 10% for income between UGX 2,820,000 and UGX 4,020,000 annually.

- 20% for income between UGX 4,020,000 and UGX 4,920,000 annually.

- 30% for income exceeding UGX 4,920,000 annually.

If CFD trading is considered part of a registered business activity, the profits may attract corporate income tax at 30% of taxable profits.

The URA imposes capital gains tax (CGT) on profits from selling capital assets like real estate or shares. However, CFDs are typically treated as derivative contracts and would more likely fall under income tax rather than CGT.

Any withdrawals or earnings sent to Ugandan bank accounts might attract withholding tax if the transactions involve international payment processors. According to the URA, withholding tax can be applied at 15% on certain payments from non-resident sources.

An Example Trade

Let’s walk through how you could use a CFD to trade Uganda’s financial markets.

Background

Stock screeners often alert me to stock trading opportunities on exchanges. However, I’m always cautious when acting on suggestions if the exchanges have thin trading conditions due to a lack of trading securities listed and low trading volume.

Instead, I’ll consider a forex CFD or, typically, an index CFD. Uganda’s stock exchange only has a handful of listed firms. Still, the all-share index, the Ugandan All Share Index (ALSI) will be attractive for many residents.

Fundamental Analysis

One of the standout attractions of trading an index is the ability to use fundamental analysis. The usual rule of thumb is that if a country’s economy is performing well and in line with most analysts’ and economists’ expectations, then the index should be bullish.

Unlike analyzing an individual stock, where you’d drill down into the stock’s metrics, with an index, you tend to examine a country’s key economic data, like government borrowing, debt v GDP, GDP growth, unemployment, inflation, interest rates, export and import figures, etc.

Technical Analysis

When I trade an index, I do so on a swing or day trading basis. If I’m looking for reasons to swing trade, I’ll generally look at the daily timeframe (TF), D1, on my charting package.

If I swing trade, I’ll have more time to consider my options than making a rapid day-trading decision. Therefore, I can carefully decide which technical indicators to use in my technical analysis and apply them to my charts.

With swing trading, you also get the opportunity to use the technical indicators (TIs) close to how the original creators intended.

Expert mathematicians like Welles Wilder and John Bollinger didn’t invent the products to apply to 5-15-minute TFs; the TIs pre-date the internet and were initially designed for trading assets like commodities on higher time frames, such as the daily, weekly, and monthly.

I only apply a few TIs from the four main groups: volume, volatility, trend and momentum because some of my trusted indicators can duplicate and overlap information.

More often than not, I’ll only rely on (at most) two indicators combined with an easy-to-translate candlestick formation like Heikin Ashi.

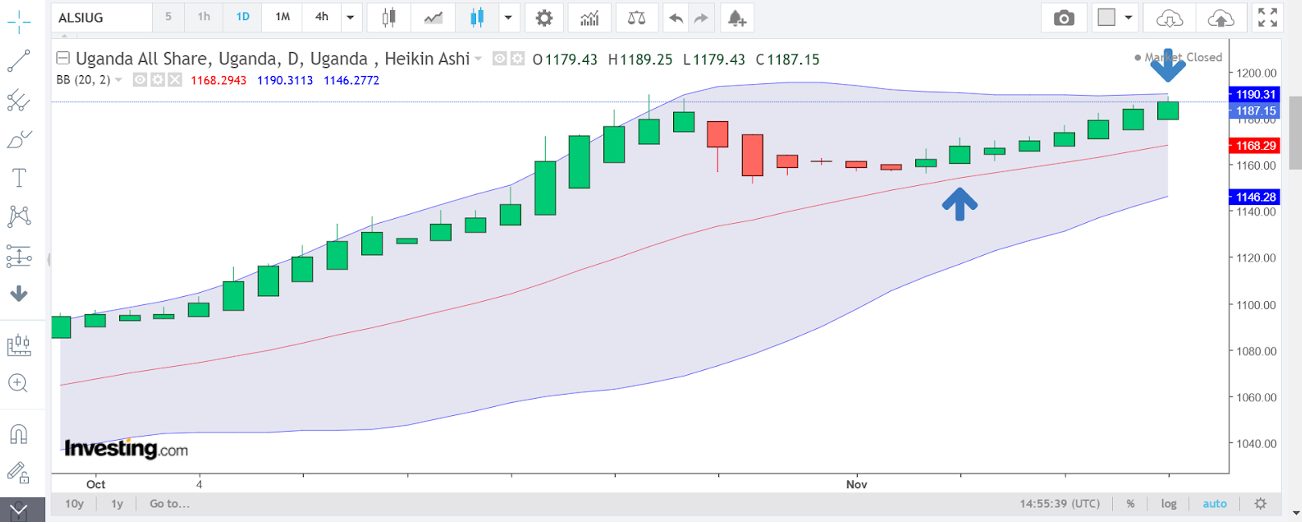

Here, I decided to use only Bollinger Bands (BBs). They’re a tool that helps me identify price trends and potential entry and exit points. BBs consist of three lines that move with the asset’s price.

- Middle band: A moving average of the price.

- Upper band: Set above the middle band by a certain number of standard deviations of price.

- Lower band: Set below the middle band by a certain number of standard deviations of price. BBs tend to widen when volatility is high and contract when volatility is low. They also signal an opportune time to trade when a stock’s price nears the upper or lower band.

1 HR Timeframe

The ALSI D1 chart below shows three distinct trading periods: bullish, ranging, and a return to bullish. The bands widened as the initial bullish period exhausted, and price fell.

This typically indicates a market about to turn; volatility and volume increase in line with increased market activity and expectation as the trend appears to end.

Then, price moved sideways in a tight range as indecision dominated; the candlesticks became small and failed to make lower lows.

After the completion of an inverted hammer with bullish properties, the formation of a full candle confirmed a return to bullish conditions. This is where I entered, as illustrated by the blue upward arrow.

I had confidence in my entry because not only had price failed to make lower lows, but price had failed to pierce the lower band during the short sell-off and sideways movement period.

I entered at 1,162.0 and exited at 1,187.0. My fixed stop loss order was placed at the then-recent low of 1,151.0.I used a CFD to take the trade and traded the equivalent of 1,000 contracts, requiring a 40% margin: 1,162 x 1,000 x 40% = UGX 464,800.

Bottom Line

CFD trading in Uganda offers exciting opportunities to explore global financial markets, but understanding the legal and tax landscape is crucial for success.

While the activity is legal and accessible, the lack of local regulation means traders must choose reputable, internationally regulated brokers for security.

The Uganda Revenue Authority (URA) expects CFD traders to declare profits as part of their personal or business income. Staying compliant by filing accurate tax returns and maintaining proper records is not just a legal obligation; it’s also a smart way to build sustainable trading habits.

Ready to take the next step? Check out DayTrading.com’s pick of the top CFD trading platforms.

Recommended Reading

Article Sources

- Bank of Baroda Uganda - Investing.com

- Uganda Clays

- Uganda Securities Exchange (USE)

- Ugandan All Share Index - Investing.com

- Ugandan shillings (UGX) - Trading Economics

- Economic calendar - Trading Economics

- British American Tobacco Uganda (BATU) - USE

- Airtel Uganda - USE

- Uganda Revenue Authority (URA)

- Uganda's Income Tax Act

- Welles Wilder - Wikipedia

- John Bollinger - Bollinger Bands

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com