CFD Trading In Tanzania

Trading in Tanzania has witnessed a rise in the popularity of contracts for difference (CFDs).

CFDs offer traders in Tanzania an avenue to harness the potential of the nation’s primary exports, such as gold and copper. By speculating on price movements, traders can aim to profit from both rising and falling markets.

The versatility of CFDs extends beyond domestic markets. Traders in Tanzania can venture into the dynamic world of African equities, tapping into the continent’s burgeoning economic growth.

This guide delves into the intricacies of CFD trading in Tanzania, thoroughly examining its benefits and potential drawbacks to ensure that traders are well-informed and compliant.

Quick Introduction

- A CFD is a financial instrument that lets you speculate on the price movement of assets like stocks or commodities without directly owning the underlying asset.

- Unlike traditional investing, CFDs do not confer ownership rights to the underlying asset. This means that you do not receive benefits associated with ownership, such as dividends.

- Leverage is a defining feature, allowing you to control positions that exceed your investment. For instance, 1:50 leverage enables you to maintain a TZS 200,000 position with TZS 4,000.

- CFDs are complex financial instruments that carry significant risks. Leverage amplifies profits and losses while trading costs such as spreads and commissions can erode profits.

- As derivative instruments, CFDs may display minor price differences relative to the actual market price of the underlying asset.

- The Capital Markets and Securities Authority (CMSA) oversees Tanzania’s financial markets. However, a regulatory framework specifically for CFD trading is still developing.

Best CFD Brokers In Tanzania

After thorough testing, we found these 4 CFD trading platforms to be the best choices for traders in Tanzania:

How Does CFD Trading Work?

Consider a scenario in which you’re intrigued by Tanzania Breweries, a Tanzania-based company listed on the Dar es Salaam Stock Exchange (DSE) that produces, distributes, and sells malt beer.

Instead of directly purchasing shares, you could trade a CFD to speculate on price movements and profit from rising and falling prices.

For instance, if you anticipated an increase in the value of Tanzania Breweries stock, you would open a ‘buy’ (or long) position on a Tanzania Breweries’ CFD. Conversely, if you foresaw a decrease in the stock’s value, you would establish a ‘sell’ (or short) position.

This would allow you to trade on margin and control a more prominent position with a smaller initial investment.

Consider a scenario where Tanzania Breweries’ stock is priced at TZS 9,000 per share, and you decide to trade 10 CFDs, each corresponding to one share. The overall value of this transaction would amount to TZS 90,000.

With the leverage provided by CFDs, you are only required to deposit a fraction of the total trade value. For example, if the leverage is 1:20, you would need an initial investment of TZS 9,000.

- If the price rises to TZS 10,000, you make a profit. Each share earns TZS 1,000 more, so your 10 CFDs earn a total profit of TZS 10,000.

- If the price falls to TZS 8,000, you will lose money. Each share will drop by TZS 1,000, meaning your 10 CFDs will lose TZS 10,000.

This example illustrates how leverage can magnify profits and losses in CFD trading.It underscores the importance of rigorous risk management, as this trading strategy is inherent in the potential for significant losses.

What Can I Trade In Tanzania?

CFDs enable you to trade and speculate on a wide range of local and global markets. However, your ability to access these markets depends on the broker you choose:

- Stock CFDs – You may be able to trade prominent stocks listed on the DSE, including companies like NMB Bank and Tanzania Portland Cement. Additionally, you might explore trading stocks from international markets in regions such as the US, Europe, and Asia, which are often more accessible.

- Index CFDs – You could trade the All Share Index (DSEI) as CFDs, which tracks the performance of local firms in Tanzania. Similarly, major global indices such as the FTSE 100 in the UK and the DAX 40 in Germany are also available for trading. These indices typically offer higher liquidity and trading volumes, which can lead to reduced trading costs.

- Forex CFDs – Tanzania’s forex market is developing but has yet to have a substantial global presence. Currency pairs such as TZS/USD, TZS/EUR, and TZS/AUD are not commonly traded in high volumes and are often unavailable based on our observations. Consequently, you might opt for major currency pairs like EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD and USD/CAD. These pairs typically offer the liquidity and trading volume necessary for day traders to exploit market opportunities.

- Commodity CFDs – Commodity trading lets you predict price movements of raw materials and essential goods, including energy products like oil and natural gas, precious metals such as gold and silver, and agricultural products like corn and soybeans.

- Crypto CFDs – In Tanzania, cryptocurrency trading is an exciting possibility. However, since local crypto firms are scarce, you’ll likely rely on international cryptocurrency brokers to trade CFDs on tokens like Bitcoin and Ethereum.

Is CFD Trading Legal In Tanzania?

CFD trading is legal in Tanzania. However, it is not explicitly regulated by local authorities such as the Capital Markets and Securities Authority (CMSA), which oversees the country’s financial and securities markets.

CFD traders in Tanzania typically rely on international brokers that comply with regulations from jurisdictions like the UK, Cyprus, or Australia.

While trading is permitted, you must choose a reputable and well-regulated broker to ensure the safety of your funds and adherence to global trading standards.

Is CFD Trading Taxed In Tanzania?

There is no specific tax regulation in Tanzania that directly addresses CFD trading. However, like other forms of trading, including forex, profits from trading CFDs could be subject to taxation under Tanzania’s general tax laws.

The Tanzania Revenue Authority (TRA) taxes income from various sources, including capital gains from investments.

If your CFD trading results in a profit, it may be considered part of your income and could be taxed accordingly, potentially at personal income tax rates (8% to 30%) or as capital gains tax (30%).

An Example Trade

Let’s explore a hypothetical scenario to understand how CFD trading might work in the Tanzanian market.

Background

Tanzania experienced a significant drop in fuel prices due to a government initiative to stabilize energy costs.

This positive economic development created a surge of optimism in the stock market, benefiting sectors like manufacturing and transportation that rely heavily on energy.

The market sentiment improved, and the DSEI, which represents the overall performance of listed stocks, showed an early upward trend.

Recognizing the potential for further gains, I could have taken advantage of this event by placing a CFD day trade on the DSEI.

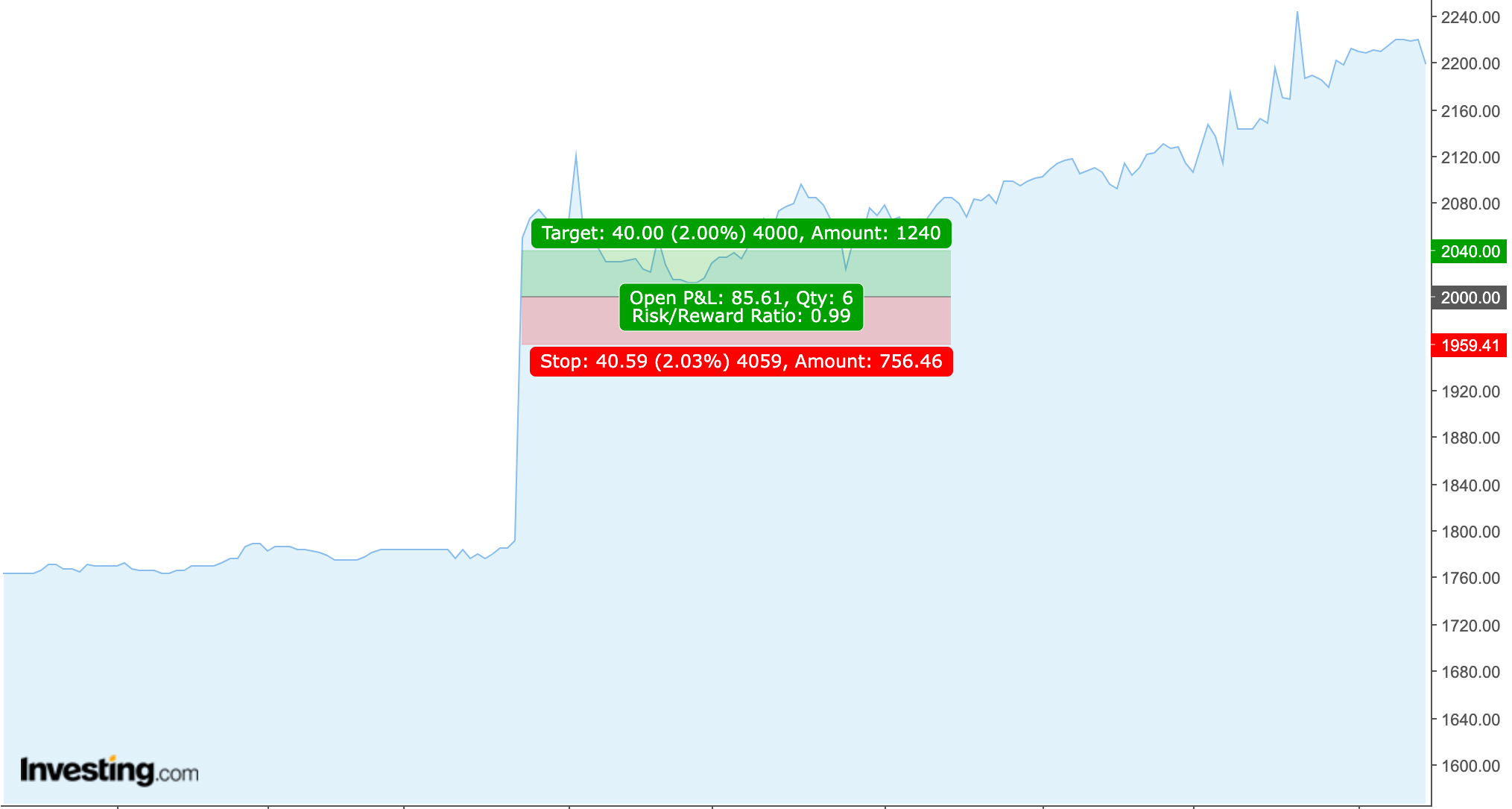

Trade Entry & Exit

By analyzing the DSEI’s price action, I would have observed a strong upward momentum supported by increased trading volumes.

The index was trading at TZS 2,000, and it would have been reasonable to suggest that it could climb for the rest of the day due to the positive news sentiment. Confident in this projection, I could have entered the market with a ‘buy’ (or long) position.

To maximize the potential returns from this opportunity, I could have used CFDs with a leverage of 1:10. Instead of investing the total trade value, I only needed to deposit 10% of the total as margin.

Let’s assume I wanted to buy 200 CFDs for this trade example. The total value of the trade was TZS 400,000 (200 units multiplied by TZS 2,000 per unit), but with the leverage, I only needed to commit TZS 40,000 upfront.

After placing the buy order at TZS 2,000, the index steadily climbed, driven by positive sentiment from the fuel price reduction. By midday, the DSEI had reached TZS 2,040. This would have been a reasonable point to secure a 2.00% profit.

The price difference between my entry and exit was TZS 40 per unit, which resulted in a total profit of TZS 8,000 for the 200 CFDs traded.

Without leverage, executing this trade would have required the full TZS 400,000 upfront, potentially limiting your capital flexibility. Using CFDs, I would have been able to trade with TZS 40,000 as the initial margin, amplifying my effective return on the investment.

Bottom Line

Although local authorities do not specifically regulate CFD trading, it is legal in Tanzania.

Traders typically access the market through international brokers, as limited local firms offer CFD trading.

While profits from CFD trading may be subject to taxation, Tanzania currently does not have specific tax regulations for this activity, and profits may be taxed as part of your income or as capital gains.

You should use a reputable broker and consult local tax experts to comply with the country’s applicable laws.

To start trading CFDs in Tanzania, research the best CFD trading platforms and choose one that best suits your needs.

Recommended Reading

Article Sources

- Capital Markets and Securities Authority (CMSA)

- Dar es Salaam Stock Exchange (DSE)

- Tanzania Revenue Authority (TRA)

- Tanzania Taxes on Personal Income - TRA

- Tanzania Capital Gains Taxes - TRA

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com