How To Use X (Formerly Twitter) For Trading

Traders have long used Twitter, now X, to research market trends and gain insights into retail investors’ appetites. However, integrated TradingView charts and a partnership with the trading platform eToro, demonstrate the site’s ambition to become an investing hub. This tutorial explains how to use X for trading, from accessing breaking news to the best trading accounts. We also unpack the pitfalls to avoid when trading with X.

Trading on X is risky due to fake news and misinformation.

Instead, consider brokers with social trading. These platforms allow users to interact and exchange ideas, similar to X, but they are designed specifically for online trading.

Top 4 Social Trading Brokers

-

1

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

2

Pionex

Pionex -

3

Exness

Exness -

4

IC Markets

IC Markets

From Politics To Trading

Early History

Twitter began its life in 2006 during a brainstorming meeting held by board members of a podcasting company, Odeo. The original idea came from Jack Dorsey, then an undergraduate student, who envisaged an SMS service that could be used to communicate with a small group of people.

In the following years, celebrities, politicians and many other public figures started tweeting and the site’s daily usage climbed from around 40,000 tweets a day in 2007 to 500 million in 2022.

X’s profound influence has been seen in the political upheaval of the Arab Spring in 2007, as demonstrators used social networks to highlight abuses and organise anti-government protests.

Financial X

But the site’s reach is not limited to politics, and communities have come up for almost any interest imaginable, including online trading.

Financial Twitter, or Fintwit, was the name for the global community who use X to discuss all things finance, investment and trading related. The most-discussed Fintwit topics today can be found using X’s hashtag (#) function or by searching through relevant trending topics.

A related X community, Crypto X, uses the social media site to discuss everything related to cryptocurrencies.

Crypto X has been instrumental in generating the hype that has sent tokens to stratospheric price gains, as well as popularizing crypto-adjacent assets such as NFTs.

How To Use X For Trading

With presidents, CEOs, billionaire business owners, day traders and finance scholars among the millions of users tweeting every day, X offers some useful content for online traders.

The basics that traders can use to reach this content include:

- Hashtags – The classic X tool for finding and following trending topics is the # symbol placed at the start of a word. Searching ‘#daytrading’ will bring up all the public tweets which include this hashtag, with the most influential tweets usually coming at the top of the feed. Hashtags also work as links, taking you to a list of tweets containing that hashtag when clicked on.

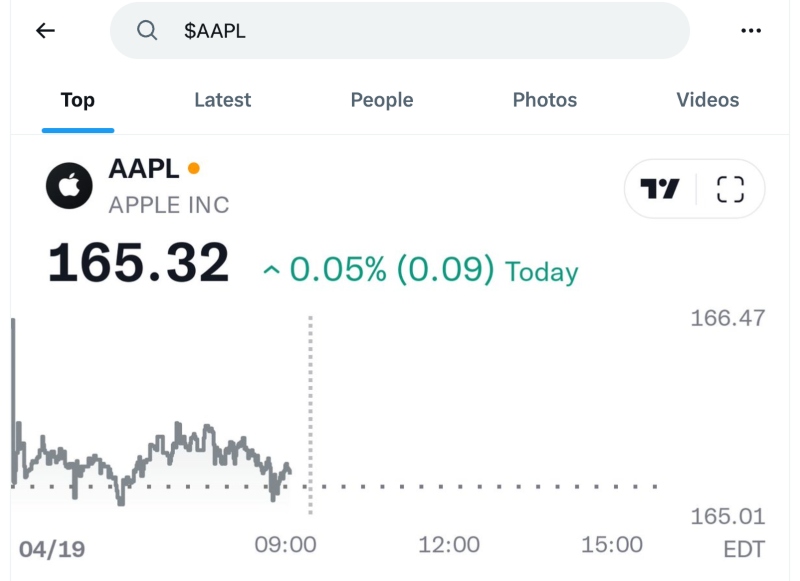

- Cashtags – A cashtag is a $ sign followed by a ticker symbol – $AAPL is the cashtag for Apple, for example. Search or click on a cashtag to reach all the tweets related to that asset.

- Integrated Apps – X’s deals with TradingView and eToro are strides toward a more integrated approach to online trading. The former brings real-time price charts of popular financial assets, while the latter allows investors to view a larger range of charts, and click-through to the eToro platform to trade stocks and crypto.

- Explore Tab – Navigate to the ‘Explore’ tab to find the latest trending topics. You can search these by location or enter a hashtag, cashtag or keyword to look for specific trading topics.

- Advanced Search – X’s advanced search function allows you to filter search results by a range of parameters, including date, engagement, language and more. It also allows you to search for tweets from specific accounts – useful for gauging whether a famous trader is worth following, among other things.

- X Spaces – This social audio function allows X users to have live conversations. It can bring together influential businessmen, politicians and experts to discuss the most important current topics spontaneously, making X Spaces a feature to watch for trading tips.

Through these tools, X can be used to help with trading in three main ways:

- Following ‘Experts’ – Find knowledgeable traders, analysts, journalists and other experts and follow them. The more you engage with experts’ content, the more it will appear on your X feed. Note, users will need to do due diligence to verify the quality and accuracy of information.

- Researching Trends – X offers numerous ways to gauge market sentiment and the mood among online traders. Following hashtags and checking replies to tweets about trading are simple ways to get a feel for market sentiment, but there are more sophisticated methods.

- Reaching Breaking News – X delivers breaking news, making it a useful tool for retail traders who need to react quickly to market events.

Following ‘Experts’

Before social media, retail traders were limited to the analysts on the television, print and radio sources available to them.

With X, you can find and follow a much broader range of opinions, allowing you to hone in on analysis of the specific markets, assets or instruments you want to trade.

If your trades involve a specific country, region or currency pair, political analysts or journalists from the relevant countries could be useful sources for analysis.

Likewise, tech journalists, experts and academics can help you get a head start on the newest products or companies generating market buzz.

You may also find staff and even CEOs of companies you are interested in on X, and following these can help you evaluate whether you want to invest or not.

Follow experts who offer insightful advice or have a unique perspective on one of your areas of interest and note the accounts they interact with for hints of who else to follow.

Some X personalities are also quite responsive to questions from their followers – so you might be able to get their opinion on a topic of interest by tweeting at them or joining a X Space they are involved with.

However, virtually anyone is free to post their opinion on a market – this does not necessarily make them a credible voice nor does it mean the content they post is accurate.

Best Trading Accounts

- @ElonMusk – The founder of Tesla and owner/CEO of X has a track record of posting tweets that move markets – from crashing the price of Tesla in 2020 to pumping Bitcoin prices in 2021.

- @Business – Bloomberg’s X handle says it all – this is all business news, delivered in real-time on the company’s feed to 9+ million followers. The feed also includes links to useful opinion pieces and analysis by Bloomberg contributors.

- @JimCramer – This day trading CNBC host is admired and derided in equal measure, but he is one of the most famous trading accounts on X. Cramer is known for his off-the-wall, energetic performance on his ‘Mad Money’ show and for a decidedly spotty record on financial advice, but he has his finger on the pulse of hyped stocks.

- @Zerohedge – More than 1.6 million X users follow this account for its alternative perspective on market news, which is also available on the Zero Hedge site.

- @PaulKrugman – This Nobel prize-winning economist tweets on a broad range of topics, and his thoughts on macroeconomic trends can provide useful insights.

- @PeterSchiff – With nearly a million followers, this Euro Pacific economist and author is one of the most influential accounts in the X trading sphere.

- @cobie – A crypto trader who posts opinions and appraisals about news and trends from crypto markets and doesn’t shill coins; followed by around 750,000 people.

- @WSBMod – As the apparent moderator of the famous Wall Street Bets subreddit that sent GameStop and AMC stocks stratospheric in 2021, this is a popular account with traders interested in meme stocks.

Researching Trends

X provides a place to research and follow trends thanks to its hashtag and cashtag functions and powerful search tools. These can help you gauge market sentiment about an asset, sector or region that you’re interested in.

Searching for keywords or hashtags will give you an idea of how popular a topic is, but it will also show you who is talking about it and what they are saying.

Some of the most significant trading events in recent years have been driven by trends on social media. The rise of meme stocks like GameStop in 2021 was a striking example of this, as were the huge gains made by popular crypto tokens such as Dogecoin, driven in large part by meme posts on X.

But relevant trends don’t need to be specifically about trading. They could be about an upcoming vote or another anticipated news event that will have a knock-on effect on markets.

If you have a significant vote coming up, for example, X can be useful for gauging the public mood and could help you plan trades that may be affected by the outcome.

Importantly, this is not a scientific method to forecast upcoming events, but it can be useful to traders alongside supplementary analysis and specialized trading tools.

Another benefit of using X to research trends is the site’s integrated apps, including charts from TradingView and compatibility with eToro. Traders can navigate from X to their eToro account to trade an asset with one click. Additionally, users of X’s Android app can automatically access the TradingView chart of supported assets by clicking the cashtag.

Breaking News

It can take hours for stories on breaking news events to be published on traditional news outlets, but on X as long as someone is present and tweeting, you can reach them instantly.

Famous occasions when a story broke on X first include the Hudson River plane crash in 2009, the London G20 riots the same year, the beginning of the Arab Spring in 2010, and Turkey’s 2013 Gezi Park protests.

Likewise, important announcements related to business often break first on X, be it through a journalist tweeting from the scene of a negotiation or from an important figure tweeting themselves.

A good example of this came during the Brexit trade negotiations between the UK and EU, as political correspondents were usually the first source of news on the progress of talks, and they often tweeted their impressions before filing them in a news story.

This can be useful for day traders, as it could allow them to catch the beginning of a profitable trend or reversal early.

The flip side of this is that X is also home to a great deal of misinformation – the notorious fake news – as well as popular accounts that may be tweeting sincere impressions but getting them wrong. Traders should practice caution and ensure they trust the source before acting on breaking news they find on X.

How Not To Use X For Trading

Like any other tool, X needs to be used correctly to get any benefit. And using this social media site irresponsibly when making trades can be dangerous.

For every trustworthy expert or honest trader, there is at least one bot account or shill looking to promote a worthless stock or crypto.

Likewise, trending topics can be manipulated using botnets or other tools that generate large volumes of tweets.

Besides that, scams are frequently run through X, often through fake accounts posting replies to popular trading personalities and sometimes through accounts posing as the personalities themselves!

You can protect yourself while trading on X with the following precautions:

- Look Out For Bots – Bots are widespread on X. You can usually identify them by scrolling through their tweets; large amounts of poorly written or copy-pasted text crammed with hashtags is a good sign of a bot. Additionally, accounts that follow many users but have few followers are also often fake. The ‘verified’ tag was once a good indicator of a trustworthy account, but it is less so now that any paying user can become verified.

- Avoid Self-Interested Accounts – Some influencers use X to promote assets that they have a stake in. These ‘shills’ are particularly widespread in the crypto sphere, where the value of a token can make huge gains from a relatively small amount of investment, at which point the early buyers can dump their stake for a profit.

- Don’t Follow Trends Blindly – Just because something is trending on X, it doesn’t mean there’s any serious interest in it in the real world. Botnets or relatively small but dedicated groups of real posters can be used to promote trending topics that have no concrete basis in reality. The best way to check is to research keywords or hashtags and check the nature of the posts.

- Only Click Trusted Links – With scammers and bots proliferating on X, you should steer well clear of any links posted by an account you don’t trust. And never offer any personal information through a DM.

- Practice Risk Management – If you feel confident enough to make a trade based on the information you find on X, make sure you employ adequate risk management measures. Even if a trend is driven by organic interest, not all meme stocks will take off like GME, and even some of the best analysts and experts get calls wrong. Ensure you are not staking too much on a single trade and use stop losses to limit what you can lose if things go south.

Alternatives To Trading With X

If you’re looking for an alternative to trading on Twitter, now X, you might think of one of the other popular social media sites, such as TikTok and Reddit. However, the best alternatives to using X for trading are often available at online brokers.

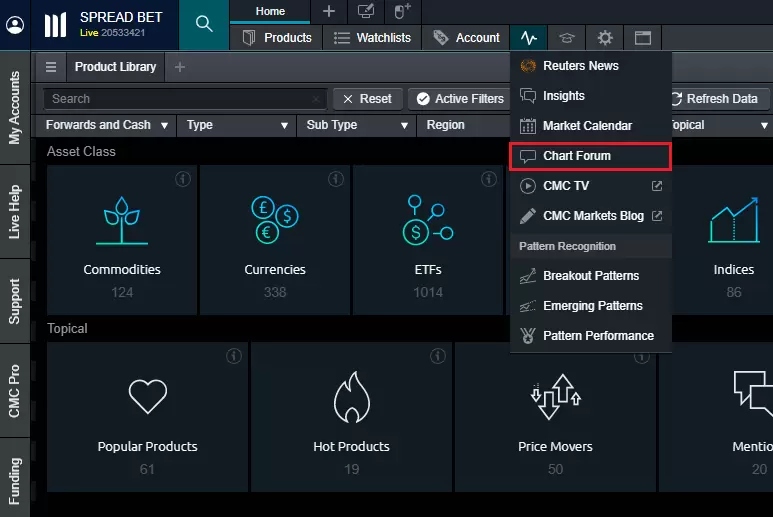

Reputable trading firms such as CMC Markets and Pepperstone provide excellent resources, including news feeds, powerful trading platforms with charting tools, expert market analysis and educational resources.

Importantly, curated analysis content provided by these brokers cuts out some of the risks posed by unknown accounts on X, and there will be far less random noise to deal with.

Additionally, you may become a better trader by making use of the educational content and grappling with all the analysis features on the trading platform. This in turn will help you recognise good (and bad) trading advice available on sites like X.

Another option is social trading. These increasingly popular platforms allow beginners to replicate the trades of profitable investors. Brands, including CMC Markets and Pepperstone, also allow users to interact, swapping tips and insights, similar to X. The key difference is that they are built and used solely for trading.

Bottom Line

X is a popular social media site that offers opportunities to traders, but it does not come without risks. X traders should strive to only follow trustworthy accounts and ignore self-interested influencers or bot-driven trends.

For many, the best practice is to rely on a broker for traditional trading purposes and to use X as a supplementary news source and research tool.

FAQs

How Do You Use X For Stock Trading?

You can use X to look up the latest news about companies, sectors or geographical regions and learn about developments that might affect stock prices. You can also follow ‘experts’ to get their opinions about the latest market news and company reports.

But while X can be a useful resource for retail investors, you should ensure that you are knowledgeable about stock trading before you make any trades based on information on X.

Should Beginners Use X For Trading?

It is possible for beginners to use X to trade, but it isn’t advisable. There is a lot of misinformation floating around X, and this could lead to poor trading decisions.

It would be better for a beginner to learn to trade on a demo account before making use of X to inform their real-world trades.

Alternatively, copy trading allows novice investors to follow the strategies of profitable traders while also exchanging ideas and tips.

Who Should You Follow On X For Day Trading?

To make the most of X, follow famous traders in the assets and regions you are interested in. These may give you insights into short-term market movements that are useful for day trading.

Popular trading accounts on X include @JimCramer (day trading CNBC host) and @PeterSchiff (Euro Pacific economist).

What Exchange Is X Trading On?

Before Elon Musk bought X in 2022, the company was traded on the NYSE. However, since X became a private company, it is not traded on any exchange.

Why Is X Not Trading On The Stock Market?

X is a private company since Elon Musk’s buy-out in 2022, so you can no longer trade X stock on any exchange.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com