CFD Trading In Trinidad And Tobago

In Trinidad and Tobago, the interest in contracts for difference (CFDs) has been steadily growing as more people look to diversify their portfolios and explore global markets.

But, like with any financial instrument, trading CFDs comes with its share of risks and rewards. That’s why we’ve crafted this beginner’s guide: to give you the insights you need to trade smarter, safer, and with confidence.

So, grab a cup of coffee (or your favorite tropical drink), and let’s dive into the vibrant world of CFD trading in Trinidad and Tobago.

Quick Introduction

- CFD traders in Trinidad and Tobago can diversify their investments beyond the island’s economy, tapping into global markets, whether it’s stocks from Wall Street, commodities like gold, or indices such as the FTSE 100.

- One standout benefit of CFDs is the ability to trade both rising and falling markets. Whether global oil prices (a key local industry) are climbing or dipping, traders can use CFDs to potentially profit by going long or short.

- CFDs offer leverage, meaning you can control a larger position with a smaller investment. This feature can amplify returns without requiring significant capital. However, it’s crucial to manage the risks that come with leverage.

- In Trinidad and Tobago (T&T), there’s no capital gains tax on trading profits, which gives CFD traders a distinct edge compared to investors in many other countries.

- CFD trading is legal in Trinidad and Tobago, but the country doesn’t have specific regulations governing it, making it essential to choose a trusted overseas provider that’s well-regulated.

Best CFD Brokers In Trinidad And Tobago

Following our extensive tests, these 4 CFD trading platforms are superior for traders in Trinidad and Tobago:

How Does CFD Trading Work?

CFD trading allows T&T investors to engage with global markets without the extra cost and admin needed to own the assets.

You only trade the difference with CFDs and use the leverage provided by your CFD broker to make well-researched predictions about whether the price of an asset will go up or down.

With leverage, you control and open bigger positions but only commit a percentage of the total value (or margin) required to buy an equivalent number of popular shares like CIBC Caribbean Bank listed on the Trinidad & Tobago Stock Exchange: TTSE.

To bring the pros and cons of leverage to life, let’s look at an example trading the T&T All Share Index through a CFD.

If you think the All T&T Index will rise, you’d think about buying a CFD position. If each CFD contract is valued at Trinidad and Tobago dollars (TTD) 1,580, and your brokerage requires a 30% margin, then to take a position on 10 CFD contracts, you’d need a margin of TTD 4,740 (1,580 x 10 x 30% = TTD 4,740).

If the All T&T rises to 1,600, the price increase will yield TTD 20 per contract. By closing your position, you would bank a total profit of TTD 200 (10 contracts x 20), excluding your broker fees. However, if the index falls to 1,560, you will lose TTD 200.

This All T&T index trading example highlights the inherent risks of CFD trading; you can control increased size using leverage, but the gains and losses are magnified.

Understanding how margin and leverage work is critical to your risk and success. If you’re a beginner trader, open a demo trading account.They’re a brilliant introduction to CFD trading. You can get familiar with platforms, practice new strategies, experiment with indicators and build confidence before risking your real money in the CFD markets.

What Can I Trade?

Trinidad and Tobago provides many trading opportunities for CFDs in various financial markets worldwide and domestically:

- Stock CFDs – You may be able to trade some of the most popular individual and high-value Trinidad and Tobago stocks listed on the Trinidad & Tobago Stock Exchange, like Massy Holdings. You could also consider trading other stocks from US, European and other global exchanges. These are more widely available and generally have more competitive trading costs.

- Index CFDs – The T&T All Share Index is a stock market index that tracks the performance of all the companies listed on the TTSE. Some CFD traders based in Trinidad and Tobago may prefer to trade market indices to capitalize on a stock exchange’s overall performance rather than deal in individual shares. Equally, you might consider trading premier global index CFDs like the Dow Jones or NASDAQ: both have high liquidity and trading volume.

- Forex CFDs – The Trinidad and Tobago dollar (TTD) is a currency traded in the foreign exchange market. An actively traded TTD currency pair is the USD/TTD, which is popular due to the international trade in Trinidad and Tobago’s main exports, natural gas and oil, which account for about 80% of the country’s total exports. Other top exports include fertilisers and iron and steel. USD/TTD has liquidity because oil, gas, agri, and ferrous products are usually sold in USD. The exotic currency pair offers opportunities for short-term currency traders interested in trading TTD. However, the spreads trading exotic and minor pairs are higher than those for major USD and EUR pairs, and trading whipsaws can be very common.

- Commodity CFDs – Vital global commodities, such as precious metals like gold and silver and crude oil, can be traded as CFDs in Trinidad and Tobago. Other popular commodities include ferrous products, agricultural, oil and gas. This allows traders to speculate on price movements often linked to the domestic economy and macroeconomic events.

- Crypto CFDs – The excitement and curiosity surrounding trading digital assets have attracted the attention of T&T’s traders. You can trade cryptocurrencies like Bitcoin and Ethereum through brokers as CFDs.

Is CFD Trading Legal In Trinidad And Tobago?

CFD trading is legal in Trinidad and Tobago, but the country doesn’t have specific regulations governing it.

While residents can trade CFDs, the absence of local regulation means traders typically rely on international brokers operating under foreign regulatory frameworks.

The Trinidad and Tobago Securities and Exchange Commission (TTSEC) oversees local financial markets but doesn’t regulate CFD brokers. This leaves the trader with the responsibility of choosing a reputable provider.

Since local oversight is absent, prioritize firms regulated by established authorities like:

Is CFD Trading Taxed In Trinidad And Tobago?

Trinidad and Tobago does not typically tax capital gains on profits from CFD trading or other financial investments. This makes trading CFDs potentially more tax-efficient compared to many countries where such profits are taxed.

Under current laws, profits from buying and selling financial instruments, including CFDs, are not considered taxable. This means you can keep all your trading profits without deductions, a significant advantage for active day traders.

However, if you trade as a business (eg a sole trader or through a registered entity) or your primary income source is trading, your profits could be considered business income and subject to standard income tax rates.

There are no withholding taxes on funds withdrawn from international brokers to Trinidad and Tobago. However, your chosen provider may have its own withdrawal fees or processes.

While there’s no direct tax on CFD trading profits, it’s always wise to consult a local tax professional to ensure compliance with the Trinidad & Tobago Revenue Authority, especially if your trading activity grows significantly or becomes your primary source of income.

An Example Trade

Let’s bring the experience of CFD trading in Trinidad and Tobago to life through a detailed example.

Background

Suppose I’m considering trading in a market with a stock exchange that offers only minimum stocks and shallow trading liquidity. In that case, I’ll generally defer to trading an index or forex currency pair with the USD as the base currency.

In this instance, I’m trading USD/TTD as my example trade. The pair has reasonable liquidity and trading interest levels because of the volume of oil and gas exports from Trinidad and Tobago.

Fundamental Analysis

When trading a pair with USD as the base currency, I don’t have to engage in too much fundamental analysis, given the US dollar’s status as the globe’s reserve currency.

But I’ll examine my economic calendar to ensure I know of any high-impact economic events about to be published or recently published.

GDP growth, unemployment figures, trade figures, deficits, debt v GDP ratios, inflation, etc., are all metrics that can impact a currency’s value on the forex market.

Technical Analysis

I maintain the adage “Less is more” when it comes to technical analysis. There is no point in lighting up your charts like Christmas trees in whatever timeframes you’ll be trading.

So, be highly selective with the technical indicators you use. You could choose one from each main group: trend, momentum, volatility and volume, or you could use one or two that might deliver as much feedback as you need to make in or out, up or down decisions.

Here, I’ll rely on the stochastic oscillator and the RSI to make my decisions, which will be supported by closely examining Heikin Ashi candlestick formations for evidence of price action.

When trading an exotic currency pair, I look for swing trading opportunities instead of day trading because the widened spreads and potential volatility will have less of an effect on my swing position compared to a scalp trade, where your fill and spread are critical to the success or failure of the trade.

I’m fond of using a two-time-frame analysis technique before deciding whether to enter or exit. In this instance, I will use 1 HR and 4 HR timeframes because I’m trying to determine a short and medium-term view to support a potential swing trading opportunity.

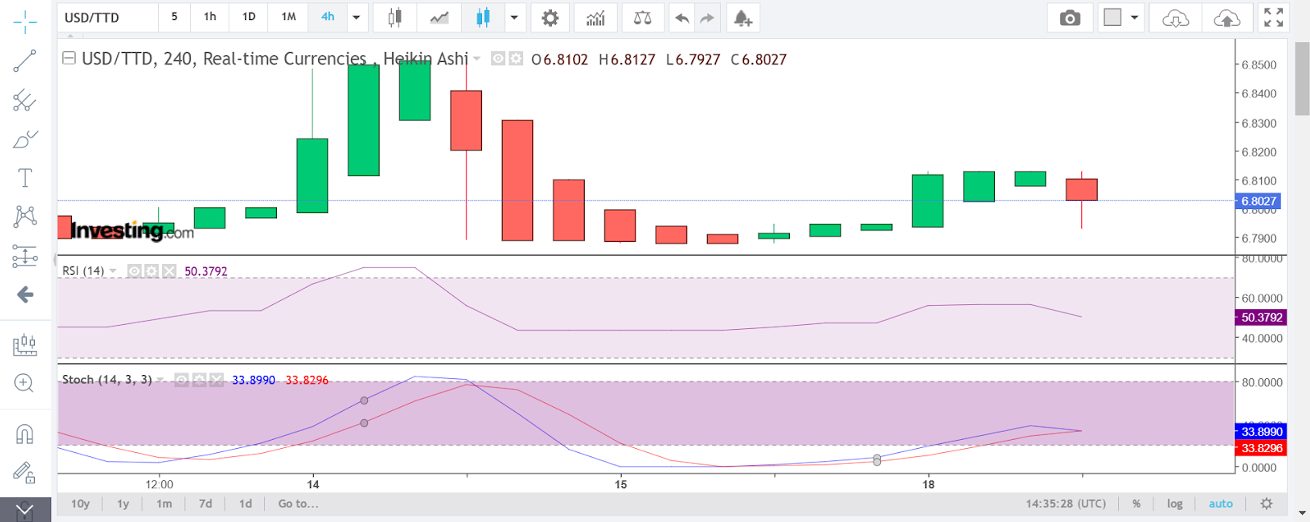

4HR Timeframe

In the chart below, on the right-hand side, using the final 4HR candle, we can see that the sentiment appears to be bearish, as evidenced by the hammer candlestick, the RSI falling below the 50 median reading, and the stochastic lines converging.

This combination of factors encouraged me to take a short trade, but I then looked at the 1HR timeframe for further confirmation.

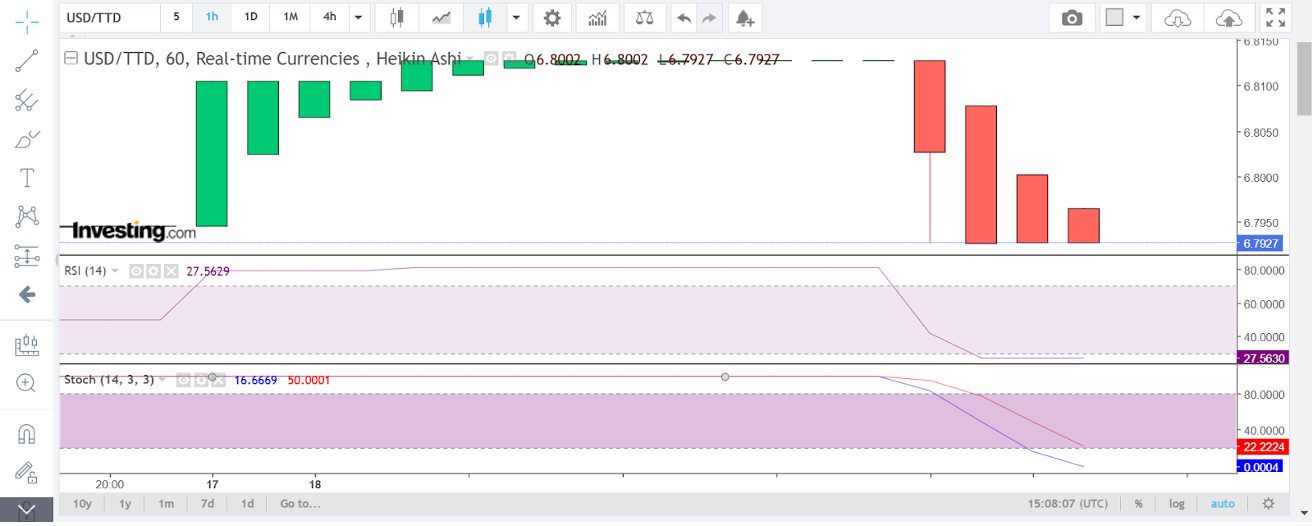

Now, if we examine the 1HR TF below, we can gauge that my decision to go short was validated.

The combination of four recent 1HR candlesticks was bearish; the stochastics had crossed, and the RSI had breached the 50 media line reading.

Despite the RSI entering the oversold area, I committed to trading short.

I used a CFD FX trade to enter short, which was filled at a price of 6,800. My take profit limit order was placed at the recent low of 6.7500.My broker required a 5% margin to take this CFD trade, and I only risked 0.5% of my account size on the position.

Bottom Line

CFD trading in Trinidad and Tobago offers traders a unique opportunity to access global markets, diversify their investments, and take advantage of a tax-friendly environment.

While the absence of local regulation means traders must rely on internationally regulated brokers, this also opens doors to some of the world’s best platforms and tools.

That said, you are responsible for choosing a reputable broker, understanding the risks, and trading responsibly.

By staying informed, managing risks effectively, and leveraging the benefits of this flexible trading instrument, you can make CFD trading a rewarding part of your financial journey in Trinidad and Tobago.

So, whether you’re looking to hedge, speculate, or explore new markets, the world of CFDs awaits, offering global opportunities right from the comfort of your island home.

Ready to get started? Turn to DayTrading.com’s choice of the best CFD trading platforms.

Recommended Reading

Article Sources

- Trinidad and Tobago NGL Limited - TTSE

- CIBC Caribbean Bank - TTSE

- Trinidad & Tobago Stock Exchange: TTSE

- Massy Holdings -TTSE

- Republic Financial Holdings - TTSE

- T&T All Share Index

- Trinidad and Tobago dollars (TTD) - Trading Economics

- Economic Calendar - Trading Economics

- Trading Whipsaws - IG

- Trinidad and Tobago Securities and Exchange Commission (TTSEC)

- Trinidad & Tobago Revenue Authority

- High-Impact Economic Events - Investing.com

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com