Regulation & Trust Rating

Choosing a trustworthy broker is critical to safeguard your funds. However, with the risk of scams and unfair trading practices, it can be difficult to know who you can put your confidence in.

That’s why we’ve developed a straightforward way to score brokers, which:

- Informs our review process, and;

- Helps traders understand what to look for in a trustworthy broker.

We call this our Regulation & Trust Rating.

What We Consider

Our Regulation & Trust Rating takes into account several considerations:

- Regulatory status: Is the broker licensed by Green Tier regulators?

- History: Does it have a clean record with no regulatory breaches?

- Transparency: Is the broker open about its trading conditions?

- Internal opinion: How much trust does our team have in the broker?

Application

Our findings in each of these areas contribute to an overall score of up to 5 – with the most trusted brokers scoring between 4 and 5.

Interactive Brokers, for example, earns a high trust score of 4.5 due to its regulation by reputable bodies like the US CFTC and UK FCA, plus its over 40 years of industry experience.

In contrast, Woxa receives a very low trust score of 1.5 due to its regulation by the high-risk Mauritius SFC and its limited track record, established only in 2021.

Regulators

The most important factor we take into account is a broker’s regulatory status.

This is because reputable regulators ensure brokers operate a fair and transparent trading environment, helping to safeguard your investments.

When we assign our ratings, we are interested in:

- How many licenses a broker holds, and critically;

- Whether they are from trusted regulators.

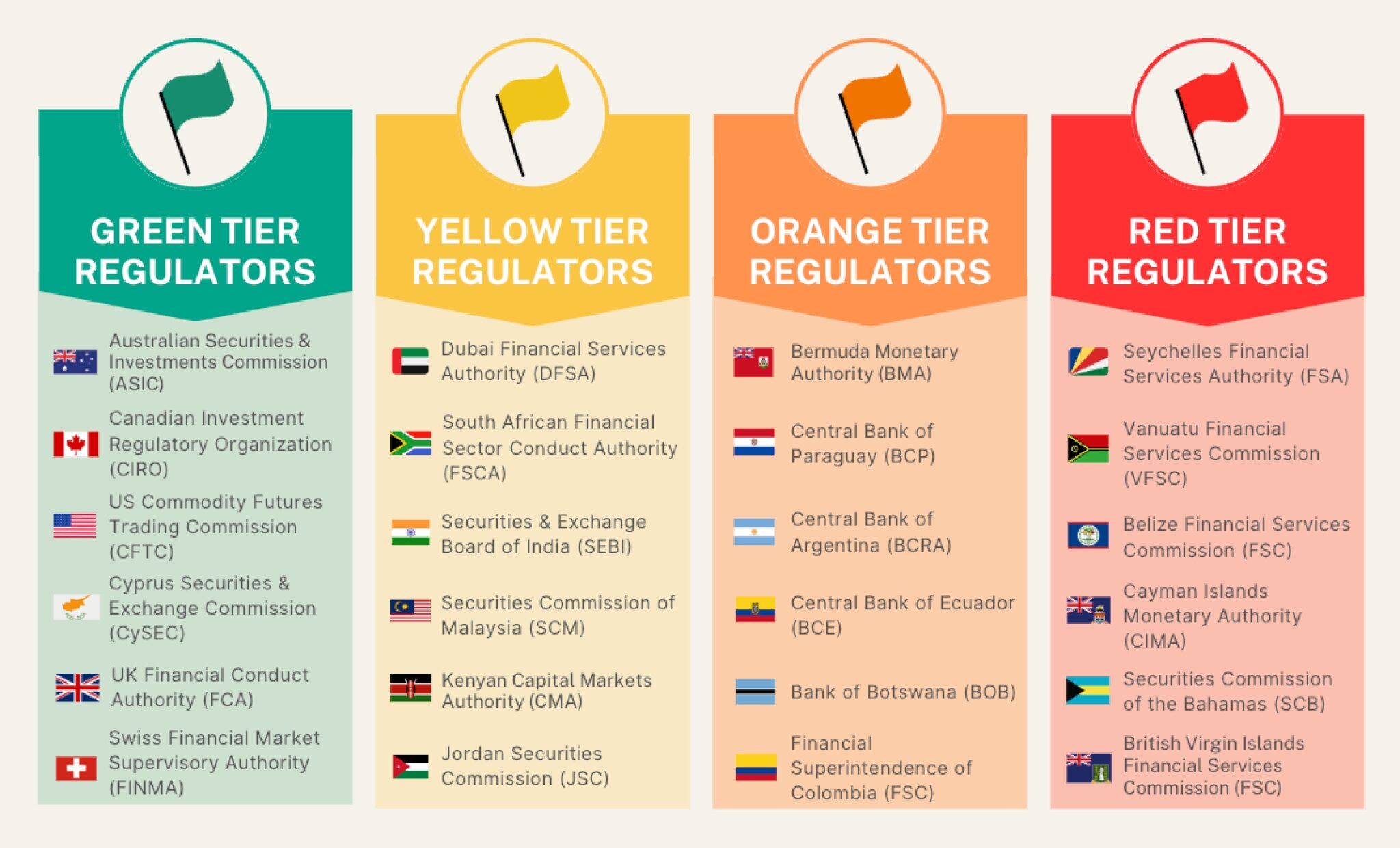

To determine whether a regulator is high-risk or low-risk, we’ve developed 4 classifications:

- Green Tier: Very low risk. The best investor protection.

- Yellow Tier: Low risk. Strong investor protection.

- Orange Tier: High risk. Limited investor protection.

- Red Tier: Very high risk. Little to no investor protection.

Green Tier Regulators

Green Tier regulators are the gold standard when it comes to regulatory oversight, and we apply the highest scores to brokers that hold one or more licenses from Green Tier regulators.

A Green Tier regulator ensures adherence to strict industry safety standards, instilling confidence even if specific jurisdictional protections, like investor compensation in case of broker bankruptcy, are unavailable to you.

- Australian Securities and Investments Commission (ASIC)

- UK Financial Conduct Authority (FCA)

- Canadian Investment Regulatory Organization (CIRO)

- Cyprus Securities & Exchange Commission (CySEC)

- US Commodity Futures Trading Commission (CFTC)

- US National Futures Association (NFA)

- US Securities & Exchange Commission (SEC)

- Japanese Financial Services Agency (JFSA)

- Monetary Authority of Singapore (MAS)

- Hong Kong Securities Futures Commission (SFC)

- German Federal Financial Supervisory Authority (BaFin)

- Spanish National Securities Market Commission (CNMV)

- New Zealand Financial Markets Authority (FMA)

- Swiss Financial Market Supervisory Authority (FINMA)

- Central Bank of Ireland (CBI)

- French Financial Markets Authority (AMF)

- Danish Financial Supervisory Authority (DFSA)

- Italian Organismo Agenti e Mediatori (OAM)

- Swedish Financial Supervisory Authority (Finansinspektionen)

- Financial Supervisory Authority of Norway (Finanstilsynet)

- National Bank of Hungary (MNB)

- Polish Financial Supervision Authority (KNF)

- Czech National Bank (CNB)

- Netherlands Authority for the Financial Markets (AFM)

- Luxembourg Commission de Surveillance du Secteur Financier (CSSF)

- Portuguese Comissão do Mercado de Valores Mobiliários (CVMV)

- Malta Financial Services Authority (MFSA)

- European Securities and Markets Authority (ESMA)

Yellow Tier Regulators

Yellow Tier regulators should provide strong investor protection, but it may not be as robust as those provided by Green Tier regulators. Regulatory scrutiny may be less rigorous for example.

That said, we still consider brokers authorized by Yellow Tier regulators trustworthy.

- Dubai Financial Services Authority (DFSA)

- South African Financial Sector Conduct Authority (FSCA)

- Securities and Exchange Board of India (SEBI)

- Securities Commission of Malaysia (SCM)

- Kenyan Central Markets Authority (CMA)

- UAE Securities and Commodities Authority (SCA)

- Jordan Securities Commission (JSC)

- Securities and Exchange Commission of Thailand (SEC)

- Securities and Exchange Commission of Brazil (CVM)

- Capital Markets Board of Turkey (CMB)

- Saudi Capital Market Authority (CMA)

- Kuwait Capital Markets Authority (CMA)

- Namibian Financial Institutions Supervisory Authority (NAMFISA)

- Ukraine’s National Securities and Stock Market Commission (NSSMC)

- Indonesia Bappebti

Orange Tier Regulators

We urge caution if a broker only holds an Orange Tier license. These regulators are less reputed and may provide limited investor protection or recourse channels in the event your broker faces financial difficulties or you have a dispute.

- Bermuda Monetary Authority (BMA)

- Central Bank of Paraguay (BCP)

- Central Bank of Argentina (BCRA)

- Central Bank of Ecuador (BCE)

- Bank of Botswana (BOB)

- Non-Bank Financial Institutions Regulatory Authority of Botswana (NBFIRA)

- Financial Superintendence of Colombia (FSC)

- Central Bank of the Russian Federation (CBR)

- Central Bank of the Republic of Uzbekistan (CBU)

- Bangladesh Securities and Exchange Commission (BSEC)

- Tanzania Capital Markets and Securities Authority (CMSA)

- Uganda Capital Markets Authority (CMA)

- Securities and Exchange Commission of Zimbabwe (SECZ)

- Eswatini Financial Services Regulatory Authority (FSRA)

- The Securities Board of Nepal (SEBON)

- Central Bank of Lesotho (CBL)

- Labuan Financial Services Authority (LOFSA)

- Chilean Financial Market Commission (CMF)

- Jamaican Financial Services Commission (FSC)

Red Tier Regulators

We consider these regulators very high risk – with little to no investor protection available. Membership requirements are often lax and regulators may not actively monitor and enforce safety measures, such as restrictions on misleading promotions.

Brokers that are only authorized by Red Tier regulators, with no additional oversight from more reputable agencies, may be operating scams.

- St Vincent & The Grenadines Financial Services Authority (SVGFSA)

- Seychelles Financial Services Authority (FSA)

- Vanuatu Financial Services Commission (VFSC)

- Belize Financial Services Commission (FSC)

- Mauritius Financial Services Commission (FSC)

- Cayman Islands Monetary Authority (CIMA)

- Securities Commission of the Bahamas (SCB)

- International Financial Services Authentication (IFSA)

- British Virgin Islands Financial Services Commission (FSC)

- Central Bank of Curacao and Saint Maarten (CBCS)

- Mwali International Services Authority (MISA)

Bottom Line

Choosing a well-regulated broker is one of the best ways to safeguard your trading funds. That said, there have been instances where even brokers licensed by trusted regulators have acted against clients and faced financial difficulties.

As a result, our Regulation & Trust Rating cannot guarantee the safety of your funds.

Only risk what you can afford to lose.