TradingMoon Review 2025

Pros

- There are over 60 crypto assets and 10+ crypto pairs, with spreads from $0.50 on BTC in the Premium account - solid value for crypto-focused traders. Even though there’s no BTC base currency, the offering itself is broad.

- We love the flexibility of MT4, cTrader, and TradingMoon’s sleek, in-house MoonTrader platform. Whether you’re after the copy trading capabilities of cTrader, the familiarity of MT4, or the intuitive experience of MoonTrader, this broker lets you trade your way.

- With 1:1000 leverage available on both Standard and Premium accounts, traders can size up quickly - but the ability to opt for 1:1 leverage shows respect for risk-aware traders too.

Cons

- Apart from the AI-generated daily market video (a nice touch), we found the research offering barebones. There’s no Autochartist, Trading Central, or live webinars - just an economic calendar and basic analysis. For serious research, you’ll need to look elsewhere.

- With 1,000+ instruments, TradingMoon covers all the basics - but stock CFDs felt limited compared to heavyweights like CMC Markets with 12,000+ instruments. If you’re after deep exposure to international equities, this might not be your final stop.

- While it benefits from the Skilling connection, TradingMoon is still licensed offshore under a 'red-tier' regulator, resulting in fewer investor protections compared to top-tier bodies like CySEC or FCA - something risk-conscious traders should consider.

TradingMoon Review

In this in-depth review of TradingMoon, we examine the platform’s advantages and drawbacks closely to give traders a clear, unbiased overview. Based on hands-on experience, we assess the broker’s services, paying particular attention to tools and conditions that matter most to short-term traders.

Regulation & Trust

2.5 / 5TradingMoon is the trading name of Skilling (Seychelles) Ltd, which is authorized and regulated by the Seychelles Financial Services Authority (FSA) under License number SD042.

Unlike its sister site, Skilling, which is regulated by the ‘green tier’ Cyprus Securities and Exchange Commission (CySEC) as per DayTrading.com’s Regulation & Trust Rating, the ‘red tier’ FSA is considered an offshore regulator. While it does provide oversight, its requirements are generally less strict.

For traders, this means a trade-off between flexibility and security. Regulation by the FSA allows TradingMoon to offer more accessible account setups, higher leverage, and fewer restrictions on trading conditions.

However, it also means fewer investor protections, such as compensation schemes or strict fund segregation requirements, which are typically mandated by regulators like the FCA (UK), CySEC (Cyprus) and ASIC (Australia).

| TradingMoon | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3.5 / 5Live Accounts

TradingMoon offers two primary account types, each tailored to different trading needs:

- Standard: Designed for beginners, this account requires a minimum deposit of $25 and offers zero commissions on trades, except for cryptocurrency CFDs, which incur taker fees starting from 0.08%. Spreads start from 0.7 pips and the maximum leverage is 1:1000.

- Premium: Aimed at more active traders, this account requires a higher initial deposit of $5,000. It offers tighter spreads starting from 0.2 pips but includes commissions from $6 per round trip. For cryptocurrency CFDs, taker fees start from 0.05%. Maximum leverage is also 1:1000.

In addition to its Standard and Premium accounts, TradingMoon offers PAMM and MAM accounts for money managers and investors. These accounts allow experienced traders to manage multiple accounts simultaneously, with profits and losses automatically distributed based on each investor’s share.

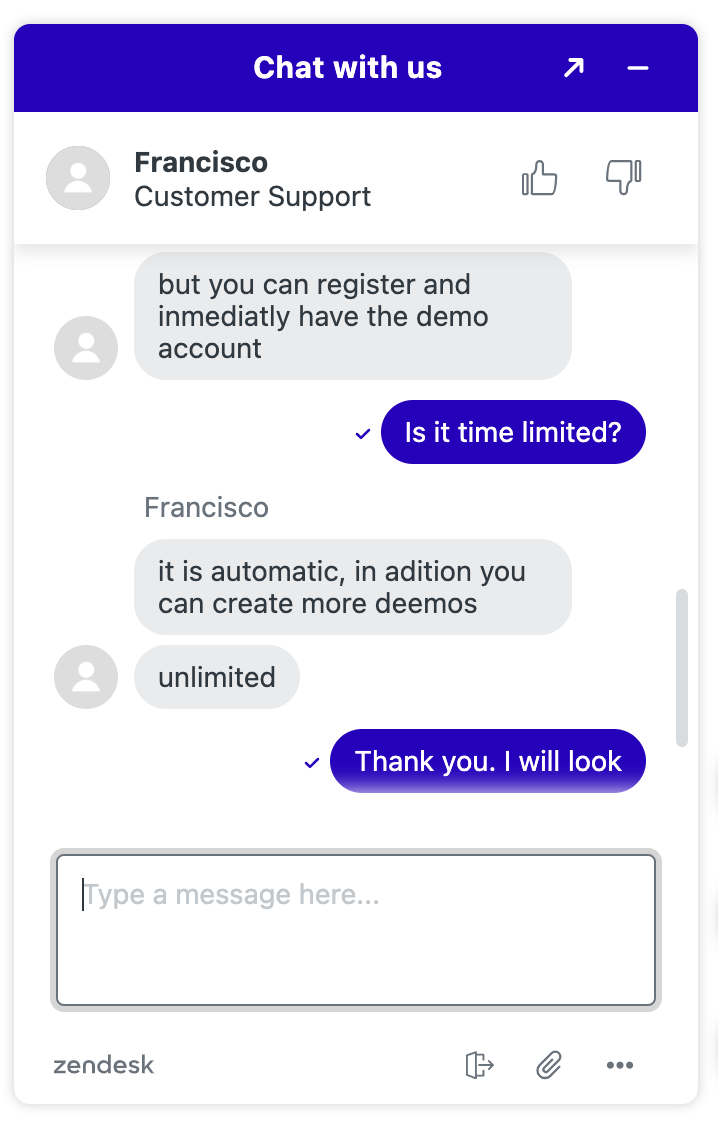

Demo Accounts

TradingMoon provides a demo account that allows you to practice trading with a virtual balance of $10,000. The website does not explicitly state the duration for which this demo account remains active, but testing revealed it’s actually unlimited.

This is great news compared to other brokers which have varying policies regarding demo account time limits. For instance, FOREX.com offers demo accounts that expire after 90 days.

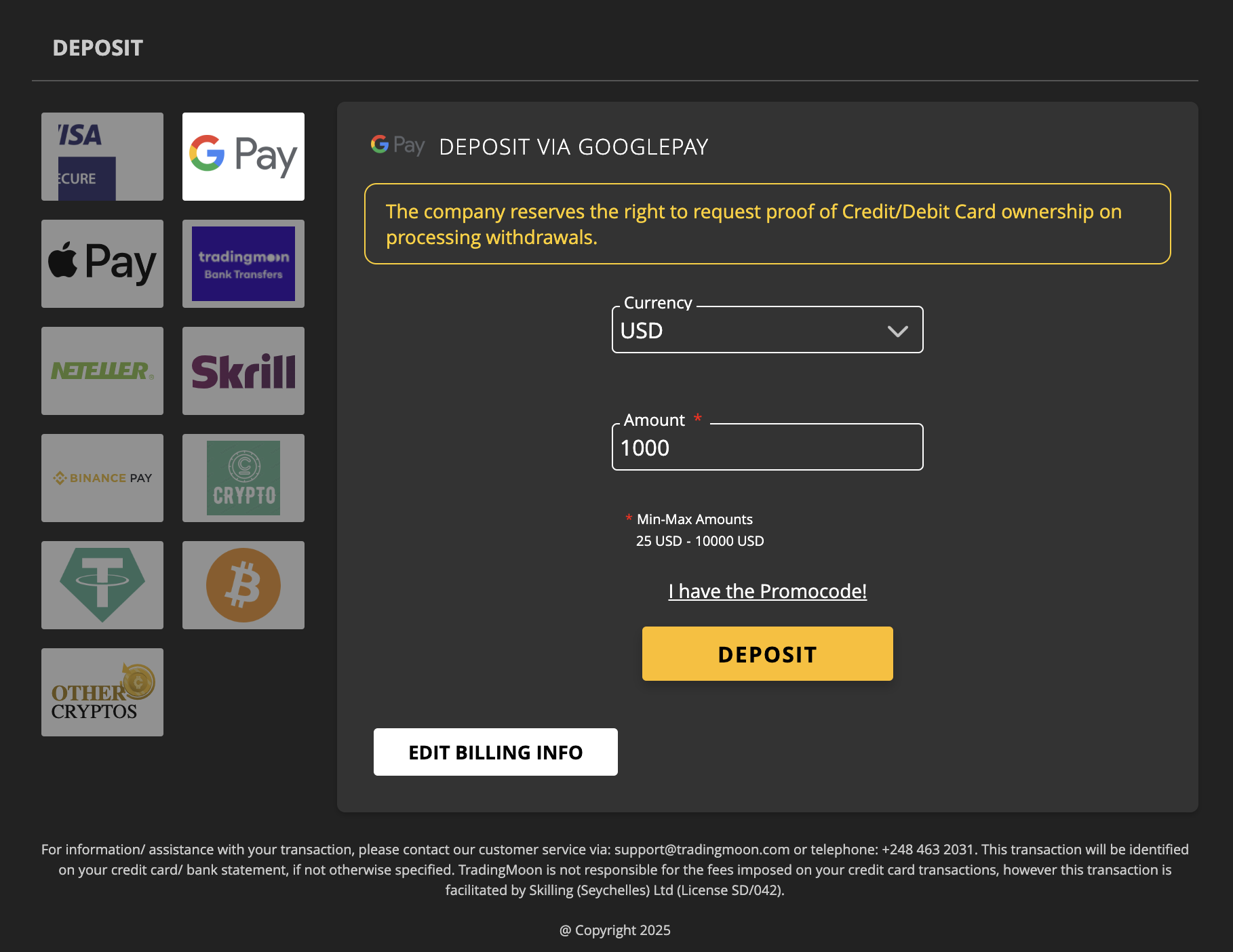

Deposits & Withdrawals

TradingMoon offers a straightforward system for managing deposits and withdrawals, giving you access to various funding options.

Supported methods include common payment systems such as debit card and credit card, bank wire transfer, e-wallets like Apple Pay and Google Pay (no PayPal), and crypto, including USDT and Bitcoin transactions.

While TradingMoon does not charge deposit or withdrawal fees, third-party providers like Neteller and Skrill may apply up to 2.9% transaction charges. Additionally, bank wires cost €15.00 for SEPA transfers and $25 for SWIFT transfers, and crypto transactions also incur fees.

Regarding base currencies, TradingMoon allows accounts to be held in five base currencies, including USD, EUR, and GBP.

This flexibility can help you avoid unnecessary conversion fees when depositing or withdrawing in your local or preferred currency. However, a BTC base account is not supported, so conversion fees will apply when transferring cryptocurrencies.

| TradingMoon | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Google Wallet, Mastercard, Neteller, PIX Payment, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $25 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

3.5 / 5TradingMoon offers a solid range of over 1,000 CFDs across multiple asset classes, providing various financial market opportunities.

- Forex: Over 74 major, minor, and exotic currency pairs, including EUR/USD, GBP/JPY and USD/MXN.

- Stocks: Over 900 stocks from leading global companies, including Apple, LVMH and Barclays.

- Commodities: 20+ commodities, including gold, silver and oil.

- Indices: 17+ major global indices, including the S&P 500, Nasdaq-100 and FTSE 100.

- ETFs: 40+ ETFs including the SPDR S&P 500 (SPY), iShares Russell 2000 (IWM) and iShares MSCI Emerging Markets (EEM) offer a way to trade in various sectors, markets, and asset classes.

- Cryptocurrencies: 60+ popular digital currencies, including Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP), as well as 10+ crypto pairs including BTC/EUR and XRP/JPY.

TradingMoon’s collection of ETFs and indices is particularly noteworthy. It offers a broad array of options if you want to diversify your trading across various sectors and global markets.

That said, TradingMoon’s range in certain asset classes—particularly stocks—is relatively limited when compared to top-tier brokers.

For example, CMC Markets stands out with a portfolio of over 12,000 CFD instruments, spanning not just commodities and currencies but also ETFs, stocks, indices, share baskets, and government bonds. This expansive offering positions CMC Markets among the most comprehensive platforms in the industry.

| TradingMoon | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:1000 | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3 / 5From our analysis, TradingMoon offers a relatively competitive fee structure, particularly regarding spreads, which positions it well compared to brokers that don’t offer zero-spread accounts.

TradingMoon provides tight spreads for forex pairs, with the Premium account in particular offering spreads as low as 0.2 pips.

For example, the EUR/USD pair has a typical spread of 0.4 pips on the Premium account, while the Standard account offers a minimum spread of 1.4 pips.

Additionally, the platform provides competitive cryptocurrency spreads, starting from $0.50 for BTC on the Premium account.

TradingMoon previously charged an inactivity fee of $5 per month for accounts without trading activity for six consecutive months. However, this fee has since been removed, making the platform more accommodating for infrequent traders.

| TradingMoon | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.4 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 6 | 0.005% (£1 Min) | 100 |

| Oil Spread | 3 | 0.25-0.85 | 0.1 |

| Stock Spread | 0.85 (Apple) | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

4 / 5TradingMoon offers a selection of platforms to cater to various trader preferences and experience levels. Here are my key findings after spending time testing and using each platform:

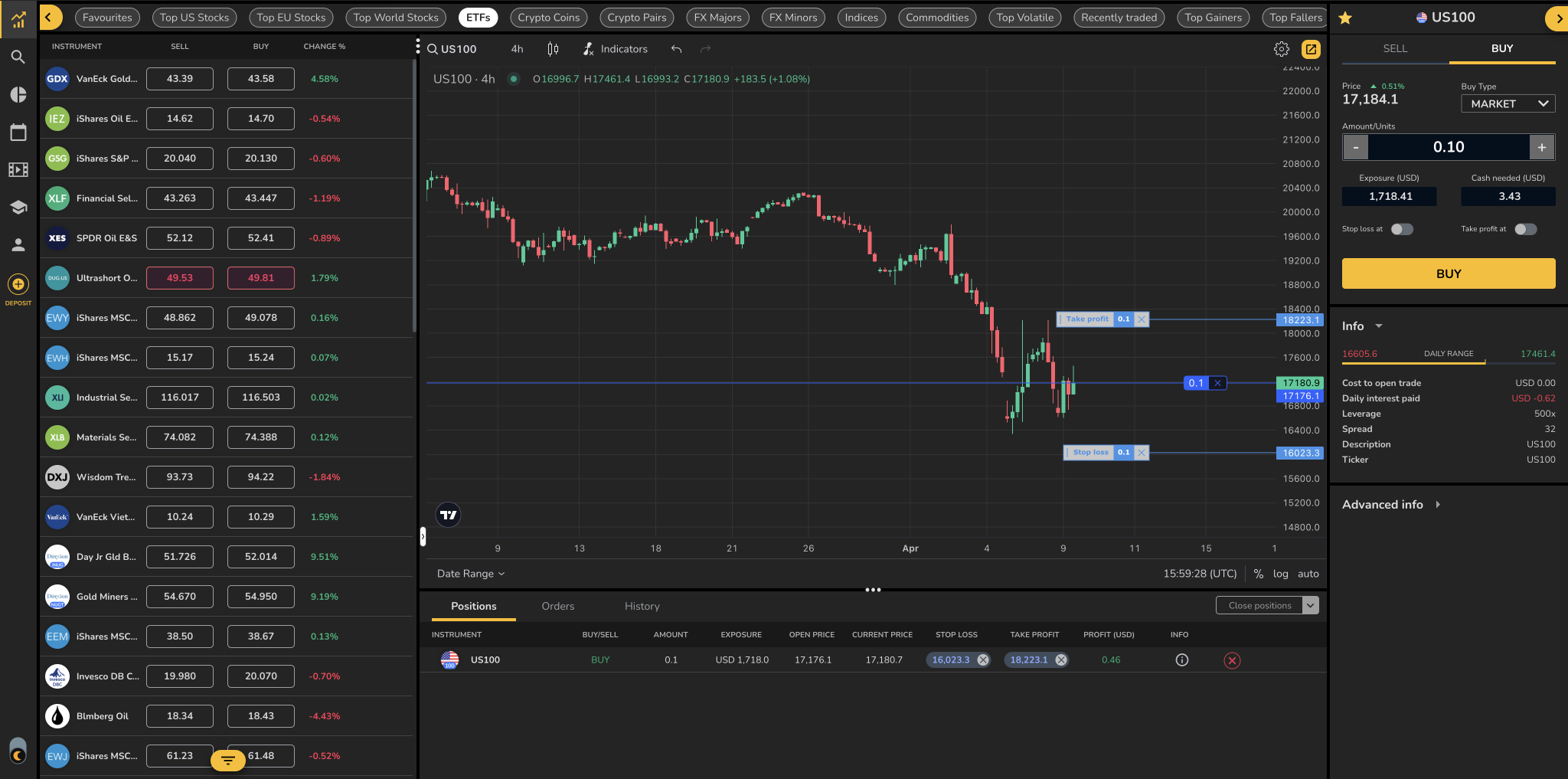

- MoonTrader: Powered by TradingView, TradingMoon’s proprietary platform provides a user-friendly and efficient trading experience. It boasts ultrafast order execution, with an average execution time of just 0.05 seconds – ideal for day traders. The platform is accessible via web and mobile devices so that you can manage your positions on the go. Its intuitive interface suits beginners and advanced traders, offering essential trading tools without overwhelming new users.

- cTrader: cTrader is a third-party platform offering advanced features catering to more experienced traders’ needs. It offers sophisticated charting tools, multiple order types, and Level II pricing, providing a comprehensive market depth view. The platform supports one-click trading and automated trading capabilities, including backtesting features, allowing you to implement and test your strategies effectively. The built-in economic calendar is also exemplary, and there’s an excellent copy trading service called cTrader Copy.

- MetaTrader 4 (MT4): MT4 is a well-established trading platform known for its reliability and extensive features. It provides advanced charting capabilities and a wide range of technical indicators and supports automated trading through Expert Advisors (EAs). MT4 is available on desktop, web, and mobile devices, ensuring accessibility across trading environments.

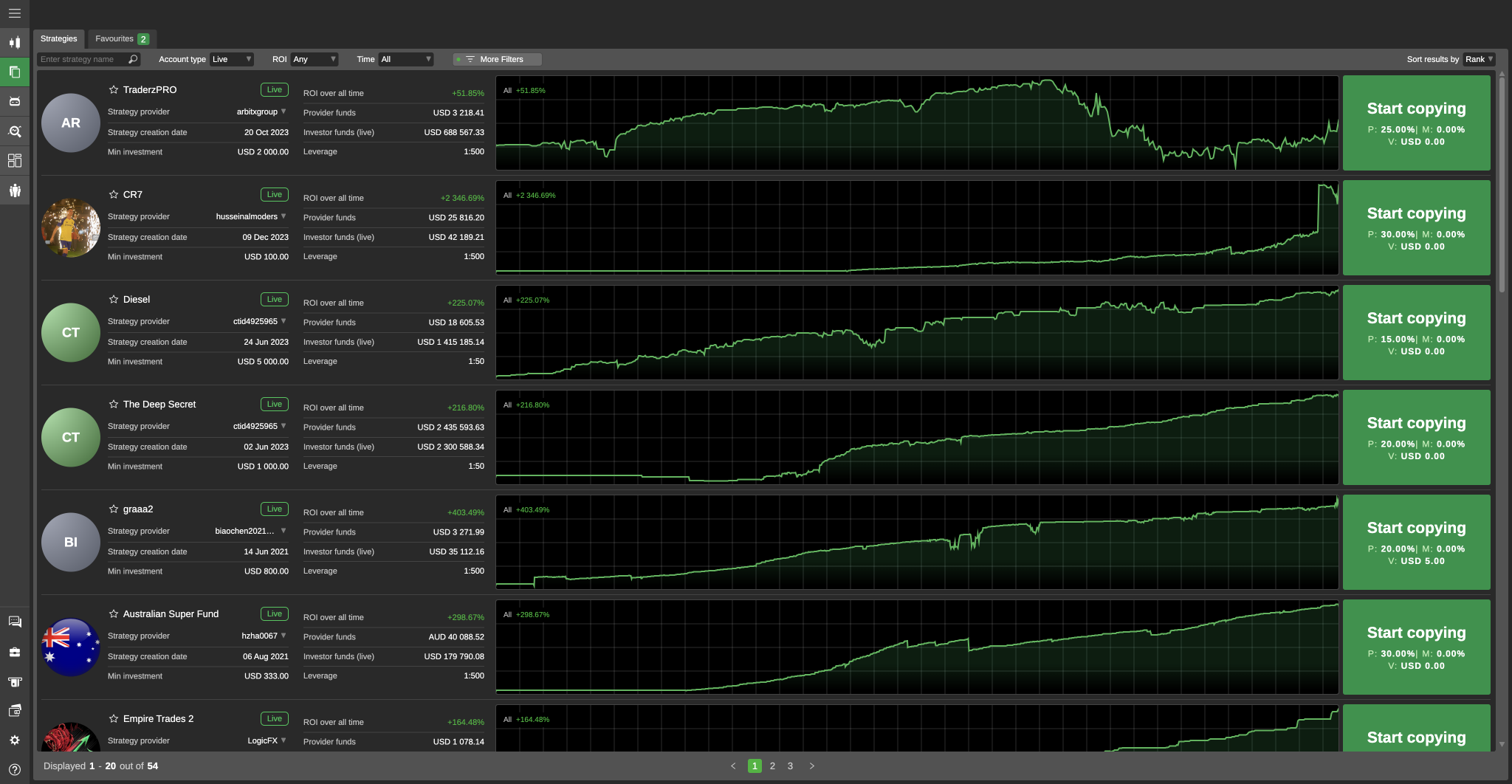

When I first tried the cTrader Copy platform on TradingMoon, I was impressed by how easy it was to get started, especially since not all cTrader brokers, like Pepperstone, support it.The interface is incredibly user-friendly, and I find it easy to find a range of experienced traders whose strategies I can copy.

Each trader’s profile contains performance details like win rates, equity graphs, and profit history, helping me assess who I want to follow. With just a few clicks, I am able to automatically replicate the trades of another trader.

One cTrader Copy feature that stands out is the risk management tools. I can set an ‘Equity Stop Loss’ to protect my investments, which gives me peace of mind. Knowing that my trades will be automatically mirrored but protected if the market turns against me makes the experience safer.

| TradingMoon | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | MoonTrader, MT4, cTrader | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

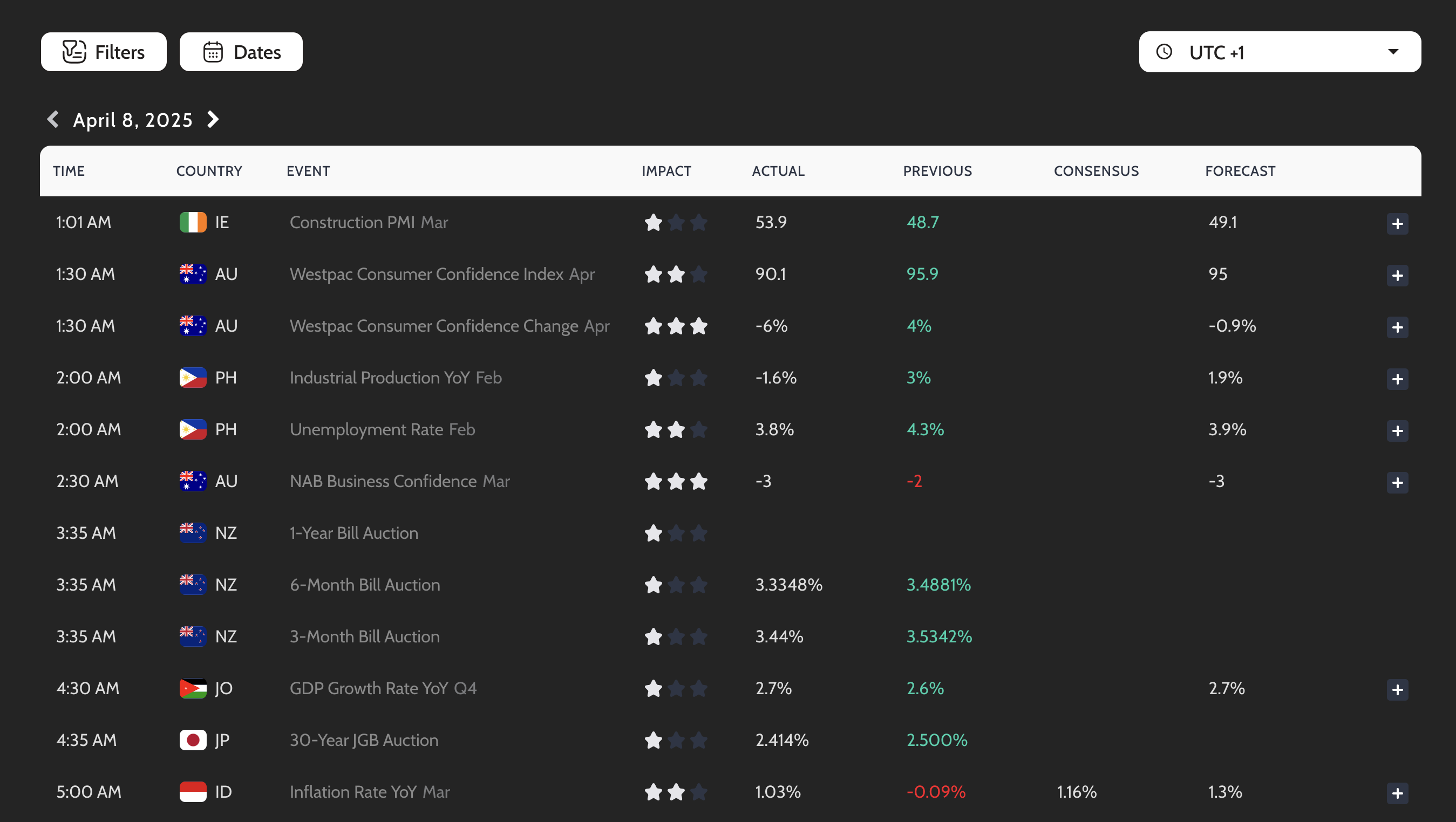

1.8 / 5TradingMoon doesn’t provide any research tools to help you trade, such as in-house technical analysis, live webinars, or a dedicated YouTube channel for real-time market analysis.

One notable feature is the daily AI-generated video update, available directly in the client dashboard. This video update offers insights into market trends, but there aren’t any specific trading opportunities to help you stay informed.

The client dashboard also has a filterable economic calendar to help you stay updated on key events.

Still, TradingMoon does not integrate third-party research providers like Trading Central or Autochartist, which are commonly available with other brokers like IC Markets to enhance technical analysis.

If you’re seeking more comprehensive research tools to help you make better trading decisions, TradingMoon’s offerings may be inferior.

| TradingMoon | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3 / 5TradingMoon offers a variety of useful and well-produced educational resources to assist you in enhancing your trading skills and knowledge.

TradingMoon’s blog on its website is a valuable resource. It offers content on trading strategies, market insights, technical analysis tools, and trading terminology.

There are also detailed guides on strategies like the Fair Value Gap and Wyckoff distribution cycle, as well as professional market analysis and commentary.

The blog also explains key trading indicators, such as the ABCD pattern, and provides definitions for essential trading terms, making it an excellent educational tool for both beginners and experienced traders.

The blog also explains key trading indicators, such as the ABCD pattern, and provides definitions for essential trading terms, making it an excellent educational tool for both beginners and experienced traders.

Within the client dashboard are more educational resources to help enhance your trading knowledge.

These include eBooks, a glossary explaining key trading terms, video courses covering topics such as fundamental and technical analysis, and platform guides for MT4 and cTrader.

| TradingMoon | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

3.5 / 5TradingMoon’s customer support feels a bit limited when compared to the offerings of leading day trading brokers.

While support is available Monday through Friday, between 07:00 and 22:00 CET, there is no assistance outside trading hours or on weekends.

Thankfully, the range of contact methods is accommodating:

- Live Chat: I can connect to an agent within seconds, and the staff are always polite and helpful.

- Email: From my experience, responses are typically received within 24 hours.

- Phone: A phone line is provided, but it is based in Seychelles, which may be less convenient for traders in other regions.

- Help Centre: Offers a comprehensive FAQ section addressing common queries related to account management, trading procedures, and platform functionalities. Additionally, it lets me submit support requests and engage with the community, fostering a collaborative environment for problem-solving and knowledge sharing.

- Social Media: Active profiles on platforms like Instagram, X and LinkedIn share updates and company news, but they are not reliable substitutes for dedicated customer support and are not typically used for handling individual queries.

In my experience, TradingMoon’s live chat service is particularly efficient. Accessing it via the website is straightforward, and the support agents are knowledgeable and responsive. They promptly address inquiries and provide clear, helpful information.However, I’d like to see the live chat widget integrated into the Moon Trader platform for added convenience. I’d also like support hours extended to at least 24/5, especially as many brokers like Exness offer 24/7 support.

| TradingMoon | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With TradingMoon?

TradingMoon offers several positives for day traders: fast execution speeds, a choice of excellent charting platforms, competitive spreads (especially on the Premium account), and access to a good range of markets with price action.

There’s also a demo account, an AI-generated daily market update, and in-house educational content—features that can benefit both beginners and experienced traders.

On the downside, TradingMoon lacks some of the advanced research tools and third-party integrations that are standard with top-tier brokers.

If you’re an intermediate trader looking for tight spreads and platform flexibility, TradingMoon could be a good fit. But you should explore other options if you’re a beginner needing structured education or someone who wants the security and reputation of a long-established, heavily regulated broker.

FAQ

Is TradingMoon Legit Or A Scam?

TradingMoon is a relatively new online platform. Although Skilling, the company behind TradingMoon, holds ‘green tier’ regulation, TradingMoon is regulated by the ‘red tier’ FSA, which doesn’t offer the same level of client protection.

Due diligence is recommended to ensure it aligns with your trading requirements.

Is TradingMoon Suitable For Beginners?

Thanks to its choice of trading platforms, TradingMoon is suitable for beginners. The broker also offers a non-expiring demo account with virtual funds, allowing new traders to practice in a risk-free environment.

TradingMoon also provides educational content through its blog, covering trading strategies, technical indicators, and basic trading terms, which can help beginners build foundational knowledge.

However, compared to leading brokers, TradingMoon lacks some beginner-friendly features like structured learning programs, live webinars, or integrations with third-party research tools like Trading Central or Autochartist.

Top 3 Alternatives to TradingMoon

Compare TradingMoon with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

TradingMoon Comparison Table

| TradingMoon | Interactive Brokers | Dukascopy | xChief | |

|---|---|---|---|---|

| Rating | 3.3 | 4.3 | 3.6 | 3.9 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $25 | $0 | $100 | $10 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | ASIC |

| Bonus | Up To $20,000 In Bonuses: Welcome Bonus, Cashback, ZeroZero, Sunday Billions, Lucky Money | – | 10% Equity Bonus | $100 No Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MoonTrader, MT4, cTrader | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:1000 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 11 | 6 | 11 | 12 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by TradingMoon and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TradingMoon | Interactive Brokers | Dukascopy | xChief | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

TradingMoon vs Other Brokers

Compare TradingMoon with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of TradingMoon yet, will you be the first to help fellow traders decide if they should trade with TradingMoon or not?