Trading212 Opens Its Doors To UK Investors

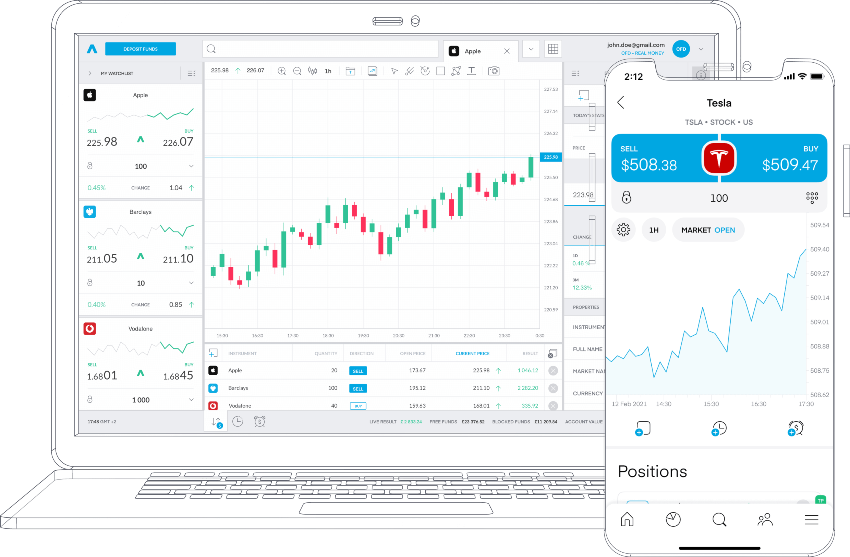

Trading212 is an established online brokerage. The firm has over 1.5 million account holders worldwide and more than £3 billion in client assets. 10,000 global stocks and ETFs are available via the broker’s mobile investing app. Read on for the details.

Invest

Trading212 was among the first brokers to offer commission-free investing. Clients can choose from thousands of stocks, decide how much they want to invest, and buy shares immediately. Market, limit, stop and stop-limit orders are available.

As well as speculating on household names from the US, including Tesla, Microsoft and Netflix, UK traders can buy and sell equities listed on the London Stock Exchange.

Users can also build diverse portfolios, known as pies, which span multiple sectors and can be tailored to individual financial goals.

The broker’s suite of trading assets are available on the web trader platform and free mobile app, which has been downloaded more than 14 million times.

Fractional stock trading is also available. Fractional shares have proved popular with novice traders and those on a budget. Account holders can buy a portion of large-value stocks, for example, one quarter or one half of a share in Meta (formerly Facebook).

CFD

As well as the broker’s straightforward investing solution, active traders can go long and short on forex, stocks, indices and commodities using leveraged CFDs. Leverage is capped at 1:30 and traders can take positions on popular assets without taking ownership of the underlying asset.

Negative balance protection is also in place, meaning clients cannot lose more than their account balance.

Should traders have account queries, a 24/7 customer support team is available with an average response time of 29 seconds.

ISA

Trading212 offers tax-free stocks and shares ISAs. UK traders can invest up to £20,000 per year with no tax on income or capital gains. ISAs are a popular longer-term and tax-efficient investment vehicle.

The broker’s ISAs are split into four main solutions:

- Cash

- Lifetime

- Stocks & shares

- Innovative finance

UK Regulation

Trading 212 UK Ltd. is regulated by the Financial Conduct Authority (registration number 609146).

The retail trading firm is also a member of the Financial Services Compensation Scheme (FSCS), meaning compensation to the tune of £85,000 is available per client in the event of broker insolvency.

Should You Invest With Trading212?

Trading212 is a well-known trading broker. With millions of active users, regulatory oversight from multiple financial watchdogs, plus a competitive, commission-free pricing model, the brand has proved popular with beginner investors, in particular.

Follow the sign-up link below to get started with Trading212.