Trading Central

Trading Central is a one-stop-shop for investment decision support. The company provides a range of broker API solutions including expert market analysis, advanced charting, asset ratings and strategy builders. Our review of Trading Central explores the different features and services available, pricing and fees, plus tips on getting started.

Best Trading Central Brokers

What is Trading Central?

Trading Central (TC) offers award-winning investing solutions that online brokers can integrate into their existing services. The leading fintech organization provides a variety of tools, trading solutions and analysis features that can be offered at a premium to clients. These include automated analytics, 24/7 expert advisors, real-time economic releases and more.

The company has partnered with over 180 brokers in more than 50 countries, including established players like eToro and Markets.com. And while access to specific features may vary between brokers, the benefits for retail traders are obvious – fully customizable tools give investors the confidence to execute advanced trading strategies. Trading Central also offers an array of educational services with topics spanning risk management, timing trades and opportunity validation.

Importantly, Trading Central does not sell its services directly to retail investors. Instead, online brokers pay to integrate the firm’s tools and features into their offering. As a result, investors will need to sign up with a supporting broker.

History

Trading Central was established in 1999 in Paris, France. The company’s founders are a group of ex financial services employees that identified a need for accountable investment research. By early 2000, the company had launched its pattern recognition solution, Recognia. The first technical analysis system, Technical Insight, went live on broker websites in 2003. Over the years, Trading Central has successfully launched a long list of tools and products, covered in more detail below.

More recently, the company opened an innovation lab in Nice to develop sophisticated AI algorithms. The firm is also now active in many global trading markets with headquarters and offices spanning London (UK), Ottawa (Canada) and Hong Kong.

Features

Trading Central provides technical, economic and fundamental analysis through signals and indicators, strategy builder tools, market sentiment features and even newsletters. Below we review the key features available:

Fundamental Insight

View and interpret complex financial data in a digestible and simple format. The tool is designed to empower investors of all experience levels to make educated decisions using top quality market data. Insights include:

- Trending View – Pinpoints significant market movers using customizable asset and country filters

- Nowcasting – A macroeconomic indicator that provides insights on asset allocation, future price movers and sector rotation

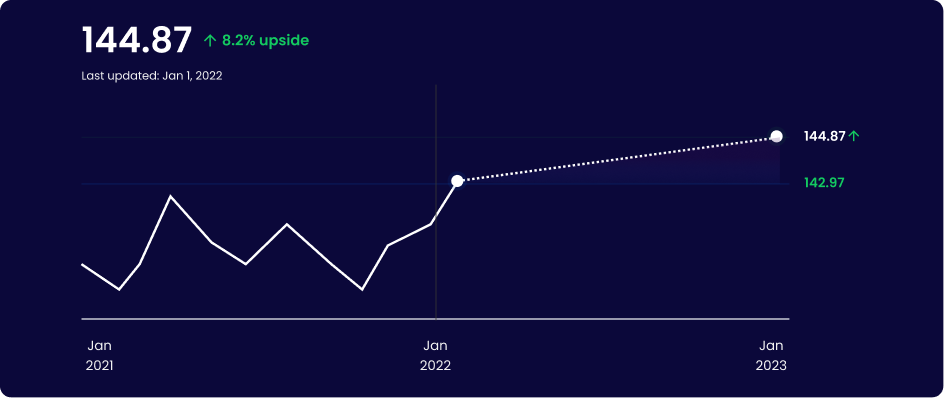

- Target Price – Delivers an estimate for where the price of a stock will be in the next 12-18 months based on quantitative analysis

- TC Quantamental Rating – A concise view of how a global share is performing based on value, growth, income, quality and momentum

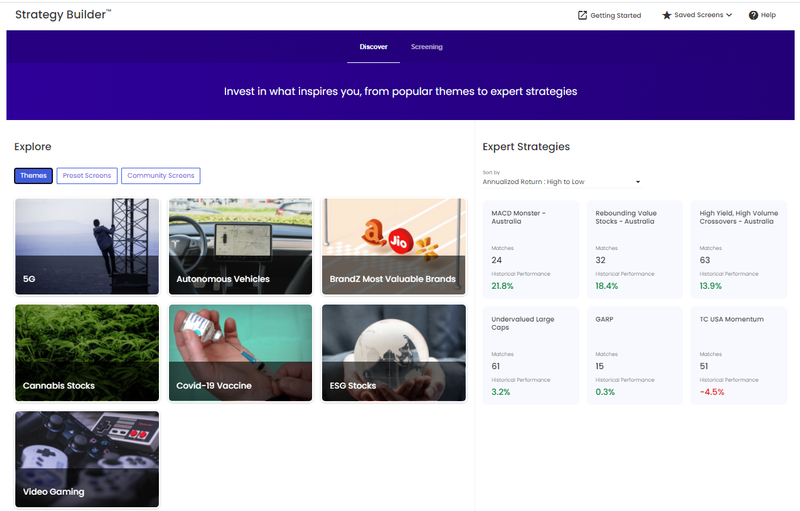

Strategy Builder

Strategy Builder is designed to empower investors to screen, develop and test bespoke trading strategies. These can be created from a pre-built archive or generated from scratch.

The tool allows filtering of stocks via 65+ different factors including fundamental and quantitative criteria. This allows users to create a portfolio based on their trading style and personal interests.

Backtesting against historical performance and embedded educational content can also help traders take full control of their investments with confidence.

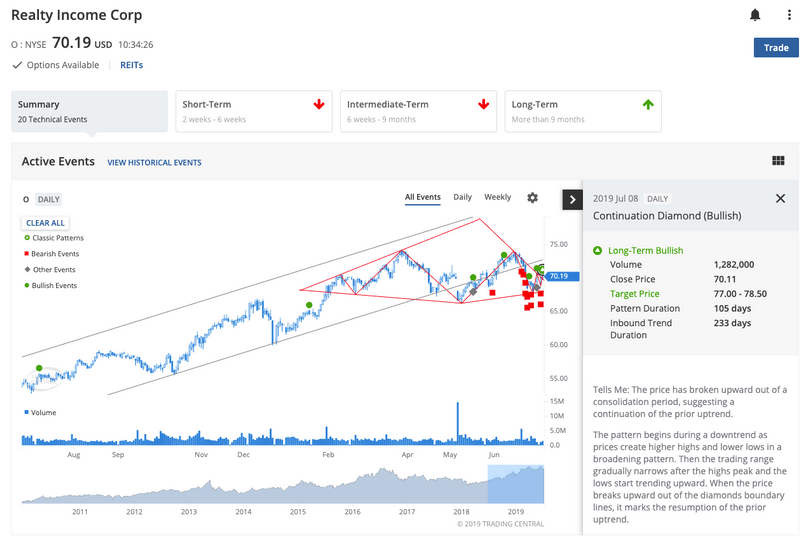

Technical Insight

Technical Insight is an award-winning programme that supports traders in developing investment strategies. The tool uses a weight-of-evidence approach to display trade outlooks. Through a balanced set of detailed, proactive analytics, educational guidance and customizable options, Technical Insight offers:

- Embedded Education – Training commentary and insightful data on market updates. Day traders can learn and view expected impacts on price movements based on relevant events. Learn at your own pace and revisit historical market events.

- Technical Score Rating – The tool provides comprehensive insights using an ‘in the moment’ approach. Known as the ‘Technical Score’, the programme displays proposed market outlooks of either bearish, bullish or neutral across a range of different timeframes.

- Intuitive Design – Stay engaged with the Technical Insight tool while on the go. The responsive design is easy to navigate and compatible with portable devices. Traders can also set up alerts and mobile app notifications, view customizable charting and help manage risk via support & resistance lines.

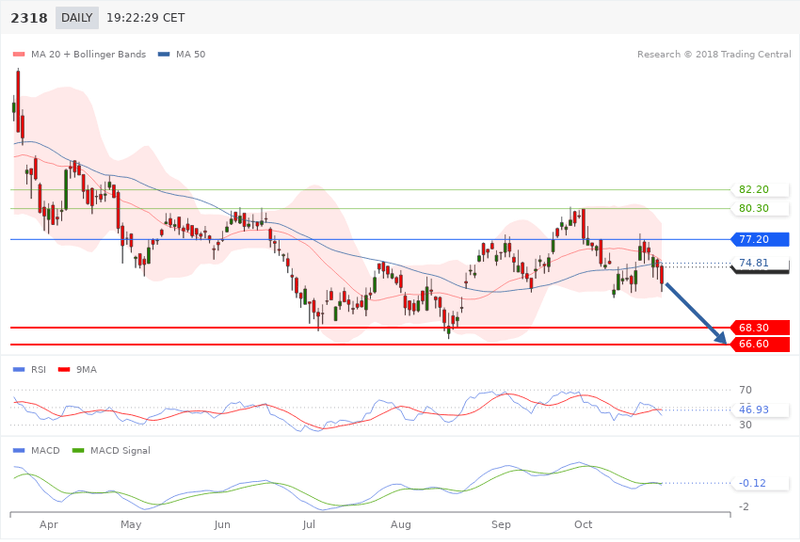

Technical Views

Technical Views uses a combination of analyst expertise and automated algorithms. The proprietary pattern recognition tool screens the market to offer trading plans based on established methodologies. This runs alongside senior analysts that validate outputs and publish the most credible and useful market views. Day traders can benefit from 24/5 global drop coverage across 8,000 instruments.

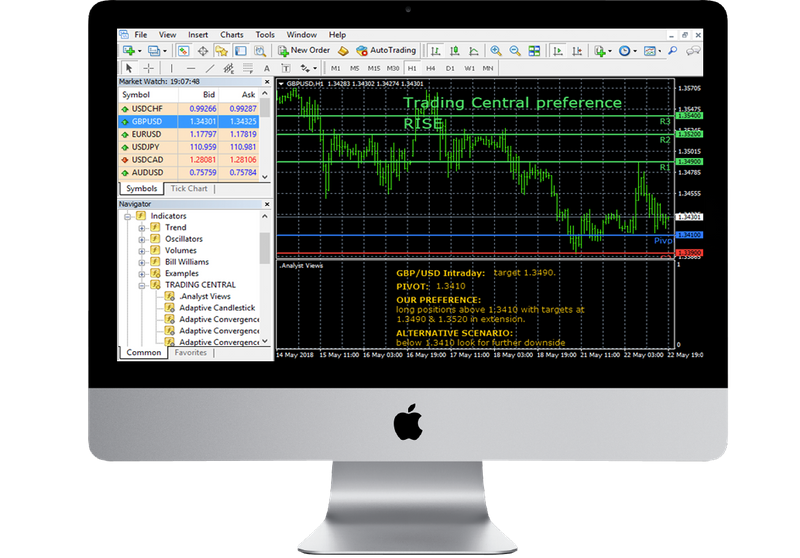

TC Alpha Generation

Compiled of three technical indicators, this Trading Central tool allows investors to identify new trading opportunities, similar vs Autochartist. Each indicator can be integrated into the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platform with a simple download.

Directional perspectives can be embedded into every chart and graph using the established technical analysis methodology. This also includes an interesting alternative scenario pivot point tool that offers target levels in a differing direction.

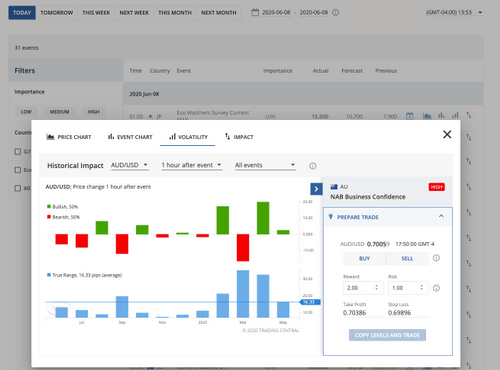

Economic Calendar

The Trading Central economic calendar supports an interactive alternative to a standard static chart. The live calendar uses real-time data to monitor potential price movement events. Whether you are trading the USD/JPY, USD/CAD or GBP/USD, you can stay up to date with macroeconomic events that could cause price volatility. Features include:

- Real-time data

- View economic events in 38 countries

- Over 115 forex charts plotted to economic events

- Historical event data published from the past 5 years

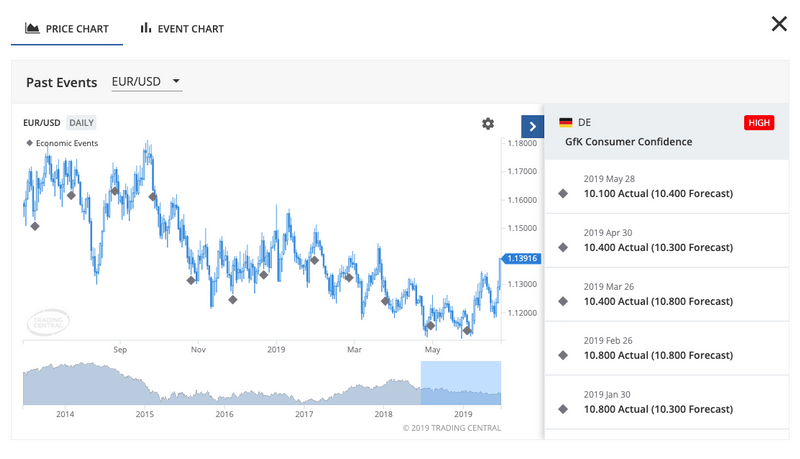

Economic Insight

The Economic Insight tool provides traders with mechanisms to observe, speculate and act on potential market-moving events. The real-time data, volatility analysis tools, and interactive charting allow event assessments on forex pairs, including the EUR/USD and GBP/JPY.

An interesting feature of Trading Central’s Economic Insight is the ‘trade set up’ feature. This allows investors to set a maximum risk appetite to view suitable stop loss, trailing stop or take profit orders.

News & Sentiment

- Expert Analysts (EAs) – The organization boasts a global team of research analysts that are on-hand to provide financial market blog posts, video content and educational tutorials. These are often published directly within your broker’s educational webpage so you don’t need to access alternative sites.

- MetaTrader Research Solutions – An enhanced Trading Central offering that allows plugin indictors and premium tools to be embedded directly on the MT4 and MT5 platforms. This is seamless integration, often via API, so there are no lengthy download requirements. You can simply opt into the analysis tools, login, and start using free signals, indicators, and featured ideas.

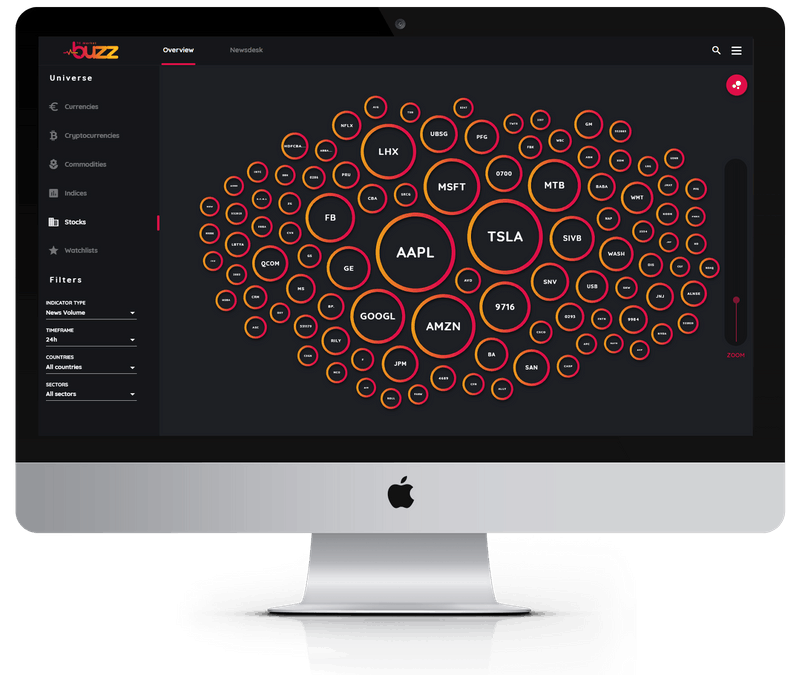

- Market Buzz – Using language algorithms, Market Buzz compiles the latest news articles, email mentions, or webpage posts into a concise data overview. This includes mentions of financial instruments or markets across Wiki, YouTube video content, Twitter, and Web TV. The tool monitors 2500+ news publications and 300+ types of events. Asset coverage includes 35,000 stocks, 330 forex pairs, and 60 commodities including Silver, Gold, Natural Gas, Palladium and Crude Oil (WTI). The daily analysis reviews are ideal for a quick performance recap.

Cost

Trading Central’s pricing is based on a B2B model. This means the cost to use tools, instruments or the research & analysis platform, will vary between brokers. While free with some providers, other online brokerages position Trading Central services as an additional premium. This can be in the form of a subscription charge or a one-off login fee.

Note, FxPro, eToro, and AvaTrade do not charge clients to use the tools, analytics, alerts or technical indicator signals for MetaTrader 4.

Pros of Trading Central

- Informed Decisions – You can feel more confident making investment decisions based on trading plans and analysis created by Trading Central tools. Information and analyst input is derived from the credible views of trading experts.

- All Day Coverage – Trading Central offers 24-hour coverage across 85+ markets including stocks, forex pairs, ETFs, indices and more. You don’t need to be restricted by standard trading hours for your analysis requirements.

- Established – Trading Central has developed a strong global reputation and is recognized across various sources such as Dow Jones and Bloomberg.

- Often Free For Traders – A significant advantage to retail traders is that Trading Central services are often free. Subscription charges are typically absorbed by major global brokerages as a competitive advantage vs others. AvaTrade, IG, Interactive Brokers, Exness and ICMarkets, for example, offer a no-fee pricing model to all of their registered clients.

- Customizable Instruments – Day traders can customize instruments, such as indicators, according to their personal preferences and strategy. This can include amendments to favoured currencies or chart patterns. TC graphs, charts and educational content are also supported on all devices including your broker’s APK and iOS mobile apps.

- Access To Professional Tools – Trading Central services are designed to offer retail traders access to institutional level tools. This includes automated analytical instruments such as pattern-recognition scanners and technical analysis. Importantly, it can reduce reliance on extensive prior knowledge of the financial markets.

- Multiple Tools And Instruments – Trading Central offers many different tools and services. Whether you want to utilize automated algorithms, view daily strategy newsletters, install indicators to cTrader, MT4 or MT5 charts, or simply follow market sentiment data, there is something for investors at all levels. Features have the same common goal – to close the institutional vs retail investor gap.

Cons of Trading Central

- Profits Not Guaranteed – It is important to remember that tools and indicators are not a guarantee that you will generate profits. The outcome of your trades will depend on how well you combine the information provided by Trading Central with your own knowledge and personal analysis.

- Access Via Registered Brokers Only – Trading Central tools can only be accessed via a supported brokerage. Services cannot be accessed individually as part of trading research or knowledge-building exercises. Traders must sign up with a licensed broker to utilize the company’s tools.

- Aimed At Professional Traders – Some tools and services may not be suitable for inexperienced investors. Previous trading knowledge and education in the financial markets may still be required to implement premium tools effectively. The advanced research and automated analytical tools may feel overwhelming to the novice intraday trader.

Regulation

Trading Central is a member of ANACOFI-CIF, an association approved by the Autorité Des Marchés Financiers (AMF). It is also registered with ORAIS, meaning it follows the relevant regulatory guidance.

The firm’s global entities hold regulations from the relevant authorities. The US franchise, for example, is registered as an investment advisor with the Securities and Exchange Commission (SEC). The Trading Central Asia Limited affiliate holds a license from the Securities and Futures Commission (SFC), enabling it to provide securities advice.

Getting Started

First, you will need to open an account with a broker that offers access to the Trading Central programme. Information on integration compatibility can normally be found within the platform interface or under the additional features web pages at your online broker.

Remember, brokers integrate features via APIs so you won’t need to download and add tools to your trading account. With that said, you may need to sign up or download alternative platforms if you choose to opt-in and use the services of a third party.

Trial access to some solutions may also be published online so you can get a feel for the features and tools.

Verdict

Trading Central provides a vast selection of tools, instruments and analytics to enhance the investing experience. Importantly, the company aims to develop solutions that bridge the gap between professional and retail trading.

From its suite of educational services to advanced market data and expert analysts, there is something for novice investors and veteran traders alike. Sign up with a registered broker to start trading today.

FAQs

Does Trading Central Offer Trade Enhancing Tools For All Assets?

Trading Central asset coverage spans 35,000 stocks, 330 forex pairs, 50 indices, a select number of crypto coins and 60 commodities. Some of the most recognised markets and assets where analysis is available include the US30, NASDAQ 100, XAUUSD, and BTC.

Can Anyone Use Trading Central Instruments?

Trading Central has developed a range of tools and instruments suited to day traders of all experience levels. From concise market buzz publications to technical analysis indicators, there is something for beginners up to seasoned investors.

Do You Have To Pay To Use Trading Central Tools?

Solutions cannot be purchased by individual investors. Trading Central is available to online brokers only. Nevertheless, many global brokers offer the firm’s services at no extra cost. See our list of supporting brokers to get started today.

What Is The Trading Central Value Analyzer?

The Value Analyzer tool provides a simple, intuitive view of key investing metrics. This includes company revenue history, dividends, and more. The unassuming indicator interprets all benchmarks via a concise coded system to show how well an instrument matches investing criteria.

Is Trading Central Legit?

Trading Central is a legitimate and award-winning trading solutions provider. It holds global regulation from the SEC and SFC, plus it is a registered member of ANACOFI-CIF, an association approved by the AMF.