Trade360 Review 2025

Awards

- Most Innovative Social Trading Technology 2017 - European Global Banking & Finance

- Forex Innovator 2016 - ATOZFOREX.COM

Trade360 Review

Trade360 is a CFD and forex broker that specialises in crowd trading, a feature that displays trader behaviour within current market conditions. This review will cover the main features of the Trade360 platform, including login, key features, regulation, and the withdrawal process. See if Trade360 is the right broker for you.

Trade360 Details

Trade360 is owned by Crowd Tech Ltd, a Cypriot investment firm founded in 2013. Trade360 is a regulated broker with licensing from the Cyprus Securities and Exchange Commission (CySEC).

Offering a range of products and trading platforms, the brokerage’s thousands of clients span multiple countries. Trade360 has also made the news for partnering with Australian cricket player Steve Smith.

Trading Platforms

Prospective users can view the online trading platform and MT5 before registering or receiving Trade360 login details, but once registered, users will be prompted to login to execute trades.

Online Trading Platform

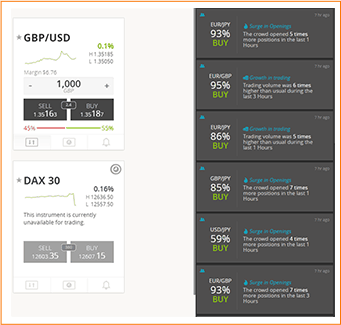

The Trade360 online system allows users to view the unique Live Feed, generated through crowd trading, which displays the percentage of traders that are buying and selling a certain asset to help inform your decisions. The online layout is accessible to beginners and traders can buy or sell in a single click. Website trading also offers an economic calendar, a daily market report, and advanced graphing capacity to provide technical market analysis.

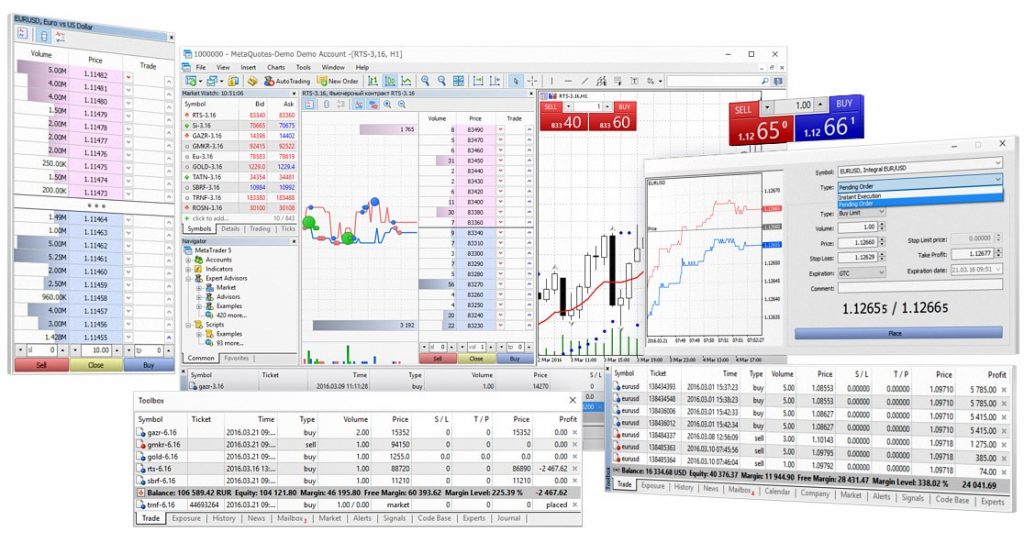

MT5

MT5 is a leading downloadable platform that gives users access to trading operations in the forex and stock markets, alongside the ability to carry out technical and fundamental analysis. Boasting dozens of indicators, multiple charting types, plus complex order types, MT5 is an excellent option for experienced traders. The platform also allows for customisation and provides access to the MetaTrader Market, where clients can download a range of tools and features.

Note, this broker does not offer MT4.

Products

Clients of Trade 360 can choose from over 200 tradeable products, including:

- ETFs – 40+ ETF CFDs

- Forex – 40+ currency pairs

- Commodities – 4 commodities, including precious metals and oil

- Stocks – Hundreds of global companies, including Twitter and Starbucks

- Indices – 7 prime indices are available, including Dow Jones and the Dax 40

To improve its rating in this review, we’d like to see the broker introduce trading in cryptocurrencies, such as Bitcoin.

Spreads & Commission

Trade360 spreads are relatively costly compared to larger brokers: EUR/USD has a spread of 3 pips and GBP/USD of 5 pips. This broker also charges a $100 fixed fee for account maintenance every 45 days, in addition to a commission for holding position open overnight. This review was particularly disappointed to see the high account maintenance fee.

Further details of Trade360 fees can be found on their website in terms and conditions.

Trade360 Leverage

Leveraged trading is available with Trade350. Maximum leverage of 1:30 is available on forex pairs, although the majority are offered at 1:20, with gold at 1:30 and 1:20 on other commodities. The maximum leverage available for stocks and ETFs is 1:5 and for indices, it’s 1:20.

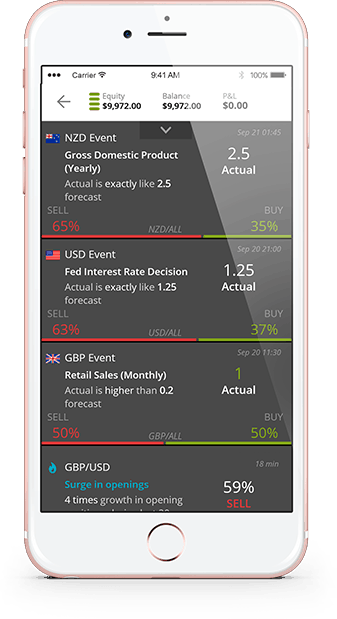

Mobile Apps

A fully-featured Trade360 app is available for download on both the Apple App store and Google Play store. The software offers a user-friendly trading experience similar to the online platform, including the live feed for crowd trading, interactive charting of real-time rates, and daily ranges.

Payment Methods

Deposits

You can finance your account using a variety of methods including credit/debit cards, eWallet, and online/local bank transfer. Payments are made directly via the websites’ Payment Page. Deposits using the mobile app are currently only possible via credit card.

The minimum deposit required by Trade360 depends on the account:

- Mini – $250

- Standard360 – $1,000

- Gold – $5,000

- Platinum – $10,000

- Diamond – $50,000

- Islamic360 – $10,000

Withdrawals

To submit a withdrawal request, traders must provide photo-ID, credit card details, and proof of residence documentation. Trade360 processes withdrawals using the same payment method that was used to place the deposit, up to the value of the initial deposit, and any additional amount is paid via direct bank transfer.

Withdrawal requests are processed within three business days, although the time to receive funds depends on the payment method used.

Demo Account

At Trade360, prospective clients can register for a demo account to try out the platform. This account does not require a deposit to be made. Instead, clients receive a virtual bankroll to explore the different trading products available and the broker’s services.

Bonuses

There are currently no promotions or no deposit bonus deal offerings at Trade360. Most CySEC-regulated firms are prohibited from offering bonus incentives.

Regulation

Trade360 holds a license from the Cyprus Securities and Exchange Commission (CySEC), and because this broker operates in the European Economic Area, it is also registered with the UK’s Financial Conduct Authority (FCA). The company is not regulated by the Australian Securities & Investments Commission (ASIC).

The investment firm behind Trade360, Crowd Tech Ltd, is subscribed to the Investor Compensation Fund. This body helps ensure that any funds belonging to a client are returned if they are inappropriately withheld.

Overall, we’re comfortable Trade360 is a legit and genuine broker and not a scam. We were also pleased to see that aside from a few exceptions, customers haven’t experienced withdrawal problems.

Additional Features

CrowdTradingTM is a useful addition that allows clients to see how other clients are trading an asset. The tool provides for an excellent way to judge market sentiment and see how successful traders are reacting to movements in price.

Recently, this broker has also collaborated with Trading CentralTM, a tool for investment decision support, which is now available directly within the online platform by clicking on the tool logo.

Trade360 Accounts

Trade360 offers five account levels: Mini, Standard360, Gold, Platinum and Diamond. All accounts allow access to a minimum line ten times that of the minimum deposit amount, bar the ‘Mini’ account which offers a minimum line of 1000 USD. Unfortunately the Mini account does not provide access to MT5, but all accounts offer 24/5 support via live chat on the website. Personal notifications and exclusive video market updates are available to account types from Gold upwards, and an Islamic account is available upon request.

Note that Trade360 also caters to professional traders through a Professional account, with advantages including leverage ratios of 1:400 and negative balance protection.

Benefits

Trade360 is user-friendly for the beginner trader and the fully functional mobile app makes trading on-the-go easy. The crowd trading statistics section is also a relatively unique attribute that many clients may benefit from. Other benefits include APIs, safe CySEC-licensing, positive customer testimonials on forums and the esteemed MT5 platform.

Drawbacks

The selection of financial instruments is small compared to larger brokers and spreads are comparatively high. The account maintenance fee may also be off-putting for traders and the minimum deposit requirement is steep.

Trading Hours

The site is available 24/7 but trading hours vary depending on the asset. At Trade360 the majority of forex pairs can be traded between 10 pm on Sunday and 9 pm on Friday and the majority of stocks can be traded Monday to Friday during normal day-time hours. Most indices and commodities can also be traded from Sunday evening until Friday evening, but prospective clients should check the Trade360 website for full details.

Customer Support

The broker’s CEO has ensured clients have several options to contact customer support:

- Chat function – 24/5 Monday to Friday, accessible from the speech bubble icon on the left side of the homepage

- Contact form – available on the Contact page

- Phone number – +357-25-030-622

- Email – support@trade360.com

The website also hosts a Help Centre with many in-depth FAQ pages where account support queries such as how to delete an account or make a complaint can be answered.

Note the broker’s headquarters address can be found on the Trade360 website.

Trader Security

Trade360 guarantees a high level of site security and data protection during and after login. The broker takes steps such as the use of separate servers in different geographical locations to separate online activity and transaction information, a double firewall protection system, and Verisign SSL for user authentication.

Trade360 Verdict

Trade360 is a CySEC-regulated broker offering something unique through its CrowdTradingTM technology. The proprietary and MT5 platforms are safe and easy to use while the withdrawal process is straightforward. With that said, our review was disappointed with the wide spreads and hefty account maintenance fee. As a result, Trade360 wouldn’t be our first choice.

Top 3 Alternatives to Trade360

Compare Trade360 with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Trade360 Comparison Table

| Trade360 | Interactive Brokers | World Forex | Dukascopy | |

|---|---|---|---|---|

| Rating | 2.5 | 4.3 | 4 | 3.6 |

| Markets | Forex, CFDs, indices, shares, commodities, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $250 | $0 | $1 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | CySEC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA | FINMA, JFSA, FCMC |

| Bonus | – | – | 100% Deposit Bonus | 10% Equity Bonus |

| Education | No | Yes | No | Yes |

| Platforms | MT5, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 | JForex, MT4, MT5 |

| Leverage | 1:30 (Retail), 1:400 (Pro) | 1:50 | 1:1000 | 1:200 |

| Payment Methods | 10 | 6 | 10 | 11 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

World Forex Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Trade360 and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Trade360 | Interactive Brokers | World Forex | Dukascopy | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | No | Yes |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

Trade360 vs Other Brokers

Compare Trade360 with any other broker by selecting the other broker below.

FAQ

Is Trade360 a scam?

Trade360 is not a scam or a hoax. This broker is owned by a genuine investment firm, Crowd Tech Ltd, which is regulated by a respected financial authority – the Cyprus Securities & Exchange Commission (CySEC).

Is Trade360 a regulated broker?

This broker is regulated by CySEC and based in Cyprus, and as such is also subject to regulation by the European Markets in Financial Instruments Directive (MiFID).

What is Trade360 crowd trading?

Crowd trading is a feature that may help traders make decisions based on the ‘wisdom of the crowd’. Clients can see how other traders behave with each asset, i.e. what percentage are buying or selling, which may help them spot market trends.

Does Trade360 offer mobile trading?

Trade360 offers a mobile app available for both iPhone and Android which provides a user-friendly interface for executing trades. The app is free to download and also offers the crowd trading feature.

What is the withdrawal process at Trade360?

Withdrawal funds are returned using the same payment method as the initial deposit. Clients may need to show the same verification documentation required at account registration.

Who owns Trade360?

Trade360 is owned by Cypriot firm – Crowd Tech Ltd. The established company has been in operation since 2013.

Is trade360 a hoax?

No, Trade360 is a legit online broker with good customer testimonials. The company has clients in multiple countries and a strong track record.

Customer Reviews

There are no customer reviews of Trade360 yet, will you be the first to help fellow traders decide if they should trade with Trade360 or not?