Tiger Brokers Review 2025

Pros

- I think Tiger Brokers competes well with similar brands when it comes to market coverage, with an excellent range of stocks and funds from US and Pacific exchanges

- I’m satisfied with the brokers strong industry reputation, with multiple awards, custodian backing (including from Interactive Brokers and DBS bank), and its appointed listing on the NASDAQ

- I appreciate that there’s no minimum deposit to get started on the powerful trading terminal, which is accessible via a stable desktop app or mobile device

Cons

- Compared to traditional brokers, there’s limited account funding methods which may be a drawback for traders used to depositing via e-wallets

- Compared to some other brokers, I think the range of educational resources and market analysis tools is lacking a little

- I think some traders may feel restricted by the single proprietary platform offering, with no access to popular third-party stock trading terminals like MetaTrader 4

Tiger Brokers Review

Tiger Brokers is a leading global multi-asset online brokerage. Innovative next-generation trading technology is offered, providing opportunities across a range of securities in global securities markets and currencies. This includes stock/equities in the US, Hong Kong, Singapore and Australia, such as Gamestop (GME), as well as futures, options, funds and more.

This Tiger Brokers review will cover the brokerage’s pricing and trading fees, a prime account guide, promotion and bonus details, deposit and withdrawal tutorials and more.

Tiger Broker Headlines

Tiger Brokers was founded in 2014 and is now an established brokerage with licensed entities across the globe. The firm has office presence in Singapore, Auckland (NZ), New York and more, with nearly 1000 employees. Tiger Brokers is regulated and authorised in several jurisdictions. This includes Tiger Brokers (NZ) Limited, authorised by the Australian Securities & Investments Commission (ASIC), and US Tiger Securities Inc, a brokerage registered with the US Securities & Exchange Commission (SEC). The owner of Tiger Brokers, UP Fintech Holding, is an established Chinese brokerage holding firm.

In recent news, Tiger Brokers was appointed a NASDAQ listing with the ticker TIGR. The broker is backed by industry-recognised shareholders, including Interactive Brokers and Xiaomi. Today, there are almost 1.5 million account holders with an annual trading volume of $219 billion. Q4 revenue earnings from December 2020, were $47.2 million. Yahoo Finance reports a share price with highs of $38.50 to date.

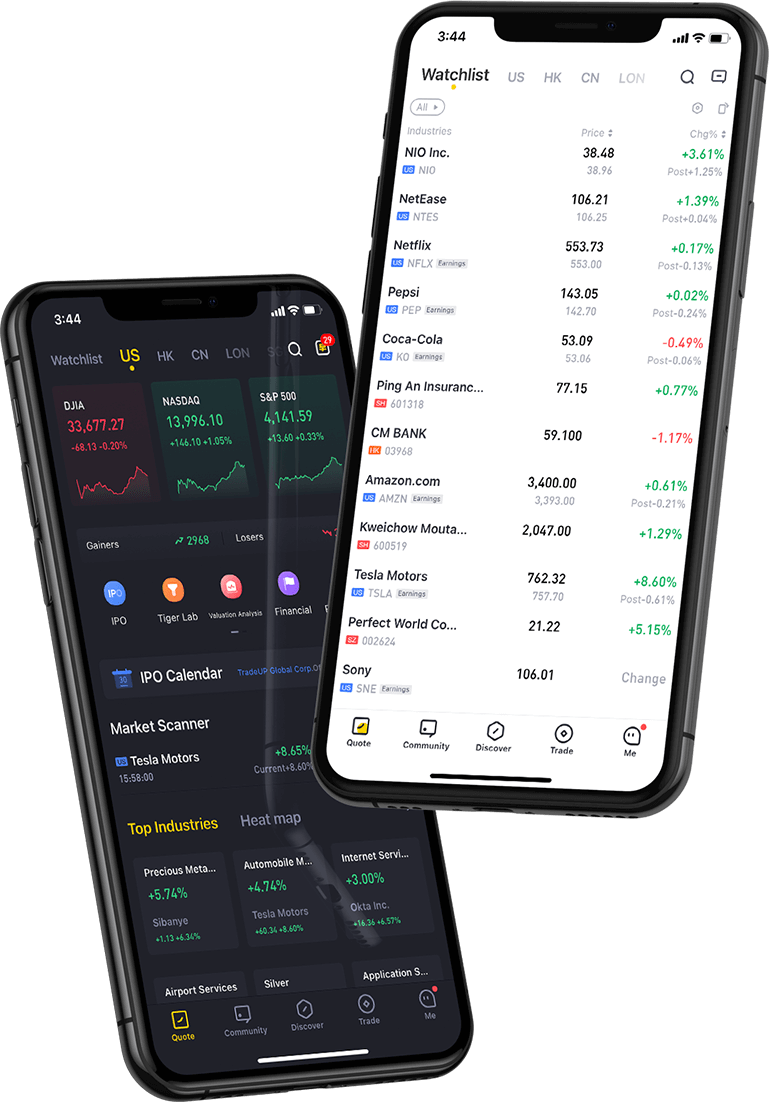

Trading Platform

The broker offers a proprietary platform terminal called Tiger Trade. This is suitable to meet the needs of both new and experienced traders with no extra fees applicable. Clients can download the platform to desktop devices, running either Windows or Mac OS, and integrate with an API. There is no web browser compatibility.

Features include:

- One-click trading

- Easy to read graphics

- Highly intuitive customisable interface

- Tiger market data with in-depth price analysis

- Profit & loss analysis, stock options trading, screeners

- Real-time stock quotes with free streaming market data

- Customisable technical indicators and ‘mini floating windows’

- Clearly displayed account data at the forefront of the dashboard

- Fully customisable dashboard with personalisation according to goals and portfolio

- Access to financial information on company stocks, global news and an economic calendar

- Tiger Brokers’ innovative trading platform features have been recognised as highly intuitive and named by KPMG’s Fintech 100 report.

Tiger Brokers has also gained much popularity in Malaysia and Indonesia thanks to their sophisticated, yet accessible, trading platform and mobile app.

Assets

The broker offers clients investing and trading opportunities in the following global markets:

- Australia: Stocks

- China: A-Shares (HKEX Northbound Trading)

- USA: Stocks, ETFs, Stock Options, Futures, OTC

- Singapore: Stocks, ETFs, Rights Issue, Futures, REITs, DLCs

- Hong Kong: Stocks, Warrants, Stock Options, CBBCs, Futures

Tiger Brokers does not currently offer cryptocurrency investing, such as Bitcoin and Ripple, or fractional shares. The broker has launched access to buy into a US IPO share subscription.

Available order types vary by instrument and include market orders, limit orders, and stop-loss orders. Validity also varies between day or good-till-cancelled (GTC). Full details can be found in the order types section on the broker’s website.

Spreads & Commission

Commissions and fees vary by market and asset class and are highly competitive vs other leading brokers. See the full commission breakdown below:

Stocks And ETFs

- China A-Shares – 0.03% x trade value

- Australian Stocks – 0.03% x trade value

- Hong Kong Stocks – 0.03% x trade value

- US Stocks and ETF’s – from $0.005 per share

- Singapore Stocks, ETFs, REITs and DLCs – 0.04% x trade value

Options, Warrants And CBBCs

- US Stock Options – from $0.65 per contract

- Hong Kong Stock Options – from 0.2% x trade value

- Hong Kong Warrants and CBBCs – 0.03% x trade value

Futures

- Equity Futures – $8 per contract

- Treasury Futures – $1.99 per contract

- Forex Futures – from $1.99 for major pairs, commission-free for micro pairs

- Index Futures – vary by index, from $0.99 per contract, including China A50 Index

- Energy Futures – vary by energy, from $0.99 per contract, including e-mini crude oil

- Agriculture Futures – vary by product, from $0.99 per contract, including corn and wheat

- Metals Futures – vary by metal, from $0.99 per contract for Micro Gold, average $1.99, including Gold and Silver

Additional platform fees, regulatory board charges and trading fees, including stamp duty, clearing, and settlement charges may apply. Visit the broker’s website for details organised by instrument.

Tiger Brokers do not charge for any of the following: deposits & withdrawals, currency exchange, account maintenance, inactivity, or custody fees. This is a very competitive characteristic, helping maximise investor profit possibilities.

Leverage

Tiger Brokers offers leverage opportunities for traders with a margin account. Leverage rates vary with the type of trade being executed; up to 1:4 leverage can be acquired for intraday trading, whereas overnight trades and GTC orders are limited to 1:2. Leverage is a good way to increase profits but can significantly magnify the risks of trading. Always ensure robust risk management strategies are in place when trading with high leverage.

Mobile Apps

The broker offers a powerful multi-asset mobile application platform, Tiger Trade. This is available to download for free on iOS and Android devices. QR code access is available on the broker’s website for quick and easy download. The app supports real-time quotes, trading history, and financial news streams so you can trade anytime, anywhere. Innovative and customisable insights and watchlists are available for set-up. This includes several tools, charts, investment calendars and market movers information to support strategic decision-making.

Integrated investing strategies are provided in the Tiger Brokers mobile app, using a widget known as Tiger Lab. This provides quantitative techniques such as super hunter long, covered call, and quant optimization.

Payment Methods

Deposits

Tiger Brokers does not have a minimum deposit requirement, which is ideal for new investors and those without much capital to put down. The brokerage accepts several payment methods for live account deposits in five currencies; USD, EUR, SGD, HKD and AUD:

Singapore Bank Accounts:

- Direct Debit Authentication – SGD only, processing time a matter of minutes, no fees, sending bank DBS/POSB

- DBS/POSB Bank Transfer – all currencies, SGD processing time 15+ minutes, other currencies 1-2 business days, no fees

- Non-DBS/POSB Bank Transfer – all currencies, SGD processing time 15+ minutes, other currencies 1-3 business days, fees vary by currency, ~ USD 25

Non-Singapore Bank Account:

- Telegraphic Transfer – any bank, 1-3 day processing time, charges dependent on sending bank

Retail accounts can hold funds in several different currencies at once. To deposit funds, follow the standard Tiger Brokers login process, select deposit, choose the relevant currency and bank then submit. The broker does not accept deposits from a joint bank account. After depositing, traders may exchange funds into different currencies and invest in corresponding markets with no interest rates or commission charges.

Withdrawals

Tiger Brokers does not charge withdrawal fees, however, third-party bank charges may apply. Similar to deposits, withdrawal methods vary by receiving bank and currency:

Singapore Bank Accounts:

- DBS/POSB Bank Transfer – all currencies, 1-3 business days, no fees

- Non-DBS/POSB Bank Transfer – all currencies, 1-3 business days, fees vary by currency, ~ USD 25, intermediary bank fees apply

Non-Singapore Bank Accounts:

- Telegraphic Transfer – any bank, 1-3 day processing time, fees vary by currency, ~ USD 25, intermediary bank fees apply

Withdrawing funds from a Tiger Brokers account is very similar to depositing; simply select withdrawal after logging in and complete the on-screen request instructions. You can view a funds record to check the status of the request.

There may be discrepancies in the value of your account and the maximum withdrawal limit. This will be the case if you are trading on margin, as you must maintain a certain capital level in your account while leveraged positions are open. Withdrawal of funds that have not yet been settled will incur a financing interest rate.

Demo Account

Tiger Brokers offer a paper trading, or practice, account. This is now a common occurrence for major online brokerages, such as Saxo, Interactive Brokers, Poems, Fsmone and Moomoo, to enhance investor relations. The Tiger Brokers online demo account is a good exercise option to become familiar with the trading platform offered and to test strategies in a risk-free environment before implementing them in the live markets.

Bonuses

Tiger Brokers regularly offer bonuses and promotional incentives. At the time of writing, the broker’s deals included a new customer welcome gift and voucher, sign-up referral promo code offers, a no-deposit bonus promotion, rewards, and free stock and commission-free trade access. A Tiger Brokers referral invitation code for new customers in 2021 was also offered, which included up to $200 commission-free trading, and free level 2 data for US stocks.

A privilege scheme is also available based on the number of trade orders per three-month time frame. Tiger Brokers’ ace traders (>200 orders in three months) gain access to elite advantages. These include 30% off US stocks commission and voucher options across established corporations, including free Starbucks, Disney and Apple stocks and shares, plus 10% off Tesla shares.

These offers are not limited to 2021. Tiger Brokers may continue to run a long-term promotion or fees-waiving deal as new customer incentives. Keep an eye on the broker’s latest news for future promotions to utilise at account opening or to grab a relevant promo opportunity to enhance your day trading experience as a registered Tiger Brokers investor.

Tiger Brokers Regulation

Tiger Brokers holds licenses in all countries of operation, including the US, NZ, Australia, and Singapore. It is good to see that the safeguarding of customer assets with segregated funds is implemented securely in all jurisdictions. The broker complies with annual and quarterly reports and review requests with internal audits conducted regularly.

In Singapore, the corporation holds a Capital Markets Services License under the Securities and Futures Act by the Monetary Authority of Singapore (MAS).

US clients can be assured of a safe investment environment as the broker is regulated by the US Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA), both of which are highly respected authorities in the financial market. Retail clients are also covered by regulation from the Securities Investor Protection Corporation (SIPC), with $500,000 compensation against the financial failure of the investment company. Visit the broker’s website for full details of all licensing and authoritative measures in place by country.

Tiger Brokers regulation is backed by secure and reliable custodians for client capital and asset protection. This includes DBS Bank and Interactive Brokers.

Additional Features

Disappointingly, Tiger Brokers does not offer an education platform or any training tools, making it less accessible to new, inexperienced investors. However, there are several features to aid clients with investment decisions. These include free price-line chart comparisons, financial data calendars, and customisable watchlists.

Tiger Brokers does provide links to a community forum and stocks college, although this is limited to Chinese-reading users and clients. It would be much more competitive if the broker included guides on buying power, insufficient margin trades, how to buy options, margin interest rate calculations and how to trade with cash.

Account Types

There are two account types available to Tiger Brokers retail clients; margin accounts and cash accounts. Similarities between the accounts include no minimum deposit requirements and no limits on the number of orders or frequency of trades. The brokerage allows clients to upgrade from a cash account to a margin account free of charge.

Margin Account

- Access to all products

- Minimum trade size 1 lot

- 1:4 leverage for intraday trading

- 1:2 leverage for overnight trading

Cash Account

- Minimum trade size 1 lot

- no margin or short selling

- Some products, including futures and options, may not be traded

Clients can open a new account via the mobile app or on the broker’s website. KYC compliance documentation is required, which will include proof of identification, current residency and tax ID. Tiger Brokers applications for opening accounts are usually processed within three business days, subject to money laundering and account origin checks.

Trading Hours

Tiger Brokers follows standard office hours and supports 24-hour trading Monday through Friday. However, these timings will vary with the instrument type being traded. For example, stock exchanges have specific opening times, whereas forex can be traded 24/5. The trading platform provides a calendar of relevant trading hours, which can also be found on the homepage of the broker’s website.

Tiger Brokers also offers some out-of-hours trading on the US stock exchange, including pre and post-market trading sessions, though there is still an eight-hour reprise.

Customer Support

Tiger Brokers offers the below customer contact options, available Monday to Friday, 08:30 – 18:30 GMT:

- Email: service@tigerbrokers.com.sg

- China Telephone: +86 400 603 7555

- New Zealand Telephone: +64 93938128

- Singapore Telephone: +65 6950 0591 & +65 6331 2277

- Live Chat: logo on right side of all webpages or within Tiger Trade app

- Address: #29-04, Singapore Land Tower, 50 Raffles Place, Singapore 048623

There are also many help topics and a broker-specific user guide on the Tiger Brokers website. These include how to open a new margin or cash account, how to understand the finance loan, trading fees, currency conversion and how to use a stock voucher.

Security

The Tiger Brokers trading platform assures users of high-tech encryptions and industry-standard data privacy. Member areas and terminal access are all password protected.

The broker has also developed a security feature it calls Tiger Token. When the token two-factor authentication (2FA) is enabled, a one-time transaction approval password is generated by the application as an additional security feature. Email notifications can also be enabled for deposits and withdrawals.

Final Word On Tiger Brokers

Overall, Tiger Brokers is a competitive securities and forex brokerage firm. It offers a highly customisable, intuitive, proprietary trading platform that supports a suite of analysis tools to support even the most experienced traders. The fee model is impressive, with no currency exchange or inactivity charges. Tiger Brokers strives for its clients’ trust, with high levels of security, good customer service and transparency. However, the lack of access to MT4 or MT5 is disappointing, removing the possibility of algorithmic trading, and there is no access to EMEA markets, such as the London Stock Exchange (LSE), which may turn away some traders.

FAQs

Is Tiger Brokers Legit?

Yes, Tiger Brokers boasts several credible licenses and is regulated by some of the safest global financial entities. Customer service is available through many different channels and live chat is running throughout trading hours.

My Tiger Brokers Account Is Saying 'You Can't Place An Order', What Can I Do?

There are several reasons why a Tiger Brokers account may not allow an order. These may include locked funds held in deposit processing status or not enough buying power. If you are unsure or receive an error code, contact the broker’s customer service team via email, their telephone hotline or live chat for assistance.

What Fees Apply When Trading With Tiger Brokers?

Tiger Brokers are highly competitive and transparent regarding their brokerage fees. For example, ETF and options charges per contract vary by trading markets with set commission charges. Clients can be assured of no account fees, including exchange rate fees, inactivity fees, holding fees, custody fees and more.

When Trading With Tiger Brokers, Am I Entitled To Dividends?

Whether a dividend is paid on a stock position depends on the corresponding issuing company. If applicable, the dividend will be automatically credited to your account. Tax fees may apply, depending on the financial jurisdiction.

I Am Unable To Withdraw From My Tiger Brokers Account, What Can I Do?

Visit your Tiger Brokers ‘withdrawal request’ records page in your account for a review of the request status. Here, you can discover that the request may be under review, rejected, failed, remitted or cancelled. Contact customer support to resolve any further issues.

What Is The Tiger Brokers Fund Mall Account?

The fund mall account allows Tiger Brokers clients to carry out unit trust investments. This entails subscribing to a variety of mutual index funds in one account, adding easy and instant diversification without needing to open a separate account.

Top 3 Alternatives to Tiger Brokers

Compare Tiger Brokers with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- Zacks Trade – Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

Tiger Brokers Comparison Table

| Tiger Brokers | Interactive Brokers | FOREX.com | Zacks Trade | |

|---|---|---|---|---|

| Rating | 3.5 | 4.3 | 4.5 | 3.9 |

| Markets | Stocks, Options, Futures, Stock Options, ETFs, Warrants, Interest Rates | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options | Stocks, ETFs, Cryptos, Options, Bonds |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $2500 |

| Minimum Trade | 1 Lot | $100 | 0.01 Lots | $3 |

| Regulators | MAS, SEC & FINRA, ASIC, SIPC, NFA, DTC, NSCC, HKMA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC | FINRA |

| Bonus | – | – | Active Trader Program With A 15% Reduction In Costs | – |

| Education | No | Yes | Yes | No |

| Platforms | Tiger Trade, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | Own |

| Leverage | 1:4 | 1:50 | 1:50 | – |

| Payment Methods | 2 | 6 | 8 | 3 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Zacks Trade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Tiger Brokers and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Tiger Brokers | Interactive Brokers | FOREX.com | Zacks Trade | |

|---|---|---|---|---|

| CFD | No | Yes | No | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | No | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | No | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | No | Yes |

| Bonds | Yes | Yes | No | Yes |

| Warrants | Yes | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | No |

Tiger Brokers vs Other Brokers

Compare Tiger Brokers with any other broker by selecting the other broker below.

The most popular Tiger Brokers comparisons:

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Tiger Brokers yet, will you be the first to help fellow traders decide if they should trade with Tiger Brokers or not?