Tickmill Review 2025

Awards

- Best Commodities Broker 2020 - Rankia Markets Experience Expo

- Best Trading Experience 2020 - Forex Brokers Award

- Best Forex Execution Broker 2019 - CFI.co Awards

- Best CFD Broker Asia 2019 - International Business Magazine

- Best Forex CFD Provider 2019 - Online Personal Wealth Awards

Pros

- Beginner-friendly educational content with user tutorials and analyst insights

- Three live accounts with five base currencies and competitive pricing

- Strong suite of trading tools; MT4, MT5, VPS, Autochartist, Acuity, and forex calculators

Cons

- Limited regulatory oversight if you sign up with the offshore branch

- Services not available to clients from the US, Japan or Canada

- Telephone support available during office hours only

Tickmill Review

Tickmill is an award-winning ECN broker offering trading in forex, indices and commodities. This review explores the MetaTrader 4 (MT4) trading platform, spreads, bonuses, plus deposit and withdrawal options. Find out whether you should sign up for a Tickmill account.

Tickmill Company Summary

Tickmill Ltd is a member of the global Tickmill Group, which consists of several trading companies established in the 1980s. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+.

Its headquarters are in London but the company has multiple offices worldwide and its clients can be found everywhere from Indonesia, South Africa, and Tanzania, to Vietnam, Estonia, Australia, and Malaysia.

Also part of the Tickmill Group Ltd is Tickmill Prime and Tickmill UK, registered in the Isle of Man.

Trading Platforms

MT4 Platform

Hugely popular due to its ease of navigation, dashboard customisation and suite of features, MT4 is the leading forex trading platform.

Traders benefit from:

- EA trading

- Charting tools

- 50+ indicators

- Historical data centre

- Order management tools

- Advanced notification system

WebTrader Platform

As an online platform, the web-based interface doesn’t require a software download.

Features include:

- 30+ indicators

- 9 time frames

- Real-time quotes

- Intuitive interface

- Customisable price charts

Popular Alternatives To Tickmill

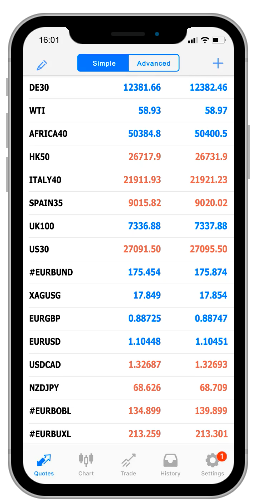

Assets

Clients have access to a range of tradeable instruments:

- Forex – Trade on 60+ major, minor and exotic currency pairs, including GBP/USD, EUR/GBP, and ZAR/USD

- Stock indices – Access 14+ indices including the FTSE, DAX, Dow Jones (US30), and NASDAQ (Nas100)

- Commodities – Trade on WTI oil and precious metals, such as gold (XAUUSD) and silver (XAGUSD)

- Bonds – Trade a selection of German bonds

Spreads & Fees

The Tickmill Classic account is commission-free with variable spreads starting from 1.6 pips. For Pro and VIP account holders, spreads begin at zero pips with low commissions.

Transaction fees are covered up to $100, but dormant accounts may be charged an inactivity fee. Triple swap charges apply to positions held overnight.

Leverage

The maximum leverage available is 1:500, but varies depending on the asset:

- Stock indices – 1:100

- Metals – 1:500

- Bonds – 1:100

- Oil – 1:100

- FX- 1:500

A margin calculator and detailed information regarding margin requirements can be found on the Tickmill website.

Mobile App

Mobile trading is available on Android (APK) and Apple (iOS) devices and makes trading on the move straightforward while retaining almost all of the desktop features. Users can analyse markets, price trends, and trade directly from charts. Mobile traders can also deposit funds, withdraw profits, and use available bonuses.

Payment Methods

Accepted payment methods include bank transfer, Visa/Mastercard, Skrill, Neteller and QIWI. The minimum deposit for Classic and Pro accounts is $100 and for a VIP account, it’s $5,000. The minimum withdrawal is $25. Payments are processed in EUR, GBP, USD and PLN.

To make a deposit or withdrawal, head to the Client Area. Customer reviews of the payment process are generally positive.

Demo Account

Tickmill offers a forex and CFD demo account. The practice account is a great opportunity to test the MT4 platform, new strategies and explore additional features, without the risk of losses. You can open a demo account from the broker’s homepage. The demo server also has rich market history data.

Deals & Promotions

Four promotional offers are available:

- ‘Get Paid To Trade’ loyalty program – Earn up to $0.75 cash rebate per lot traded depending on your monthly volume

- $30 welcome bonus – Set up and login to your account to withdraw your welcome bonus

- Trader of the month – The top-performing trader earns a $1,000 free trading bonus

- Predict the NFP – Win $500

For any issues claiming your deposit bonuses, see full bonus terms and conditions under the ‘Promotions’ tab. The customer support team can also assist with bonus queries.

Note, deals are not available to all account holders and in all jurisdictions. For clients trading with Tickmill UK and Tickmill Europe, access to promotions will be limited due to regulatory oversight.

Regulation & Licensing

Tickmill Ltd is regulated by the Seychelles Financial Services Authority (FSA). Tickmill UK Ltd is authorised by the Financial Conduct Authority (FCA). Tickmill Europe Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC). These are reputable regulatory agencies and help contribute to the broker’s high trust rating.

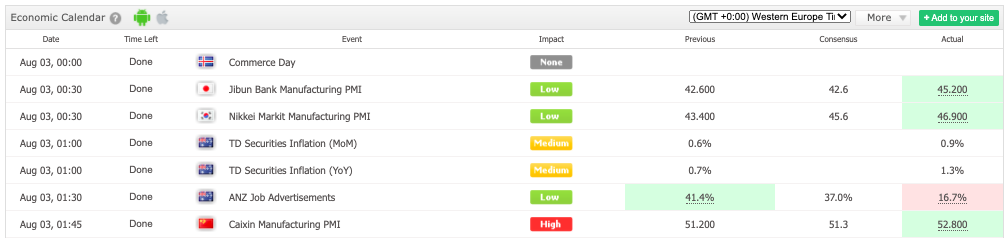

Additional Features

Tickmill offers multiple additional features to assist traders, including:

- Free VPS

- News blog

- Copytrade

- TradingView

- Economic calendar

- One-click (EA) trading

- Video tutorials & seminars

- Forex & pip calculators

Account Types

Tickmill offers three account types:

- Classic – Trade CFDs on 62 currency pairs, major indices, bonds and commodities. Variable spreads start from 1.6 pips and there are no commissions. A Classic account is suitable for both beginners and experienced traders.

- Pro – Aimed at experienced traders. Spreads from zero pips, commission payable on 2 currency units per side per lot (0.0020% notional). Stop and limit levels are 0. No commission on stock indices, oil and bonds.

- VIP – An exclusive account for high volume traders. Commission payable on 1 currency unit per side per lot. No commission on CFDs, stock indices, oil and bonds. Spreads from zero pips, minimum deposit $50,000.

An Islamic trading account is also available.

For issues regarding invalid account requests, check the list of accepted countries below or contact the customer support team.

Trading Hours

FX trading is available 24 hours, 5 days a week. German bonds can be traded between 00:00 to 23:00 GMT. Gold markets are open from Monday to Friday, 01:02 to 23:57 GMT and Silver Monday to Thursday from 01:00-24:00 GMT, and Friday 01:00 to 23:57 GMT.

Opening times for CFDs will depend on their respective market. Head to the official Tickmill website for more information. Trading hours can also be viewed in the MT4 terminal.

Customer Support

Customer support is available Monday to Friday 7:00 – 16:00 GMT via:

- Phone – +852 5808 2921

- Email – support@tickmill.com

- Live chat – chat logo on the right of the homepage

The support team can help with a range of queries, from registration and verification documents to swap-free conditions, forgotten passwords and account FAQs.

Additional information can be found on Tickmill’s LinkedIn and YouTube platforms.

Security

Tickmill’s internal systems are FSA compliant, so client funds are held in segregated accounts. The broker adheres to industry safety standards and only offers secure deposit and withdrawal options. Negative balance protection is available to all clients.

Tickmill Verdict

Tickmill is a regulated broker offering the MT4 trading platform, a suite of additional resources, plus multiple account options. Take Tickmill’s services vs Pepperstone, XM, ZuluTrade or IC Markets, and traders benefit from competitive fees but sacrifice such a diverse product list.

Top 3 Alternatives to Tickmill

Compare Tickmill with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Tickmill Comparison Table

| Tickmill | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| Rating | 3.3 | 4.3 | 3.6 | 4 |

| Markets | Forex, CFDs, indices, commodities, bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 | $1 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, CySEC, FSA, LFSA, SC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | SVGFSA |

| Bonus | 30% deposit bonus | – | 10% Equity Bonus | 100% Deposit Bonus |

| Education | Yes | Yes | Yes | No |

| Platforms | MT4, MT5, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:500 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 14 | 6 | 11 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Tickmill and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Tickmill | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Tickmill vs Other Brokers

Compare Tickmill with any other broker by selecting the other broker below.

The most popular Tickmill comparisons:

FAQ

Does Tickmill offer an Islamic account?

Yes, Tickmill offers a swap-free account, compliant with Sharia law. See the broker’s website for instructions on how to open an account.

Is Tickmill a true ECN broker?

Yes, Tickmill is an ECN broker and not a market maker. This arguably means clients benefit from lower fees and operate in a more transparent trading environment.

Is Tickmill available to US clients?

No, services are not available to those from the US. Traders from Canada, Japan and some other countries are also unable to open real-money trading accounts.

Is Tickmill a good broker?

Tickmill is a highly regulated and well-established broker, offering the popular MT4 platform. With decent welcome bonuses and customer support also available, Tickmill a solid online broker.

Does Tickmill have the NASDAQ?

Yes, clients can trade on the NASDAQ. Tickmill traders also have access to a dozen or so other stock indices, plus 62 currency pairs, commodities, and German bonds.

Customer Reviews

There are no customer reviews of Tickmill yet, will you be the first to help fellow traders decide if they should trade with Tickmill or not?