ThinkTrader

ThinkTrader is a powerful platform designed by ThinkMarkets for forex trading and CFD trading in a range of markets. This review will dive into the platform’s analysis features, payment methods and additional features, before comparing it to some of its major competitors. Find out how to get started with ThinkTrader today.

ThinkTrader Platform

ThinkTrader, formerly Trade Inceptor, is the proprietary trading platform offered by broker ThinkMarkets. The broker was established in 2010 and subsequently rebranded as ThinkMarkets in 2017. The ThinkTrader platform supports trading across numerous asset classes including forex, indices, cryptocurrencies, commodities and CFDs. Clients are accepted from over 180 countries and can choose between eight base currencies.

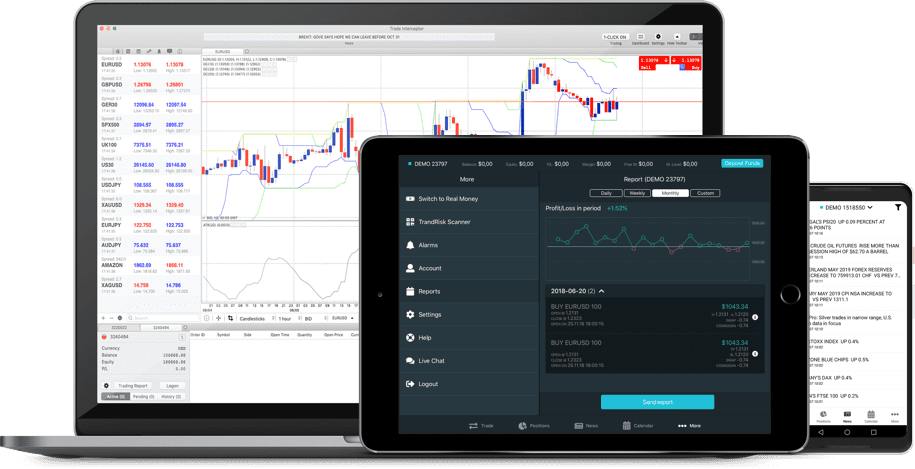

Importantly, the platform is available as both a downloadable trading terminal and via web browsers.

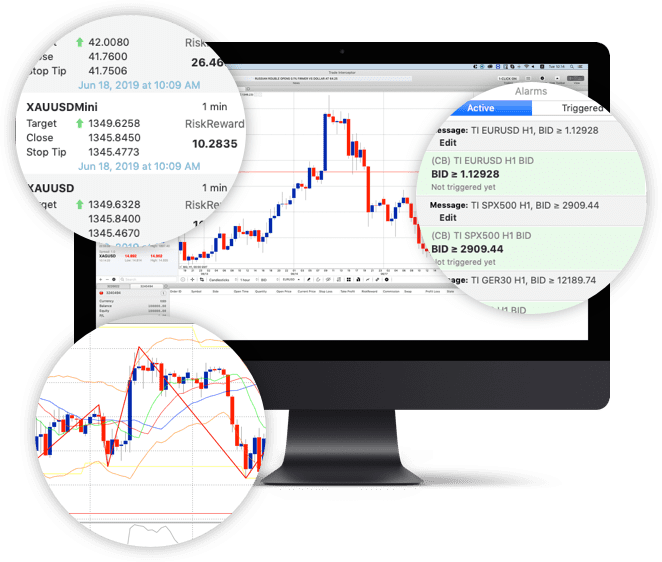

The ThinkTrader platform interface is streamlined and user-friendly. It supports a host of advanced features, options for customisation and can be accessed from mobile, tablet and desktop devices. Features include:

- 125 indicators

- Free VPS hosting

- Real-time news updates

- Single multi-device login

- Up to 200 cloud-based alerts

- In-app deposits & withdrawals

- Multiple one-click order closing

- Customisable trading history reports

- 50 drawing tools & 40 analytical objects including lines, channels, Gann, Fibonacci and Elliott tools

How To Trade

To trade on the ThinkTrader platform, you’ll need to open an account. The process is straightforward and can be accessed via the Create Account tab located on the ThinkMarkets website.

You’ll be required to submit personal details and then prompted to complete a short questionnaire about your trading experience. You’ll get the chance to choose between the ThinkTrader or the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) interfaces, as well as choosing between eight base currency options and leverage up to 1:500.

There is no minimum deposit required to open a ThinkTrader account.

Mobile App

Clients can trade anytime, anywhere with the ThinkTrader mobile app. The app is compatible with iOS and Android (APK) devices and is available to download from the Apple and Google Play Store.

The app supports all the features of the desktop platform including innovative analysis, cloud-based alerts and multi-deal closure. Clients can also monitor four real-time charts with the Quad screen display. The app has received over 15,000 five star reviews and is a key part of the ThinkMarkets offering.

Payment Methods

Several payment methods are supported on the ThinkTrader platform, including:

- Bank Wire Transfer

- Debit/Credit Cards

- Neteller

- PayPal

- Skrill

- BitPay

Payments are payable in AUD, EUR, CHF, GBP and USD. Bitcoin, Ether and Bitcoin Cash are accepted for those that opt for BitPay. Bank Wire transfers will take 1-3 business days to process. Payments made using Visa or Mastercard offer instant execution whilst e-payment solutions Neteller and Skrill can take up to 10 minutes to be credited.

To fund your account, head to ThinkPortal and select Deposit Funds which can be found under the Funding tab. Inter-account transfers are supported. Up to two transfers can be actioned within a 24 hour period.

To withdraw funds, select Withdrawals followed by New Request, also located under the Funding tab in the ThinkPortal. You’ll be directed to complete a withdrawals form. Withdrawals can take up to 1 day to be processed.

ThinkMarkets does not supply third-party payments.

Additional Resources

ThinkTrader also offers a range of educational resources. In addition to trading courses, guides and webinars, the platform offers free articles covering the latest topics in global trading and investment activities. Resources are tailored to beginners, intermediate and advanced traders so there is something to suit all experience levels. There are also economic calendars and glossaries available for all clients.

ThinkTrader integrates with the TrendRisk Scanner, a signals and stock scanning tool also developed by ThinkMarkets. This tool will actively search a range of markets with risk management approaches to provide you with live opportunities.

Social trading is also supported by ThinkTrader through integration with the ZuluTrade platform. This allows clients to filter through the top traders to see their strategies and markets, allowing portfolio diversification or automation.

Regulation

ThinkMarkets is authorized by some of the world’s most prominent regulatory bodies including:

the Australian Securities and Investments Commission, (ASIC) Financial Conduct Authority (FCA) and the South African Financial Sector Conduct Authority (FSCA). License numbers can be found below.

- FCA: 629628

- ASIC: 424700

- FSP: 2017/098181/07

Benefits

The ThinkTrader platform has a lot to offer, not least:

- Suite of advanced technical tools

- Wide range of instruments

- Free Backtesting software

- Social & copy trading

- Automated trading

- Islamic account

- API trading

- EA trading

- Free VPS

Drawbacks

There are however a few limitations of the ThinkTrader platform that clients should be aware of:

- Some reported bugs in the app

- Less industry-wide usage than some competitors

Contact Details

To get in touch with the team behind the ThinkTrader platform you have several options:

- Phone: +44 203 514 2374

- Email: support@thinkmarketsco.uk

- Live chat

24/7, multi-language support is available through the platform. The company is also active across social media platforms including: Facebook, Instagram, LinkedIn and Twitter in addition to running a popular YouTube channel. For help with a query be sure to get in touch. The team are generally responsive, knowledgeable and polite.

Safety

ThinkTrader has taken a number of steps to ensure the safety and security of client funds. In partnership with Lloyd’s of London, up to $1,000,000 client funds are protected in the event of insolvency. The insurance is automatically applied to all clients and doesn’t require clients to opt in.

Trading through the platform is facilitated by some of the most trusted global banks including Barclays and Lloyd’s of London. An added layer of protection is delivered via segregated accounts in which all clients funds are held.

ThinkTrader Verdict

ThinkTrader is an advanced trading platform with a competitive suite of analysis tools and charting options. The software also boasts a strategy backtesting feature, social, copy and automated trading functionalities and a free VPS. Moreover, ThinkTrader supports cloud-based alerts and customer support is available in a range of languages. ThinkTrader is thus great for both novice and advanced traders.

FAQs

Is ThinkTrader Legit?

Yes, ThinkTrader is a legitimate trading platform. The software is easy to navigate, supports a wealth of advanced trading tools and is safe and secure.

Is ThinkTrader Safe?

The security features supported by the ThinkTrader platform have our confidence. The platform works with the world’s foremost banks, holds all client funds in segregated accounts and offers an insurance policy of up to $1,000,000 in the case of insolvency.

Do Windows PC Devices Support The ThinkTrader Platform?

Clients can access the ThinkTrader platform from Windows, Mac, APK and iOS devices, including PCs, iPhones, iPads and Macs. ThinkTrader is available to download and supported online via browsers.

Where Can I Download ThinkTrader For PC?

The desktop ThinkTrader platform is available for download from either the Mac App Store or the Windows store. Links can also be found on the ThinkMarkets website.

Is ThinkTrader Available In Australia?

Yes, clients located in Australia are able to access the ThinkTrader platform. The platform is available worldwide in over 180 countries, with notable exceptions including the USA, Japan and Iran.

Is There A ThinkTrader Demo Account?

ThinkTrader’s features can also be used as a market simulator in a demo account. ThinkMarkets loads up your account with virtual funds for a risk-free trading environment for strategy testing, market exploration and learning.