ThinkMarkets Increases Margin Requirements Following Unprecedented Volatility

ThinkMarkets is urging clients to fund accounts following a spike in market volatility. The broker is increasing margin requirements on a string of its contracts for difference (CFDs). The changes come into force on February 09, 21:00 GMT.

New Margin Requirements

The changes affect growth stocks and volatile ETFs, including Beam, Canada Goose, SunPower, Pinterest, Peloton, Virgin Galactic and Work Horse Group. The revised margin requirements for some assets are substantial.

ThinkMarkets added: “Due to unprecedented volatility and low levels of liquidity in the global equity markets, ThinkMarkets is increasing the margin requirements on a selection of CFD equity products across our MT4, MT5 and ThinkTrader platforms”.

Margin Explained

Margin is the minimum amount of capital that needs to be held in an account before placing a leveraged trade. Margin requirements are important to prevent significant losses during erratic market activity. If a trader fails to maintain the minimum balance, they may receive a margin call, requiring them to either deposit more funds or sell existing assets.

Leveraged trading is particularly popular among retail investors using CFDs. It enables individuals to take larger positions than their capital would otherwise allow. It also means that traders can diversify portfolios by opening positions across multiple markets.

About ThinkMarkets

Founded in 2010, ThinkMarkets is a multi-regulated broker with more than 550,000 clients in 180 countries. The brokerage offers more than 1,500 assets spanning forex, stocks, indices, precious metals and cryptocurrencies. Spread betting is also offered to UK clients.

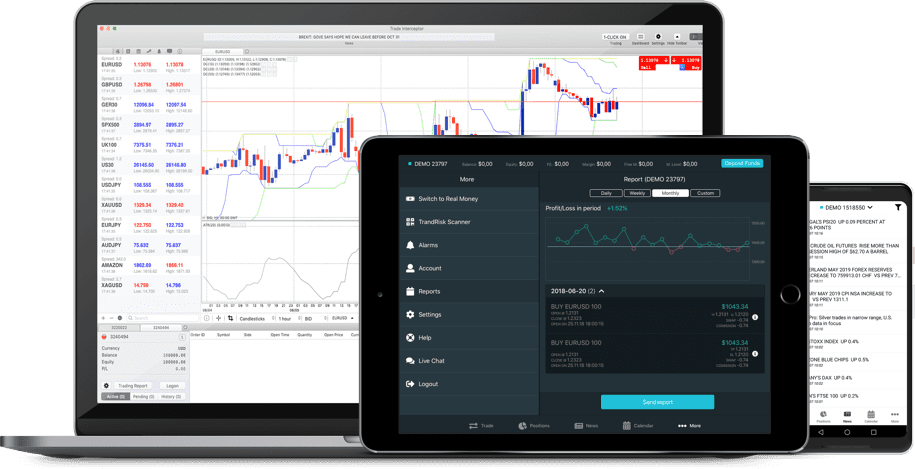

As well as the renowned MetaTrader 4 and MetaTrader 5 platforms, the brand hosts a proprietary web-based terminal. The ThinkTrader solution has 80+ indicators, 50 drawing tools and 14 chart types. 200 cloud-based notifications are also available.

ThinkMarkets offers leverage up to 1:500 on forex assets, 1:200 on indices and commodities, and 1:10 on cryptocurrency. In line with regulations, the broker caps retail leverage to 1:30 for traders in Europe, Australia and the UK.

Use the sign-up link below to start trading today.