Forex Trading in Thailand

Thailand’s impressive rise as a global economic player has unlocked investment opportunities for its citizens, notably an interest in forex trading. The country’s financial landscape is flourishing, fueled by a robust emerging market economy and a sound monetary framework.

Thailand’s average daily trading volume in the foreign exchange market was $15 billion in 2022, up from $14 billion in 2019, according to the Bank of International Settlements (BIS).

This guide explains the essentials of forex trading in Thailand, provides actionable tips, and walks through an example forex trade.

Quick Introduction

- The Thai baht (THB) was pegged to the US dollar (USD), however the peg was abandoned in July 1997 with the baht losing 60% of its value by October of the same year, though it has since rallied and emerged as one of the least volatile currencies.

- The Bank of Thailand (BOT) oversees the country’s monetary policy, while the Securities and Exchange Commission (SEC) is another central regulatory body concerned with investment activities.

- The tax treatment of forex trading profits can be complex in Thailand, with residents potentially paying a progressive Personal Income Tax (PIT) ranging from 0% to 35% to the Revenue Department.

Top 4 Forex Brokers in Thailand

These 4 trading platforms stood out from the crowd for Thai forex traders:

How Does Forex Trading Work In Thailand?

Forex trading in Thailand allows you to profit from currency fluctuations. Due to the limitations of the Thai baht, mainly traded against the US dollar through the USD/THB, there are also other popular choices for Thai traders, including established pairs like EUR/USD (euro/US dollar) or JPY/USD (Japanese yen/US dollar).

To start trading currencies online in Thailand, you’ll need to:

- Open an account with a top forex broker – we recommend choosing an ASIC– or FCA-regulated firm for robust regulatory oversight.

- Deposit funds – The THB isn’t widely used as a base currency for forex accounts, but brokers may allow deposits and withdrawals in THB.

- Execute forex trades – your broker will provide a desktop, mobile, and/or web-based platform.

Is Forex Trading Legal In Thailand?

Forex trading in Thailand was illegal until 2017 when an amendment to the Securities and Exchange Act BE 2535 was made. Now, residents can trade forex through licensed brokers, both domestic and international.

However, while the domestic forex brokerage scene in Thailand is relatively limited, most reputable international forex brokers welcome Thai traders, providing a global pool of trading platforms.

Leverage, a popular tool with day traders, can get complex in Thailand’s forex market. Most Thai residents trade through international firms that are often regulated by established authorities like the FCA or CySEC. These regulators typically impose stricter leverage limits, with a typical maximum around 1:30 for major currency pairs.

Since Thailand doesn’t directly regulate forex brokers, some Thai traders might choose offshore brokers operating in less stringent jurisdictions. These firms might offer significantly higher leverage ratios, sometimes reaching 1:500 or even 1:3000.While this can be tempting for experienced traders seeking to amplify potential returns, it’s crucial to understand this elevates the risks.

Is Forex Trading Taxed In Thailand?

Thailand taxes profits from forex trading, so you must report your income and pay taxes according to current laws. Understanding how taxes apply to forex trading is essential to avoid legal trouble.

Under the tax system, your income tax rate is determined by your overall income. This rate follows a progressive structure, ranging from 0% to 35%.

When Is The Best Time To Trade Forex In Thailand?

Unlike traditional stock exchanges, the foreign exchange market boasts extended trading hours, operating 24/5. However, activity is unique throughout this timeframe. Specific periods experience surges in trading volume, leading to enhanced liquidity.

This increased liquidity often translates to tighter spreads between the bid and ask prices. Tighter spreads mean a lower cost per trade, making these active periods attractive for many forex day traders.

Some windows offer distinct advantages for Thai traders. These prime times often overlap with significant trading sessions in other global financial hubs.

The impractical Asian-American window (2:00 to 5:00 local time) bridges the tail-end of the New York session with the beginning of the Sydney session. This overlap can increase liquidity due to combined trading activity, potentially leading to tighter spreads.

The busy London-New York overlap (19:00 to 23:00 local time) captures the first two hours of the New York session, coinciding with the final hours of the London session. This peak period often boasts the highest trading volume globally, offering a potentially more dynamic trading environment for Thai participants.

Example Trade

Imagine you’re a day trader in Thailand interested in the THB/USD currency pair. Here’s a hypothetical example of a day trading strategy:

Event Background

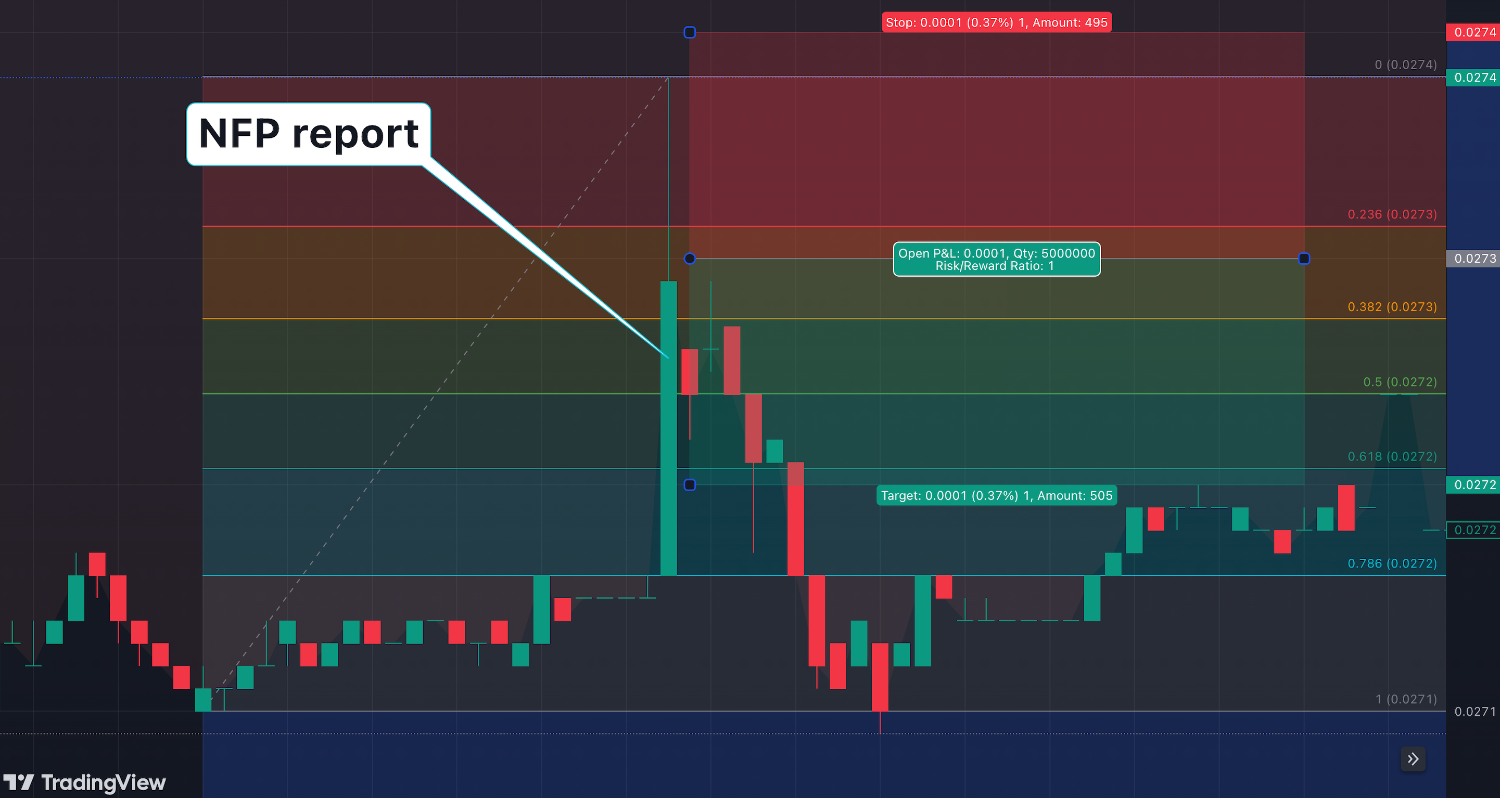

The US Bureau of Labor Statistics released its monthly non-farms payroll report (NFP). The NFP report is a critical economic indicator, often impacting the US dollar’s strength.

Interpretation Of Data

Although this reading increased by 175,000, following the 315,000 increase recorded in the previous month, it was below the market expectation of 238,000.

I anticipated the announcement would affect the THB/USD currency pair in the short term and presented an opportunity for a scalp trade.

Trade Entry

With my analysis and risk management strategy in place, I prepared to enter the trade. The initial market reaction to the NFP announcement showed the dollar weakening against the Thai baht, suggesting a bullish move for the THB/USD pair.

However, prices are often volatile around NFP releases and I expected a pullback. Based on this, I used a Fibonacci retracement tool on a 15-minute chart and decided to sell the pullback.

Using my forex trading platform, I executed a sell order at the current market price, ensuring that my stop-loss and take-profit levels were predefined to automate my risk management strategy.

Trade Exit

I closely monitored the trade, especially during the volatile period following the economic announcement. Fortunately, the market moved as anticipated, and my take-profit level was triggered automatically after 45 minutes.

The stop-loss order would have minimized my loss if the market had moved against my position.

Post-Trade Analysis

After the forex trade closed, I conducted a post-trade analysis to sharpen my future strategies. This analysis involved scrutinizing the accuracy of my initial assessment, the effectiveness of the risk management measures I employed, and the efficiency of my trade execution.

Bottom Line

Forex trading is legal and popular in Thailand, with residents accessing the market primarily through overseas forex brokers.

Once inaccessible due to its peg with the US dollar, the Thai baht now fluctuates in line with the global foreign exchange market, albeit with the some intervention by the Bank of Thailand to limit drastic volatility.

Recommended Reading

Article Sources

- Bank of Thailand (BOT)

- Securities and Exchange Commission (SEC)

- Securities and Exchange Act BE 2535

- Bank of International Settlements (BIS)

- Thailand Revenue Department

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com