Best Trading Platforms For Technical Analysis

For day traders, technical analysis is often the backbone of successful trading. By examining price movements, volume, and historical trends, you can make more informed decisions and precisely spot entry and exit points.

But which is the best trading platform for technical analysis? Let’s dig into our top picks.

5 Best Trading Platforms For Technical Analysis In 2025

Whether you’re looking for advanced indicators, real-time data, or powerful charting tools, our hands-on tests show these 5 platforms deliver the best-in-class solutions to elevate your technical analysis trading experience:

- TradingView: Unbeatable variety of chart types, indicators, and drawing tools. The intuitive design and vast community make it perfect for all traders.

- ProRealTime: Excels in its precision and customization. Ideal for advanced traders needing robust technical analysis tools and reliable, cloud-based performance.

- cTrader: User-friendly with sophisticated charting for technical analysis. Perfect for intermediate to advanced traders, especially those prioritizing charting, algo trading and fast execution.

- MetaTrader 5 (MT5): MT5 builds on MT4’s reliability with more timeframes and indicators. Suited for active traders wanting comprehensive market access and advanced automated trading.

- MetaTrader 4 (MT4): A reliable classic for technical analysis. MT4’s simplicity and strong community support make it excellent for those starting in forex trading.

Top Platforms For Technical Analysis Comparison

| TradingView | ProRealTime | cTrader | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | |

|---|---|---|---|---|---|

| Chart Types | 20+ (line, bar, candlestick, Renko, etc) | 8+ (line, bar, candlestick, Heikin Ashi, Point & Figure, etc) | 4 (line, bar, candlestick, Heikin Ashi) | 3 (line, bar, candlestick) | 3 (line, bar, candlestick) |

| Timeframes | 20+ | 15+ | 26 | 21 | 9 |

| Indicators | 100+ | 100+ | 70+ | 38+ | 30+ |

| Drawing Tools | Extensive tools: pitchfork, regression, etc | Extensive tools: Fibonacci, channels, etc | Advanced tools: Fibonacci, Gann angles, etc | Expanded tools: Fibonacci, Gann, etc | Basic tools: trendline & shapes. |

| Usability Rating | 5/5 | 4/5 | 4.5/5 | 4/5 | 3/5 |

| Customizability Rating | 5/5 | 5/5 | 5/5 | 4/5 | 4.5/5 |

| Speed/Reliability Rating | 4/5 | 5/5 | 4.5/5 | 4.5/5 | 5/5 |

| Experience Level Suitability | All Levels | Intermediate to Advanced | Intermediate to Advanced | Intermediate to Advanced | Beginner to Intermediate |

| Device Compatibility | Desktop, Web, Mobile | Desktop, Web, Mobile | Desktop, Web, Mobile | Desktop, Web, Mobile | Desktop, Mobile |

Rankings By Category

Alongside our top 5 overall rankings, you can see which platforms finished 1st and 2nd place in each category:

Best Chart Types

- Winner: TradingView – Offers over 20 chart types (eg line, bar, candlestick, Renko, Heikin Ashi, Kagi), making it ideal for traders who want various visual options for trend analysis.

- Runner-Up: ProRealTime – Excels for its detailed charting capabilities, including Point & Figure, Heikin Ashi, and various unique chart styles tailored to advanced analysis.

Most Timeframes

- Winner: cTrader – Offers 26 timeframes, allowing precise multi-timeframe analysis.

- Runner-Up: ProRealTime and MT5 – Both support a wide range of timeframes (ProRealTime offers intraday to yearly), which is helpful for traders who analyze multiple perspectives on price action.

Largest Indicator Library

- Winner: TradingView – With 100+ built-in indicators plus user-created scripts, TradingView offers unmatched variety.

- Runner-Up: ProRealTime – 100+ indicators and a programming language (ProBuilder) for custom creations.

Best Drawing Tools

- Winner: TradingView – A rich set of tools like trend lines, Fibonacci retracements, regression channels, and Gann tools.

- Runner-up: cTrader – Provides advanced drawing options, such as Fibonacci and Gann angles, and other essentials for detailed analysis.

Usability (Most Intuitive)

- Winner: TradingView – Its clean, highly intuitive interface and robust social features make it accessible to beginners and efficient for pros.

- Runner-Up: cTrader – Impresses with its sleek, modern design, cTrader is also user-friendly and less daunting than software like MT5.

Customizability

- Winners: ProRealTime and TradingView (tied) – ProRealTime’s customizability includes ProBuilder for custom indicators, while TradingView’s Pine Script enables deep personalization of indicators and strategies.

- Runner-Up: cTrader – Allows C# programming for bots and custom indicators with extensive customization, making it great for algorithmic traders.

Speed/Reliability

- Winner: MetaTrader 4 (MT4) – MT4 has been optimized for years, and its light resource use makes it highly reliable on various devices.

- Runner-Up: ProRealTime – Impressive for its smooth operation even with multiple charts, and it’s cloud-based, reducing local system load, which ensures high stability and fast response.

Most Suitable For Beginners

- Winner: TradingView – Intuitive and visually straightforward, with a vast community and educational resources that make it accessible to beginners.

- Runner-Up: MetaTrader 4 (MT4) – With its straightforward layout and supportive community, MT4 is a good choice for those starting with forex or basic technical analysis.

Most Device Compatibility

- Winners: TradingView and cTrader (tied) – Both offer web, desktop, and mobile versions, allowing seamless device transitions.

- Runner-Up: ProRealTime – Primarily web-based but offers a downloadable desktop version and mobile support for flexible access.

Read the pros and cons of using each platform for technical analysis below.

1. TradingView

Why We Chose TradingView

TradingView is one of the most widely used platforms globally, with over 30 million users, many of whom are day traders in markets like CFDs, forex, and stocks.

We love it for its social features and visually appealing charts, and it has carved out a niche as a platform for active traders who want reliable, powerful analysis tools with the added benefit of an active trading community.

TradingView’s flexibility and social features make it a favourite of mine, though more advanced backtesters or those needing direct broker integration may need to weigh the trade-offs.

Pros

- TradingView comes loaded with 100+ built-in indicators, covering everything from Volume Profile to Stochastic RSI and Ichimoku Clouds. This selection meets the needs of beginners and advanced traders.

- TradingView’s social features make it unique. Traders can publicly share their charts and analysis or follow other traders to see their setups. You can also publish your ideas and get feedback, which adds a new level of community-driven insight that other platforms lack.

- TradingView’s charting tools are highly detailed and very customizable. You can draw trendlines, channels, Fibonacci retracements, and more. All charts are cloud-based, so your settings stay synced across devices.

- TradingView lets you see up to 16 charts simultaneously (on higher plans) and view an asset across multiple timeframes. This is fantastic for traders like me who run multi-timeframe analysis. You can, for example, monitor a 5-minute chart alongside a daily and weekly chart.

- TradingView’s alert system is incredibly flexible. You can set up alerts based on price, indicators, or even custom scripts and get notified by email, SMS, or directly on the platform. This feature is handy for traders who rely on specific indicators like the RSI hitting a threshold.

Cons

- While TradingView offers a free version, many of the best features – including multiple indicators on a single chart, custom alerts, and extended chart layouts – are behind a paywall. For traders who need these advanced tools, the Pro or Pro+ plans can feel costly.

- TradingView supports fewer brokers for direct trading than other software like MetaTrader. While it has popular options like OANDA and FOREX.com, its list is still limited, which can be frustrating if your preferred broker isn’t on the list.

- While the Strategy Tester is helpful, it’s somewhat limited compared to more robust platforms. It lacks multi-asset testing and optimization features, so more advanced backtesting – like portfolio backtesting – isn’t supported.

- Pine Script is powerful, but it has a learning curve for those new to coding. While the language isn’t overly complex, some beginners find creating custom indicators or modifications challenging. However, TradingView does provide plenty of documentation, and the active community can help with troubleshooting.

- TradingView’s mobile app is generally user-friendly, but some features – like custom indicators and specific drawing tools – are limited to mobile. This might be a drawback for traders who frequently use mobile for technical analysis, mainly if they rely on intricate setups that require more screen space.

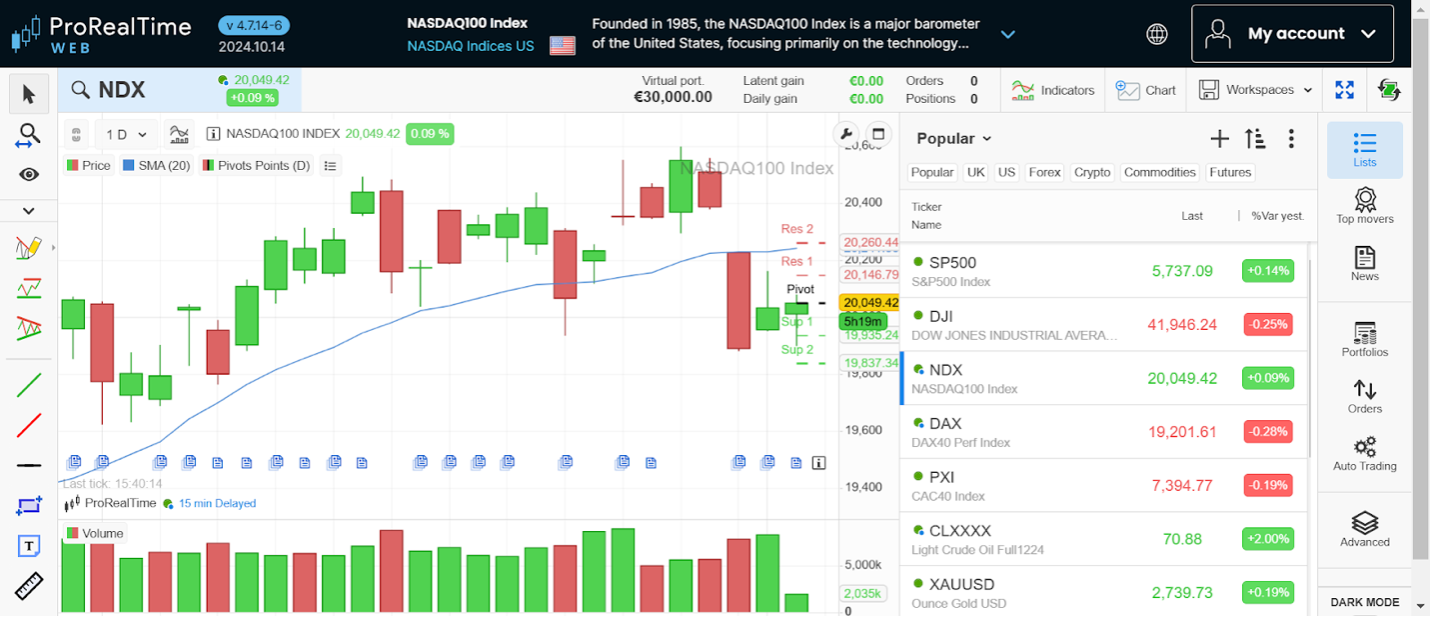

2. ProRealTime

Why We Chose ProRealTime

ProRealTime stands out among trading platforms, especially those relying heavily on technical analysis.

Excelling for its advanced charting tools and smooth interface, it has become a go-to for retail traders, especially in CFDs, forex, and other high-stakes markets.

The platform boasts over 825,000 users worldwide, many of whom are professionals or active retail traders. This speaks volumes about its popularity and trustworthiness.

I’ve used ProRealTime for over a decade, and it probably requires more hands-on involvement than many other platforms we’re subjecting to our technical analysis examination.

Pros

- ProRealTime boasts a vast library of over 100 indicators, which can be a game-changer for technical analysts. Popular options include Moving Averages, Bollinger Bands, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

- If you’re a trader like me who wants to tweak settings, ProRealTime is for you. You can adjust each indicator’s parameters, create unique combinations, or build custom indicators using ProRealTime’s programming language, ProBuilder.

- The platform’s drawing tools are impressive, allowing traders to mark key levels, trendlines, Fibonacci retracements, and more. This can be helpful for price action traders who rely on support and resistance levels, trend channels, or Fibonacci extensions to anticipate market movement.

- ProRealTime supports multi-timeframe analysis, meaning you can view the same asset across different time intervals simultaneously. This is invaluable for traders who like to see both the long-term trend and the shorter-term fluctuations.

- The platform allows you to set up customized alerts based on specific indicator levels, helping you stay on top of critical moments without constant monitoring. For example, if RSI hits an overbought level on a 1-hour chart, you can set an alert that sends a notification so you know to re-evaluate the position.

Cons

- ProRealTime’s extensive features and customizable options can overwhelm beginners. While powerful, the platform doesn’t simplify advanced indicators like Ichimoku Clouds or Parabolic SAR, which require more in-depth knowledge to use effectively. Beginners can feel lost in the options.

- Although ProRealTime’s ProBuilder language is robust, it isn’t as widely supported or flexible as Pine Script on TradingView. ProBuilder does allow for custom indicators, but it’s not as intuitive for complex coding tasks, a drawback for day traders who rely on highly specialized indicators or automation scripts.

- ProRealTime focuses heavily on technical analysis but lacks direct access to fundamental data. This can limit traders who like to blend technical and fundamental analysis. For example, ProRealTime doesn’t provide earnings reports or macroeconomic data in the same space.

- While ProRealTime does offer real-time data, the costs can add up if you want access to multiple markets or premium data feeds. For example, if you’re trading forex, US stocks, and European indices, you’ll likely face additional fees for each market.

- Even though ProRealTime excels in traditional technical analysis, it lacks some advanced machine learning and AI-driven tools emerging in other platforms. For traders interested in next-gen tools like algorithmic pattern recognition, ProRealTime is behind. Instead, platforms like MT5 offer basic AI-based analysis.

3. cTrader

Why We Chose cTrader

cTrader has gained popularity for its clean, modern interface and emphasis on user experience, making it a solid alternative to MetaTrader.

Shining for its advanced charting tools, smooth order execution, and compatibility with ECN brokers, cTrader is particularly attractive to short-term traders who rely on technical analysis for CFDs, forex, and other assets.

The platform also appeals to day traders seeking better pricing transparency and direct market access, offering a competitive edge in fast-paced markets.

cTrader’s modern interface, advanced charting tools, and transparent pricing make it a top choice for traders focusing on technical analysis, especially those who value direct market access and fast execution.While the platform has a few drawbacks, like limited broker support and a smaller marketplace for add-ons, I’ve always found it excellent for traders seeking a modern, efficient workspace.

Pros

- cTrader’s interface is highly intuitive, with a sleek design that feels modern and user-friendly. The platform offers customizable layouts, allowing traders to arrange chart windows, timeframes, and indicators according to their preferences.

- cTrader provides over 70 built-in indicators, including Average True Range (ATR), Bollinger Bands, MACD, and Stochastic Oscillator. The platform also includes drawing tools like trend lines, Fibonacci retracements, and Gann angles, catering to technical analysts relying on detailed chart annotations.

- You can open multiple charts with different timeframes and place them side by side, making multi-timeframe analysis seamless. This feature is a big plus for traders who want to track short-term and long-term trends simultaneously, helping them identify setups across different time horizons.

- cTrader offers transparent pricing and fast execution speeds, making it a top choice for day traders who value order precision. With Level 2 pricing (Depth of Market), traders can see the order book, giving insights into liquidity and market depth.

- cTrader’s alert system is highly flexible, allowing traders to set alerts based on price levels, indicators, or chart conditions. You can receive notifications via email, SMS, or directly within the platform, ensuring you’re always aware of significant market changes without continuously monitoring charts.

Cons

- Although cTrader has a growing community, its marketplace for indicators and trading bots is still smaller than MetaTrader’s extensive library. For traders looking for a wide range of ready-made tools, cTrader may require more effort to find the custom indicators or bots they need.

- cTrader’s advanced features and sleek graphics require more system resources than platforms like MT4. This can result in slower performance on lower-spec devices, especially when running multiple charts or automated strategies. Traders with older computers may need upgrading.

- cTrader isn’t as widely supported by brokers as MetaTrader, so traders may have fewer options when choosing a broker for direct trading. Additionally, I’ve found some brokers may offer different conditions (such as spreads or commission rates) on cTrader compared to MetaTrader.

- While cTrader is free, some brokers or third-party providers may charge additional fees for specific features, data feeds, or trading tools. Unlike software with more free add-ons, cTrader’s advanced functionality sometimes comes with a price tag.

- While cAlgo does offer backtesting, its capabilities are somewhat limited compared to MT5’s multi-threaded back tester. For instance, multi-asset or multi-timeframe backtesting isn’t fully supported, and some traders feel the speed and analysis depth is restricted.

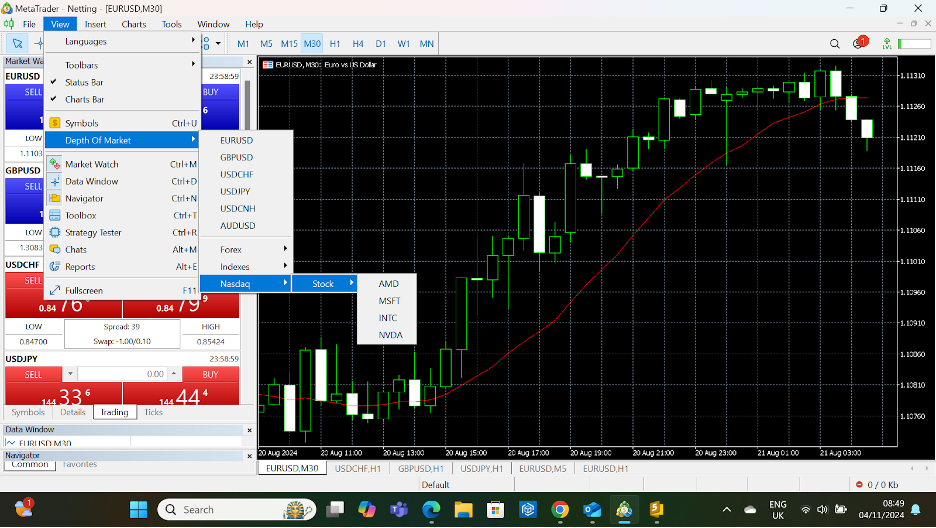

4. MetaTrader 5

Why We Chose MetaTrader 5 (MT5)

MetaTrader 5, or MT5, is the successor to MT4, offering a more modern and powerful platform designed for multi-asset trading.

While MT4 focuses heavily on forex, MT5 is built with a more comprehensive toolkit for trading various asset classes, including stocks, commodities, indices, and cryptocurrencies.

MT5 has gained popularity for its advanced features, faster execution, and additional charting tools. For short-term traders prioritizing technical analysis, MT5 brings a stellar set of tools and flexibility, making it a solid choice.

I’ve discovered that MT5 is a robust and versatile platform with enhanced capabilities for multi-asset and advanced technical analysis. Its flexibility, advanced backtesting, and customizable alerts make it an excellent choice for experienced traders.However, the added complexity and system requirements may be drawbacks for inexperienced users.

Pros

- MT5 offers a broader range of built-in indicators (38 vs. MT4’s 30), including essentials like Moving Averages, Stochastic Oscillators, Ichimoku Clouds, and more. The platform also supports 21 timeframes, compared to MT4’s 9, which gives traders far more flexibility.

- With MT5, you can access more drawing tools and chart types, such as Heikin Ashi and Renko charts. These features can be handy for technical analysts who want additional options to visualise trends. The expanded toolset includes Fibonacci retracements and Gann tools, which are valuable for advanced traders.

- MT5 is built for multi-asset trading, allowing users to trade a more comprehensive range of markets. It also offers Depth of Market (DOM) functionality, especially for stock and futures traders. DOM shows real-time order flows, giving insights into buy and sell volumes at various price levels.

- One standout feature is its multi-threaded Strategy Tester, which allows for faster and more comprehensive backtesting. MT5 can test multiple pairs simultaneously and has multi-currency support for portfolio testing. The optimization tool also provides results that help traders identify profitable parameters.

- MT5 supports advanced alerts based on indicators and custom conditions, a significant upgrade from MT4’s basic price-based alerts. This feature allows traders to stay on top of specific market conditions without needing constant monitoring. Alerts can be customized to notify you when indicators cross particular levels.

Cons

- MT5’s advanced features and customization options can feel overwhelming for newer traders, especially those just learning technical analysis. For beginners, MT5’s vast functionality might create a steeper learning curve than MT4’s more straightforward layout.

- Not all brokers support MT5, particularly in markets like forex, where MT4 still dominates. While MT5 is gaining traction, traders with a preferred broker may find that MT4 has more established support. Additionally, I’ve seen some brokers offer different assets or features on MT5 than MT4.

- Although MQL5 is more powerful than MQL4, it’s more complex to learn. The language’s object-oriented nature requires more advanced programming skills for traders who want to create custom indicators or auto systems. While the MT5 resources are growing, beginners might find it challenging to code EAs.

- MT4 has been around longer, so it has a larger community with more resources, such as custom indicators, EAs, and forums. MT5 is catching up, but traders might need more ready-made tools or community-generated scripts for MT5 than MT4.

- MT5 requires more system resources than MT4, which might run less smoothly on older or less powerful computers. This can be an issue for traders who rely on multiple charts, indicators, or automated trading.

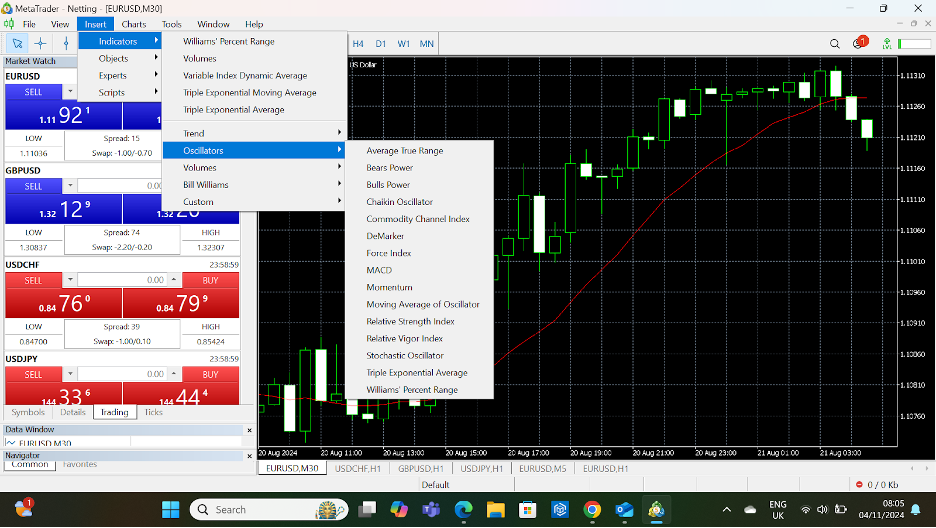

5. MetaTrader 4

Why We Chose MetaTrader 4 (MT4)

MetaTrader 4, or MT4, is one of the most widely used forex trading platforms, with a solid reputation built over nearly two decades.

Known for its user-friendly interface and dependable performance, MT4 has a substantial following among short-term traders focusing on technical analysis.

Its popularity stems from its stability, extensive broker support, and customizable trading tools. With millions of users worldwide, MT4 is still a top pick for day traders, particularly in the forex market.

MT4’s strengths lie in its reliability, customization potential, and support for automated trading, making it a terrific choice for technical analysis and forex trading.While it may lack modern features and advanced customization options, in my opinion, it remains a highly dependable and versatile platform.

Pros

- MT4 offers over 30 built-in indicators, covering popular choices like Moving Averages, MACD, Bollinger Bands, RSI, and more. These are essential for technical traders who rely on indicators to track momentum, spot trends, and identify potential reversals.

- MT4 is known for its customization through MQL4, a dedicated programming language that allows users to create custom indicators, scripts, and even automated trading systems, known as Expert Advisors (EAs). For traders with coding knowledge, this opens up endless possibilities for personalizing their technical analysis.

- MT4’s Strategy Tester lets traders backtest EAs against historical data, which is crucial for validating strategies before live trading. Although not as advanced as dedicated software, the Strategy Tester offers performance metrics, helping traders refine their approach based on simulated results.

- MT4’s stability and low resource demand make running easy on almost any computer, even those with modest processing power. This reliability is a major advantage for traders who need a platform that won’t lag or crash during high-volume sessions.

- MT4 is supported by an extensive range of brokers, making it convenient for traders to find a compatible brokerage with minimal effort. This also means traders have a choice of more assets, spreads, and account types than on some other platforms with fewer broker options.

Cons

- While MT4 is functional, its interface can feel dated compared to newer solutions like TradingView or cTrader. The design is simple but lacks the modern aesthetics and streamlined experience that many traders are now used to. For traders who value sleek, intuitive layouts, MT4 may feel clunky.

- Although MT4 includes a set of standard indicators, its built-in selection can feel limited, especially for advanced technical analysts. For instance, complex indicators like Volume Profile or Renko Charts are not natively supported, so traders need to find plugins or custom indicators.

- While MT4 covers the basics well, its charting tools need more depth than other platforms. For instance, drawing tools like Fibonacci retracements or advanced shapes are somewhat basic. For traders who prefer to mark up charts with a variety of tools, MT4 can feel restrictive.

- Although MT4 has a basic alert feature, it needs more flexibility and customization that traders enjoy on platforms like TradingView. You can set price alerts, but setting alerts based on specific indicators or complex conditions isn’t possible without custom scripting, which requires additional technical knowledge.

- Unlike platforms like TradingView, MT4 doesn’t offer social or community features where traders can share ideas or access community-created content. This can feel isolating, especially for newer traders who benefit from learning and sharing ideas with others.

Bottom Line

TradingView is the best trading platform for technical analysis given its all-encompassing feature set, accessibility for all levels, and powerful customization options.

Still, ProRealTime and cTrader offer advanced capabilities that appeal to traders seeking specific technical tools and customization.

MetaTrader 5 and MetaTrader 4 also remain reliable choices for forex traders, with MT5 being the better fit for those looking to diversify across asset classes.

Ultimately, in selecting the right platform for technical analysis, you must match your trading style, experience level, and desired features with each platform’s offerings.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com