tastytrade Review 2025

Pros

- Wide range of asset classes including options, futures, stocks, ETFs and indices with the majority available to trade 24/5

- Transparent pricing model including a $1 commission on stocks and ETF options, with maximum limits per leg for some assets

- Good choice of account types suitable for various investment goals including IRAs and individual/joint trading accounts

Cons

- No credit/debit card payments

- Narrow range of instruments with no forex trading

- Less suitable for beginners with no demo account and basic educational resources

tastytrade Review

tastytrade, previously tastyworks, is a regulated online brokerage for active investors, where you can trade options, stocks and futures instruments. This review will cover trading fees, minimum deposits, platforms, mobile apps and demo accounts. We also look at the broker’s margin and leverage rates, regulation and extended hours trading, so you can find out whether you should sign up with tastytrade today.

tastytrade Details

tastytrade is a brokerage firm that was founded in 2017 and is dedicated to active options traders. Therefore, the platform is primarily suited to experienced traders, though it also offers stocks and futures. The company has headquarters in Chicago, US and was created by the founders of the Thinkorswim platform, including Scott Sheridan and Tom Sosnoff, along with former CFO Kristi Ross and CTO Linwood Ma.

tastytrade is regulated by the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA) and the National Futures Association (NFA). Australian residents are protected by the Australian Securities and Investments Commission (ASIC).

tastytrade accepts members from over 50 countries, including European countries like Germany, Greece and the Netherlands, as well as the UK, Malaysia, New Zealand, Singapore and the UAE. However, the broker is expanding their list of accepted countries to include the likes of Canada. In 2021, the firm opened up a waiting list for Candian residents. However, the broker does not specify its availability in Hong Kong and Japan.

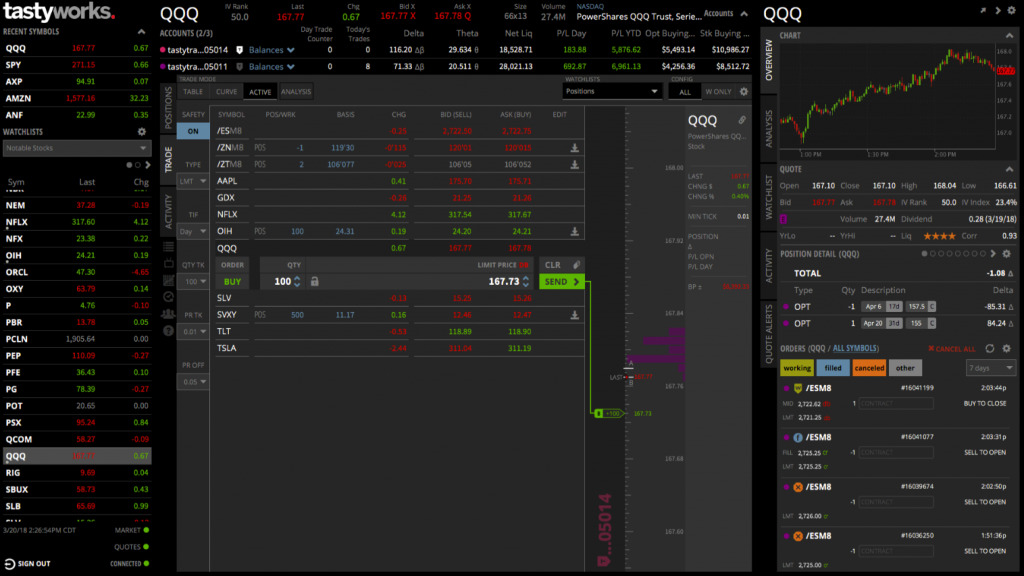

Trading Platform

tastytrade offers one trading platform that can be accessed via desktop, web and mobile. As the creators of Thinkorswim, the platform has been inspired by this powerful interface. There are several special features included:

- Curve Analysis: This provides a visual method to intuitively set up trades for entry. The interface has clear profit and loss zones where you can adjust your strikes and expirations quickly and easily.

- Quick Roll: This feature allows you to roll your option positions through the next expiration cycle with a simple click. Additionally, you can set your default rolls into a weekly or monthly expiration cycle to encourage more efficient trading.

- Quick Order Adjustments: With a simple few clicks, working orders can be adjusted. You can cancel, replicate, duplicate or invert working orders that haven’t been filled yet.

- Per Cent Of Profit Limit Orders: This provides probabilities over prediction with the per cent-of-profit limit orders feature. This feature allows you to choose a price that has better odds.

- ETF-Equivalent Futures Delta: Futures are a complex asset that requires careful risk assessments. However, this feature offers an easy way to see ETF-future equivalent data as opposed to relying on varying tick-sizes and notional values that don’t offer a benchmark.

- Trading Inspiration: The broker provides fresh insight straight onto the tastytrade platform. This feature is a dedicated feed with a live video stream where you can watch top-performing traders work the markets in real-time.

tastytrade does not currently offer level 2 data/quotes as they do not offer direct order routing to specific exchanges. Instead, they focus on execution. APIs are also available to download and a Zero Hash account can be opened for cryptocurrency trading. The broker is soon to introduce Lookback, which is a new options backtesting feature.

Assets

As mentioned, tastytrade is specifically dedicated to options trading but also offers stocks and futures. If you wish to trade forex, commodities or mutual funds, then you may want to find an alternative. While this broker offers a limited range of products, options traders can rest assured with a specialised and niche offering that is specifically designed for them. The broker offers the following assets:

- ETFs

- Stocks

- Cryptocurrency: 13 coins, inc. Bitcoin

- Futures, Microfutures, Smalls Futures

- Options on Stocks, ETFs and Micro Futures

Note that this broker only covers US markets. tastytrade does not support OTC or penny stock trading, neither do they offer classic stock screeners.

Fees

When it comes to pricing, tastytrade offers low trading fees. The broker charges $1 per contract for stock options and $2.50 per contract for options on futures when opening a position. Closing a position does not incur any charges. Additionally, the platform does not charge any inactivity fees or account maintenance fees.

Futures contracts are charged at $1.25 per contract, while micro futures contracts have a $0.85 per contract exercise fee. Stock and ETF trading is also commission-free. Other UK alternatives to tastytrade such as Interactive Brokers UK (IBKR) are also FCA regulated.

tastytrade also caps commissions at $10 per leg on equity options trades and $10 per side for opening and closing crypto trades. All futures trades incur a clearing fee of $0.30 per contract + exchange fees + NFA Fee. tastytrade is confident in its low pricing structure when compared to other popular brokers like Fidelity, E-Trade, CurrencyFair and Schwab.

Leverage

Standard margin trading accounts (non-IRA) have leverage rates of 1:2 for stocks (like GME), according to FINRA regulation. For example, if you have $10,000 of options buying power, your account will have $20,000 of stock buying power. However, the Portfolio Margin accounts allow up to 1:5 leverage. The trading level received is based on how you self-report your Investor Profile. Options approval is key for access to level 3 margin trading. Futures margin calls are typically due T+1 from the day that they are issued, otherwise it might show negative buying power.

Mobile Apps

The tastytrade mobile app is available to download for iOS and Android. The mobile platform is similar to the web platform and shares many of its major functions, such as watchlists, quote information and charts. However, some drawbacks include not enabling price alerts and order notifications. The mobile app also provides two-step/2 factor authentication (2FA) using an authenticator app and QR code.

Payment Methods

tastytrade offers four methods for funding and withdrawing from your account with no deposit fees. However, withdrawal fees are quite high at USD 45 for international wire transfers and USD 25 for wire transfers within the US. The options are:

- ACH (4 business days)

- Cheque (3 business days)

- Wire transfer (1 business day)

- Transfer between broker accounts via ACAT

International accounts can only use the bank wire and Currency Fair methods and payments can only be made in USD. Fund transfers from international sources can take 3 to 5 business days to appear in your trading account. However, withdrawal times can take 1-3 business days on US accounts. The broker does not accept debit/credit cards or Revolut.

Demo Account

tastytrade does not currently offer a demo paper trading account or simulated environment. However, the broker suggests that users can open a tastytrade account without funding it so that they can gain access to the platform. There is also a tutorial video on how to use the web platform.

Deals & Promotions

tastytrade offers a referral affiliate program, which allows members to receive referral credits for each qualified referee. Members can win prizes such as a Google Home, trips to Chicago and even a Tesla Model 5. Members can also take advantage of the broker’s 100 shares or 10 options promos, where they have the choice to receive 100 shares of stock or 10 long options contracts.

The broker is also running a cryptocurrency bonus giveaway for members who open an account up to September 30, 2021. tastytrade is giving away USD 1,000,000 worth of cryptocurrency, gifting new users with $50 in crypto for accounts initially funded with USD 200. Accounts funded with over USD 2,000 are credited with USD 200 worth of crypto.

tastytrade also runs periodic new account sign-up bonuses, like the 250 challenge that provides the opportunity to earn $250 by test driving a simulated tastytrade account. Therefore, it is worth checking out their website for any updates.

Regulation & Licensing

tastytrade is licensed and regulated by the Financial Industry Regulatory Authority (FINRA) and is a member of the National Futures Association (NFA). US clients are also protected by the Securities Investor Protection Corporation (SIPC) scheme for up to USD 500,000. Note that some investment products, such as futures, are not covered by SIPC.

Australian residents, on the other hand, are protected by the Australian Securities and Investments Commission (ASIC).

Education

While tastytrade does not have a dedicated educational centre, Tastytrade’s ‘Learning Centre’ teaches you about how to trade options and futures, the Iron Condor, Pop 50, jade lizard, ZEBRA, indicators stop losses, how to exercise options, selling puts and more.

The broker’s YouTube videos and help centre offer tutorials on how to navigate the platform. This includes how to set up a bracket order also known as a One Triggers a One Cancels Other (OTOCO) order or a One Cancels Other (OCO) order. The help centre also breaks down dividends payment, how to carry out a solo 401k rollover, how to set up a trailing stop loss, orders, net liquidity, building a journal, selling puts, last x size, open interest, maintenance excess, keyboard shortcuts, hotkeys and more. tastytrade also have some unique terms like GTC and quick roll. Therefore, the broker’s help centre provides a glossary.

Account Types

tastytrade offers a range of account types to cater to different needs. While there is no minimum deposit requirement to open a cash account, you require at least a USD 2,000 balance to gain any leverage features.

- The Works: The most flexible account package designed for active retail traders. It provides access to all the available products and enables any options trading strategy on the platform (i.e. covered call) on top of an individual margin.

- Joint: Tenants in Common (TIC), With Rights of Survivorship (WROS) accounts

- Retirement: Traditional, Roth & SEP IRAs

- Individual: Margin or cash accounts

- International

- Corporate

- Trust

Coming soon to the platform are custodial account types like UGMA/UTMA and Coverdell.

To open an account, you will need an email address, social security number or ITIN, address and personal details. To view your account number, you must login to the website.

Note that the margin account has a 3-day trade limit in a rolling 5-business day period, otherwise, it will go into PDT. A cash account is not limited to a certain number of day trades, though you can only day trade with settled funds or you receive a good faith violation. tastytrade doesn’t offer fractional shares when you buy or as part of dividend reinvestment.

Trading Hours

tastytrade executes equity security trades during regular trading hours, i.e. Monday through Friday from 08:30 CT until 15:00 CT for equities and from 08:30 CT until 15:15 CT for ETFs.

Extended trading hours are available on the platform from 07:00 until 08:30 CT and 15:00 until 17:00 CT for equities and 07:00 until 08:30 CT and 15:15 CT until 17:00 ETFs.

Customer Support

If the tastytrade platform is not working, keeps crashing, encounters an error code 422 or if your margin check failed, you can contact customer support for help.

- Mailing Address: 1000 W. Fulton Market, Suite 220, Chicago, IL, 60607 Fax: 312-724-7364

- Live Chat: Bottom right of the website

There is no listed phone number or email for the customer support team. Nonetheless, the broker’s help centre and countless community pages on Reddit provide additional support, such as reviews, hard to borrow fees, Quicken and release notes.

Information on paying tax for US and non-US residents, such as those in the UK or Malaysia, can be found on our trading taxes guide or a number of online sites.

Safety & Security

The tastytrade trading platform provides a secure trading environment. All futures accounts positions and cash balances are segregated via Apex Clearing Corporation. tastytrade Inc. also adopts high encryption standards and servers are signed with SSL certificates. The mobile platform enables 2FA technology and the broker is regulated by reputable agencies. However, tastytrade does not offer negative balance protection.

tastytrade Verdict

tastytrade, previously known as tastyworks, is a decent broker backed by an experienced team in the financial industry that offers a powerful trading platform with competitive trading fees that are designed to cater to advanced options traders. Additionally, there is a range of educational content and analysis tools on the network alongside a strong selection of account types and order types. If you are an active derivatives trader, you may well find tastytrade to be a good choice.

FAQs

Is tastytrade A Good Broker?

tastytrade is a good broker for active traders that primarily trade stocks, futures and options. It offers a powerful platform inspired by the Thinkorswim platform and has a competitive pricing structure. It is also regulated and backed by good security processes. Therefore, we would consider tastytrade a decent broker to trade with.

Is tastytrade A Direct Access Broker?

No, tastytrade is not a direct market access (DMA) broker. There is no direct-access routing and no Level II data.

How To Close A Position On tastytrade?

There are many ways to close a position on the tastytrade platform. This can be done from the positions tab, then clicking on the symbols group. After selecting the legs you want to close, you can select “close position” to generate a closing order ticket. This can also be done from the right sidebar order window, trade tab and activity tab.

Does tastytrade Have A Demo Or Paper Trading Account?

No. tastytrade do not currently offer a demo account or simulated environment. Instead, the broker suggests that they can open a live account without funding their account to have a look at the platform and markets offered.

How Much Capital Do I Need To Open A tastytrade Account?

There are no account minimums to open an account at tastytrade. However, you will be limited to what you can trade based on your account type and available buying power. Individuals require at least USD 2,000 for margin privileges. Additionally, if your account remains unfunded, it will switch to delayed data quotes.

Top 3 Alternatives to tastytrade

Compare tastytrade with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular and top-tier online brokerage. It is also quick and easy to open a new account.

- eToro USA – eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

tastytrade Comparison Table

| tastytrade | Interactive Brokers | Firstrade | eToro USA | |

|---|---|---|---|---|

| Rating | 3 | 4.3 | 4 | 3.4 |

| Markets | Stocks, ETFs, Cryptos, Futures, Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed | Stocks, Options, ETFs, Crypto |

| Demo Account | No | Yes | No | Yes |

| Minimum Deposit | $0 | $0 | $0 | $100 |

| Minimum Trade | – | $100 | $1 | $10 |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA | SEC, FINRA |

| Bonus | – | – | Deposit Bonus Up To $4000 | Invest $100 and get $10 |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | TradingCentral | eToro Trading Platform & CopyTrader |

| Leverage | – | 1:50 | – | – |

| Payment Methods | 3 | 6 | 4 | 4 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Firstrade Review |

eToro USA Review |

Compare Trading Instruments

Compare the markets and instruments offered by tastytrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| tastytrade | Interactive Brokers | Firstrade | eToro USA | |

|---|---|---|---|---|

| CFD | No | Yes | No | No |

| Forex | No | Yes | No | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | No | No |

| Oil | No | No | No | No |

| Gold | No | Yes | No | No |

| Copper | No | No | No | No |

| Silver | No | No | No | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

tastytrade vs Other Brokers

Compare tastytrade with any other broker by selecting the other broker below.

The most popular tastytrade comparisons:

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of tastytrade yet, will you be the first to help fellow traders decide if they should trade with tastytrade or not?