CFD Trading In Eswatini

Contracts for difference (CFDs) are becoming popular for traders in Eswatini who aim to profit from short-term price movements across various markets.

The sugar industry, a cornerstone of the Southern African economy, presents one such opportunity. Additionally, CFDs can be used to speculate on African stocks and high-risk cryptocurrencies.

This beginner’s guide will help you gain a comprehensive understanding of CFD trading in Eswatini, including its benefits, drawbacks, and regulatory environment.

Quick Introduction

- When trading CFDs, you’re speculating on the price movement of an asset without actually owning it. This makes CFDs flexible for trading various asset types, but you don’t receive any ownership benefits like dividends in the case of stocks.

- CFDs offer leverage, allowing you to control positions larger than your initial investment. This magnifies potential profits but also losses. For instance, with 1:10 leverage, a Swazi lilangeni (SZL) 1,000 deposit can control a SZL 10,000 position. Risk management is essential.

- CFD trading is complex and risky, with costs like spreads, and commissions. Additionally, because CFDs are derivatives, their prices may vary slightly from actual market prices.

- Eswatini’s financial markets are supervised by the Financial Services Regulatory Authority (FSRA), an ‘orange tier’ regulator under DayTrading.com’s Regulation & Trust Rating, which does not have specific regulations on CFD trading.

Best CFD Brokers In Eswatini

After conducting hands-on tests, we’ve determined these 4 CFD providers are the best for traders in Eswatini:

How Does CFD Trading Work?

Imagine you’re interested in buying Swaziland Property Investment Ltd (SWAPROP) shares, a company listed on the Eswatini Stock Exchange (ESE).

Rather than buying the actual stock, you can use a CFD to speculate on SWAPROP’s price movements, allowing you to trade on margin without owning the shares.

If you believe SWAPROP’s stock price will rise (sitting at SZL 10 per share), you can open a CFD buy (long) position with your broker for 1,000 shares. With leverage, you only need to deposit a percentage of the position’s total value, say 10%, so you invest SZL 1,000 to control the SZL 10,000 position.

If SWAPROP’s stock rises to SZL 12, the CFD will reflect this SZL 2 per share increase. Your profit would be SZL 2,000 (SZL 2 per share x 1,000 shares) minus any fees. Because you only invested SZL 1,000, the return is substantial, demonstrating how leverage can amplify gains.

However, if SWAPROP’s price fell to SZL 8, you would lose SZL 2 per share, or SZL 2,000 in total. This loss is more significant than your initial investment, illustrating the leverage risk.

Additionally, if you hold the position overnight, you’ll pay daily financing fees, which can add up, especially if the position takes longer than expected to become profitable.

In this way, CFDs allow you to gain exposure to stock price movements on the ESE without owning the shares.However, leverage and fees make it a high-risk strategy best suited for those with experience managing market risks.

What Can I Trade?

CFDs offer diverse trading opportunities in Eswatini and across the globe, though availability depends on your broker:

- Stock CFDs – You may be able to trade popular Eswatini stocks like Nedbank on the ESE or explore a broader range of stocks from the US, Europe, Asia, and other global markets, which are more widely supported by online trading platforms.

- Index CFDs – The ESE does not offer a direct index-tracking CFD, so many traders focus on global indices like the S&P 500 (US), FTSE 100 (UK), or Nikkei 225 (Japan) to capitalize on broader market performance. These indices offer high liquidity and competitive trading costs.

- Forex CFDs – The SZL, pegged 1:1 to the South African rand (ZAR), is Eswatini’s national currency. While used only in Eswatini, it’s less traded than major currencies. Its liquidity is low, and due to its fixed exchange rate, it is primarily traded against the ZAR. As a result, many active traders focus on USD pairs for their superior liquidity and competitive trading costs.

- Commodity CFDs – Commodity trading resembles stock trading but focuses on raw materials and primary goods like coffee, gold, agricultural products, or natural gas. Oil, a key ingredient in numerous products, from petrochemicals to diesel, is the most widely traded commodity.

- Crypto CFDs – You can join in the excitement of trading cryptocurrencies in Eswatini. Still, you’ll typically have to do so through international crypto brokers, as Eswatini has no local crypto firms.

Is CFD Trading Legal In Eswatini?

CFD trading is legal in Eswatini. However, while the FSRA and the Central Bank of Eswatini (CBE) do not outright ban it, there is also no local regulatory oversight for CFD providers, trading practices, or investor protections related to CFDs.

Suppose you want to trade CFDs in Eswatini. In that case, you’ll likely have to do so through international online brokers, which often offer a wide range of CFD products, including forex, commodities, indices, and cryptocurrencies.

Reputable international CFD brokers are usually regulated in other jurisdictions, such as the UK, EU, or Australia, and provide services globally, including in Eswatini.

Is CFD Trading Taxed In Eswatini?

Eswatini does not have specific tax regulations that address CFD trading, so the tax implications are unclear. However, there are some general considerations:

General Income Tax

Although there are no explicit rules on CFD trading profits, general income tax principles could apply. If CFD trading is your primary source of income, the Eswatini Revenue Service (ERS) might consider it taxable income, especially if the trading is frequent and substantial like for day traders.

In this case, profits from CFD trading could be categorized as ‘other income’ and subject to the standard income tax rates of 20% to 33%, though there is no formal guidance on this.

Capital Gains Tax

Eswatini doesn’t impose a broad capital gains tax (CGT), so occasional profits from CFD trades may not be taxed as capital gains. However, if CFD trading is treated as an income source, some form of income tax may still apply, depending on the tax authority’s assessment.

Without specific tax rules for derivatives or CFD trading, traders in Eswatini may not have explicit reporting requirements for trading profits or losses.

That said, transparency with the tax authority is generally advised, mainly if CFD trading constitutes a significant portion of income.

To ensure compliance with the latest tax regulations in Eswatini, I suggest consulting a professional tax advisor who is familiar with how the rules apply to CFD trading activities.

An Example Trade

To illustrate how CFD trading in Eswatini functions daily, let’s examine an example trade.

Background

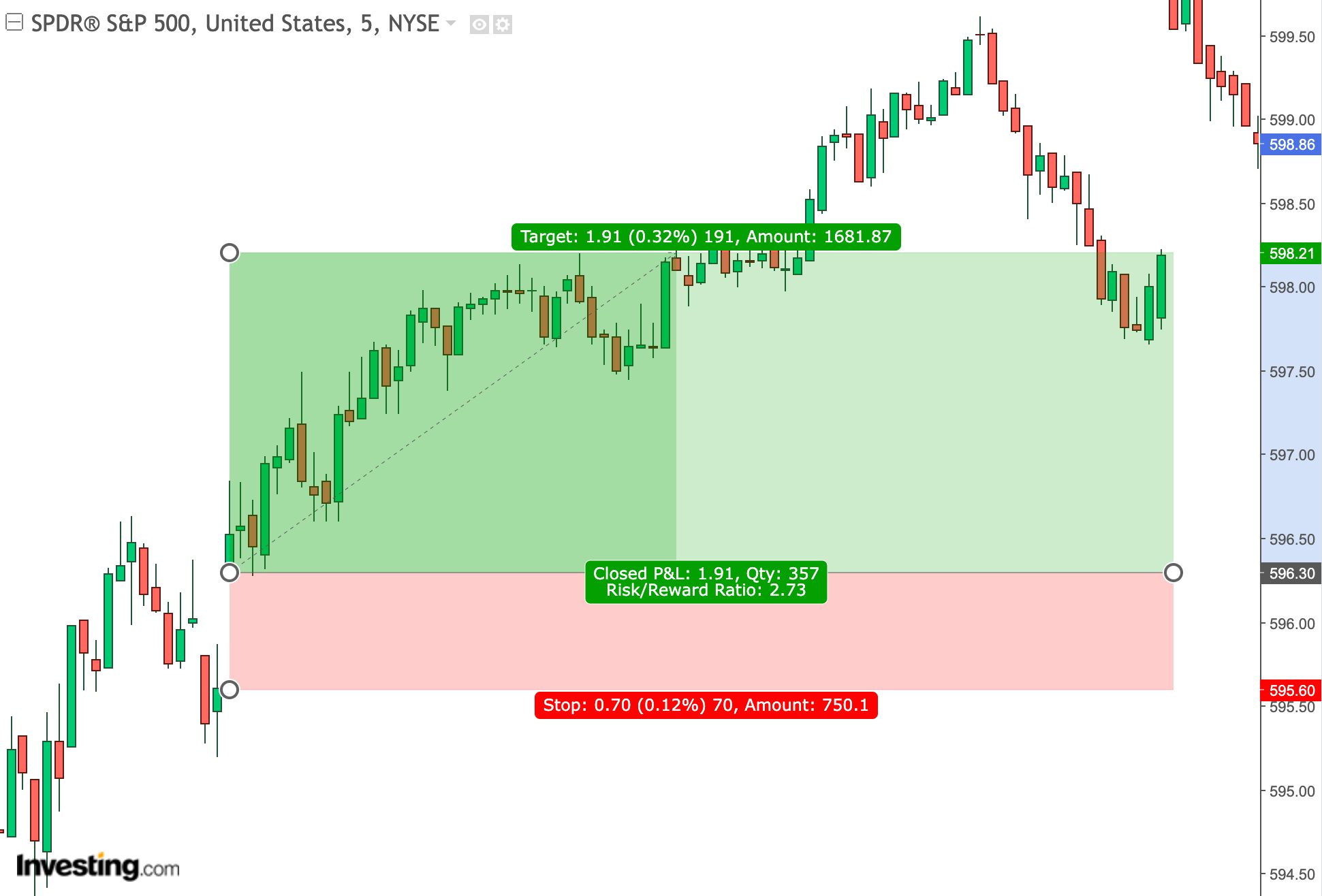

A surprising economic development from the US Federal Reserve influenced the global markets, including the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index and is widely followed by international traders.

The Fed announced an interest rate cut to stimulate economic growth amid concerns about a potential economic slowdown. This unexpected rate reduction spurred investor optimism and drove a surge in US stock prices as the lower rates were seen as favorable for corporate earnings and economic activity.

Following the announcement, SPY rallied as buyers flocked into the market, and the ETF gained considerable momentum.

A trader based in Eswatini could have capitalized on this movement through a CFD trade on SPY, hoping to capture a short-term price increase based on this positive news.

Trade Entry & Exit

The major benefit of CFDs is that they offer the potential to increase your potential return (or loss) due to leverage. You could use 1:5 leverage on a SPY CFD to make the most of your capital, meaning a SZL 5,000 investment would control SZL 25,000 worth of SPY shares.

SPY had jumped from 593 to 595 per share the day before the Fed announcement. On the next trading day following the announcement, it could have been an ideal opportunity to buy (go long) the SPY at the opening of the US session for a price of 596, aiming for a modest gain if SPY rallied all day.

There was no need to set a take profit level – the trade could be left open all day and closed just before the US session ended. To protect against a loss, you could have set a stop loss (SL) at the previous day’s closing price.

This trade could have potentially played out in your favor, with SPY increasing 2 points (0.34%) from 596 to 598. Since SPY increased by 2 points, you could have earned on each point increase for the total leveraged amount (SZL 25,000). So, your profit would have been SZL 85.

Bottom Line

In Eswatini, CFD trading is legal but operates without specific local regulation, meaning you’ll likely have to rely on international brokers, often regulated in other jurisdictions, to access these products.

While there are no explicit tax rules for CFD trading in Eswatini, general income tax principles may apply if trading becomes a significant source of your income.

Due to the risks of high leverage and the lack of local investor protections, you should carefully select reputable brokers and consider professional advice for tax compliance.

To start trading CFDs in Eswatini, explore DayTrading.com’s choice of the top CFD trading platforms to find the one that best suits your needs.

Recommended Reading

Article Sources

- Financial Services Regulatory Authority (FSRA)

- Eswatini Stock Exchange (ESE)

- Central Bank of Eswatini (CBE)

- Eswatini Revenue Service (ERS)

- Eswatini Personal Income Tax - PWC

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com