Day Trading in Eswatini

Eswatini – whose name officially changed from Swaziland in 2018 – is home to a relatively small population and economy. This means that the country’s financial markets are also relatively modest. However, thanks to ongoing reform of the country’s regulatory and economic landscape, interest in day trading is steadily picking up.

This guide explains how day trading in Eswatini works. It talks about the African nation’s regulatory and tax regime, discusses the different types of financial securities that can be traded, and provides an example of what a short-term trade might look like.

Quick Introduction

- Day traders in Eswatini can trade a broad spectrum of securities, including equities at the Eswatini Stock Exchange (ESE) and commodities like sugar as the country is a major producer.

- The country’s financial markets are regulated and supervised by the Financial Services Regulatory Authority (FSRA). The FSRA is categorized as an ‘orange tier’ regulator under DayTrading.com’s Regulation & Trust Rating.

- Active traders are typically required to pay progressive income tax on their profits to the Eswatini Revenue Service (ERS) depending on their total income.

Top 4 Brokers in Eswatini

Following our hands-on tests and analysis, these 4 platforms are a cut above the rest for day traders in Eswatini:

What Is Day Trading?

Day trading is a method of financial market speculation where investors open and close their positions on the same day. It typically involves a high frequency of trades which can be held open from a matter of minutes to several hours.

Traders seek to capitalize on volatile markets and to profit from small price changes. This is a high-risk, high-reward strategy in which traders typically use leverage (borrowed funds) to maximize their earnings.

Day traders in Eswatini can trade a wide variety of financial securities like currency pairs containing the Swazi Lilangeni (SZL), bonds, commodities, cryptocurrencies, and derivatives.

CFD trading in Eswatini, in particular, is on the rise – providing a flexible instrument for speculating on rising and falling markets over the short-term.

Stocks are bought and sold on the Eswatini Stock Exchange (ESE), a relatively small trading venue with a limited number of equities and debt securities. Low liquidity makes day trading Eswatini stocks potentially challenging.

Is Day Trading Legal In Eswatini?

Yes. Financial markets – with the exception of cryptocurrencies – are overseen by the Financial Services Regulatory Authority (FSRA).

The body says it was established in 2010 “with the mandate to foster financial stability through regulation and prudential supervision of financial services providers.”

The organization is responsible for regulating, supervising and modernising the non-bank financial sector, to ensure that it operates efficiently and transparently and that investors are well protected. Its role includes issuing licences to financial services companies and carrying out enforcement action where necessary.

Under its long-term strategic plan, the FSRA intends to steadily increase regulatory compliance over the coming years. It hopes to achieve compliance of 90% by 2031/2032, up from 70% in 2025/2026, with a view to eventually hitting the 100% milestone.

I recommend checking out the FSRA’s directory of authorized financial institutions when selecting a brokerage.The regulator also handily provides details of unauthorized firms and companies whose trading licences have been revoked on its “Public Notices”.

How Is Day Trading Taxed In Eswatini?

Active traders usually need to pay income tax on their earnings to the Eswatini Revenue Service (ERS).

The body is responsible for administering the country’s tax regime, and it has made sweeping changes in recent times to boost tax revenue and modernize the system.

Day traders generally pay a progressive amount of income tax at the following rates:

| Taxable Income (In SZL) | Tax Rate |

|---|---|

| 0 to 100,000 | 0 SZL plus 20% of taxable income above 0 SZL |

| 100,000.01 to 150,000 | 20,000 SZL plus 25% of taxable income above 100,000 SZL |

| 150,000.01 to 200,000 | 32,500 SZL plus 30% of taxable income above 150,000 SZL |

| 200,000.01 and above | 47,500 SZL plus 33% of taxable income above 200,000 SZL |

Getting Started

Individuals can be ready to begin trading Eswatini’s financial markets after three simple steps:

- Selecting a broker. The first task is, with some help from the FSRA’s database of approved companies, to choose a brokerage to do business with. Alternatively, investors can decide to use a broker that’s approved by a well-respected overseas regulator like the FCA in the UK. Important things to think about include trading fees, the functionality of the trading platform, the range of tradeable financial instruments (Eswatini markets are less common but global markets are widely supported), and trade execution speeds (a critical consideration for short-term trading).

- Opening an account. This step may take less than 10 minutes based on our experience, although the exact process will vary from broker to broker. At this point, you’ll need to provide some personal details, along with proof of ID and address. You’ll also usually have to answer some investment-related questions (like trading knowledge, investment goals, and attitude to risk).

- Depositing some Swazi Lilangeni. With your trading account open, you’ll be eager to transfer some money in so you can begin dealing in the markets. Payments are most commonly made by debit card or wire transfer. Some brokerages may also accept deposits via an online payment provider (like Eswatini Mobile’s e-Mali).

A Day Trade In Action

But what might a short-term trade look like? Let’s talk through how a forex trade involving the Swazi Lilangeni (SZL) and the US dollar (USD) may happen.

The Set-Up

My plan is to trade Eswatini’s currency after the US Federal Reserve makes its next interest rate announcement.

After carrying out some economic research, I conclude that the central bank will keep rates on hold at 5%. This differs from the broader market, which has priced in a 0.25% reduction, to 4.75%.

If I’m correct, the USD will likely rise in value against a multitude of currencies, including the SZL. I aim to capitalize on this by taking a short position, which involves me selling the African currency while simultaneously buying the buck.

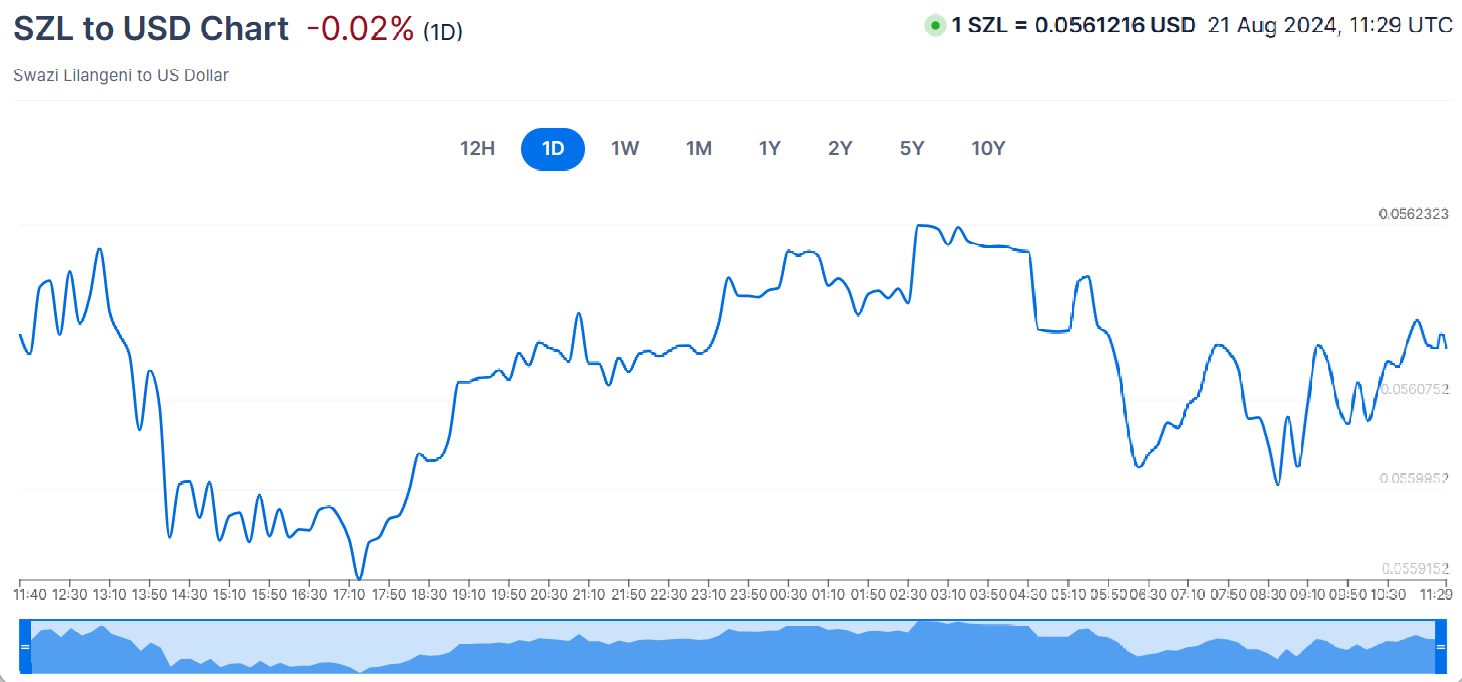

Before placing my trade, I also conduct some technical analysis to try and identify price and volume patterns and trends.

Combing charts is an essential part of short-term trading, and in this case, could provide a clearer idea of where the SZL/USD might move to.

The Trade

The Federal Reserve is due to make its rate announcement at 14:00 Eastern Standard Time (EST), or 20:00 SAST. So I sit down at 19:50 local time to punch in my trade.

At this time the SZL/USD cross is trading at 0.0560534. So I place a ‘take profit’ order at 0.0559993, and a ‘stop loss’ instruction at 0.0561013.

The ‘take profit’ order allows me to manage risk by automatically closing my trade – and thus locking in any gains I may make – if the pair falls to my chosen level. The ‘stop loss,’ on the other hand, shuts my position if the SZL/USD rises, which in turn would limit any losses I may make.

Shortly afterwards, the Fed makes its monetary policy announcement. And it’s good news for me, showing that interest rates have been locked at 5%.

The SZL/USD cross falls following the news, and within 30 minutes has triggered my ‘take profit’ order to 0.0559993, giving me a profit of 541 pips.

Note this trade is hypothetical. Forex trading in Eswatini presents challenges for active traders looking to speculate on the SZL given its limited liquidity and availability on trading platforms.

Bottom Line

Eswatini is home to a small but growing day trading community. Efforts to regulate the financial markets are ongoing, although investor protections remain limited compared with those enjoyed in more developed countries.

Traders primarily use trading platforms that are authorized by respected international regulators rather than local ones. As with any region, investors in the African country should be on guard for potential scammers.

To start actively trading, turn to DayTrading.com’s selection of the top platforms for day trading.

Recommended Reading

Article Sources

- The World Bank in Eswatini – World Bank

- Eswatini Stock Exchange (ESE)

- Financial Services Regulatory Authority (FSRA)

- Eswatini Revenue Service (ERS)

- Eswatini Income Tax - ERS

- Our Resources - ERS

- Individual - Taxes on personal income - PwC

- Eswatini Makes Big Changes to its Income Tax Laws – Regan van Rooy

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com