Synthetic Call

A Synthetic Call is a trading strategy that is designed to replicate the payoff of a traditional call option using a combination of other financial instruments, such as stocks and options.

Goal of a Synthetic Call

The goal of a Synthetic Call is to create the same profit potential as a call option, while avoiding some of the high premium costs associated with buying a call.

How to Create a Synthetic Call

To create a Synthetic Call, a trader would typically:

- Purchase a long position in the underlying asset (e.g., a stock) and

- Simultaneously buy a put option on that same asset.

This combination creates a payoff profile that is similar to that of a call option.

If the price of the underlying asset increases, the trader will benefit from the long position, while the put option will expire worthless.

If the price of the underlying asset decreases, the put option will be exercised, and the trader will be obligated to purchase the underlying asset at the exercise price, and offset the losses from the long position.

When Is the Synthetic Call Useful?

Synthetic Calls can be useful in situations where a trader believes that the price of the underlying asset will increase, but does not want to pay the high premium costs associated with buying a call option.

An ITM call option acts much closer to the underlying and has less effective premium built into it considering its moneyness.

They can also be useful for traders who want to take advantage of favorable market conditions, but have limited capital available to invest.

Risks of a Synthetic Call

Synthetic Calls also come with risks.

If the price of the underlying asset decreases significantly, the trader will face losses.

The price may also not rise enough to have a winning trade.

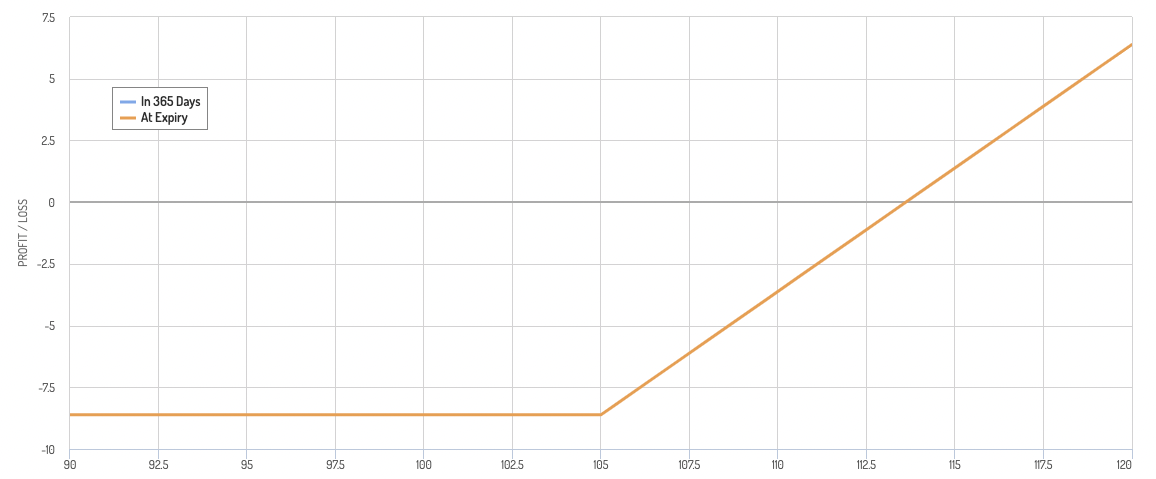

Synthetic Call Payoff Diagram

The payoff diagram generally appears as having a fixed downside while generally having a large upside.

The extent of the possible downside and possible upside is largely dependent on the inherent moneyness of the Synthetic Call.

A Synthetic Call that’s deeper OTM will have less downside and higher upside than one that’s closer to ITM to reflect the underlying probability of the Synthetic Call paying out.